Silica Aerogel Market Size, Share & Industry Analysis, By Form (Powder, Blanket, and Others), By Application (Building & Construction, Aerospace & Defense, Automotive, Oil & Gas, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

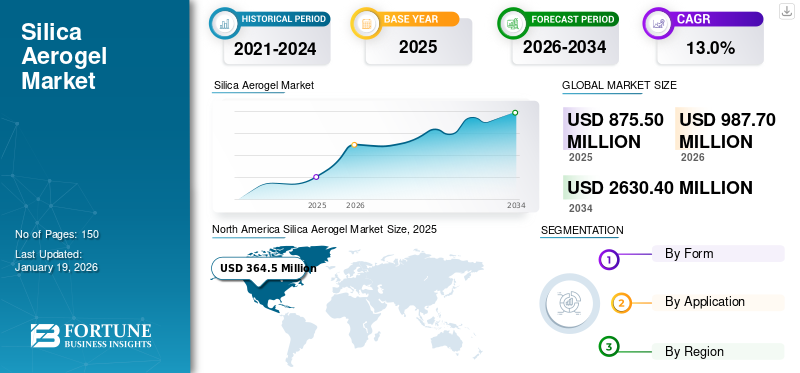

The global silica aerogel market size was valued at USD 875.5 million in 2025 and is projected to grow from USD 987.7 million in 2026 to USD 2,630.40 million by 2034, exhibiting a CAGR of 13.0% during the forecast period. North America dominated the silica aerogel market with a market share of 42.00% in 2025.

The global market is witnessing significant growth opportunities driven by various applications such as building & construction, aerospace & defense, and oil & gas. Silica aerogel is an advanced, highly porous nanostructured material composed primarily of silica dioxide, characterized by its extremely low density, high surface area, and remarkable thermal insulation properties. The structure consists of a three-dimensional network of silica nanoparticles with air filling the pores, giving it unique properties such as low thermal conductivity, optical transparency, and high acoustic damping capacity. The growing global importance of energy efficiency and carbon reduction is driving the growth of the market.

The main players working in the market include Aerogel Technologies, LLC, ENERSENS, JIOS Aerogel., Cabot Corporation, and Guangdong Alison Hi-Tech.

Silica Aerogel MARKET TRENDS

Rising Demand for Energy-Efficient and Sustainable Insulation Materials to Impel Market Development

A significant trend shaping the market is the growing global focus on energy efficiency and sustainability. Governments and industries are increasingly prioritizing materials that can reduce energy consumption while lowering greenhouse gas emissions. Silica aerogels, with their exceptional thermal insulation properties, align perfectly with these objectives by enabling energy savings in buildings, pipelines, and industrial systems. Their lightweight and environmentally friendly characteristics make them particularly attractive in construction. Additionally, regulatory pressure to improve energy efficiency standards is pushing industries toward advanced insulation options, creating new opportunities for aerogels.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Energy-Efficient Insulation in Construction is Fueling the Market Expansion

One of the major drivers for the market is the rising demand for energy-efficient insulation in the building and construction sector. With urban populations increasing and governments introducing strict energy efficiency regulations, the need for advanced insulation solutions has surged. Silica aerogels offer exceptional thermal resistance while being extremely lightweight, making them an ideal substitute for conventional insulation materials. Their thin profile allows for better space utilization in high-density urban buildings, while simultaneously reducing heating and cooling costs.

MARKET RESTRAINTS

Supply Chain Constraints and Raw Material Availability Are Hindering the Market Growth

An important challenge for the market is the instability of its supply chain and the limited availability of raw materials. Making silica aerogel requires a constant supply of silica precursors, solvents, and special chemicals, many of which can be expensive or hard to procure. Events such as the COVID-19 pandemic showed how supply chain disruptions can affect production due to reliance on a few suppliers. Furthermore, since most key manufacturers are located in certain regions, any local issues can cause delays or shortages worldwide.

MARKET OPPORTUNITIES

Expanding Use of Silica Aerogels in Energy-Efficient Building and Construction Brings New Opportunities for Manufacturers

The growing global demand for energy-efficient buildings presents a significant opportunity for silica aerogel manufacturers. With stricter government regulations on energy conservation and sustainability in construction, aerogels are becoming highly attractive as advanced insulation materials. Their exceptional thermal performance, low thermal conductivity, and ability to reduce heating and cooling costs make them suitable for green buildings and retrofitting projects. As urbanization accelerates, particularly in the Asia Pacific and the Middle East, the need for innovative materials that meet green certification standards is rising.

MARKET CHALLENGE

High Manufacturing and Processing Costs of Silica Aerogels to Challenge Market Growth

One of the most significant challenges hindering wider adoption of silica aerogels is their high production and processing costs. The manufacturing process requires advanced technology, specialized equipment, and strict environmental conditions, all of which increase capital expenditure for producers. Compared to conventional insulation materials such as fiberglass or mineral wool, these products are considerably more expensive, making them less accessible to cost-sensitive industries and regions. Additionally, limited raw material suppliers and the need for precision in synthesis further drive up operational costs, hindering silica aerogel market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Form

Rising Adoption of Specialty Chemical Formulations Boosts Powder Segment Growth

Based on form, the market is classified into powder, blanket, and others.

The powder segment holds the largest silica aerogel market share as it is widely utilized in paints, coatings, insulation additives, and specialty chemical formulations. Its ultralight structure and nanoscale porosity provide exceptional thermal insulation and surface modification benefits, making it ideal for enhancing performance in various industrial applications. Its flexibility in blending with polymers, adhesives, and composites gives manufacturers the advantage of creating innovative lightweight products.

