Carbon Felt and Graphite Felt Market Size, Share & Industry Analysis, By Raw Material (Rayon Based, Pan Based, and Pitch Based), By Application (Optic Fibres, Furnace, Heat Shields, Automotive Exhaust Lining, Battery, and Others), By End-user (Electrical and Electronics, Automotive, Power Generation, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

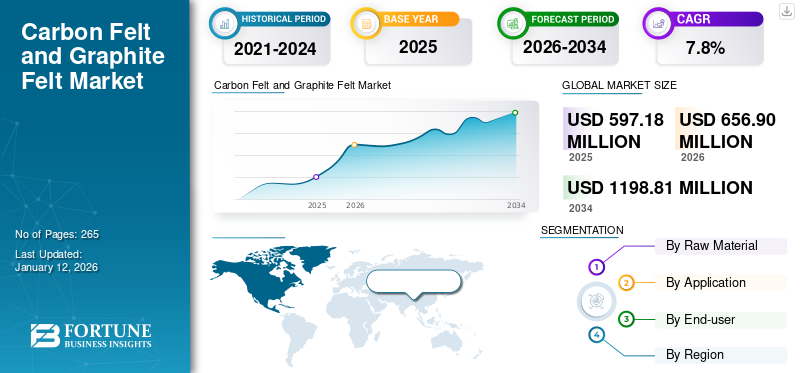

The global carbon felt and graphite felt market size was valued at USD 597.18 million in 2025 and is projected to grow from USD 656.9 million in 2026 to USD 1198.81 million by 2034, exhibiting a CAGR of 7.8% during the forecast period. Asia Pacific dominated the global market with a share of 57% in 2025.

The carbon felt and graphite felt encompass non-woven textile materials produced by carbonizing or graphitizing polyacrylonitrile (PAN), rayon, or pitch-based fibers. These felts are valued for their lightweight structure, high thermal stability, chemical resistance, and excellent insulating performance. Unlike conventional woven fabrics, they provide uniform porosity and low thermal conductivity, making them highly effective in high-temperature environments. These materials are widely used in applications such as thermal insulation for high-temperature furnaces, electrodes in batteries and fuel cells, and components in metallurgical, solar, and semiconductor industries. Beyond established industrial applications, demand is increasingly shaped by their role in clean energy technologies, particularly in vanadium redox flow batteries, lithium-ion batteries, and hydrogen energy systems.

The market encompasses several major players, with Mersen, SGL Carbon SE, Kureha Corporation, Nippon Carbon Co., Ltd., and Beijing Great Wall Co., Ltd. at the forefront. Broad portfolio with innovative product launch and strong geographic presence expansion has supported the dominance of these companies in the global carbon felt and graphite felt market.

MARKET DYNAMICS

MARKET DRIVERS:

Expansion of Semiconductor and Solar Manufacturing Sustains Demand for Graphite Felt

The expansion of semiconductor and solar manufacturing directly sustains demand for graphite felt, as every new production line requires high-purity furnace insulation. In Czochralski crystal growth, felt linings control thermal gradients that determine wafer quality, while in solar ingot casting, they ensure consistent heating cycles with minimal contamination. These roles make graphite felt a built-in consumable for each wave of capacity growth. Unlike consumer products that fluctuate with short demand cycles, semiconductor fabs and photovoltaic plants operate on multi-year investment plans. When a new fab or ingot facility becomes operational, multiple furnaces are installed, each lined with specialized felt and requiring periodic replacement. This creates a steady, measurable pull for graphite felts tied directly to the pace of industrial expansion rather than day-to-day shifts in electronics markets. These factors are expected to drive the carbon felt and graphite felt market growth.

- IEA indicated global PV manufacturing capacity approaching ~1,000 GW in 2024, more than doubling in short order. This encompasses ingot/wafer production stages that employ graphite insulation and felt in casting/crystal-growth lines.

MARKET RESTRAINTS:

Susceptibility to Oxidation Restricts Broader Use of Carbon and Graphite Felts

A key limitation of carbon and graphite felts is their limited stability in oxidative environments. They perform exceptionally in vacuum or inert atmospheres, but when exposed to oxygen at elevated temperatures, the material begins to degrade. Oxidation can start gradually at about 400–500 °C and tends to accelerate significantly once temperatures rise above 600–700 °C. As the fibers react with oxygen, structural integrity declines, surface area decreases, and the felt eventually becomes brittle. In applications that demand purity, even minor oxidation can release particles or gases that risk contaminating the process.

