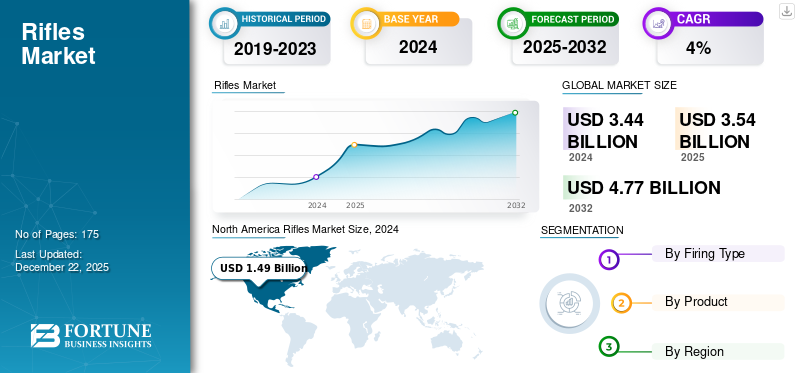

Rifles Market Size, Share & Industry Analysis, By Firing Type (Non-Automatic, Semi-Automatic, and Automatic), By Product (Assault Rifles, Light Machine Guns, Designated Marksman Rifles, General-Purpose Machine Guns, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global rifles market size was valued at USD 3.44 billion in 2024. The market is projected to grow from USD 3.54 billion in 2025 to USD 4.77 billion by 2032, exhibiting a CAGR of 4.35% during the forecast period. North America dominated the rifles market with a market share of 43.31% in 2024.

A rifle is a long-barreled firearm designed to be fired from the shoulder, distinguished by spiral grooves called "rifling" cut into the interior of its barrel. These grooves cause the bullet to spin as it exits the barrel, creating gyroscopic stability that dramatically improves accuracy and effective range compared to smooth-bore weapons. Rifles are precision instruments commonly used for hunting, military operations, law enforcement, and competitive target shooting, where their superior accuracy at long distances makes them the preferred choice over pistols or shotguns.

The market growth is attributed to the global industry involved in the production, distribution, and sale of rifles, which are long-barreled firearms designed for high shooting and powerful impact. This market includes various types of rifles such as hunting, sporting, military, and law enforcement agencies firearms, including traditional non-automatic rifles and modern semi-automatic rifles, sniper rifles and automatic rifles.

The COVID-19 pandemic had a significant impact on the firearms market, leading to an increase in demand due to concerns over personal safety and economic uncertainty. This surge in gun purchases has raised public health and safety concerns, particularly regarding the potential rise in domestic violence incidents and suicide risks associated with increased firearm accessibility.

RUSSIAN-UKRAINE WAR IMPACT

The Russia-Ukraine War has had several impacts on the global arms market, including the rifles market share. The war has strained Russia's defense production capabilities, limiting its ability to fulfill commitments, including those involving rifles. This disruption has created opportunities for other suppliers, such as China, to expand their presence in the global market. Heightened security concerns, particularly among nations bordering Russia have led to increased defense expenditures, driving global demand for firearms and other military equipment. This surge in demand benefits arms manufacturers globally, potentially boosting the production and sales of rifles. The war has positively impacted the stock performance of many defense companies, with an event study on arms manufacturers revealing significant positive abnormal stock returns for most firms during the conflict period.

Sanctions and the diversion of Russian military equipment to the battlefield have disrupted global supply chains, causing delays and breaches in international arms contracts. This affects the availability of rifles and other military equipment. In response to the war, some countries have increased their military production. For example, Russia has boosted the production of certain weapons systems, though its overall capacity remains strained.

The Russia-Ukraine War has reshaped the global arms market by creating opportunities for new suppliers, driving demand for military equipment, and raising concerns over illicit arms trade. However, the specific impact on the rifles market is part of broader trends affecting the entire defense industry.

