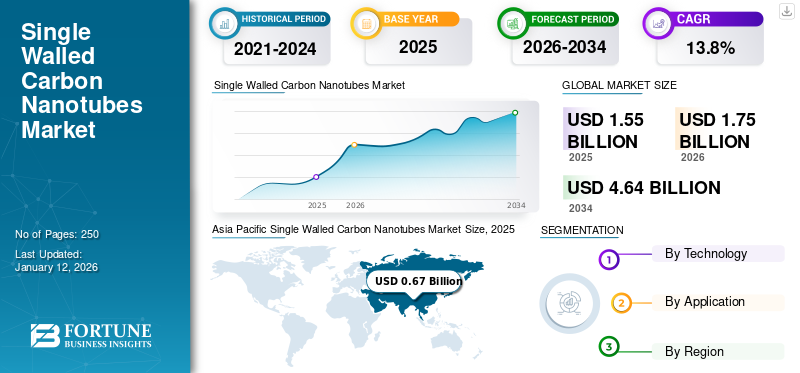

Single Walled Carbon Nanotubes Market Size, Share, & Industry Analysis, By Technology (Chemical Vapor Deposition (CVD), Arc Discharge, and Others), By Application (Plastics & Composites, Electrical & Electronics, Energy, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global single walled carbon nanotubes market size was valued at USD 1.55 billion in 2025 and is projected to grow from USD 1.75 billion in 2026 to USD 4.64 billion by 2032, exhibiting a CAGR of 13.80% during the forecast period. Asia Pacific dominated the single walled carbon nanotubes market with a market share of 43% in 2025.

Single walled carbon nanotubes (SWCNTs) are cylindrical nanostructures with a single layer of carbon atoms arranged in a hexagonal lattice, offering exceptional mechanical, electrical, and thermal properties. With diameters typically ranging from 0.4 to 2 nanometers and lengths up to several centimeters, SWCNTs exhibit remarkable strength, over 100 times stronger than steel at a fraction of the weight and flexibility, making them ideal for advanced composites, aerospace, and wearable electronics. Their electrical properties vary from metallic to semiconducting depending on chirality, enabling applications in nanoelectronics, such as transistors, sensors, and conductive films. SWCNTs also boast high thermal conductivity, rivaling diamond, which is valuable for heat management in microprocessors and energy storage systems.

The production methods, including arc discharge, laser ablation, and chemical vapor deposition (CVD), often yield mixtures of metallic and semiconducting nanotubes, requiring post-processing techniques such as density gradient ultracentrifugation or chromatography for separation. Additionally, dispersion and compatibility with polymers or solvents remain hurdles for scalable integration.

The global market is experiencing significant growth, driven by advancements in nanotechnology and increasing demand across various industries. Single walled carbon nanotubes, known for their exceptional mechanical, electrical, and thermal properties, are widely used in electronics, energy storage, aerospace, and biomedical applications. The electronics sector, particularly in flexible displays, sensors, and conductive films, is a major contributor to market expansion, as it offers superior conductivity and flexibility compared to traditional materials. Their application in lithium-ion batteries and supercapacitors in energy storage enhances performance, aligning with the growing demand for efficient energy solutions. The aerospace and defense industries also leverage SWCNTs for lightweight, high-strength composites, improving fuel efficiency and durability.

Carbon Solutions, Inc., Klean Commodities, OCSiAl, NoPo Nanotechnologies, and CHASM Advanced Materials, Inc. are among the key players operating in the industry.

SINGLE WALLED CARBON NANOTUBES MARKET TRENDS

Rising Investments in Nanotechnology R&D to Boost Market Growth

Increased investments in nanotechnology research and development (R&D) will propel the market during the forecast period. Governments, academic institutions, and private enterprises are funding projects to explore new applications and scalable production methods for single walled carbon nanotubes.

- For instance, the European Union’s Horizon 2020 program has allocated substantial funding for nanomaterials research, including SWCNT-based innovations in medicine, aerospace, and composites.

