Small-scale Ammonia Market Size, Share & Industry Analysis, By Product (Liquid Ammonia, Gas Ammonia, Solvent Properties Ammonia, and Solid Ammonia), By Application (Chemical Industry, Agriculture, Metallurgical Industry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

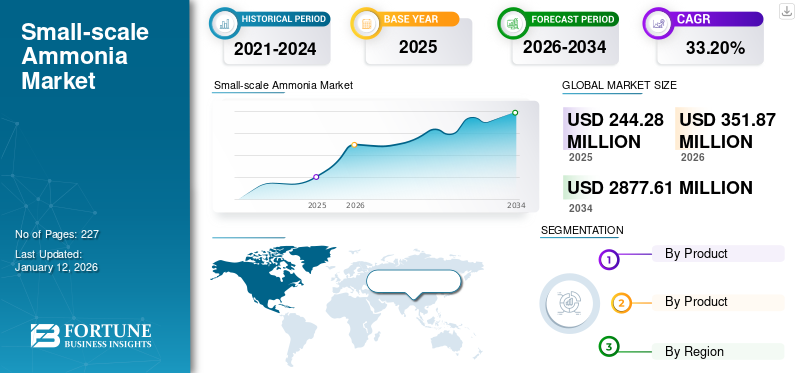

The global small-scale ammonia market size was valued at USD 244.28 million in 2025. The market is projected to grow from USD 351.87 million in 2026 to USD 2877.61 million by 2034 at a CAGR of 33.20% during the forecast period.

Small-scale ammonia production refers to the production of ammonia in smaller quantities (200 to 500 metric tons per day) than the traditional large-scale ammonia plants. These plants are often more flexible, able to use a wider range of feedstocks, and serve local needs more effectively. They are also more environmentally sustainable as they can utilize renewable energy sources and reduce transportation costs. While the economics of small-scale ammonia production may be less favorable due to economies of scale, advancements in technology and the growing demand for sustainable solutions are driving interest in this approach.

GLOBAL SMALL-SCALE AMMONIA MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 244.28 million

- 2026 Market Size: USD 351.87 million

- 2034 Forecast Market Size: USD 2877.61 million

- CAGR: 33.20% from 2026–2034

Market Share:

- China led the global small-scale ammonia market in 2023 with a 49.39% share, rising from USD 1.57 million in 2022 to USD 5.68 million in 2023.

- By product, liquid ammonia held the dominant position due to its ease of storage, transport, and dosing advantages.

- By application, agriculture was the largest segment in 2023, driven by the rising need for nitrogen-based fertilizers.

- The metallurgical industry accounted for a modest 2.8% share in 2023.

- Decentralized production and green ammonia generation using renewable energy sources are gaining traction globally.

Key Country Highlights:

- China: Dominated the market in 2023 (USD 5.68 million), with strong growth backed by domestic manufacturers and local green ammonia initiatives.

- United States: Rising fertilizer demand and advancements in green ammonia tech are boosting small-scale production and direct distribution to farms.

- Germany & EU: Escalating natural gas costs and CO₂ regulations have fueled demand for decentralized, low-emission production methods.

- Japan: Pilot and demonstration-scale projects, such as CCS-based ammonia plants in Kashiwazaki, are driving R&D and deployment.

- Middle East & Africa: Countries like Saudi Arabia and Morocco are scaling up green ammonia capacity through hydrogen-focused investments targeting 2030 goals.

MARKET DYNAMICS

SMALL-SCALE AMMONIA MARKET TRENDS

Government Policies and Incentives to Create Opportunity for Small-Scale Ammonia Market

Government policies and incentives are playing a crucial role in creating opportunities for the small-scale ammonia market growth. These initiatives are designed to support the development of localized production methods, particularly in the context of sustainable and green ammonia production.

- China witnessed a small-scale ammonia market growth from USD 1.57 million in 2022 to USD 5.68 million in 2023.

Recent initiatives focus on promoting green ammonia, which is produced using renewable energy sources. The Indian government introduced a new incentive scheme under the National Green Hydrogen Mission aimed at fostering green hydrogen and ammonia production system. This includes direct financial incentives to reduce production costs and encourage investment in sustainable technologies. In addition, governments, particularly in countries like India, provide significant subsidies for fertilizers, which directly impacts ammonia demand as it is a critical raw material for nitrogenous fertilizers.

Government funding for research into green ammonia technologies is expected to drive innovation and lower costs involved in small-scale production methods. This support helps create a more favorable environment for businesses looking to invest in decentralized ammonia production units.

