Satellite Payload Market Size, Share & Industry Analysis, By Payload Type (Communication, Imaging, Navigation, and Others), By Vehicle Type (Small and Medium-to-heavy), By Orbit (LEO, GEO, and MEO), By Application (Weather Monitoring, Telecommunication, Scientific Research, Surveillance, and Others), By End-Use (Commercial and Military), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

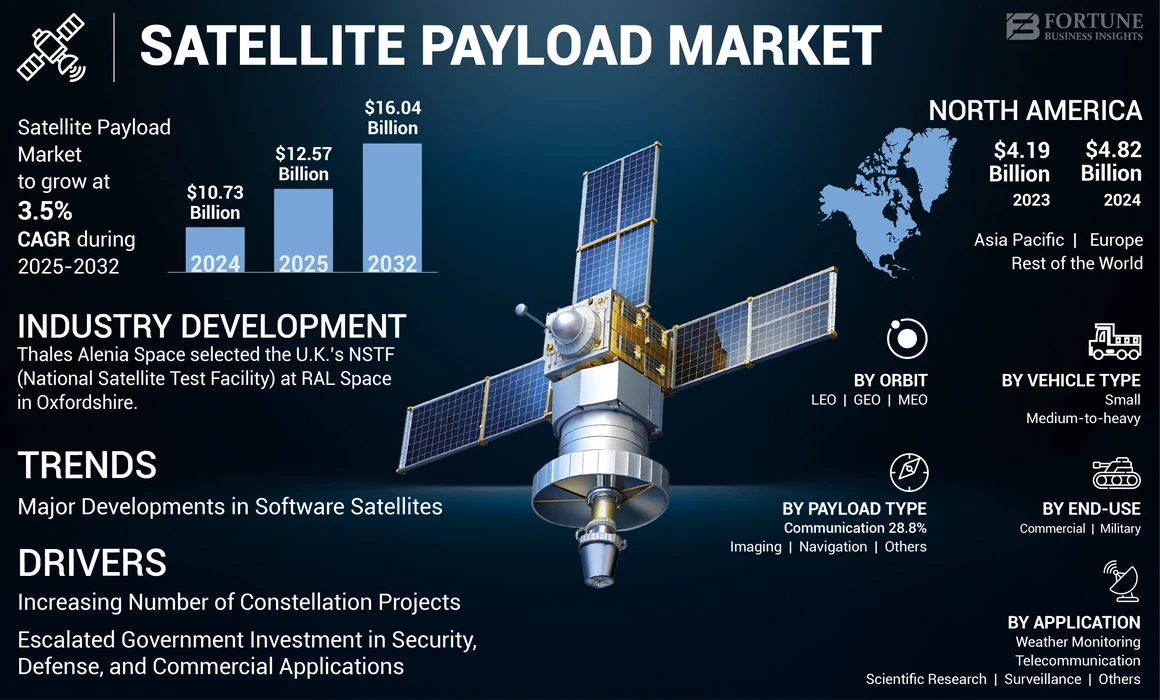

The global satellite payload market size was valued at USD 10.73 billion in 2024 and is projected to grow from USD 12.57 billion in 2025 to USD 16.04 billion by 2032, exhibiting a CAGR of 3.5% during the forecast period. North America dominated the global satellite payload market, accounting for 44.92% of the market share in 2024. The industry growth is driven by constellation deployment acceleration, defense modernization programs, bandwidth demand expansion, Earth observation investments, and satellite platform miniaturization across civil and military space ecosystems.

A scientific or technological instrument carried on board a satellite for a specific purpose is termed a payload. The term is used to describe the portion of a spacecraft that carries out the main mission objectives. Payloads vary in their purpose, size, composition, and capabilities. They can be scientific equipment, communication equipment, instruments, or any other specialized equipment that is needed for the mission.