- In the U.S., companies, including Nanotech Labs and Carbon Solutions, collaborate with universities to develop cost-effective synthesis techniques, such as chemical vapor deposition (CVD), to enhance SWCNT production efficiency.

Furthermore, the aerospace and defense sectors are investing in SWCNT-reinforced composites for lightweight, high-strength materials in aircraft and satellites. The growing focus on nanotechnology commercialization and breakthroughs in SWCNT purification and functionalization are expanding their industrial applicability. As R&D efforts unlock new possibilities, the single walled carbon nanotubes market is expected to witness sustained growth driven by innovation and expanding uses across multiple industries.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Electronics and Conductive Materials to Drive Market Growth

The market is significantly driven by their increasing adoption in the electronics industry, particularly in conductive materials and flexible electronics. Single walled carbon nanotubes possess exceptional electrical conductivity, mechanical strength, and thermal stability, making them ideal for applications such as transparent conductive films, transistors, and sensors.

- For instance, due to their flexibility and superior conductivity, single walled carbon nanotubes are being used as an alternative to indium tin oxide (ITO) in touchscreens and displays. Companies such as Chasm Advanced Materials and Canatu are leveraging SWCNTs to develop next-generation flexible and foldable electronics, including wearable devices and rollable displays.

Additionally, the rise of 5G technology has spurred demand for high-performance conductive materials in antennas and electromagnetic shielding, where SWCNTs offer a lightweight and efficient solution. The miniaturization of electronic components further fuels this demand, as SWCNTs enable the development of smaller, faster, and more energy-efficient devices. As the electronics industry continues to innovate, the need for SWCNTs is expected to grow, positioning them as a critical material in advanced electronic applications.

MARKET RESTRAINTS

High Production Costs May Hamper Market Growth

The synthesis of SWCNTs involves complex processes such as chemical vapor deposition (CVD), arc discharge, and laser ablation, all of which require expensive raw materials, specialized equipment, and controlled environments. For instance, high-purity carbon sources and metal catalysts, including cobalt, nickel, or iron, are essential for single walled carbon nanotube growth, driving up material costs. Additionally, post-production purification and functionalization processes to remove impurities and tailor properties further escalate expenses. These high costs make single walled carbon nanotubes less competitive than alternative materials such as multi-walled carbon nanotubes (MWCNTs) or conductive polymers, particularly in price-sensitive applications such as energy storage or composites.

- For example, in the lithium-ion battery industry, where cost efficiency is critical, manufacturers often opt for cheaper alternatives despite SWCNTs’ superior conductivity and mechanical strength. Until scalable and cost-effective production methods are developed, the high price of SWCNTs will remain a significant barrier to market expansion.

MARKET OPPORTUNITIES

Rising Demand for Energy Storage and Batteries Sector to Create Lucrative Opportunities in Market

The global demand for high-performance energy storage solutions in electric vehicles (EVs) and renewable energy systems presents a significant opportunity for the market. Single walled carbon nanotubes enhance battery performance by improving conductivity, increasing energy density, and extending cycle life. For instance, SWCNTs can be used as conductive additives in lithium-ion batteries in electrodes, enabling faster charging and higher capacity.

- Companies, including NAWA Technologies, are leveraging SWCNTs to develop ultra-fast-charging batteries, which could revolutionize the EV market. Additionally, SWCNTs are being explored for use in next-generation batteries, such as lithium-sulfur and solid-state batteries, where their high surface area and mechanical strength can address key challenges such as sulfur shuttling and dendrite formation.

With the EV market projected to grow at a significant CAGR and governments globally pushing for cleaner energy, the adoption of SWCNTs in energy storage systems is poised for exponential growth.

MARKET CHALLENGES

Regulatory and Environmental Concerns May Hamper Market Growth

The market faces significant challenges due to regulatory uncertainties and environmental concerns surrounding nanotechnology. Governments and regulatory bodies, such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), have yet to establish comprehensive guidelines for the safe production, handling, and disposal of SWCNTs.