The susceptibility of carbon and graphite felts to oxidation is a natural material constraint. It secures their role in high-performance processes but limits wider adoption in industries that operate in open-air or cost-sensitive environments.

MARKET OPPORTUNITIES:

Growth of Energy Storage Technologies Opens New Pathways for Carbon and Graphite Felts

The accelerating shift toward renewable energy is creating demand for reliable storage solutions, and this trend is opening a clear opportunity for carbon and graphite felts. In vanadium redox flow batteries, for example, felts are used as porous electrodes that allow efficient ion exchange. Their high surface area, electrical conductivity, and chemical stability make them an excellent match for this role. With grid-scale storage projects expanding in regions focused on renewable integration, the need for durable and efficient electrode materials is only set to increase.

Hydrogen technologies provide another avenue. Felts can serve as electrode backings in electrolysers and fuel cells, where conductivity and resistance to chemical attack are critical. Here, surface modification and activation treatments are proving to enhance performance further.

CARBON FELT AND GRAPHITE FELT MARKET TRENDS:

Rising Demand for Clean and High-Temperature Processing is one of the Significant Market Trends

The growing need for ultra-clean, high-temperature processing has positioned carbon and graphite felts as the insulation materials of choice in vacuum and inert-atmosphere furnaces used for semiconductor manufacturing. At the same time, surface-engineered felts are gaining traction in batteries, fuel cells, and hydrogen systems. Conventional ceramic or fibrous insulators release particles or gases at elevated temperatures, which can compromise yield in sensitive processes. Graphite felts, when properly purified and graphitized, can sustain service at very high temperatures in vacuum or inert atmospheres, and can be manufactured to very low ash levels, with minimal gas evolution under controlled heating conditions. This makes them indispensable in crystal growth and advanced metallurgical applications.

MARKET CHALLENGES:

High Manufacturing Costs to Hamper Market Growth

The production of graphite felts is inherently costly, as the processes of carbonization and graphitization necessitate extended furnace cycles at temperature ranges between 2,800 and 3,000 °C. Consequently, unit costs are highly susceptible to fluctuations in electricity and gas prices, in addition to costs associated with carbon and environmental compliance. Capital-intensive equipment, such as graphitization furnaces and CVI/CVD lines, along with stringent quality assurance measures and elevated scrap risks involving premium rayon or specialized PAN precursors, further augment conversion expenses. Post-processing steps, including activation, coatings, rigidization, and machining, contribute additional labor and consumable costs.

Furthermore, batch processing and prolonged cycle durations restrict throughput and working-capital efficiency. Regions with volatile energy prices or rigorous emissions regulations, the variability in costs broadens, thereby complicating the establishment of global pricing frameworks. These dynamics exert pressure on profit margins when contractual cost pass-through mechanisms are limited and help maintain price differentials relative to lower-cost insulation alternatives or non-graphitized grades, thereby constraining rapid scalability.

Download Free sample to learn more about this report.

Segmentation Analysis

By Raw Material

Rayon Based Segment to Witness Highest CAGR, Driven by Precise Control Over Porosity

On the basis of raw material, the market is classified into rayon based, pan based, and pitch based.

The rayon based segment is expected to grow at the highest CAGR during the forecast period. Rayon fiber felts are considered premium products owing to their exceptionally low ash content, precise control over porosity, and extended service life in vacuum or high-temperature environments. They are the preferred materials for hot zones in semiconductor and compound semiconductor manufacturing, crystal growth processes such as silicon carbide (SiC), and vanadium redox flow battery (VRFB) electrodes, where electrolyte mass transport and cleanliness are critical.

The pan based segment dominated the carbon felt and graphite felt market share in 2024, providing optimal cost-efficiency for furnace insulation, heat treatment, and general industrial applications. A broad global supply network, simplified qualification processes, and a variety of form factors, including soft felts, rigidized boards, and machined kits, render PAN the preferred option for most refurbishment projects and new installations. Pricing remains the market baseline, significantly influenced by energy and precursor costs; however, suppliers can enhance margins through value-added conversion and assembly processes. The segment is anticipated to witness consistent mid-single-digit growth, driven by electrification efforts, the reshoring of industrial capacity, and a substantial installed base that fosters recurring spare parts demand.

By Application

FurnaceSegment Leads the Market due to Lower Maintenance Costs

Based on application, the market is segmented into optic fibres, furnace, heat shields, automotive exhaust lining, battery, and others.