MARKET DRIVERS

Increasing Demand for Localized Production Will Drive Market Growth

The increasing demand for localized production is reshaping the ammonia market, making small-scale facilities an essential component of future ammonia supply chains. There is a growing preference for locally-produced agricultural inputs, driven by the desire to reduce carbon footprints and support local economies. Small-scale ammonia production facilities can meet this demand more effectively than larger, centralized plants.

While small-scale production can incur higher capital costs, it often results in lower operating costs, especially when utilizing sustainable or waste energy sources. The elimination of storage and transportation expenses can bring the total costs close to or even below those of large-scale ammonia production carried out elsewhere, particularly in remote locations.

The shift toward localized production is also a response to the volatility in natural gas prices, which has historically been a major cost driver in ammonia production. As prices rise, the economic feasibility of small-scale operations becomes more attractive, particularly when they can leverage local renewable energy sources.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Limited Awareness and Acceptance of Small-Scale Production Benefits to Restrain Market

Limited awareness and acceptance of the benefits associated with small-scale ammonia production are significant factors restraining its growth. Many stakeholders, including farmers and local businesses, may not fully understand the operational benefits and economic viability of small-scale ammonia production. This lack of awareness can lead to hesitancy in adopting new technologies or methods.

While small-scale production can be more sustainable and flexible, it is often perceived as more expensive compared to traditional large-scale ammonia production. The initial capital investment and operating costs may deter potential users who are accustomed to conventional methods.

Although the technology for small scale ammonia production has been proven, skepticism may still be faced regarding its reliability and efficiency. Stakeholders might prefer established large-scale operations that have a long history of performance.

To overcome these challenges, industry stakeholders must enhance awareness and understanding of the benefits of small-scale ammonia production. Initiatives that focus on education, demonstration projects, and targeted marketing could help shift perceptions and encourage adoption in a market poised for growth due to increasing demand for sustainable practices and localized production solutions.

MARKET OPPORTUNITIES

Decentralized Production of Ammonia is Gaining Traction as an Opportunity for Market

Decentralized ammonia production allows for the establishment of smaller-scale plants that can operate near the point of use, such as farms or industrial sites. This proximity minimizes transportation distances, reducing logistics costs by up to 76%.

Utilizing renewable energy sources like wind and solar power, decentralized systems can produce "green ammonia" by electrolyzing water to generate hydrogen, which is then combined with nitrogen from the air. This process significantly lowers carbon emissions compared to traditional methods that rely on fossil fuels.

Decentralized production can shift cost drivers from natural gas to renewable electricity, potentially making ammonia production profitable again under varying market conditions. The flexibility in production allows for adaptation to local resource availability and energy costs.

MARKET CHALLENGES

Impact of Inflation On Small-scale Ammonia Industries May Challenge Market Growth

Inflation typically leads to increased costs of raw materials and energy inputs. For small-scale green ammonia production, which often relies on renewable energy sources like solar or wind, fluctuations in energy prices can significantly affect the Levelized Cost of Ammonia (LCOA). The current cost of producing green ammonia is estimated to be between USD 900 and USD 950 per ton, influenced heavily by the cost of electricity and renewable energy infrastructure.

The demand for green ammonia is expected to grow as industries seek sustainable alternatives to conventional ammonia production methods. However, inflation can reduce the purchasing power of consumers and businesses, potentially dampening the product’s demand in the short term. The fertilizer sector, which consumes over 90% of ammonia, may face challenges if farmers are unable to afford higher prices for fertilizers derived from green ammonia.

As conventional (grey) ammonia production remains cheaper due to established supply chains and lower input costs (largely driven by natural gas prices), small-scale green ammonia producers must navigate these competitive pressures. Inflation can exacerbate this situation by increasing operational costs, making it harder for green ammonia to compete without significant subsidies or carbon pricing mechanisms in place.

IMPACT OF COVID-19

The COVID-19 pandemic significantly impacted the small-scale ammonia industry, exacerbating the existing challenges while also creating new opportunities. Initially, the industry faced a negative demand shock, with global ammonia production declining due to disruptions in supply chains, labor shortages, and restrictions on transportation. Furthermore, while the pandemic initially led to reduced sales and operational disruptions for many small enterprises, it also prompted a renewed focus on food security and local agricultural needs, thus revitalizing interest in ammonia as a critical input for fertilizers. Overall, the pandemic served as a catalyst for transformation within the ammonia sector, pushing it toward more resilient and sustainable production models.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism often leads to tariffs and import restrictions aimed at safeguarding domestic industries. For example, the U.S. has implemented tariffs on imported solar panels and wind turbine components, which can similarly affect the ammonia sector by increasing costs for renewable energy inputs necessary for ammonia production. Such policies can hinder the competitiveness of small-scale ammonia producers who rely on imported technologies or raw materials.