- For instance, concerns about the potential toxicity of SWCNTs, similar to those associated with asbestos, due to their needle-like structure, have slowed their adoption in medical applications such as drug delivery or imaging.

Additionally, environmental risks, such as the persistence of SWCNTs in ecosystems and their unknown long-term effects, have led to stricter scrutiny and delayed approvals. In 2022, a proposed SWCNT-based coating for sports equipment was shelved in Europe due to unresolved environmental impact assessments. Without standardized regulations and conclusive safety data, companies may avoid investing in SWCNT-based products, stifling single walled carbon nanotubes market growth.

Download Free sample to learn more about this report.

Trade Protectionism and Geopolitical Impact

While no direct trade tariffs specifically target single-walled carbon nanotubes, the global market remains significantly shaped by non-tariff barriers and stringent regulatory frameworks concerning environmental safety and human health. Regulatory bodies in key markets, such as the European Union and the U.S., have implemented comprehensive oversight for nanomaterials, often requiring extensive testing, labeling, and risk assessments. These evolving standards can lengthen approval timelines and increase compliance costs for producers and exporters, effectively acting as a form of trade protectionism. As a result, companies aiming to international SWCNT trade must navigate complex and often inconsistent regulatory landscapes, potentially limiting market access and discouraging smaller firms from entering or expanding globally. This regulatory burden, while not a tariff in the traditional sense, can have a similarly protective effect on domestic industries by raising the barrier to entry for foreign competitors.

Segmentation Analysis

By Technology

Chemical Vapor Deposition (CVD) Segment Held Dominant Share Due to Its Properties

Based on technology, the market is segmented into chemical vapor deposition (CVD), arc discharge, and others.

The chemical vapor deposition (CVD) segment held the largest single walled carbon nanotubes market share in 2024. The segment's growth is driven due to its scalability, controllability, and cost-efficiency. The method’s compatibility with various substrates facilitates integration into flexible electronics and thin-film devices. Furthermore, plasma-enhanced CVD (PECVD) advancements have improved growth rates and reduced energy consumption, enhancing commercial viability.

The arc discharge segment is set to witness significant growth during the forecast period due to its ability to produce high-crystallinity nanotubes with minimal defects, making it suitable for advanced applications. The process’s high-temperature environment ensures the formation of high-quality SWCNTs with excellent electrical conductivity, appealing to the electronics and photonics industries.

By Application

Plastics & Composites Segment Led Market Due to Its Exceptional Mechanical Strength

Based on application, the market is segmented into plastics & composites, electrical & electronics, energy, and others.

The plastics & composites segment held the largest market share in 2024. The segment's growth is driven by its exceptional mechanical strength, lightweight properties, and enhanced durability. Single walled carbon nanotubes are increasingly used as reinforcing additives in polymers to create high-performance composites for aerospace, automotive, and sports equipment.

The electrical & electronics segment is expected to grow substantially during the forecast period due to its superior electrical conductivity, flexibility, and miniaturization potential. SWCNTs are used in transistors, flexible displays, and conductive inks for printed electronics, enabling thinner, lighter, and more efficient devices.

The energy segment is set to witness considerable growth during the forecast period due to its potential to enhance energy storage and conversion systems. SWCNTs are widely used in lithium-ion batteries, supercapacitors, and fuel cells to improve conductivity, charge capacity, and cycle life.

Single Walled Carbon Nanotubes Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Single Walled Carbon Nanotubes Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share in 2025, generating revenue worth USD 0.67 billion. The market growth is driven by rapid industrialization, government support, and booming electronics and automotive sectors. China, Japan, and South Korea lead production and consumption, with companies including Cnano Technology and Zeon Corporation scaling up manufacturing. China’s push for advanced materials in batteries and flexible electronics boosts demand, while Japan’s expertise in nanotechnology drives innovation.

