Self-Healing Networks Market Size, Share & Industry Analysis, By Offering (Solution and Services), By Enterprise Type (Small & Mid-sized Enterprises (SMEs) and Large Enterprises), By Network Type (Physical, Virtual, and Hybrid), By Application (Networking Configuration & Provisioning, Network Traffic Management, Root Cause Analysis, Network Access Control, Security Compliance Management, and Others), By Industry (IT & ITES, Telecommunications, BFSI, Healthcare, Retail, Education, and Others), and Regional Forecast, 2026 – 2034

SELF-HEALING NETWORKS MARKET SIZE AND FUTURE OUTLOOK

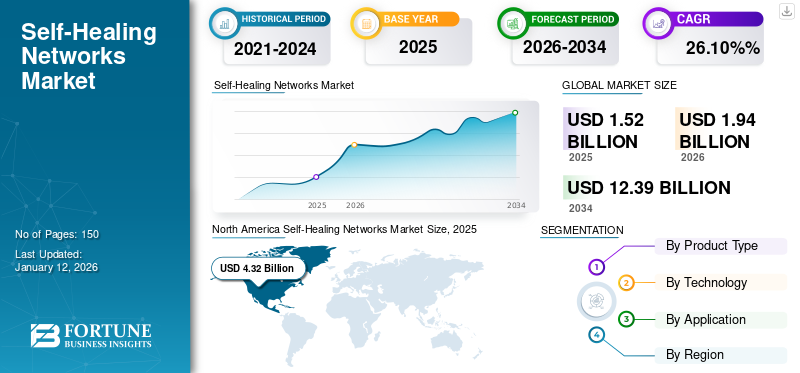

The global self-healing networks market size was valued at USD 1.52 billion in 2025. The market is projected to grow from USD 1.94 billion in 2026 to USD 12.39 billion by 2034, exhibiting a CAGR of 26.10% during the forecast period. North America dominated the market with a share of 43.90% in 2025.

Self-healing networks help enhance network uptime and reliability, which is essential for existing digitally-driven enterprises. By computerizing the recognition and resolution of network issues, the purpose of these networks is to reduce downtime and preserve seamless connectivity.

AIOps (Artificial Intelligence for IT Operations), which is a combination of AI for network tasks, plays a vital role by offering the intelligence and learning competencies required for pre-emptive problem-solving. Moreover, the incorporation of autonomous features warrants that these networks can individually handle routine responsibilities and anomalies, minimizing the requirement for human intervention and improving the whole network’s resilience. For instance,

- As per industry experts, various use cases of Artificial Intelligence (AI) in network environments include network performance optimization (40%), security threat detection (38%), traffic analysis & optimization (34%), and self-healing (23%).

Key players, such as Cisco Systems, Inc., Fortra, LLC, SolarWinds Worldwide, LLC, CommScope, and Elisa Polystar, among others, are enhancing their solutions by integrating technologies within their solutions and services, upgrading existing solutions, and many other business strategies.

IMPACT OF GENERATIVE AI

Incorporation of Generative AI Capabilities to Open up Various Market Opportunities

Enterprises with more advanced AI and automation environments are more likely to have Gen AI in their operations. Use cases characteristically differ as per organization, but generative AI can particularly be valuable for multifaceted cloud-driven network applications.

Some of the use cases include traffic modeling, resource allocation, topology generation, and dynamic Quality of Service (QoS). Gen AI can constantly expand and update the database with the newest network configurations, troubleshooting guides, and many other practices. Thus, this form of AI can be a key technology in enhancing routine network functions. For instance,

- In November 2024, AWS and Tech Mahindra announced a collaboration to develop a GenAI-driven platform for telecom networks. It aims to improve network efficacy and customer experiences. The platform by Tech Mahindra is developed on AI, Machine Learning (ML), and GenAI services empowered by AWS. This will encourage customers to move their network processes from an on-premises substructure to a real-time preventive and proactive model functioning on a hybrid cloud.