MARKET DYNAMICS

MARKET DRIVERS

Advancements in Modern Weaponry to Drive Market Growth

The evolution of warfare from traditional to modern combat has significantly transformed military operations. The size and composition of armed forces are shifting, with a growing emphasis on advanced technologies such as weaponized robots, vehicles, light weapons, and unmanned ground vehicles to enhance combat effectiveness. This shift is driving progress across the defense and arms market.

Technological innovations in firearms include machine guns with high cyclic rates, such as models that fire 5.56mm NATO rounds at 750 rounds per minute and M240 guns capable of reaching up to 1,000 rounds per minute. Companies such as True Velocity are developing new ammunition types, such as the 6.8mm caliber, designed to offer greater range and precision compared to the standard 5.56mm NATO rounds. These efforts align with the U.S. military's pursuit of advanced firearms, with companies such as General Dynamics Corporation, Textron Systems, and SIG SAUER selected for key roles in these initiatives.

Similarly, India is transitioning from 5.56mm to more lethal 7.62mm rifles and ammunition, contributing to rising demand for small-caliber ammunition. These advancements reflect the ongoing modernization of weaponry, which is reshaping the dynamics of modern warfare and fueling growth in the market.

Increasing Demand from Civilians and Pandemic-Driven Purchases to Fuel Market Growth

Handguns and shotguns are primarily used for commercial purposes such as personal protection, sports, and hunting. Rising demand among civilians for handguns, rifles, and shotguns will contribute to market expansion. For instance, in August 2024, India has officially signed a new agreement to import an extra 73,000 SiG Sauer assault rifles from the United States. This delivery will supplement the 72,400 rifles previously acquired for frontline Army personnel, in light of the ongoing military standoff with China in eastern Ladakh. The industry is also benefiting from the expansion of shooting ranges and heightened concerns over personal security. Additionally, the COVID-19 pandemic led to a surge in gun purchases in the U.S. in March 2020, as consumers reacted to uncertainty surrounding public safety. This behavioral shift may continue to influence global market growth in the coming years.

MARKET RESTRAINTS

Inconsistent International Regulations to Restrict Market Growth

The regulation of arms, ammunition, and other combat equipment varies widely across countries due to differences in their economic, legal, and political frameworks. These regulatory disparities impact domestic and international players in the small arms market. Failure to comply with these regulations can lead to reduced sales, revenue, and profit margins, and may result in administrative or criminal penalties. As a result, market players must strictly adhere to the gun ownership laws and regulatory requirements of both their home countries and foreign markets in which they operate. Procurement processes in many countries are often affected by these regulations.

Key examples include import-export controls, technology transfer laws, and anti-corruption measures, which differ from one country to another. Non-compliance with these standards can significantly impact the activities of market participants, potentially reducing global market revenue. The rifles market growth is further hindered by the differences in regulations between countries, which are shaped by economic, legal, and political considerations.

Rifles Market Overview & Key Metrics

Market Size & Forecast

- 2024 Market Size: USD 3.44 billion

- 2025 Market Size: USD 3.54 billion

- 2032 Forecast Market Size: USD 4.77 billion

- CAGR: 4.35% from 2025–2032

Market Share

- North America dominated the rifles market with a 43.31% share in 2024, supported by high defense spending, large-scale procurement programs (e.g., U.S. Army’s Next Generation Squad Weapon), and extensive civilian firearm ownership. The region benefits from robust domestic manufacturing, strong export capabilities, and widespread participation in sporting and hunting activities.

- By product type, assault rifles are projected to account for the largest market share during the forecast period, fueled by rising geopolitical tensions, modernization programs, and increasing adoption in both defense and civilian segments.

Key Country Highlights

- United States: Leads global demand, driven by military modernization initiatives (e.g., XM5 and XM250 rifle programs) and significant civilian firearm purchases influenced by personal security concerns.

- India: Growing procurement of advanced rifles such as SiG Sauer assault rifles and collaborations with Russia for AK-203 production boost market expansion.

- China: Increased defense budgets, domestic manufacturing capacity, and extensive civilian ownership underpin strong demand.

- Europe: Moderate growth supported by leading firearm manufacturers (e.g., Heckler & Koch, Beretta) and ongoing NATO-related defense upgrades.

