Smart Coatings Market Size, Share & Industry Analysis, By Function (Anti-corrosion, Self-cleaning, Anti-microbial, Anti-fouling, Anti-icing, Color-shifting, and Others), By End-use Industry (Building & Construction, Automotive, Aerospace and Defense, Marine, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

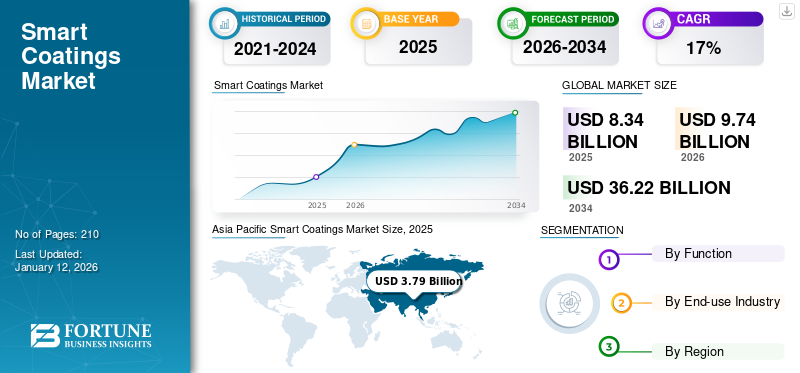

The global smart coatings market size was valued at USD 8.34 billion in 2025. The market is projected to grow from USD 9.74 billion in 2026 to USD 36.22 billion by 2034 at a CAGR of 17.7% during the forecast period of 2026-2034. Asia Pacific dominated the smart coatings market with a market share of 46% in 2025.

Smart coatings represent a groundbreaking advancement in materials science, offering dynamic adaptability by responding to environmental stimuli such as temperature, light, pH, or electrical signals. These innovative coatings are engineered to perform specific functions, including self-healing scratches on automotive surfaces, resisting corrosion in harsh marine or aerospace environments, regulating building temperatures through energy-efficient window coatings, or providing antimicrobial protection on medical devices. For instance, self-repairing coatings on smartphones or cars minimize wear, while thermochromic windows optimize indoor climate control. Additionally, their eco-friendly potential is prolonging product lifespans and reducing resource consumption. As research progresses, intelligent coatings are poised to revolutionize industries by merging sustainability with cutting-edge functionality, paving the way for smarter, greener technologies.

The Sherwin-Williams Company, 3M, AkzoNobel N.V., DuPont, & PPG Industries, Inc. are the key players operating in the market.

SMART COATINGS MARKET TRENDS

Superior Functional Properties Over Traditional Coatings to Support Market Growth

Smart coatings outperform traditional alternatives by addressing niche demands through advanced functionalities. Self-healing coatings, for example, incorporate microcapsules that release repair agents upon damage, extending the lifespan of pipelines in the oil and gas industry. Anti-icing coatings, which leverage hydrophobic materials to prevent ice buildup, are vital for wind turbines and aircraft wings in cold climates.

Stimuli-responsive coatings, such as thermochromic or photochromic variants, enable dynamic applications such as smart windows that adjust tint based on sunlight intensity. These properties reduce long-term maintenance costs as well as enhance safety and efficiency. A notable example is PPG’s SunClean™ glass coating, which uses photocatalysis to break down dirt on greenhouse surfaces, improving light transmission and crop yields. By solving industry-specific challenges, these coatings are redefining performance benchmarks across sectors.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Corrosion-Resistant Coatings to Aid Market Growth

Corrosion is a critical challenge in automotive, aerospace, and construction industries, where exposure to moisture, chemicals, and extreme temperatures accelerates material degradation. Intelligent coatings with anti-corrosive properties (e.g., epoxy, polyurethane, or nanotechnology-based formulations) protect metal surfaces, reducing maintenance downtime and repair costs. For example, these coatings in offshore oil rigs or marine vessels prevent saltwater-induced rust, extending asset lifespans by decades. Regulatory mandates (e.g., REACH, EPA) also push industries to adopt eco-friendly, high-performance coatings that minimize environmental harm while ensuring safety and compliance.

Rapid Urbanization and Infrastructure Development Drives Adoption in Construction Sector

Global urbanization is driving demand for smart infrastructure that combines durability with sustainability. These coatings are integral to modern construction projects, such as energy-efficient buildings (using heat-reflective coatings to reduce cooling costs) and self-cleaning facades (e.g., TiO₂-based coatings that break down pollutants with sunlight). Mega-projects such as smart cities, bridges, and tunnels prioritize these coatings to combat urban pollution, enhance thermal management, and reduce lifecycle costs. Governments and private developers increasingly view smart coatings as a long-term investment to future-proof infrastructure against climate change.

MARKET RESTRAINTS

Reliance on Expensive Raw Materials such as Nanomaterials and Rare Earth Elements May Hinder Market Growth

The advanced functionalities of smart coatings depend on costly inputs such as nanomaterials (e.g., graphene, carbon nanotubes), rare earth elements (e.g., cerium for UV resistance), and specialized polymers. For instance, self-healing coatings require microcapsules filled with healing agents, which are expensive to synthesize and integrate. Additionally, complex manufacturing processes (e.g., plasma deposition and sol-gel techniques) demand significant R&D investments and specialized equipment. These costs make these coatings prohibitively expensive for Small and Medium Enterprises (SMEs) or price-sensitive markets such as developing regions. Even in advanced economies, industries such as automotive may hesitate to adopt them due to thin profit margins.