The furnace segment dominates the market share of 62.92% in 2026, driven by the need for enhanced durability and reduced maintenance costs. These materials are employed as soft felts, rigidized panels, machined boards, and multilayer hot-zone assemblies, facilitating uniform temperature distribution and energy efficiency. As manufacturers aim to increase throughput, improve yield, and achieve decarbonization objectives, furnace builders and operators are progressively dependent on felts for consistent thermal management and prolonged maintenance intervals. This widespread and recurrent application constitutes the majority of market volume and establishes a foundation for consistent replacement demand.

The battery segment is expected to experience the fastest growth over the projected period. As utility companies and industrial operators scale long-duration storage solutions to incorporate renewable energy sources and improve grid stability, demand for validated electrode felts is rising, driven by high-value projects. Strict qualification processes and post-treatments, such as activation and heat treatment, are instrumental in supporting premium pricing and establishing supplier loyalty once systems are operational.

The heat shields segment is poised to experience significant growth over the projected period. Felts are integrated into multilayer stacks and composite laminates, frequently combined with metallic foils or ceramic barriers to fulfill rigorous thermal and weight requirements. As safety, performance, and efficiency standards escalate across industrial machinery and propulsion-related systems, the specification of engineered felt shields broadens, supporting consistent and medium-to-high value demands.

By End-user

Electronics Segment Dominates the Market due to its Various Benefits

Based on end-user, the market is segmented into electrical and electronics, automotive, power generation, and others.

To know how our report can help streamline your business, Speak to Analyst

The electrical and electronics segment dominates the market share of 62.79% in 2026, with demand primarily driven by semiconductor and compound-semiconductor fabrication facilities, photovoltaic equipment manufacturers, and precision electronics producers seeking ultra-clean, durable hot-zone materials. Felts offer benefits such as low outgassing, dimensional stability, and consistent thermal fields in processes including crystal growth, diffusion, annealing, and vacuum heat treatment furnaces, thereby enhancing yield and minimizing downtime. Furthermore, the segment is projected to grow at a CAGR of 8.1% during the study period.

The power generation segment is also experiencing the fastest growth over the projected period. Grid-scale energy storage deployments are driving long-duration applications, where flow batteries benefit from graphitized felts used as porous electrodes. Operators prioritize low ash content, tuned permeability, and stable surface chemistry to ensure efficiency and multi-year durability. Project awards and commissioning schedules result in shipment irregularities, but once validated, suppliers generally maintain positions throughout the asset's lifespan. In addition, battery applications are set to hold a 23.3% share in 2025.

Carbon Felt and Graphite Felt Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

The Asia Pacific held the dominant share in 2025, valued at USD 340.73 million, and maintained its leading share in 2026, with USD 377.87 million. The region serves as the volume hub, primarily driven by China, Japan, and an increasingly significant India. This region witness extensive adoption of photovoltaic (PV) and electronics furnace technologies, metal heat-treatment processes, and industrial equipment. Pan based felts are predominant in standard insulation applications due to their cost-effectiveness and widespread availability. In 2026, the carbon felt and graphite felt market in China is estimated to reach USD 199.45 million. The Japan market is projected to reach USD 61.83 million by 2026, and the India market is projected to reach USD 30.2 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

- China is the largest consumer and producer of carbon and graphite felts within the region, supported by extensive ecosystems in photovoltaic, semiconductor, specialty metals, and industrial furnace industries. Pan based felts dominate the market for routine insulation and retrofit applications, while higher-purity rayon-based grades are employed in qualified hot zones for crystal growth and advanced electronics.

Europe

Europe is anticipated to witness a notable growth in the coming years. During the forecast period, the region is projected to record a growth rate of 6.1%, which is the second-highest amongst all the regions, and touch the valuation of USD 114.66 Million in 2025. The Europe region is inclined toward high-purity applications in sectors such as semiconductors, photovoltaics (PV), specialty metals, and research. This trend supports a greater adoption of rayon-based felts in qualified high-temperature zones. Stricter environmental standards and energy-efficiency regulations promote furnace retrofits and the development of multilayer heat-shield designs. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 18.27 million, Germany to record USD 35.51 million in 2026, and France to record USD 18.41 million in 2025.