RIFFLES MARKET TRENDS

Integration of Technological Advancements and Increased Defense Spending to Boost Market Growth

The integration of advanced technologies such as improved targeting systems, digital enhancements, and smart rifles capabilities, is gaining popularity across the market. These innovations enhance accuracy and user experience, contributing to market growth. Additionally, modular rifle designs allow users to customize components for different purposes, enhancing ease of use and versatility. This trend is particularly appealing to both civilian and military consumers. The use of lighter materials and advancements in ammunition technology, such as reduced recoil and improved terminal ballistics, are driving demand for modern rifles.

- North America witnessed rifles market growth from USD 1.42 Billion in 2019 to USD 1.49 Billion in 2024.

Countries such as the U.S., China, India, and Russia are increasing their military budgets, which is driving the demand for advanced rifles. The ongoing geopolitical tensions and conflicts, such as the Russia-Ukraine conflict, have led many military forces to upgrade their inventories with modern rifles, contributing significantly to market growth. For example, the U.S. Army's Next Generation Squad Weapon (NGSW) program aims to replace existing rifles with more advanced models.

Download Free sample to learn more about this report.

SEGMENTATION Analysis

By Firing Type

Automatic Segment Growing Significantly as Growing Demand of New Age Weapons over Traditional Non-Automatic Guns

By firing type, the market is divided into non-automatic, semi-automatic, and automatic.

The automatic segment is estimated to be the fastest-growing during the forecast period, driven by modernized weapon advancements, rising civilian demand, and military modernization programs. Moreover, increasing geopolitical tensions and the need for advanced targeting systems are contributing to the segment’s expansion.

By Product

Assault Rifle Segment to Display fastest-Growth due to Rising Geopolitical Tensions

By product, the market is divided into assault rifles, light machine guns, designated marksman rifles, general-purpose machine guns, and others.

The assault rifle segment is estimated to be the fastest-growing during the forecast period (2025-2032). Key drivers include technological advancements, increased defense budgets, and growing civilian interest in self-defense. Military modernization programs and escalating geopolitical tensions are also fueling demand. For instance, India and Russia have collaborated on producing AK-203 assault rifles for the Indian Armed Forces.

RIFLES MARKET REGIONAL OUTLOOK

By Region, the market has been divided into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Rifles Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to hold the largest market share globally during the forecast period, driven by its substantial defense budget, extensive network of shooting ranges in the U.S. and Canada, and ongoing procurement of new weaponry for combat operations. Notable examples include for instance, in April 2022, The Army has recently granted a contract to firearm maker SIG Sauer for two new weapons for soldiers: the XM5 rifle and the XM250 automatic rifle. The XM5 is set to succeed the M4/M4A1 carbine rifle for soldiers engaged in close-quarters combat, while the XM250 will take over the role of the M249 Squad Automatic Weapon. Additionally, Colt Canada secured a contract to supply new rifles to the Canadian military.

The U.S. rifles market represents a significant portion of the larger Guns & Ammunition Manufacturing sector, which comprises 693 companies as of 2025—an increase of 1.3% from 2024 and experiencing an average annual growth rate of 2.2% from 2020 to 2025. This industry exhibits low concentration in market share, with Olin Corporation being the leading entity. Rising U.S. defense expenditures and ongoing initiatives, such as the Next Generation Squad Weapon (NGSW) program, are driving substantial rifle purchases for military and law enforcement purposes. For instance, in March 2025, FN America, LLC, a producer of military products, received a firm-fixed-price IDIQ contract, potentially worth up to USD 39,643,953, to provide the U.S. Department of Defense's (DoD) Defense Logistics Agency (DLA) Land and Maritime with barrels for M240 and M249 machine guns.

Asia Pacific

The Asia Pacific region is expected to experience significant growth due to rising cross-border conflicts and terrorist activities. Increased defense spending and military modernization efforts in countries such as South Korea, Australia, China, and India are further driving this expansion. India and China have substantial civilian weapon ownership, with around 71 million and 49 million weapons, respectively. Recent defense acquisitions and modernization policies in India have further contributed to market growth.