MARKET OPPORTUNITIES

Technological Advancements in Self-Healing, Nano-Coatings, and IoT-Integrated Solutions for Enhanced Performance will Create a Market Opportunity

Breakthroughs in self-healing coatings (e.g., polymers that repair scratches via heat/light activation) and multifunctional nano-coatings (e.g., antibacterial surfaces for healthcare settings) are revolutionizing the market. For example, automotive companies are testing coatings that autonomously fix minor paint damage, reducing repair costs. Meanwhile, IoT-enabled smart coatings embedded with sensors can monitor structural health (e.g., detecting bridge cracks) or environmental conditions (e.g., humidity in agricultural storage). These innovations align with emerging sectors such as renewable energy (solar panels with anti-reflective coatings) and wearable electronics (flexible, conductive coatings for smart textiles). Collaborations between tech firms, universities, and coating manufacturers accelerate R&D, creating opportunities to penetrate high-growth niches such as electric vehicles and 5G infrastructure.

MARKET CHALLENGES

Durability in Real-World Conditions May Create a Market Challenge

A persistent challenge for smart coatings is maintaining their lab-proven performance under real-world conditions. Environmental stressors, such as prolonged UV exposure, can degrade the self-cleaning properties of TiO₂ coatings over time. In marine environments, mechanical wear from saltwater and abrasion strips anti-fouling layers from ship hulls, necessitating frequent reapplications. Extreme temperatures also pose issues. Self-healing polymers may fail to activate in sub-zero conditions, limiting their utility in cold climates. To address these gaps, companies such as BASF are developing accelerated aging tests that simulate decades of environmental stress in months, enabling faster iteration of durable formulations. Bridging the divide between laboratory innovation and field reliability is essential for market credibility

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted global supply chains and industrial activities, directly impacting the smart coatings market growth. Border closures, trade restrictions, and labor shortages hindered raw material procurement and delayed production, particularly affecting industries such as automotive and aerospace, which are major consumers of coatings. However, the pandemic also accelerated demand for smart coatings, such as antimicrobial and self-cleaning variants, driven by heightened hygiene concerns in healthcare and public spaces. For instance, hospitals increasingly adopted antimicrobial coatings to reduce infection risks, aligning with the healthcare sector’s expansion. Additionally, the crisis underscored the need for resilient and sustainable solutions, prompting R&D investments in eco-friendly coatings with low Volatile Organic Compounds (VOCs) and energy-efficient properties. Despite initial setbacks, the market adapted by leveraging digital tools for remote collaboration and process optimization, ensuring continuity in innovation and production.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Rising trade protectionism and geopolitical tensions have reshaped the global trade landscape, influencing the smart coatings market trends. The shift from multilateralism to bilateral agreements, coupled with tariffs and export restrictions, has complicated cross-border supply chains for raw materials such as advanced polymers and nanomaterials. For example, geopolitical rivalries between the U.S. and China have spurred regionalization efforts, with companies diversifying production hubs to mitigate risks. This trend is evident in Asia Pacific’s dominance, where countries such as China and India are advancing localized manufacturing to meet regional demand. Furthermore, trade barriers in critical sectors such as pharmaceuticals and renewable energy have intensified competition for smart coating technology, particularly in anti-corrosion and thermal-resistant applications. Governments are also prioritizing "economic security," leading to stricter regulations on foreign investments in strategic industries, which could slow global collaboration but foster regional innovation ecosystems.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

R&D is revolutionizing the smart coatings market through functionality, sustainability, and digital integration advancements. Key innovations include self-healing coatings that autonomously repair scratches, reducing maintenance costs in automotive and aerospace sectors, and stimuli-responsive coatings that adapt to environmental changes (e.g., temperature or light) for energy-efficient buildings. Nanotechnology is a critical driver, enabling ultra-thin, durable layers for electronics and marine applications. At the same time, biomimetic designs, such as shark skin-inspired anti-fouling coatings, enhance fuel efficiency in the marine industry. Sustainability remains a focal point, with R&D efforts targeting water-based formulations, reduced VOC emissions, and circular economy principles. Additionally, digital tools such as AI and IoT accelerate R&D cycles, enabling predictive analytics for coating performance and faster commercialization. Collaborations between academia and industry, particularly in North America and Asia Pacific, further propel breakthroughs, ensuring the market meets evolving regulatory and consumer demands.

SEGMENTATION ANALYSIS

By Function

Anti-corrosion Segment Dominated Market Due to its Active Safeguard Against Rust Resistance

Based on function, the market is classified into anti-corrosion, self-cleaning, anti-microbial, anti-fouling, anti-icing, color-shifting, and others.