North America

The market in North America is estimated to reach USD 98.83 million in 2025 and secure the position of the third-largest region in the market. Demand is driven by the semiconductor, aerospace, and advanced industrial heat-treatment sectors, with incremental support from grid-storage pilot projects and commercial vehicle thermal requirements. Buyers in the region prioritize qualified, low-ash insulation suitable for vacuum furnaces and crystal-growth equipment. Meanwhile, automotive programs continue to specify felt material for exhaust and heat-shield applications in internal combustion engines, hybrid vehicles, and vocational fleets. In 2026, the U.S. market is estimated to reach USD 96.4 million. The U.S. serves as the primary market in North America, representing the majority of regional demand and exhibiting a preference for high-specification applications in sectors such as semiconductor manufacturing, photovoltaic/crystal growth, aerospace, and advanced industrial heat treatment.

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in this market. The Latin America market in 2025 is set to record USD 17.90 million in its valuation. The growth of the market is driven by cost-effective PAN-based insulation and cut-to-fit heat-shield components, with selective adoption of higher-grade products in export-oriented manufacturing facilities and energy projects. In the Middle East & Africa, GCC is set to attain the value of USD 11.47 million in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players:

Acquisition and Expansion Initiatives are Essential Aspects for the Growth of Companies Operating in the Market

Large companies use their scale, R&D, and sustainability efforts to stay competitive, whereas regional firms tend to focus on cost savings and proximity to local infrastructure projects. Some of the key market players include Mersen, SGL Carbon SE, Kureha Corporation, Nippon Carbon Co Ltd., and Beijing Great Wall Co. Ltd. These players are adopting strategies such as acquisition, expansion, and partnerships to gain share in the carbon felt and graphite felt market.

LIST OF KEY CARBON FELT AND GRAPHITE FELT COMPANIES PROFILED:

- Mersen (France)

- HPMS Graphite (U.S.)

- CGT Carbon GmbH (Germany)

- Carbon Composites, Inc. (U.S.)

- Kureha Corporation (Japan)

- Saginaw Carbon (U.S.)

- Allied Metallurgy Resources LLC (U.S.)

- Beijing Great Wall Co., Ltd. (China)

- SGL Carbon SE (Germany)

- Olmec Advance Materials Ltd. (England)

- Coidan Graphite Products Ltd. (U.K.)

- Bay Carbon Inc. (U.S.)

- AMK METALLURGICAL MACHINERY GROUP CO., LTD. (China)

- Nippon Carbon Co Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Mersen acquired GMI group (Graphite Machining, Inc.), a purification and machining of graphite, carbon, and graphite composites company. This new acquisition complements Mersen’s Advanced Materials footprint in the U.S., adding volume and transformation capacities of isostatic, extruded graphite, and insulation materials and enabling synergies between the plants. It reinforces the Group’s leading position in markets such as aerospace, process industries, and energies.

- August 2022: SGL Carbon expanded its carbon felt and graphite felt production capacity for industries such as semiconductors, solar, and energy storage at its Meitingen site in Germany and its facilities in North America and China. The company announced plans to significantly increase graphite product capacities, including felts, through a mid-range double-digit million-euro investment over the next two years. A new soft felt production plant for carbonized and graphitized soft felt is currently under construction in Meitingen.

REPORT COVERAGE

The global market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.8% from 2026-2034 |

|

Unit |

Value (USD Million), Volume (Kiloton) |

|

Segmentation |

By Raw Material, Application, End-user, and Region |

|

By Raw Material |

· Rayon Based · Pan Based · Pitch Based |

|

By Application |

· Optic Fibres · Furnace · Heat Shields · Automotive Exhaust Lining · Battery · Others |

|

By End-user |

· Electrical and Electronics · Automotive · Power Generation · Others |

|

By Geography |

· North America (By Raw Material, Application, End-user, and Country) o U.S. o Canada · Europe (By Raw Material, Application, End-user, and Country/Sub-region) o Germany o France o U.K. o Italy o Spain o Rest of Europe · Asia Pacific (By Raw Material, Application, End-user, and Country/Sub-region) o China o India o Japan o Southeast Asia o Australia o Rest of Asia Pacific · Latin America (By Raw Material, Application, End-user, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Raw Material, Application, End-user, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 656.9 million in 2026 and is projected to reach USD 1198.81 million by 2034.

In 2025, the market value stood at USD 340.73 million.

The market is expected to exhibit a CAGR of 7.8% during the forecast period (2026-2034).

The pan based segment led the market by raw material.

The key factors driving the market are the rising demand for cleaner high-temperature processing.

Mersen, SGL Carbon SE, Kureha Corporation, Nippon Carbon Co Ltd., and Beijing Great Wall Co. Ltd. are some of the prominent players in the market.

Asia Pacific dominated the market in 2026.

Increased focus on higher-purity felts for semiconductor and clean-tech applications are the key factor expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us