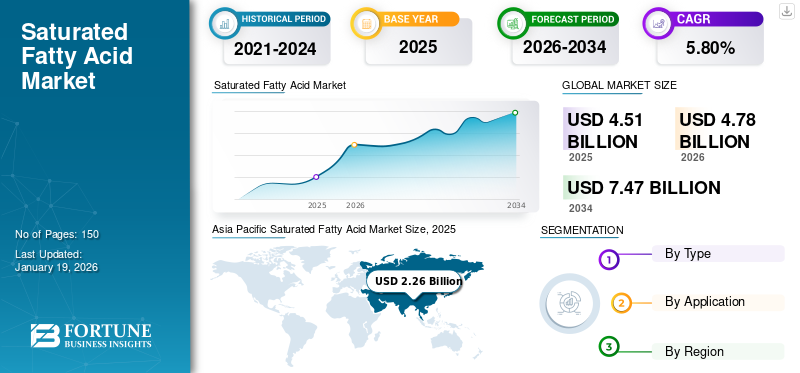

Saturated Fatty Acid Market Size, Share & Industry Analysis, By Type (Stearic acid, Palmitic acid, Lauric acid, Myristic acid, and Others), By Application (Food & Beverages, Cosmetics and Personal Care, Pharmaceutical, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global saturated fatty acid market size was valued at USD 4.51 billion in 2025. The market is projected to grow from USD 4.78 billion in 2026 to USD 7.47 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. Asia Pacific dominated the saturated fatty acid market with a market share of 50% in 2025.

Saturated fatty acids are commercially sourced from natural fats, including tallow, palm oil, and coconut oil, and undergo processes like hydrolysis and fractional distillation to yield pure compounds. Common types include stearic acid, palmitic acid, lauric acid, and myristic acid. Their molecular structure allows them to play a vital role in forming rigid lipid bilayers in cell membranes, making them important in biological systems. Additionally, SFAs serve as key intermediates in producing surfactants, emulsifiers, and other industrial compounds. The global market is witnessing significant growth opportunities driven by various applications like food & beverages, cosmetics, pharmaceuticals, and chemicals. Rising demand for clean-label ingredients and biodegradable products is driving the market growth.

The main players working in the market include PMC Biogenix, Inc., BASF Corporation, Wilmar International Ltd, AAK, and KLK OLEO.

SATURATED FATTY ACID MARKET TRENDS

Shift Toward Bio-Based and Eco-Friendly Production Methods for Sustainability Alignment

Manufacturers of this product are increasingly exploring greener, bio-based production pathways to align with sustainability goals and global environmental standards. This trend includes adopting enzymatic processes, green solvents, and renewable feedstocks to reduce energy usage, emissions, and waste. The traditional extraction of fatty acids often involves high-temperature hydrolysis and chemical treatment, but cleaner technologies are now emerging as cost-effective and scalable alternatives. In particular, large players are investing in integrated facilities capable of recovering by-products and minimizing resource consumption.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Food & Beverage Sector Globally is fueling the Market Growth

The increase in the global food and beverage sector is a major driver for the saturated fatty acid industry. These fatty acids, particularly stearic and palmitic acids, are widely used as emulsifiers, texturizers, and stabilizers in processed food products, dairy products, and bakery items. Growing demand for ready-to-eat and convenience foods, particularly in urban areas, is fueling their usage. Emerging economies such as India, China, Brazil, and Southeast Asian countries are witnessing a rush in fast-food consumption due to rising disposable incomes and changing lifestyles.

MARKET RESTRAINTS

Stringent Health Regulations Reducing the Use of Saturated Fatty Acids in Processed Foods

Health regulations have become more aggressive in limiting saturated fat intake due to links with cardiovascular diseases and obesity. Several national food safety authorities have implemented tighter nutritional guidelines, forcing food producers to reformulate products to lower saturated fat content. This directly reduces consumption from key segments like packaged snacks, baked goods, and ready-to-eat meals. The negative perception surrounding saturated fats is also amplified by consumer health consciousness campaigns and media influence. These regulations are gradually shifting consumer preference toward unsaturated fatty acids.

MARKET OPPORTUNITIES

Growing Demand for Natural and Plant-Based Ingredients in Cosmetics Creates New Opportunities

As consumer preferring are shifting toward clean-label and plant-based skincare products, these types of fatty acids, especially stearic and palmitic acids, are gaining renewed importance in cosmetic formulations. These fatty acids serve as emulsifiers, thickeners, and surfactants in creams, lotions, shampoos, and soaps. Brands seeking alternatives to synthetic chemicals increasingly turn to naturally derived fatty acids for product consistency and skin compatibility. The expanding global personal care industry, especially in Asia Pacific and Latin America, presents strong opportunities for saturated fatty acid market growth.