SELF-HEALING NETWORKS MARKET TRENDS

Rising Demand for Automation across Network Environment Solutions to Propel Market Growth

Network automation has emerged as a vital solution to resolve several issues, including enabling network engineers to simplify their work operations, minimize errors, and enhance operational efficiency.

Network automation is the process of performing numerous repetitive tasks, such as monitoring, device configurations, and troubleshooting, with the help of either some scripts or tools and software in a network environment. It provides numerous benefits, such as resource & time efficiency, accuracy & consistency, faster deployment, faster troubleshooting, and better compliance & security by employing automated procedures that identify and respond to network problems in real-time. Thus, network engineers can generate a more resilient and strong network infrastructure. Self-healing networks can minimize downtime and enhance network accessibility. For instance,

- According to Resolve Systems Insights 2024, approximately 65% of enterprise networking operations are done manually. The transition to automation offers various prospects to enhance reliability, efficiency, and scalability. By 2026, 30% of enterprises are anticipated to automate a vast majority of their network functions.

Thus, the demand for network automation is increasing among organizations, thereby driving the self-healing networks market growth.

MARKET DYNAMICS

Market Drivers

Increasing Network Complexity to Drive Demand for Self-Healing Network Solutions

Rising network complexity and technological advancements with the deployment of 5G, the growth of IoT devices, and the incorporation of SDN (Software-Defined Networking)/Network Functions Virtualization (NFV) are making physical network management impractical. Thus, the rise in such technological advancements will increase the demand for improved performance and reliability. For instance,

- As per IoT Analytics Insights 2023, there were around 1.28 million private 5G IoT connections across the globe in 2023, which was 5% of the total 25.6 million 5G IoT connections.

In the context of 5G, automation is essential for preserving performance, scalability, and reliability. Efficiency is necessary to keep up with the requirements of 5G networks, where reliability and speed are critical. As networks grow more complex with the incorporation of 5G, IoT, and cloud computing, the need for automated solutions to identify, repair, and diagnose network issues effectively increases.

Self-healing networks attempt to minimize the operational load on IT staff, enabling them to emphasize more strategic operations instead of daily network management. Another prominent objective is to enhance network security with the help of continual monitoring and faster response to probable threats.

Such factors will surge the demand for network automation, thereby driving the market share.

Market Restraints

Interoperability Issues across Various Network Components Can Hamper Market Progress

The requirement for seamless integration with several components of networks, devices, and technologies can generate interoperability issues. Various tools can have different functions, features, protocols, and interfaces that are essential to be assimilated and coordinated.

Network interoperability becomes crucial in accomplishing end-to-end connectivity. The more varied networks exist, the greater the need to ensure that they can interoperate in a way that makes endway communication feasible.

Self-healing network tools may not be consistent or compatible with the present network devices, standards, or systems. It can lead to errors, conflicts, or failures that can impact network security or performance.

Thus, the lack of ability to resolve these network interoperability issues can hinder the market growth.

Market Opportunities

Promotion of Edge Computing and SD-WAN to Create Numerous Lucrative Market Opportunities

The rise in cloud services and edge computing increases the demand for networks that can adapt in real-time to varying work operations and distributed resources. Also, as cloud providers are introducing more as-a-service solutions, industries are shifting toward Infrastructure as Code (IaC) and software-defined infrastructure models.

Self-healing networks are highly compatible with Software-Defined Networking (SDN) and Network Function Virtualization (NFV), enabling programmable and flexible network management. Such technologies facilitate faster recovery and fault identification across the network infrastructure. For instance,

- According to a Juniper Networks report, the technology penetration rate of SD-WAN in the Americas is 58%, Europe, the Middle East & Africa is 26%, and Asia Pacific is 5%.

Various enterprises develop and establish their own SD-WAN networks, and several are in view of managed SD-WAN services. Such growing adoption of SD-WAN networks will create multiple opportunities for market growth.

SEGMENTATION ANALYSIS

Benefits of Self-Healing Network Solutions Fueled Their Demand

By offering, the market is bifurcated into solution and services.

