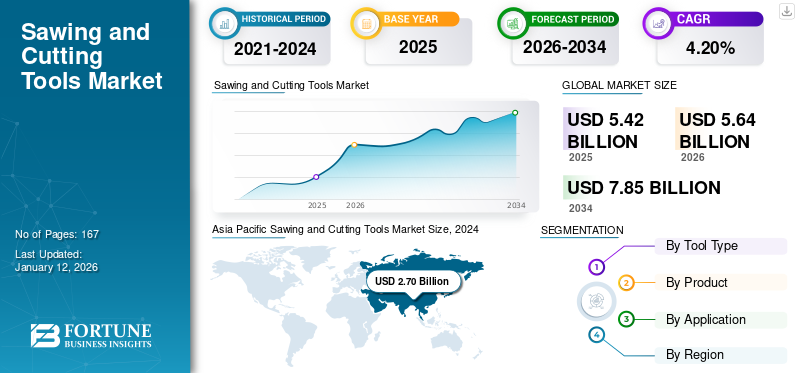

Sawing and Cutting Tools Market Size, Share & Industry Analysis, By Tool Type (Corded and Cordless), By Product (Hack Saw, Band Saw, Jig Saw, Circular Saw, Table Saw, Shear, Nibbler, Cutter, and Others), By Application (Do-It-Yourself (DIY) and Industrial), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global sawing and cutting tools market size was valued at USD 5.42 billion in 2025 and is projected to grow from USD 5.64 billion in 2026 to USD 7.85 billion by 2034, exhibiting a CAGR of 4.20% during the forecast period. The Asia Pacific dominated global market with a share of 51.43% in 2024.

The sawing and cutting tools market is characterized by an evolving landscape driven by the intense competition among competitors and the emergence of new and innovative tools. The market’s nature is mostly aligned with the overall health of the manufacturing processes, exhibiting a derived demand for sawing and cutting tools in complex industrial operations. The market’s key characteristics include different product offerings such as hack saw, band saw, jig saw, circular saw, table saw, shear, nibbler, cutter, and others.

Download Free sample to learn more about this report.

Global Sawing and Cutting Tools Market Overview

Market Size:

- 2025 Value: USD 5.42 billion

- 2026 Value: USD5.64 billion

- 2034 Forecast Value: USD 7.85 billion, with a CAGR of 4.20% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific accounted for the largest market share in 2024 (USD 2.70 billion), driven by rapid industrialization, infrastructure development, and urbanization, with China and India leading the region.

- Tool Type Leader: Corded tools remain dominant, favored for high-power industrial and commercial applications, while cordless tools are growing fastest due to ergonomics and battery advancements.

- Product Leader: Cutting tools (including band saws and circular saws) hold the largest market share, driven by advancements in tool design and demand for high-performance, lightweight solutions.

- Application Leader: Industrial applications dominate, supported by investments from major manufacturers and demand from fabrication, construction, and automotive sectors.

Industry Trends:

- Automation & Smart Tools: Integration of automation, AI, and machine learning is optimizing operations and driving the shift to automated and semi-automatic tools.

- Product Redesign & Ergonomics: Manufacturers are focusing on lightweight, energy-efficient, and ergonomically compliant tools for long-duration use.

- Supply Chain Resilience: Trade tariffs and supply chain volatility are prompting manufacturers to diversify markets and strengthen supply chains.

- Tool as a Service (TaaS): Growth in freelance contractors and commercial tool rental services is expanding market access and reducing barriers for end users.

Driving Factors:

- Technological Advancements: Upgrades in tool material, power source, and integration of Industry 4.0 technologies are boosting productivity and efficiency.

- Industrial & Construction Growth: Expansion in automotive, shipbuilding, woodworking, and infrastructure projects is fueling demand for advanced sawing and cutting tools.

- Government Incentives: Incentive plans, such as India’s USD 1,423.17 million plan for hand and power tools, are supporting market growth and local manufacturing.

- DIY Market Expansion: Rising household spending and DIY trends in developed and developing countries are increasing demand for user-friendly tools.

Technological advancements play a pivotal role with advancements in the tool material, power source type, and Industry 4.0 technology, such as data analytics, IIoT, and robotics, is driving market potential in the long term. Furthermore, manufacturers are focusing on developing ergonomically compliant and energy efficient products for long-duration working. Manufacturers such as Milwaukee and Makita are incorporating lightweight tools into their product portfolio that offer more productive time and are easy to operate for long durations.

During the COVID-19 pandemic, the power tool market fell to negative levels owing to the immediate shutdown of factories, disruption in transportation, destabilization of the economy, related ecosystem, and other factors. The pandemic further extended these hindrances by highlighting the need for market resiliency and adaptability hampered by a disturbed trade balance. As the global economy recovers the sawing and cutting tools sector witnesses a poised growth driven by the infrastructure projects, the rebound of the automotive sectors, and the continuous pursuit of production excellency.