- According to the Observatory of Economic Complexity (OEC), in 2023, the global trade for beauty products was USD 70.4 billion, which is 9.02% more than in 2022. France and South Korea hold the largest share in the export, with 18.6% and 11.4% of the share respectively. This growth brings a major opportunity for the saturated fatty acid sector as it is used in cosmetics production.

MARKET CHALLENGE

Price Volatility and Unstable Feedstock Supply Chains Challenge the Market Growth

The production of fatty acids is highly dependent on the availability and cost of feedstocks such as palm oil, coconut oil, and animal fats. Price fluctuations caused by climate change, export restrictions, geopolitical instability, and changing agricultural policies can severely impact supply chain stability. Additionally, regulatory scrutiny on deforestation and sustainable sourcing adds another layer of complexity, especially for producers operating in environmentally sensitive zones.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Growing use of Stearic Acid in the Food and Pharma Industry is driving the Segment Dominance

Based on type, the market is classified into stearic acid, palmitic acid, lauric acid, myristic acid, and others.

The stearic acid segment holds the largest saturated fatty acid market share due to its widespread industrial usage. It is prominently used in cosmetics as a thickener and emulsifier, giving products such as lotions and creams a smooth texture. In the food industry, stearic acid serves as a release agent and is also used in confectionery coatings. Pharmaceuticals utilize it in tablets and capsules for its stability and binding capabilities. As demand continues in personal care and food formulations, the market for stearic acid remains stable.

Palmitic acid, a fatty acid commonly derived from palm oil, plays a critical role in food, cosmetic, and pharmaceutical applications. It is extensively used in margarine, baked goods, and non-dairy creams as a flavor and texture enhancer. In cosmetics, it provides emollient properties, helping improve skin feel in lotions, creams, and cleansers. Pharmaceuticals utilize palmitic acid in creams and ointments, particularly where skin absorption is necessary. The wide availability of palm oil makes palmitic acid cost-effective and accessible.

Lauric acid, a medium-chain fatty acid, is primarily sourced from coconut oil and palm kernel oil. It is highly valued in the personal care industry for its antimicrobial and surfactant properties, making it a key component in shampoos, soaps, and skincare formulations. In the food industry, lauric acid is used in the production of nutritional supplements, infant formulas, and confectionery products due to its quick energy conversion and digestibility.

By Application

Food & Beverages Sector Drives Substantial Demand for Saturated Fatty Acids due to Their Preservation Properties

Based on the applications, the market is classified into food & beverages, cosmetics and personal care, pharmaceutical, and others.

The food & beverages industry holds the largest saturated fatty acid market share, due to their textural, stabilizing, and preservation properties. Compounds like stearic and palmitic acids are extensively used in baked goods, dairy products, confectionery, and processed foods to enhance flavor, mouthfeel, and shelf life. They act as emulsifiers, release agents, and texture improvers. These products are also found in the formulation of hydrogenated oils and fat substitutes.

Saturated fatty acids are integral to the cosmetics and personal care segment, offering diverse benefits such as moisturization, emulsification, and texture enhancement. Stearic acid is used in creams and lotions to provide thickness and consistency. These fatty acids are favored for their natural origin and compatibility with plant-based formulations, aligning with the rising demand for sustainable and skin-safe ingredients. They are also valued for their mildness and non-toxic nature, making them suitable for sensitive skin applications.

The pharmaceutical industry leverages fatty acids for their biocompatibility, stability, and functional versatility in drug formulations. Stearic and palmitic acids are commonly used as excipients in tablets and capsules, acting as lubricants and binders that enhance compressibility and reduce friction. These fatty acids also form the base of lipid-based drug carriers that enhance bioavailability and control drug release. The demand for high-purity, pharmaceutical-grade excipients is rising alongside the increasing complexity of drug formulations.

Saturated Fatty Acid Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Saturated Fatty Acid Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the dominating share in the market, fueled by rapid industrialization, urbanization, and a rising middle-class population. Countries such as China, India, Indonesia, and Malaysia are major contributors due to their vast palm and coconut oil production capacity. These oils serve as key raw materials for various fatty acids, including palmitic, stearic, and lauric acids. The food industry is expanding significantly in the region, with increased demand for packaged, processed, and convenience foods, which drives fatty acid use.