In addition, payload is used for a variety of applications, from observing and studying the Earth's environment to exploring distant planets and galaxies. They play an important role in space exploration, weather forecasts, environmental monitoring, and communications. For instance, in January 2023, AAC Clyde Space launched its AAC AIS-Sat1 (Kelpie 1) satellite for earth observatory applications, such as the Automatic Identification System (AIS), that aid in the imaging of marine vessels. Additionally, in February 2023, Thales Alenia Space launched its Amazonas-Nexus communication satellite for the Spanish telecommunications company Hispamar. Such initiatives across the globe propel the market growth of satellite mission payloads during the forecast period.

The satellite payload market is experiencing structural transformation as space systems shift from low-frequency, bespoke missions toward high-volume, capability-driven deployments. Payloads increasingly define satellite value, performance differentiation, and mission economics. Governments, defense agencies, and commercial operators are prioritizing payload innovation to maximize data throughput, responsiveness, and lifecycle efficiency.

Satellite payload market size expansion is driven by rising investments in communications bandwidth, Earth observation, navigation resilience, and surveillance capabilities. Proliferation of low Earth orbit constellations is reshaping payload architectures, favoring smaller, software-defined, and modular designs. At the same time, geostationary orbit platforms continue to demand high-power payloads optimized for long-duration missions and wide-area coverage.

Satellite payload market share remains concentrated among established aerospace primes with vertically integrated manufacturing and deep customer relationships. However, competitive dynamics are evolving. Specialized payload developers, particularly in imaging sensors, radio frequency systems, and onboard processing, are capturing incremental value as operators seek performance optimization rather than full-platform differentiation.

Satellite payload market trends indicate growing adoption of digital payloads, active electronically steered antennas, and reconfigurable transponders. These technologies enhance operational flexibility and enable in-orbit adaptability. Military demand remains a critical stabilizing factor, supporting high-specification payload procurement despite budget cycles.

Satellite payload market growth is expected to remain robust through the forecast period. Expansion is supported by national security imperatives, commercial connectivity demand, and scientific exploration missions. Regionally, North America and Europe anchor high-value payload development, while Asia-Pacific accelerates capacity expansion. Overall, the market outlook reflects sustained demand for payload-centric innovation within an increasingly competitive and diversified space economy.

Satellite Payload Market Trends

Key Developments in Software Satellites Will Catalyze the Market Growth

Satellites with software-defined capability, which can be configured through commands from ground stations, have an AI-based payload and an operating processor. The satellite may have beamforming antennas, route processors, and demodulation capabilities that are software-defined. These satellites are capable of updating and reconfiguring themselves as needed.

By allowing operators to adjust the beams as needed, next-generation software satellites will be able to offer improved connectivity for in-flight broadband users. Extremely high speed, improved capacity flexibility, redundancy, and backward compatibility will also be supported by the satellites for future mobility applications. In addition, software-defined satellites and software-defined network solutions have been announced by a growing number of legacy organizations and startups.

- North America witnessed satellite payload market growth from USD 4.19 billion in 2023 to USD 4.82 billion in 2024.

Satellite payload market trends increasingly emphasize digitalization and reconfigurability. Operators favor payloads capable of in-orbit reprogramming to adapt to changing demand patterns. Software-defined payloads reduce dependency on fixed architectures and extend mission relevance.

Active electronically steered antennas represent a significant trend. These systems enable dynamic beam shaping and rapid reallocation of capacity. Adoption is expanding across communications and defense applications due to enhanced flexibility and performance.

Miniaturization continues to shape payload design. Smaller satellites require compact, lightweight payloads without sacrificing capability. Advances in materials, electronics, and thermal management support this transition. Onboard processing is gaining prominence. Payloads increasingly integrate edge computing to preprocess data before transmission. This capability reduces bandwidth requirements and improves responsiveness for time-sensitive applications.

Download Free sample to learn more about this report.