IMPACT OF RECIPROCAL TARIFFS

Volatile Market Dynamics and Disturbed Trades are Restructuring Market

Due to the trade war, prominent tool manufacturers experience additional risks, such as decreased foreign demand, research and development investment, and thereby fueling the need for a resilient supply chain. Further, the impact of tariffs on power tools is a major reason for the market restructuring. Many manufacturers are focusing on identifying new markets and increasing their offerings in existing markets, supporting the merger and acquisition strategies of major manufacturers globally. The reciprocal tariffs' impact is very high in the short term, as it would delay order proceedings, and in the long term, it would create a price pressure on the end user, creating difficulties for the market.

- For instance, in April 2025, Stanley Black & Decker, a prominent power tools manufacturer, said that they were raising their prices and shifting their supply chain in response to the Trump administration’s tariffs. The prices will be raised in the second quarter of 2025 and further in the third quarter.

MARKET DYNAMICS

MARKET TRENDS

Focus on Integrating Automation and Redesigning of Products for Improvement

The market is experiencing a major shift to automated tools and technologies that use advanced AI and ML techniques to optimize various operations. Businesses are redesigning their products for enhanced use in industries such as automotive, aerospace, steel construction, and others. The advanced tools are designed to meet the strong usage requirement of these industries and equally compliant to the global standards that drive sawing and cutting tools market trends in long term.

- For instance, in May 2025, Cosen, a prominent band saw manufacturer, displayed four of their cutting-edge band saw solutions that are semi- and fully-automatic, designed for more enhanced accuracy, safety, and productivity.

MARKET DRIVERS

Embracing Product’s Operation and Technological Upgrades Bolsters Market Growth

The market for sawing and cutting tools is witnessing rapid growth during the forecast years, owing to its extended battery life and the adoption of automation and smart solutions across various end-use verticals, such as shipbuilding, automotive, woodworking, aerospace, and others, is widening. These industries are implementing smart manufacturing, wherein the overall workflow process, including assembly, production, and other aspects are connected. End users embrace the latest upgrades and benefit from the product performance, boosting satisfaction and bolstering the sawing and cutting tools market growth during the forecast period.

- For instance, in April 2024, Milwaukee introduced the M12 1-¼"-2” copper tubing cutter, which delivers faster and cleaner cuts. The product delivers high performance and adjusts automatically to the diameter of different cut types K, L, and M.

MARKET RESTRAINTS

Volatility in User Prices and Supply Chain Volatility are Hindering Market Growth

The demand for power tools is growing with the emergence of an innovative, efficient, and easy-to-use range of tools. However, supply chain volatility and end-user product prices are a major factor that constrains market growth. Moreover, the cost of power tool ownership increases with increasing material costs, further limiting the power tools' sales growth.

MARKET OPPORTUNITIES

Commercialization of Tools and Supporting Incentives to Mitigate Risks and Opportunities

The market for commercial power tools is anticipated to flourish in the forecast period, owing to the rising number of contractors acting freelance across the residential and commercial sectors, delivering Tool as a Service (TaaS). These affordable services are easy to avail, reducing the need for tool expertise, and initial investment in acquiring a tool is further fueling sawing and cutting tools market size.

- For instance, in April 2025, NiTi Ayog, a government body of the Government of India, proposed a USD 1,423.17 million incentive plan to boost India’s hand and power tool sector. The plan aims to achieve a 10% market share in power tools and a 25% share in the hand tools sector.

Segmentation Analysis

By Tool Type

Recursive Corded Tools in Industrial Cutting Demand Drives Segmental Dominance

On the basis of tool type, the market is categorized into corded and cordless.

Among these, corded tools remain a dominant segment. They are anticipated to forecast the highest growth, owing to their recursive demand from commercial and industrial customers demanding high-power electric tools. Moreover, it has revolutionized the work culture of industries such as construction, automotive, and other industries, as they save time and costs for stakeholders.

Meanwhile, cordless tools are growing progressively, gaining the highest CAGR owing to their easy handling and ergonomics. According to The European Power Tool Association, the rechargeable battery industry holds a heavy investment in research & development activities.

By Product

Advancements in Cutting Tools for Nurturing Production Fuels Product Demand

On the basis of product, the market is categorized into hack saw, band saw, jig saw, circular saw, table saw, shear, nibbler, cutter, and others.

The cutting tools segment holds the largest market share in 2024 and is experiencing the highest growth due to the advancements in cutting tools, which benefit manufacturers with minimized downtime and better cutting. Band saws and circular saws are witnessing a progressive growth owing to the growing demand for saw profiles that can deliver high performance, lightweight, and without sacrificing time.

Hack saw, shear, jig saw, and nibbler are showcasing moderate growth due to the continuous innovation delivering consistent cutting process results.

By Application

Industrial Application Dominates with Increasing Commercial Investments

The application segment is further categorized into Do-It-Yourself (DIY) and industrial.