The solution segment held the highest market share of 58.25% in 2026. Self-healing network solutions offer numerous benefits, such as enhanced network reliability, minimized downtime, quicker issue resolution, better scalability, and cost efficiency, among others.

The services segment is anticipated to record the highest CAGR during the forecast period owing to the growing demand for network reliability among businesses. With self-healing networks, service vendors can match a firm's business Service-Level Agreements (SLAs) with precise technical configurations and services. Such benefits will contribute to the segment’s development.

By Enterprise Type

Adoption of Automated Network Management Tools Increased among Large Enterprises Due to Presence of Vast Network Infrastructure

Based on enterprise type, the market is categorized into small & mid-sized enterprises (SMEs) and large enterprises.

The large enterprises segment held the highest market share in 2024. The presence of a huge and complex network infrastructure increases the need for network automation solutions, such as self-healing networks among large enterprises. They help them reduce operational burden, improve network reliability, and ensure sustenance for digital infrastructure and hybrid IT environments. The large enterprises segment is likely to hold 56.86% of the market share in 2026. For instance,

- According to the NetBox Labs Survey Insights 2023, surveyed senior executives in larger enterprises stated that 66% of network management tasks would be automated by the year 2026.

The small & mid-sized enterprises segment is predicted to record the highest CAGR of 30.70% during the forecast period. These network solutions help SMEs with simplified network management, enhanced security, and cost-efficiency, thereby contributing to the market’s progress.

By Network Type

Preference for Hybrid Networks to Rise Owing to Increasing Awareness of Their Benefits

Based on network type, the market is segmented into physical, virtual, and hybrid.

The hybrid segment is anticipated to register the highest CAGR of 32.70% during the forecast period. Enterprises are beginning to recognize the benefits of a hybrid networking approach, which includes better cost management, improved redundancy & reliability, and enhanced IT security, thereby increasing preference for such networks among enterprises. For instance,

- As per the Enterprise Management Associates (EMA Insights), 43% of enterprises select a hybrid network with combined internet and MPLS.

The physical network type segment accounted for the highest market share in 2024 owing to the rising implementation of Software-Defined Networks (SDN) among enterprises across the globe. This network type encourages automation in network management, thereby contributing to the progress of self-healing network solutions. The physical segment is anticipated to capture 41.69% of the market share in 2026.

By Application

Varied Use Cases of Networking Configuration & Provisioning Surged Its Demand

Based on application, the market is segmented into networking configuration & provisioning, network traffic management, root cause analysis, network access control, security compliance management, and others (policy management).

The networking configuration & provisioning segment accounted for the highest market share in 2024 due to its higher implementation and use in enterprise network deployment, Internet of Things (IoT), and network provisioning of service providers. Also, its enhanced capabilities help improve security, network stability, standardization, and consistency. The networking configuration & provisioning segment is anticipated to hold 27.10% of the market share in 2026.

The security compliance management segment is projected to register the highest CAGR of 31.80% during the forecast period of 2025-2032. The increasing need for enterprises to adopt better security control & monitoring solutions to recognize compliance risks, audit compliance, and many more will contribute to the segment progress.

By Industry

Growing Technological Investments in Telecommunications Propelled Segment Growth

Based on industry, the market is categorized into IT & ITES, telecommunications, BFSI, healthcare, retail, education, and others (manufacturing).

The telecommunications segment held the highest market share in 2024. Network automation represents a key goals for telecommunications, particularly for major telcos. These networks provide a "Zero-X" experience (zero-touch, zero wait, and zero trouble) through their robust competencies in self-management, self-configuration, self-optimization, and self-security. Also, the growing technological investments in telecom will contribute to the progress of the segment. The telecommunications segment is anticipated to capture 26.10% of the market share in 2025. For instance,

- In June 2024, ServiceNow announced a strategic investment in Prodapt, a provider of network and digital services for the telecom and technology sectors. ServiceNow telco-dedicated Ecosystem Ventures’ investment will help in the digital business transformation over AI-driven solutions, improved go-to-market capabilities, and expansion of Now Platform skills.