Europe

Europe is projected to be the second-largest global market, driven by strong academic research, government-backed nanotechnology programs, and demand from the automotive and renewable energy sectors. Countries, including Germany, France, and the U.K., are at the forefront, with companies such as OCSiAl and Thomas Swan expanding production capacities. The European Union’s strict regulatory framework ensures product safety but slows commercialization due to lengthy approval processes.

North America

North America is expected to grow significantly over the forecast period, driven by strong R&D investments, advanced manufacturing capabilities, and high demand from electronics, aerospace, and energy storage industries. The U.S. is a key player, with companies such as Carbon Solutions and NanoIntegris leading production and commercialization efforts. Government initiatives, such as the National Nanotechnology Initiative (NNI) funding, further accelerate innovation. The region’s well-established semiconductor and battery industries contribute to SWCNT adoption, particularly in conductive films and next-generation lithium-ion batteries.

Latin America

The Latin American market is expected to grow moderately, driven by academic research and niche industrial applications. Brazil is the most active, with universities and startups exploring SWCNTs for energy storage and biomedical uses.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth due to underdeveloped nanotechnology ecosystems and low industrial demand.

COMPETITIVE LANDSCAPE

Key Industry Players

Manufacturers Collaborate with Universities to Boost Their Market Share and Maintain Presence in Business

The global market share is concentrated and competitive with major market players, including Carbon Solutions, Inc., Klean Commodities, OCSiAl, NoPo Nanotechnologies, and CHASM Advanced Materials, Inc. Most of the companies are forming strategies in the form of partnership, collaboration, joint venture, and new product development to enhance their product portfolio and expand their company's global reach. Low business feasibility, owing to high manufacturing costs, is likely to be a concerning reason for the industrial participants. However, regulatory inclination toward promoting nanotechnology shall be the driving factor for manufacturers.

LIST OF KEY SINGLE WALLED CARBON NANOTUBE COMPANIES PROFILED

- Carbon Solutions, Inc. (U.S.)

- Klean Commodities (Canada)

- OCSiAl (Luxembourg)

- NoPo Nanotechnologies (India)

- CHASM Advanced Materials, Inc. (U.S.)

- Continental Carbon Nanotechnologies, Inc. (U.S.)

- Raymor (Canada)

- Thomas Swan & Co. Ltd. (U.K.)

- ZEON CORPORATION (Japan)

- Aritech Chemazone Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- May 2025: ZEON CORPORATION and Sino Applied Technology (SiAT) signed a strategic partnership to spearhead funding of USD 20 million to support the expansion of production capacity for single walled carbon nanotube conductive paste, a critical nanomaterial for next-generation battery technologies.

- October 2024: OCSiAl opened its first European graphene nanotube facility. The facility has a nameplate annual capacity for graphene nanotube synthesis of 60 tons, as well as lines dedicated to various nanotube dispersions, R&D, and quality control laboratories.

- June 2024: OCSiAl completed the construction of a facility for the production of single walled carbon nanotube dispersions in Serbia to support the manufacturing of high-performance batteries. The facility features state-of-the-art equipment and clean, room-operated production lines, adhering to the highest quality standards.

- May 2024: NoPo Nanotechnologies secured USD 3 million in pre-Series A funding to scale up its production of single walled carbon nanotubes. This investment aims to enhance the company’s engineering capabilities and support a global market strategy, addressing the growing demand for CNTs in energy storage, electronics, and healthcare.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 13.8% during 2026-2034 |

|

Segmentation |

By Technology

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.75 billion in 2026 and is projected to reach USD 4.64 billion by 2032.

In 2025, the Asia Pacific market value stood at USD 0.67 billion.

The market is expected to exhibit a CAGR of 13.8% during the forecast period of 2026-2034.

The plastics & composites segment led the market by application.

The growing demand from the electronics industry will drive the markets growth.

Carbon Solutions, Inc., Klean Commodities, OCSiAl, NoPo Nanotechnologies, and CHASM Advanced Materials, Inc. are the top players.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us