The ongoing geopolitical instability, particularly stemming from conflicts like the Russia-Ukraine war, has resulted in significant disruptions in global ammonia supply chains. For instance, the cessation of Russian ammonia exports to Europe has created a void that other suppliers have struggled to fill, leading to increased prices and uncertainty in the market.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

The shift toward small-scale ammonia production has accelerated recently, primarily due to the need for flexibility and reduced logistical costs. Small-scale plants allow for localized production, which minimizes transportation emissions and effectively caters to regional demands.

There is a growing emphasis on green ammonia, which is produced through renewable energy sources rather than fossil fuels. Research is focusing on methods, such as alkaline electrolysis for producing hydrogen combined with nitrogen from the air to create ammonia. This approach not only reduces carbon emissions, but also aligns with global decarbonization efforts. The establishment of small-scale green ammonia plants is seen as a viable alternative to traditional large-scale plants, particularly as economic incentives like carbon taxes are implemented. As research continues to evolve, the focus on decentralized production methods, green ammonia initiatives, and innovative technologies like ammonia cracking will likely reshape the landscape of ammonia production. These factors will make it more adaptable to changing market needs and environmental standards.

SEGMENTATION ANALYSIS

By Product

Liquid Ammonia Segment Dominated Market Due to its Versatility and Efficiency in Various Applications

Based on product, the market is classified into liquid ammonia, gas ammonia, solvent properties ammonia, and solid ammonia.

The liquid ammonia segment held the highest share of the global market in 2023 and is estimated to record a significant growth rate during the forecast period. Liquid ammonia can be stored in bulk tanks and transported more conveniently than gaseous ammonia, which requires high-pressure cylinders. This makes it a cost-effective solution for industries needing large quantities of ammonia. The liquid form also allows for precise dosing, enhancing its efficiency in applications, such as fertilizers where accurate application rates are crucial.

Gas ammonia, primarily in the form of anhydrous ammonia (NH₃), plays a pivotal role in the global ammonia industry. This colorless gas, characterized by its pungent odor, is a key chemical used extensively in agriculture, industrial applications, and as a precursor for various chemicals.

By Application

To know how our report can help streamline your business, Speak to Analyst

Agriculture Accounted for Most Prominent Market Share Owing to its Demand for Nitrogen-Rich Fertilizers

Based on application, the market is segmented into chemical industry, agriculture, metallurgical industry, pharmaceutical, and others.

The agriculture segment led the market accounting for 80.89% market share in 2026.Ammonia is primarily utilized in the production of nitrogen-based fertilizers, which are essential for enhancing crop yields. Anhydrous ammonia, in particular, is favored due to its high nitrogen content and cost-effectiveness compared to other fertilizers.

The increasing global population and the corresponding rise in food demand are primary drivers for ammonia consumption in agriculture. As food production intensifies, the need for effective fertilizers becomes more pronounced, leading to sustained demand for ammonia-based fertilizers.

Moreover, small-scale ammonia plants are gaining traction in the chemical industry due to their flexibility, reduced environmental impact, and ability to meet local demands. Recent advancements include the use of electride catalysts that enable ammonia synthesis at lower pressures and temperatures compared to conventional methods. This innovation facilitates the downsizing of production facilities. The metallurgical industry segment is expected to hold a 2.8% share in 2023.

SMALL-SCALE AMMONIA MARKET REGIONAL OUTLOOK

China

China accounted for the leading market share in 2023; the market in the country was valued at USD 5.68 million. The small-scale ammonia market in China is experiencing sustained growth and is projected to continue expanding positively in the coming years. The presence of local manufacturers, such as Ordos Ammonia Technology Co., Ltd., Shenzhen Energy, Damao Banner Electric Power New Future Energy Co., Ltd., Jidian Shares, and Inner Mongolia Shenfeng Green Chlorine Chemical Co., Ltd. is causing a surge in both the production and consumption of small-scale ammonia.

North America

The increasing demand for fertilizers in North America, coupled with advancements in green ammonia technology introduced by leading companies, is driving small-scale ammonia production. The growing need for anhydrous ammonia is further fueling this trend as it can be directly applied to soil as a fertilizer, eliminating the need for nitrogen-based products. This presents an opportunity for project owners to produce green hydrogen and ammonia and distribute them directly to farmers.