The healthcare segment is predicted to register the highest CAGR of 32.20% during the forecast period. Implementation of self-healing networks in healthcare helps ensure better reliability and availability of critical systems, specifically in environments where continuous data transmission is essential for patient care and operational efficiency.

SELF-HEALING NETWORKS MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Self-Healing Networks Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North American market size in 2025, stood at USD 0.67 billion. North America held the highest market size of USD 0.85 billion in 2026, owing to the greater and early adoption of advanced technologies across IT, ITES, and telecommunication sectors. Also, the presence of prominent market players, such as Cisco Systems, Inc., Commscope, IBM Corporation, and Fortra, LLC, will contribute to North America's self-healing networks market share.

Download Free sample to learn more about this report.

The U.S. market size is expected to hit USD 0.54 billion in 2026. Growing usage of AI (Artificial Intelligence) and Machine Learning (ML) within self-healing network solutions can deliver substantial prospects for the U.S. market by enhancing user experiences, enabling more functionalities, and driving innovation. For instance,

- In February 2023, Juniper Networks expanded its partnership with IBM to integrate its network automation capabilities with RAN (Radio Access Network) optimization and O-RAN (Open Radio Access Network) technology.

South America

South America is predicted to grow at a considerable rate during the forecast period. The rising penetration of 5G networks and growing concerns about security threats will aid the market growth in this region. As self-healing networks help detect and recover from these attacks, they will contribute to the market development in the region.

Europe

Europe region is expected to hit USD 0.46 billion in 2026, making it the second-largest market, with a CAGR of 29.50% during the forecast period. This region will account for a noteworthy market share during the upcoming period due to the greater adoption of advanced technologies, such as AIOps, within networking. Countries, such as the U.K., Germany, France, and Spain, among others, have higher technological investments in research & development and deployment of smart network management solutions. For instance,

- As per Industry Insights, projects related to smart network management accounted for approximately 26% of the overall budget of smart grid projects across European countries.

The market in U.K. is projected to hit USD 0.11 billion in 2026. The market size for Germany is likely to reach USD 0.0986 billion in 2026 and France’s market size is estimated to USD 0.05 billion in 2025.

Middle East & Africa

The Middle East & Africa is anticipated to be the fourth-largest market with a value of USD 0.16 billion in 2026 and to register a substantial CAGR during the forecast period. Middle Eastern countries, such as Turkey and UAE, have higher network investments in telecommunications. Also, various market players are expanding their networking solutions in the region. The GCC market is expected to account for USD 0.04 billion in 2025. For instance,

- According to Industry Insights 2024, Turkey is considering merging its telecom fiber substructure into one unit to expand its network and resolve issues of private firms arising from expensive infrastructure investments.

Asia Pacific

Asia Pacific is projected to be the third-largest market with a value of USD 0.4 billion in 2026, showcase the highest CAGR over the forecast period. Rapid digital transformation and rollout of 5G networks will drive the market expansion in the region. Also, telecom companies in China, India, and Japan, among other countries, are actively adopting AI-driven self-healing network solutions to enhance the reliability of their 5G networks. The market in China is expected to reach USD 0.09 billion in 2026. Japan is likely to reach USD 0.08 billion in 2026 and Indian market is projected to reach USD 0.11 billion in 2026. For instance,

- In November 2024, China Mobile, in partnership with ZTE, announced the launch of an AI-based Green Telco cloud solution with varied hardware architectures. The solution makes use of their experience and exploration of telco network energy-saving mechanisms, aiming to apply AI to improve energy efficiency in telco-cloud substructures.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Introducing Modernized Solutions to Extend Business Reach

Players in the market, such as Fortra, LLC, Cisco Systems, Inc., Commscope, and SolarWinds Worldwide, among others, are introducing new solutions to improve their positioning by using advanced technological enhancements, addressing varied consumer requirements, and gaining a competitive edge. They are prioritizing product offering enhancement and strategic alliances, mergers, and acquisitions to strengthen their portfolio. Such progressive product launches will aid them in maintaining and enhancing their market share in a dynamically evolving industry.