North America

North America holds a significant share in the saturated fatty acid industry, driven by strong demand from food, pharmaceutical, and personal care products. The U.S. leads due to its advanced food processing sector and high consumption of packaged goods. Cosmetic manufacturers are increasingly adopting natural fatty acids in skincare and personal hygiene products, supporting regional growth. Pharmaceutical applications also contribute steadily, with fatty acids being used in excipients and topical treatments.

Europe

Europe is a prominent region in the saturated fatty acid industry, driven by stringent regulations, growing consumer awareness, and a focus on sustainability. Countries like Germany, France, and U.K. are leading contributors due to their advanced food and cosmetics sectors. The region emphasizes the use of natural and organic ingredients, prompting the replacement of synthetic fatty compounds with plant-based alternatives such as stearic and lauric acids. Europe's cosmetic industry extensively utilizes fatty acids for emulsification and moisturization in skincare products.

Latin America

Latin America presents moderate growth potential in the saturated fatty acid industry, largely supported by local agricultural resources and rising consumer interest in processed foods and cosmetics. Brazil, Argentina, and Colombia are key markets owing to expanding food processing industries and an increasing focus on personal care products. Palm oil production in countries like Colombia provides a cost-effective source for palmitic and stearic acid extraction.

Middle East & Africa

The Middle East & Africa region is an emerging market for fatty acids, characterized by increasing industrial development and growing consumer interest in personal care and pharmaceutical products. South Africa, the UAE, and Saudi Arabia are prominent countries contributing to regional demand. In the cosmetics sector, there's a gradual shift toward clean and organic formulations, boosting the demand for fatty acids.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions

The saturated fatty acid market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include PMC Biogenix, Inc., BASF Corporation, Wilmar International Ltd, AAK, and KLK OLEO, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY COMPANIES PROFILED

- Twin Rivers Technologies, Inc. (U.S.)

- PMC Biogenix, Inc. (U.S.)

- BASF Corporation (Germany)

- Baerlocher GmbH (Germany)

- Wilmar International Ltd (Singapore)

- AAK (Sweden)

- Emery Oleochemicals (U.S.)

- CREMER OLEO GmbH & Co. KG (Germany)

- Berg+Schmidt GmbH & Co. KG (Germany)

- KLK OLEO (Malaysia)

KEY INDUSTRY DEVELOPMENTS

- November 2024: BASF partnered with Acies Bio to drive sustainable production of “Personal and Home Care ingredients". This partnership focuses on biotechnology, specifically developing fermentation technology from methanol to produce fatty alcohols, essential building blocks for various ingredients in the home and personal care markets, including surfactants.

- May 2024: Emery Oleochemicals has entered into an exclusive distribution partnership with LEHVOSS Functional Fluids for its products, including esters, polyols, and carbon/fatty acids across Europe. This collaboration is aimed at enhancing Emery Oleochemicals’ presence and market position in the European region.

- October 2023: BASF SE has introduced Emulgade Verde 10 MS to advance its polyglyceryl fatty acid ester technology, supporting natural formulations and aligning with current market trends. This new, versatile O/W emulsifier delivers both sustainability advantages and proven high performance.

- April 2023: KLK OLEO, the manufacturing division of Malaysia's Kuala Lumpur Kepong Berhad (KLK), completed its acquisition of a controlling stake in Temix Oleo, an Italy-based oleochemical company. This strategic acquisition allows KLK OLEO to expand its product offerings in the oleochemical market.

- April 2023: KLK OLEO announced a new expansion site in West Port, Malaysia, represented by the groundbreaking ceremony, which marks a strategic step for the company as a leading global oleochemical producer. The expansion focuses on increasing the production capacity for fatty alcohols and fatty acids fractions, allowing KLK OLEO to better cater to its worldwide customer base.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.80% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Stearic acid · Palmitic acid · Lauric acid · Myristic acid · Others |

|

By Application · Food & Beverages · Cosmetics and Personal Care · Pharmaceutical · Others |

|

|

By Region · North America (By Type, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, Application, and Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, Application, and Country) o China (By Application) o Japan (By Application) o India (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, Application, and Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, Application, and Country) o GCC (By Application) o South Africa (By Application) · Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.51 billion in 2025 and is projected to reach USD 7.47 billion by 2034.

In 2025, the market value stood at USD 4.51 billion.

The market is expected to exhibit a CAGR of 5.80% during the forecast period.

The stearic acid segment led the market by type in 2025.

The expansion of the food and beverage industry is expected to be the primary driver of market growth.

PMC Biogenix, Inc., BASF Corporation, Wilmar International Ltd, AAK, and KLK OLEO are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

The growing demand for the food & beverage industry, driven by a growing population and growing demand for processed and packaged foods, is likely to drive the adoption of the product in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us