Europe

The European market is anticipated to grow at a moderate pace, with companies such as Fabbrica d'Armi Pietro Beretta S.p.A., Heckler & Koch GmbH, and Thales Group contributing to this expansion.

Rest of the World

The rest of the world, including the Middle East & Africa, and Latin America, is projected to experience moderate growth due to growing political tensions, increased military investments, and the development of innovative civilian firearms products.

Competitive Landscape

KEY INDUSTRY PLAYERS

Military Modernization, Civilian Demand, and Rapid Technological Advancement Drives the Market Growth

The emergence of cutting-edge technologies, including biometric sensors, Radio Frequency Identification (RFID), and advanced weaponry, along with the creation of rifles made from polymer materials, represents the next wave of innovation in the market. Major market players such as Kalashnikov Group, Smith & Wesson Brands Inc., Sturm, Ruger & Co. Inc., and Glock Ges.m.b.H. maintain their leading positions through varied product portfolios, growing R&D investment, and a heightened emphasis on mergers and acquisitions.

LIST OF KEY RIFLES COMPANIES PROFILED

- Kalashnikov Group (Russia)

- Heckler & Koch GmbH (Germany)

- Remington Arms Compant LLC (U.S.)

- Israel Weapons Industries (Israel)

- Colts Manufacturing LLC (U.S.)

- FN Herstal (Belgium)

- American Outdoor Brands Corporation (U.S.)

- Glock Ges.m.b.H. (Austria)

- Smith & Wesson Brands Inc. (U.S.)

- Sturm, Ruger & Co., Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024 – India finalized a deal to purchase 73,000 SiG Sauer SiG-716 assault rifles from the U.S. for USD 832 million, following a previous purchase of 72,400 units. These rifles are meant for frontline forces stationed along the borders with China and Pakistan. The move comes amid delays in Russian AK-203 rifles in India.

- January 2024 – Israeli company lands unprecedented contract to provide the IDF with uniform rifles. ARI Arms secures a landmark USD 26 million agreement to provide OR-4 assault rifles to the IDF, substituting Tavor rifles, standardizing infantry weapons and supporting Israel’s aims to enhance local arms manufacturing.

- September 2023 –The UK Ministry of Defence signed a USD 93.4 million agreement to procure the L403A1 rifle system under Project HUNTER. The Alternative Individual Weapon (AIW) system consists of an advanced optical sighting system and muzzle signature reduction feature, enhancing combat accuracy for British soldiers.

- August 2023 –The Brazilian firearms producer, Taurus Armas, is competing for a major contract launched by the Indian Government. The tender seeks to acquire 425,000 rifles, possibly utilizing domestic manufacturing in line with the 'Make in India' program

- January 2022 – Sako Ltd and the Finnish Defence Forces Logistics Command entered into a contract to acquire the Rifle System M23. The procurement followed a partnership on the rifle system's development between Sako Ltd and the Finnish Defence Forces during 2020–2021, as outlined in the letter of intent between them.

Report Coverage

This research report delivers a comprehensive market analysis, incorporating both qualitative and quantitative data. It details market size and growth across all segments and examines market dynamics, emerging trends, and the competitive environment. Key insights include adoption patterns, recent industry activities (partnerships, M&A), SWOT analysis of major players, Porter's Five Forces analysis, dominant business strategies, and crucial industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.35% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Firing Type

|

|

By Product

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 3.44 billion in 2024 and is projected to reach USD 4.77 billion by 2032.

In 2024, the North American market value stood at USD 1.49 billion.

Registering a CAGR of 4.35%, the market will exhibit steady growth in the forecast period.

Heckler & Koch GmbH, American Outdoor Brands Corporation, Glock Ges.m.b.H., Sturm, Ruger & Co., Inc, and Smith & Wesson Brands Inc. are the major players in the market.

North America is likely to dominate the market in terms of share.

Asia Pacific region is expected to fastest-growing during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us