Major Players in the Market

Fortra, LLC, Cisco Systems, Inc., Commscope, SolarWinds Worldwide, LLC, ManageEngine, Ivanti, Telefonaktiebolaget LM Ericsson, and Nokia, among others, are the largest players in the market.

List of Self-Healing Network Companies Profiled:

- Fortra, LLC. (U.S.)

- Cisco Systems, Inc. (U.S)

- Commscope (U.S.)

- SolarWinds Worldwide, LLC. (U.S.)

- Elisa Polystar (Sweden)

- Hewlett Packard Enterprise Development LP (U.S.)

- ManageEngine (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia (Finland)

- Ivanti (U.S.)

- IBM Corporation (U.S.)

- ACT Fibernet (India)

- VMWare (U.S.)

- Juniper Networks, Inc. (U.S.)

- BlueCat Networks (Canada)

- Beegol (Brazil)

- Huawei Technologies Co., Ltd. (China)

- BMC Software (U.S.)

- Appnomic (India)

- Versa Networks, Inc. (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS:

- January 2025: Fortra released an upgrade to the Intermapper Version 6.6.3. The company upgraded the jQuery of the Intermapper library from v1.10.2 to v3.6.0, which is intended for the web server. It also offered sustenance for Mac OS 13/14 Intel.

- December 2024: Nokia, in an alliance with Elisa, announced the launch of the first commercial 5G Cloud RAN installment with the help of Red Hat OpenShift. The deployment claimed to simplify the shift toward 6G, which is projected to be more cloud-driven. Cloudification is a prominent factor in Elisa's expansion of self-healing and self-driving autonomous networks.

- October 2024: Telstra and Ericsson collaborated to launch the trial positioning of the Ericsson Intelligent Automation Platform (EIAP) in Telstra’s commercial network. EIAP enabled the App positioning of Ericsson Automated Configuration Consistency (EACC). It aligns with Telstra's aim of shifting toward an intent-based network that offers self-healing, self-optimization, and self-assurance with nominal human intervention.

- September 2024: CommScope announced the launch of the RUCKUS Pro AV product, offering both wireless and wired networking solutions. The new product offering provides purpose-based, enterprise networking solutions improved for high-end commercial and residential AV installations.

- May 2023: Nokia announced the launch of an AI/ML-based fixed network insight solution for telecommunications. Nokia's fixed applications include the Altiplano Access Controller and WiFi Cloud Controller, which can be installed with the help of a SaaS subscription. The fixed network SaaS component offers operators the required path toward self-healing fixed broadband networks and AIOps.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Major players operating in the market are intended to make constant investments in research and development. These investments in R&D are intended to incorporate technologies, such as generative AI, advanced artificial intelligence, and machine learning capabilities to predict network failures, optimize resource allocation, and automatically reroute network traffic.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the solutions and services. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 26.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Offering, Enterprise Type, Network Type, Application, Industry, and Region |

|

Segmentation |

By Offering

By Enterprise Type

By Network Type

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

Fortra, LLC. (U.S.), Cisco Systems, Inc. (U.S.), Commscope (U.S.), SolarWinds Worldwide, LLC. (U.S.), Elisa Polystar (Sweden), HPE Network Orchestrator (U.S.), ManageEngine (U.S.), Ivanti (U.S.), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland). |

Frequently Asked Questions

The market is projected to reach a valuation of USD 12.39 billion by 2034.

In 2025, the market was valued at USD 1.52 billion.

The market is projected to record a CAGR of 26.10% during the forecast period.

The telecommunications industry led the market in 2025.

Increasing network complexity propels market growth.

Fortra, LLC, Cisco Systems, Inc., Commscope, SolarWinds Worldwide, LLC, Elisa Polystar, HPE Network Orchestrator, Telefonaktiebolaget LM Ericsson, and Nokia are the top players in the market.

North America held the highest market share in 2025.

By application, the security compliance management segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us