Silica aerogel blankets are one of the most widely used forms of aerogel, known for providing excellent thermal insulation while being flexible and strong. These blankets are made by combining aerogel with fiber materials, making them easy to handle, cut, and install in many different uses. Their lightweight and durable nature positions aerogel blankets as an great alternative to traditional insulation materials. As energy-saving rules and carbon emission limits become stricter, more industries are expected to start using these blankets.

By Application

Building & Construction Segment Dominates Due to Its Thermal Insulation Capabilities

Based on application, the market is classified into building & construction, aerospace & defense, automotive, oil & gas, and others.

The building and construction segment holds the largest silica aerogel market share, due to its superior thermal insulation capabilities. With increasing focus on green buildings and energy-efficient structures, aerogels are being integrated into wall panels, windows, facades, and roofing systems. Their lightweight yet strong structure makes them ideal for both residential and commercial applications, reducing energy consumption by minimizing heat loss and improving HVAC efficiency.

In aerospace and defense, silica aerogels are highly valued as they provide excellent insulation in extreme temperatures and help reduce weight. Aircraft makers use aerogel in parts such as the fuselage, fuel tanks, and cabin walls to make planes more fuel-efficient and safe. In the defense field, aerogels are used in protective clothing, thermal suits, and lightweight armor, offering both insulation and shock protection. Space agencies also use aerogels in spacecraft to manage heat and protect delicate equipment from the harsh environment of outer space.

The oil and gas industry is one of the biggest users of the product due to their mechanical strength and excellent insulation, even in tough conditions. Aerogel blankets are widely used on underwater pipelines, LNG (liquefied natural gas) transport systems, and refinery equipment to keep temperatures steady and save energy. These blankets are also water-resistant and fireproof, which helps prevent condensation and rust, making equipment last longer.

Silica Aerogel Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Silica Aerogel Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 364.5 billion in 2025 and USD 411 billion in 2026. North America holds the largest share in the market, driven by strong adoption in building insulation, aerospace, and oil & gas. The U.S. remains the key hub due to advanced R&D, government-backed sustainability initiatives, and strong aerospace and defense industries. The region’s stringent energy efficiency regulations encourage the use of aerogels in construction, particularly in commercial buildings and retrofitting projects. The aerospace sector, including NASA and private space companies, has significantly boosted the product demand.

Europe

Europe represents a strong growth for silica aerogel market, largely supported by strict energy conservation policies and the region’s aggressive climate targets. Countries such as Germany, France, and the U.K. are leading adopters, with construction applications witnessing strong demand due to stringent building energy codes. EU funding programs supporting green construction and renewable energy infrastructure continue to encourage aerogel uptake. Strong regulatory push and technology advancements are expected to position Europe as a prominent consumer.

Asia Pacific

Asia Pacific is the fastest-growing region in the market, driven by rapid urbanization, rising industrialization, and expanding energy infrastructure. China leads in demand, fueled by large-scale construction projects, strict energy conservation goals, and increasing aerospace manufacturing activities. Japan and South Korea also show strong uptake, particularly in electronics, defense, and automotive sectors. India is emerging as a significant market, with emphasis on energy-efficient construction and industrial modernization, creating new opportunities for aerogel applications.

Latin America

Latin America presents strong growth opportunities for the product, particularly in construction and oil & gas sectors. Brazil and Mexico are the major markets, with their expanding urban infrastructure and energy industries fueling demand. Aerogels are being adopted in energy-efficient building projects, driven by increasing awareness of green construction and the need to reduce electricity consumption from cooling systems.

Middle East & Africa

The Middle East & Africa region holds significant potential for silica aerogels, mainly driven by oil and gas infrastructure and rising construction activities. Countries such as Saudi Arabia, UAE, and Qatar are leading adopters, with aerogel blankets widely used in pipeline insulation, LNG transport, and refinery applications. The region’s ongoing mega infrastructure projects, including sustainable city initiatives and high-rise developments, are boosting aerogel adoption.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Position in the Market

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include Aerogel Technologies, LLC, ENERSENS, JIOS Aerogel., Cabot Corporation., and Guangdong Alison Hi-Tech. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY SILICA AEROGEL COMPANIES PROFILED

- American Elements (U.S)

- Aerogel Technologies, LLC. (U.S.)

- Shanghai Aerogelzone Technology Co., Ltd. (China)

- Shanghai PIM Technology Co., Ltd (China)

- Henan Minmetals East New Materials CO. LTD. (China)

- ENERSENS (France)

- JIOS Aerogel. (Singapore)

- Svenska Aerogel (Sweden)

- Cabot Corporation. (U.S.)

- Guangdong Alison Hi-Tech (China)

REPORT COVERAGE

The global market analysis provides information on market size and forecast by all segments. It includes details on the market dynamics and market trends expected to drive the market during the forecast period. It offers information about the key regions, key industry growth, new product launches, details on partnerships, mergers & acquisitions, and a number of silica aerogel manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.0% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Form

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 987.7 million in 2026 and is projected to reach USD 2,630.40 million by 2034.

In 2025, the market value stood at USD 875.5 million.

The market is expected to exhibit a CAGR of 13.0% during the forecast period (2026-2034).

Aerogel in powder form lead the market by form.

The expansion of the construction industry is the key factor driving market growth.

Aerogel Technologies, LLC, ENERSENS, JIOS Aerogel., Cabot Corporation., and Guangdong Alison Hi-Tech are some of the leading players in the market.

North America dominates the market.

The growing demand for green and energy-efficient buildings is likely to drive the adoption of aerogel in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us