Satellite Payload Market Drivers

Expanding Constellation Projects to Boost Growth of Satellite Payload Market

A satellite constellation (or swarm) is a system of identical or similar-type artificial objects that serve the same goal and are controlled by the same entity. These groups transmit information to ground stations across the globe and are sometimes internally connected. They are meant to be complementary, and they serve as a system. Satellites in swarms rotate through comparable orbits with orbital planes to provide continuous and virtually uninterrupted global coverage.

In November 2023, the U.K. intended to establish a new constellation of small satellites aimed at improving research on climate change and disaster monitoring with Spain and Portugal. Four Portuguese spacecraft and one built by a U.K. company called Open Cosmos will form the first phase of the constellation. The U.K.'s Space Agency will contribute USD 3.8 million toward developing this satellite. Sixteen satellites with EO and telecommunications payloads will be included in the Atlantic Constellation when it is done.

As more private companies and governments invest in satellite constellations for telecommunications, earth observation, weather monitoring, or other uses, the demand for innovative sensors is growing. These sensors need to be used for the capture and transmission of vital information back to Earth in real-time. This makes it easier for organizations and bodies to make informed decisions.

Also, sustained demand for high-performance space-based data and connectivity. Governments and commercial operators increasingly rely on satellites to support communications, intelligence, navigation, and environmental monitoring. Payload capability directly determines mission effectiveness, driving continuous investment in advanced sensing and transmission technologies.

Growth in broadband connectivity requirements further accelerates payload demand. Satellite operators are expanding capacity to serve underserved regions, mobility platforms, and secure communications networks. This expansion necessitates payloads with higher throughput, frequency flexibility, and digital signal processing capabilities.

Increased Government Investment in Defense, Security, and Commercial Applications to Drive Market Growth

The demand for satellite equipment is fueled by the increasing importance of space-based assets for defense and security purposes. These payloads are used for monitoring, intelligence gathering, and early warning systems. For defense and safety purposes, satellites play a key role in the surveillance and gathering of information.

Defense modernization programs represent a significant driver. Military payloads prioritize resilience, redundancy, and secure communications. Governments invest heavily in next-generation payloads to enhance situational awareness and protect strategic assets, supporting stable demand independent of commercial cycles.

Technological advancements reinforce adoption. Improvements in miniaturization, power efficiency, and onboard processing enable more capable payloads within constrained mass and volume limits. These innovations align with the rapid deployment models of low Earth orbit constellations.

Furthermore, the Space Force has asked for funding to support the development of Deep Space Advanced Radar Capability, a planned radar system that will detect enemy threats in geostationary orbit. The budget request for FY 2024 also includes enhancements to the ground-based Electro-Optical Deep Space Surveillance System to detect previously undetectable space threats and collect intelligence to support actionable space domain awareness.

Satellite payloads capable of tracking ballistic missile launches, as well as providing early warning systems, are also recording investments by governments. As they allow for quick responses to missile threats and the protection of territories and populations, these payloads are essential for national security. Such initiatives catalyze the market growth across the globe.

RESTRAINING FACTORS

Slowdown by Malfunctioning of Sensor May Hinder the Market Growth

The success of a space mission may be directly affected by the malfunctioning of payloads. Sensor data are vital for accuracy and reliability in order to make the right decisions during a mission. Sensor failure may result in insufficient data collection, measurement errors, and a more severe decision-making process.

In such situations, leaked information could frustrate the mission's objectives and thwart scientific discoveries or the mission's planned operational objectives. Space-based sensors are exposed to extremely harsh conditions, including intense radiation, vacuum, and temperature fluctuations. These environmental conditions can lead to sensor degradation, premature wear, and even complete failure. These factors are set to hamper the satellite payload market growth.

Ensuring the reliability and durability of satellite sensors is an important task for both space agencies and manufacturers. The results can be disastrous, including data loss, mission failure, and waste of precious resources if sensors fail on a space mission.

Despite favorable demand fundamentals, the satellite payload market faces several constraints. High development and qualification costs remain a significant barrier. Payloads require extensive testing to meet reliability standards, extending timelines and increasing financial risk.