In the segment, the industrial sector is witnessing the highest growth owing to the growing investment of major manufacturers, such as Milwaukee Tools and Makita are mainly emphasizing manufacturing sawing and cutting tools that can deliver more precision cuts and longer tool life. Moreover, rising demand from the industrial fabrication and construction industries fuels the market growth.

The Do-it-Yourself (DIY) application is projected to have a remarkable impact on the market, owing to the growth and trend witnessed by DIY enthusiasts, mainly due to the increasing spending capability and the rising number of households across developed and developing countries.

Sawing and Cutting Tools Market Regional Outlook

The market is categorized by region into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Sawing and Cutting Tools Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific has proven to be the dominant and exponentially growing region for the power tool sector. The demand for cutting and sawing tools is directly proportional to the increase in industrialization, infrastructure development, and urbanization. Further, the growing demand for high-speed cutting tools in industrial fabrication and complex metal cutting operations is driving the regional demand. China and India are leading the Asia Pacific region, while businesses supporting R&D in Japan, South Korea, and Taiwan are expanding sawing and cutting tools market share.

North America

North America remained a strong and mature market for cutting and sawing tools because of the presence of numerous power tool manufacturers and high-value customers with consistent demand for advanced cutting tools for various cutting and woodworking operations.

The U.S. cutting and sawing tools market is growing steadily, driven by the rapid adoption of battery-powered tool technology. These tools offer freedom of movement and enhanced operational efficiency in cutting and sawing operations.

Europe

The European region is projected to showcase potential growth owing to the stagnant demand for tools in metal cutting and forestry. Furthermore, a smaller customer base and domestic demand fulfillment by regional players support the market growth.

Middle East & Africa

The Middle East and Africa region witnessed a notable contraction during the pandemic that took almost two years to recover. The market is steadily growing as a preference for energy-efficient and compact tools rises during the forecast period.

Latin America

The Latin American market is estimated to witness the lowest growth throughout the forecast years. Less supportive policies and few investments in public infrastructure lessen the demand for cutting and sawing tools.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Portfolio Expansion for Market Penetration is Driving Growth

Prominent players engaged in sawing and cutting tools operating through distribution channels or existing offices worldwide and are placing a growing emphasis on launching precision and efficient products in the existing market. Moreover, major tool manufacturers are focusing on the development of advanced precision cutting tools that can deliver precision over quantity with faster cutting speed and more cuts in a single charge to benefit industry players in the long term.

- For instance, in May 2024, Makita U.S.A. Inc. introduced its new innovation accessory category of diamond blades optimized for use with battery-powered cordless grinders and cutters. These blades feature ultra-thin kerfs that can deliver faster cuts per charge.

LIST OF KEY SAWING AND CUTTING TOOLS COMPANY PROFILED

- Atlas Copco AB (Sweden)

- Emerson Electric Co. (U.S.)

- Enerpac Tool Group (U.S.)

- Hilti Corporation (Liechtenstein)

- Ingersoll Rand (U.S.)

- Koki Holdings Co. Ltd. (Japan)

- Makita Corporation (Japan)

- Robert Bosch GmBH (Germany)

- Stanley Black & Decker Inc. (U.S.)

- DeWalt (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Makita Inc., a high-quality professional tool manufacturer, has introduced the XDefence tool management XGT communication adapter. It enables communication between XGT series batteries and tools, and PC tool management software, benefiting from better tool management and increased security.

- November 2024: Makita Inc. has introduced a 40V high-powered XGT battery that can deliver more power and run cooler. The batteries are designed to deliver high power under heavy load applications and are 35% more powerful, compact, and cooler than existing battery lines.

- October 2024: Makita Inc. released a new 40V max XGT 9-inch power cutter designed to deliver more power and less vibration than previous models. The tool is suitable for masons, general contractors, hardscape contractors, fire and rescue professionals, and many others.

- September 2024: Milwaukee Tool introduced next-generation deep cuts and band saws that deliver better user-cutting performance. The new band saws cut 4-inch black iron pipes 20% faster than old ones.

- June 2024: Milwaukee refined its chainsaw capabilities by utilizing a 20’’ dual battery chain saw that delivers 70 cc power and faster cutting with reduced stalls. The expansion of their professional chainsaw solution drives performance and productivity.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and product applications. It also offers insights into market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.20% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Tool Type

|

|

By Product

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The market is projected to reach USD 7.85 billion by 2034.

In 2025, the market was valued at USD 5.42 billion.

The market is projected to grow at a CAGR of 4.20% during the forecast period.

The cutter product segment is expected to lead the market.

Embracing products operation and technological upgrades bolsters market growth.

Atlas Copco AB (Sweden), Emerson Electric Co. (U.S.), Enerpac Tool Group (U.S.), Hilti Corporation (Liechtenstein), Ingersoll Rand (U.S.), Koki Holdings Co. Ltd. (Japan), Makita Corporation (Japan), Robert Bosch GmBH (Germany), Stanley Black & Decker Inc. (U.S.), and Tectronic Industries Co. Ltd. (China) are the top players in the market.

Asia Pacific is expected to hold the highest market share.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us