Europe

The growth of small-scale ammonia production in Europe has been robust due to several factors, including increasing natural gas prices and rising greenhouse gas emissions from nitrification and denitrification. According to AmmPower, the ammonia synthesis process generates 451 million metric tons of CO2 emissions globally every year. Additionally, around 60% of the hydrogen produced globally in 2022 was used for ammonia production, with over 90% of this hydrogen derived from natural gas reforming and coal gasification. This has led to a surge in natural gas prices and increased CO2 emissions from natural gas and coal gasification plants.

Japan

Numerous ongoing projects in Japan are surging the demand for small-scale ammonia production and expected to propel the market’s growth during the forecast period. The country boasts a variety of projects related to small-scale ammonia production, including a startup company and a demonstration-sized plant. Moreover, a demonstration-sized plant utilizing Auto Thermal Reforming (ATR) technology and CCS in depleted gas fields has been constructed in Kashiwazaki City to produce ammonia and hydrogen. This small-scale CCS ammonia project aims to gain operational experience in CCUS and assess the CO2 storage potential of Japan’s depleted gas reservoirs.

Middle East & Africa

In the Middle East & Africa, the increasing emphasis on green hydrogen production for manufacturing green ammonia presents promising opportunities for the market. Key regional players, including Saudi Arabia, Africa, Morocco, and Namibia, are strategizing to expand their green ammonia and hydrogen manufacturing and export capabilities, driving market growth. For instance, according to the Energy Forum, hydrogen is poised to become a pivotal component of Saudi Arabia's future energy landscape. The country has ambitious plans to produce 4 million tons per year of "clean" hydrogen or equivalent PtX products by 2030.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Adopted Product Development and Capacity Expansion Strategies to Maintain Market Dominance

Damao Banner Electric Power New Future Energy Co., Ltd., Jidian Shares, Ordos Ammonia Technology Co., Ltd., Inner Mongolia Shenfeng Green Chlorine Chemical Co., Ltd., and Shenzhen Energy are the key players in the market. Major investments are being done by these companies in developing additives that address evolving demands for sustainability and performance.

LIST OF KEY SMALL-SCALE AMMONIA COMPANIES PROFILED

- Damao Banner Electric Power New Future Energy Co., Ltd. (China)

- Jilin Electric Power Co., Ltd. (China)

- Ordos Ammonia Technology Co., Ltd. (China)

- Inner Mongolia Shenfeng Green Chlorine Chemical Co., Ltd. (China)

- Shenzhen Energy (China)

- CF Industries (U.S.)

- Hy2Gen (Germany)

- HydrGEN (U.S.)

- Yara International (Norway)

- Enaex (Chile)

KEY INDUSTRY DEVELOPMENTS

- September 2024 – Tsubame BHB Co., Ltd. secured a second commercial order in Japan for its small ammonia synthesis facilities, which will be used for industrial applications. The newly ordered facilities have an annual production capacity of 500 tons. Tsubame BHB will provide both the small ammonia manufacturing facilities and the necessary ammonia synthesis catalysts. The company is also exploring the possibility of expanding these facilities in the future.

- June 2024 – Yara International, a leading Norwegian fertilizer producer, launched Europe's largest green hydrogen facility, which will be used to produce green ammonia. The company began producing renewable hydrogen and ammonia at its Heroya plant in Porsgrunn, Norway. The facility, which houses the largest electrolyzer in Europe, represented a major milestone in Yara's efforts to reduce its carbon footprint.

- May 2024 – Toyo Engineering, Nippon Seisen, and Chubu Electric Power signed an agreement to develop a small ammonia cracking unit that will produce on-demand hydrogen for use in refueling vehicles and accelerating electricity generation in Japan.

- February 2024 – Enaex S.A., a Chilean ammonium nitrate producer, and NYK Bulk & Projects Carriers Ltd. signed an agreement to investigate the use of low-carbon ammonia as a fuel for transporting copper products from Chile to the Far East. The collaboration between the two companies aims to explore the potential benefits of using ammonia as a more sustainable alternative for transporting copper products to international markets.

- December 2023 – Saudi Arabia's ACWA Power is partnering with Indonesia's state-owned electricity provider PLN and fertilizer producer PT Pupuk Indonesia to develop the largest green hydrogen facility in Indonesia. The Garuda Hidrogen Hijau (GH2) Project, which is expected to begin commercial operations in 2026, will utilize 600 megawatts of solar and wind power to produce 150,000 tons of green ammonia per year. The project is estimated to cost over USD 1 billion.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, products, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 33.20% from 2026 to 2034 |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 351.87 million in 2026 and is projected to reach USD 2877.61 million by 2034.

Recording a CAGR of 33.20%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

The agriculture application segment led the market in 2025.

Increased demand for localized production will aid the market’s growth.

Increased demand for localized production will aid the market’s growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us