Supply chain complexity further restrains growth. Payload manufacturing depends on specialized components, radiation-hardened electronics, and precision manufacturing capabilities. Disruptions or material shortages can delay mission schedules and inflate costs. Integration challenges also limit scalability. Payloads must interface seamlessly with satellite platforms, launch vehicles, and ground systems. Customization requirements increase engineering complexity, particularly for multi-mission platforms.

Market Opportunities:

Expanding low Earth orbit constellations present a significant opportunity. Large-scale deployments require high volumes of standardized payloads, creating repeatable revenue streams for suppliers. This shift favors modular designs and scalable manufacturing. Defense and security applications offer long-term growth potential. Governments continue to invest in resilient space architectures, driving demand for secure communications, surveillance, and navigation payloads. These programs support premium pricing and long-term contracts.

Emerging markets represent an additional opportunity. As national space programs mature, demand for communication and Earth observation payloads increases. Partnerships and technology transfer initiatives facilitate market entry. Commercial Earth observation presents a growing upside. High-resolution imaging and analytics support applications ranging from agriculture to urban planning. Payloads optimized for multispectral and synthetic aperture radar imaging enable differentiated offerings.

Satellite Payload Market Segmentation Analysis

By Payload Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Imaging Payload Dominated Owing to Increased Demand for Earth Observation Satellites

By payload type, the market for satellite payload is segmented into communication, imaging, navigation, and others.

Imaging Payloads

The imaging segment accounted for the largest market share in 2024. Imaging satellites provide high-resolution imagery and accurate measurements of the shape, size, and location of objects in space and on Earth. Such imaging satellites have important applications in geospatial data collection and are expected to dominate this field.

Imaging payloads support Earth observation, surveillance, and environmental monitoring missions. This segment includes optical, multispectral, hyperspectral, and synthetic aperture radar systems. Demand is driven by applications requiring persistent monitoring and high spatial resolution. Commercial imaging payloads prioritize revisit rates and data monetization, while military payloads emphasize precision and resilience. Imaging payloads contribute meaningfully to value creation despite lower volumes than communication payloads.

For instance, in March 2023, Capella Space launched its Capella-10 (Whitney 8) satellite, which has the primary purpose of earth observation and radar imaging. The company operates the satellite, which is located in LEO orbit, for this type of imaging.

Communication Payloads

The communication segment is anticipated to be the fastest-growing segment during the forecast period of 2025-2032. The communication satellite plays a crucial role in space by transmitting signals around the Earth's axis, enabling communication between widely separated geographical areas. With an increase in space missions, these satellites are expected to record notable demand during the forecast period. For instance, in September 2022, as part of its contract to provide the operator with the satellite, AST SpaceMobile launched the Bluewalker 3, which will allow mobile phones to connect directly to the satellite and work primarily for communication purposes.

Communication payloads represent the largest revenue-generating segment within the satellite payload market. Demand is driven by broadband connectivity, mobility services, secure government communications, and backhaul requirements. These payloads emphasize high throughput, frequency agility, and spectral efficiency. Digital channelization and beamforming capabilities increasingly define differentiation. Adoption is strongest in commercial telecommunications and defense sectors, making communication payloads central to satellite payload market growth and market share concentration.

- The communication segment is expected to hold a 28.8% share in 2024.

Navigation Payloads

Navigation payloads enable positioning, navigation, and timing services critical to civilian and defense infrastructure. These payloads demand exceptional accuracy, redundancy, and signal integrity. Government ownership dominates this segment due to national security implications. While deployment volumes are limited, long program lifecycles and premium specifications support stable revenue contribution. Navigation payloads reinforce the strategic importance of the satellite payload market.

By Vehicle Type Analysis

Medium-to-heavy Segment Dominated Owing to Increased Heavy Payload Satellite Launches by Various Space Agencies

On the basis of vehicle type, the market for satellite payloads is segmented into small and medium-to-heavy.

Medium-to-Heavy Satellites

The medium-to-heavy segment dominated the market in 2024 due to increasing scheduled medium and heavy-weight satellite launches by major public and private satellite operators for numerous applications. For instance, in October 2022, Angosat-2, a medium-heavy satellite, was launched by the ISS Reshetnev into orbit for Angosat. The satellite launch mass for communication applications weighs nearly 2,150 kg.

Medium and heavy satellites carry high-power, high-capability payloads optimized for long-duration missions. These payloads support geostationary communications, defense applications, and advanced scientific missions. While volumes are lower, revenue per payload is substantially higher. This segment remains critical for sustaining value concentration within the satellite payload market.

Small Satellites

The small segment is predicted to be the fastest-growing segment during the forecast period of 2025-2032. There are increasing launches of low-weight satellites, such as those below 500 kg, due to the growing number of small satellites used for a wide range of applications, such as earth observation, communications, and scientific research. Satellite constellation projects by SpaceX, Amazon, One Web, and others will boost the growth of this segment.

Small satellites dominate unit volumes within the satellite payload market due to constellation-driven deployment models. Payloads for small satellites emphasize compact form factors, low power consumption, and rapid manufacturing. These payloads support communications, imaging, and scientific missions. Cost efficiency and scalability drive adoption, contributing significantly to the overall satellite payload market size expansion.

By Orbit Analysis

LEO Segment Dominated Owing to Increased Satellite Launching Missions in Low Earth Orbit

By orbit, the market is segmented into LEO, GEO, and MEO.

Low Earth Orbit (LEO)

Low Earth orbit dominates growth dynamics within the satellite payload market. LEO payloads prioritize low latency, high revisit rates, and distributed architectures. Constellation deployment models favor standardized payloads and rapid iteration. Adoption is strongest in broadband communications and Earth observation. LEO drives volume-led satellite payload market growth.

The LEO segment dominated the market in 2024 and is projected to be the fastest-growing segment during the forecast period. LEO orbit is near the Earth’s surface. Therefore, satellites can circle the planet for less time to provide continuous surveillance over an area. The increasing launch of communication, imaging, navigation, and other satellites in LEO by various key market players is anticipated to drive segmental growth during the forecast period.

Geostationary Orbit (GEO)

Geostationary orbit payloads emphasize high power output, wide coverage, and long operational lifetimes. These payloads support broadcast, fixed satellite services, and strategic communications. Despite slower growth, GEO payloads maintain a substantial share of market value due to complexity and performance requirements.

The GEO segment is anticipated to grow with the second-highest CAGR from 2025 to 2032. The growth of the segment is due to a rise in the transmission of radio frequency signals from fixed antennas. The GEO satellites allow for the establishment of permanent communication links. Further, growing demand for large satellites in order to cover a large surface area is anticipated to foster the growth of the market. For instance, in September 2023, Arianespace signed a contract with Intelsat to launch a small geostationary communication satellite. In the early part of 2026, Intelsat plans to launch a satellite called IS-45. On a more powerful version of Ariane 6, the Ariane 64, the satellite will fly with unnamed passengers.

Medium Earth Orbit (MEO)

Medium Earth orbit payloads primarily support navigation and specialized communications missions. This segment balances coverage and latency advantages. Adoption remains limited but strategically important, particularly for government-led programs.

By Application Analysis

Telecommunication Segment Dominated the Market Owing to Increased Demand for SATCOM

By application, the market for satellite payloads is segmented into weather monitoring, telecommunication, scientific research, surveillance, and others.

The telecommunication segment dominated the market in 2024 and is projected to be the fastest-growing segment during the forecast period of 2024-2032, owing to the rising demand for space-based connectivity. There has been an increase in the launch of communication satellites to provide services such as MSS and VSAT. For instance, in January 2024, the commercial arm of India's space agency, ISRO, announced that a large communications satellite will be launched on a SpaceX Falcon 9 later this year. In the second quarter of 2024, ISRO will send a GSAT 20 communications satellite into orbit. Telecommunication applications dominate commercial demand. Payloads support broadband, mobility, and secure communications. Continuous capacity expansion sustains satellite payload market growth.

The weather monitoring segment is anticipated to grow with the second-highest CAGR during the forecast period of 2025-2032. The growth in the segment is due to the increased use of satellites for analyzing climate, monitoring hazards worldwide, and forecasting weather. For instance, in November 2022, NASA successfully launched the third of a series of polar-orbiting weather satellites for the National Oceanic and Atmospheric Administration. Weather monitoring payloads support forecasting, climate analysis, and disaster preparedness. Governments and research institutions drive demand. Payloads emphasize sensor accuracy and data continuity.

Scientific payloads enable space exploration and fundamental research. These missions drive innovation but represent limited commercial scale. Surveillance payloads support defense and security objectives. High specification requirements sustain premium pricing.

By End-Use Analysis

Military Segment Dominated the Market Owing to Increased Satellite Launching Missions for Border Security and Surveillance

By end-use, the market for satellite payloads is segmented into commercial and military.

Military end-use sustains high-value demand. Payloads emphasize security, resilience, and redundancy. Defense programs stabilize satellite payload market growth across cycles. The military segment dominated the market in 2024. Increasing spending from various defense agencies around the globe in order to strengthen surveillance and geo-mapping activities is one of the key factors contributing to the market share of this segment in 2023. For instance, in March 2023, the Progress Rocket and Space Center from Russia launched BARS-M4 (Cosmos 2567), a surveillance satellite for the Russian Defense Military. Earth observation and electronic intelligence missions are the primary uses of the satellite.

Commercial end-use drives volume growth. Operators prioritize cost efficiency, scalability, and data monetization. Commercial demand reshapes payload design toward modularity and digitalization. The commercial segment is estimated to exhibit the highest CAGR from 2025 to 2032. Increasing demand for telecommunication, navigation, and third-party users for payloads further contributes to the market share of this segment. For instance, in May 2023, India launched and successfully placed a second-generation navigation satellite in orbit. The 2,232 kg NVS-01 satellite is part of India's NavIC satellite navigation system, initially named Indian Regional Navigation Satellite System (IRNSS), and was carried by a Geostationary Satellite Launch Vehicle (GSLV). NavIC is India's global GPS positioning system. Such satellites will boost the growth of the commercial segment across emerging nations as well.

REGIONAL INSIGHTS

Geographically, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

North America Satellite Payload Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Satellite Payload Market Analysis:

North America holds the largest satellite payload market share. The market was valued at USD 4.82 billion in 2024. The regional growth is due to an escalation in investment events by government and private players such as SpaceX, Blue Origin, Lockheed Martin Corporation, OneWeb, Sierra Nevada Corporation, The Boeing Company, and others. In addition, the increasing number of launch missions by various research organizations boosts the market growth in the region.

North America represents a high-value satellite payload market supported by defense spending, commercial connectivity demand, and advanced space infrastructure. The region prioritizes digital payloads, secure communications, and Earth observation capabilities. Strong government funding and private-sector participation sustain innovation. Mature supply chains and systems integration expertise reinforce North America’s leadership in the high-performance satellite payload market.

United States Satellite Payload Market:

The United States dominates the global satellite payload market through sustained defense investment and commercial constellation development. Payload demand focuses on secure communications, surveillance, and broadband capacity. Strong collaboration between government agencies and private operators accelerates innovation. Advanced manufacturing capabilities and software-defined payload adoption support continued satellite payload market growth across civil and military missions.

Asia-Pacific Satellite Payload Market Analysis:

Asia Pacific is anticipated to be the fastest-growing region during the forecast period. The expansion of the region is due to a growing space industry. The main technology economies that invest in space exploration programs and missions are China, Japan, India, Australia, and others. These countries are focusing on adopting new and advanced satellite technologies, satellite constellations, and others. For instance, in January 2023, Australian space company Equatorial Launch Australia announced a goal to ensure a space launch from Arnhem Land.

Asia-Pacific is the fastest-expanding satellite payload market, driven by national space programs and rising commercial demand. Governments invest in communications, navigation, and Earth observation payloads to support economic and security objectives. Expanding manufacturing capacity and domestic innovation ecosystems accelerate deployment. The region’s scale significantly influences global satellite payload market growth dynamics.

Japan Satellite Payload Market:

Japan’s satellite payload market emphasizes technological precision, resilience, and scientific capability. Payload demand centers on Earth observation, disaster monitoring, and secure communications. Strong government funding and collaboration with domestic manufacturers support steady innovation. Advanced electronics and miniaturization expertise sustain Japan’s role in high-quality satellite payload market development.

China Satellite Payload Market:

China holds a significant share of the satellite payload market due to extensive government investment and large-scale constellation deployment. Payload demand spans communications, navigation, and surveillance missions. Strong domestic manufacturing and vertically integrated programs support rapid scaling. These factors reinforce China’s expanding satellite payload market share and influence global competitive dynamics.

Europe Satellite Payload Market Analysis:

The European market for satellite payloads will experience substantial growth during the forecast period. The growing demand for small advanced satellites is a driver of growth in this region. For instance, in January 2022, a commercial satellite, Menut, was launched by Open Cosmos with a primary application that includes earth observation. The satellite will use optical/infrared imaging payload capabilities for various applications under earth observations. These important developments are driving the payloads market in this region.

The European satellite payload market is shaped by institutional programs, commercial telecommunications demand, and strategic autonomy objectives. The region emphasizes high-reliability payloads for navigation, Earth observation, and secure communications. Coordinated multinational initiatives support stable procurement cycles. European suppliers focus on interoperability, regulatory compliance, and long-term mission resilience, sustaining steady satellite payload market expansion.

Germany Satellite Payload Market:

Germany plays a central role within the European satellite payload market due to strong aerospace engineering capabilities and institutional backing. Payload development emphasizes precision, reliability, and defense-grade performance. Government-supported programs and commercial partnerships drive demand. Integration with broader European space initiatives strengthens Germany’s contribution to the satellite payload market size and technology leadership.

United Kingdom Satellite Payload Market:

The United Kingdom satellite payload market benefits from growing commercial space activity and defense modernization efforts. Demand focuses on communications, Earth observation, and secure data services. Government support for innovation and private-sector participation accelerates payload development. The United Kingdom’s focus on small satellite payloads supports incremental satellite payload market growth and diversification.

Latin America Satellite Payload Market Analysis:

Latin America represents an emerging satellite payload market driven by growing demand for communications and Earth observation services. Government-led programs support weather monitoring and connectivity initiatives. Limited domestic manufacturing constrains scale, but partnerships facilitate capability development. As regional space programs mature, the satellite payload market growth potential strengthens steadily.

The countries across Latin America are primarily focusing on space services and space-related equipment. The market growth in the region is expected to be driven by an increase in contracts for space launches in Brazil, Argentina, and Colombia. For instance, in September 2022, Satellogic signed a three-year contract with the Government of Albania to provide Albania with a dedicated satellite, a unique program based on Satellogic's Constellation as a Service (CaaS) model, which provides Albania with access to two new satellites, Albania-1(NuSat-32) and Albania-2(NuSat-32).

Middle East & Africa Satellite Payload Market Analysis:

The Middle East and Africa satellite payload market remains developing but is strategically important. Demand is driven by communications, surveillance, and weather monitoring requirements. Government investment underpins most programs. Market growth depends on international partnerships, technology transfer, and expanding national space strategies supporting long-term satellite payload adoption.

Satellite Payload Industry Competitive Landscape

Leading Players Focus on Technological Advancements in Satellite Payload for Various Applications

The global market is relatively consolidated, with key players being SpaceX, Airbus S.A.S., Maxar Technologies, Northrop Grumman Corporation, and others. To increase their market share and sustain competition in the market, key players are focusing on technological developments, product innovations, and mergers & acquisitions. For different end users, such as the military, commercial, and public sectors, significant investments have been made in the research and development of satellite payloads.

For instance, in May 2023, Viasat completed the acquisition of Britain's Inmarsat, merging two of the largest satellite operators in geosynchronous orbit. In addition, in March 2023, Luxembourg SES publicly acknowledged its interest in merging with U.S.-based Intelsat and Luxembourg's own INTELSAT.

The satellite payload industry's competitive landscape is characterized by a concentrated group of established aerospace primes alongside a growing cohort of specialized payload technology providers. Market leadership is anchored in deep engineering expertise, long qualification cycles, and long-standing relationships with government and commercial satellite operators. Competitive intensity varies by payload complexity, orbit, and end-use profile.

Large, vertically integrated aerospace companies command a significant satellite payload market share, particularly in high-power communication, navigation, and defense payloads. Their strengths include system-level integration, compliance with stringent reliability standards, and the ability to manage multi-decade mission lifecycles. These players benefit from predictable institutional demand and high entry barriers that protect margins.

Mid-sized and specialized vendors focus on discrete payload subsystems such as sensors, radio frequency components, onboard processors, and antenna technologies. These firms compete through innovation speed, customization, and cost efficiency. Their role is expanding as operators increasingly decouple payload sourcing from full satellite platforms to optimize performance and cost.

Strategic partnerships are a defining feature of competition. Payload manufacturers collaborate closely with satellite bus providers, launch service companies, and downstream data analytics firms. Early co-design engagement improves integration outcomes and shortens deployment timelines. Defense programs further encourage consortium-based approaches to mitigate risk and ensure redundancy.

List of Top Satellite Payload Companies:

- Airbus S.A.S (Netherlands)

- L3Harries Technologies (U.S.)

- Lockheed Martin Corporation (U.S.)

- Maxar Technologies (U.S.)

- Northrop Grumman Corporation (U.S.)

- Sierra Nevada Corporation (U.S.)

- SpaceX (U.S.)

- ST Engineering (Singapore)

- Thales Group (France)

- The Boeing Company (U.S.)

Latest Satellite Payload Industry Developments:

- January 2024: Airbus Defence and Space advanced its digital payload roadmap by validating reconfigurable communication payloads, supporting flexible bandwidth allocation using software-defined transponder technology.

- May 2024: Thales Alenia Space secured a government contract to develop next-generation navigation payloads, strengthening strategic autonomy through enhanced signal resilience and precision timing capabilities.

- September 2024: Northrop Grumman expanded production capacity for military satellite payloads, aiming to improve delivery timelines using modular manufacturing and advanced integration processes.

- February 2025: Lockheed Martin demonstrated onboard processing enhancements for Earth observation payloads, enabling faster data exploitation through edge computing and artificial intelligence-enabled analytics.

- June 2025: L3Harris Technologies partnered with a commercial operator to co-develop high-throughput communication payloads, targeting constellation scalability using active electronically steered antenna systems.

REPORT COVERAGE

The report provides an in-depth market analysis. It comprises all major aspects, such as R&D capabilities, supply chain management, competitive landscape, and optimization of the manufacturing capabilities and operating services. Moreover, the report offers insights into the global satellite payload market trends, growth analysis, and size, and highlights key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.5% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Payload Type

|

|

By Vehicle Type

|

|

|

By Orbit

|

|

|

By Application

|

|

|

By End-Use

|

|

|

By Geography

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 10.73 billion in 2024.

The market is likely to grow at a CAGR of 3.5% over the forecast period (2025-2032).

The telecommunication segment led the market.

The market size in North America stood at USD 4.8 billion in 2024.

Expanding satellite constellations is one of the key factors anticipated to drive the global market growth.

Some of the top players in the market are SpaceX, Airbus, Lockheed Martin Corporation, L3 Harris Technologies Inc, and Sierra Nevada Corporation.

Malfunctioning issues and the high cost of sensors are expected to hinder market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us