The anti-corrosion segment held a significant share of the global market in 2024 and is estimated to record a substantial annual growth rate during the forecast period. These have advanced protective layers designed to protect metal surfaces from corrosion by responding to environmental changes or damage. Unlike traditional coatings that act as passive barriers, smart coatings can contain microcapsules loaded with corrosion inhibitors, which are released in response to triggers such as changes in pH or the onset of corrosion. For example, pH-sensitive microcapsules can detect local acidic conditions caused by corrosion and release inhibitors precisely where needed, offering targeted protection and reducing the use of toxic compounds such as chromates. This approach enhances the longevity and durability of metals and aligns with environmental regulations by enabling safer, more sustainable inhibitors.

The self-cleaning function holds the highest growth rate in the market. These coatings are engineered to repair damage autonomously, such as microcracks or scratches, thereby restoring their protective function without external intervention. These coatings often incorporate micro- or nanocapsules filled with healing agents released upon mechanical damage, filling cracks and re-establishing the coating’s integrity. Some systems use polymers with intrinsic self-healing properties, activated by stimuli such as heat or light, while others employ reversible chemical bonds for repeated healing cycles. This segment is likely to grow with a considerable CAGR of 18.2% during the forecast period (2026-2034).

The anti-fouling segment is foreseen to attain 28.85% of the market share in 2026.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Building & Construction Led Market Due to its Widespread Integration into Modern Architectural Designs and Infrastructure Projects

By end-use industry, the market is segmented into building & construction, automotive, aerospace and defense, marine, and others.

The building & construction segment accounted for the largest global smart coatings market share in 2025. This dominance is driven by integrating intelligent coatings into modern architectural designs and infrastructure projects, where they offer enhanced durability, protection against corrosion, and resistance to environmental factors such as humidity and temperature fluctuations. These coatings are widely applied to building components such as glass, steel, and aluminum, providing functionalities such as self-cleaning, antimicrobial, anti-corrosion, and solar-reflective properties. These features contribute to reduced maintenance costs, improved energy efficiency, and extended building lifespans, making them especially attractive for high-rise, commercial, healthcare, and residential buildings.

The automotive segment holds a substantial share as they are primarily used to protect vehicle surfaces from scratches, corrosion, UV radiation, acid rain, and extreme weather, enhancing vehicle durability and aesthetic appeal. Self-healing and self-cleaning coatings are gaining traction for reducing maintenance and repair costs. The adoption of smart coatings is further accelerated by the shift toward electric vehicles and the need for advanced surface protection and functionality in new automotive designs.

The marine segment held 37.06% of the market share in 2026.

SMART COATINGS MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Smart Coatings Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant market share valued at USD 3.25 billion in 2024 and USD 3.79 billion in 2025, driven by rapid industrialization and infrastructure development in China, India, and Southeast Asia. Asia Pacific is the third largest market set to hold USD 4.45 billion in 2026. China accounted for the leading market share in 2024, valued at USD 3.25 billion. China, the world’s largest coatings producer and consumer, leads due to its booming construction industry and investments in smart transportation solutions, such as Nippon Paint’s photocatalytic coatings for urban development. In 2026, China is set to be worth USD 2.46 billion. Japan’s shipbuilding industry, supported by mergers such as Japan Marine United and Imabari Shipbuilding, fuels demand for marine coatings, while India’s healthcare expansion boosts antimicrobial coating demand. India is poised to reach USD 0.65 billion in 2026, while Japan is anticipated to encounter the valuation of USD 0.59 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America, led by the U.S., is a key innovator and is expected to grow at a CAGR of 17.7% during the forecast period. The market is driven by aerospace, defense, and energy infrastructure demand. The U.S. Army’s Smart Coatings program focuses on corrosion control and bioweapon detection, while energy projects such as solar panels and wind turbines demand self-cleaning and anti-reflective coatings. Major players such as 3M and Sherwin-Williams strengthen the market, with the U.S. accounting for a majority share of regional revenue. The automotive sector’s recovery post-pandemic and investments in electric vehicles further propel the demand for anti-corrosion coating. The U.S. market is poised to grow with a valuation of USD 1.86 billion in 2026.

Europe

Europe is the second largest market anticipated to hold USD 2.23 billion in 2026, exhibiting a CAGR of 22.9% during the forecast period (2026-2034). The market in Europe is driven by aerospace, construction, and sustainability initiatives. The U.K. market is expanding, projected to reach a value of USD 0.24 billion in 2026. France’s aerospace hub, home to Airbus and Safran, relies on anti-icing and corrosion-resistant coatings for aircraft manufacturing. Strict EU environmental regulations also push demand for eco-friendly solutions. Germany is foreseen to hold USD 0.39 billion in 2026, while France is expected to be valued at USD 0.26 billion in the same year.

Latin America

Latin America benefits from urbanization and automotive investments in Brazil & Argentina. Mexico’s post-pandemic industrial recovery and Brazil’s construction boom drive demand for anti-corrosion and antimicrobial coatings in the Latin America market.

Middle East & Africa

The Middle East & Africa is the fourth largest market expected to gain USD 0.58 billion in 2026. Market growth in the Middle East & Africa is attributed to a rise in oil & gas infrastructure and smart city projects. Anti-corrosion coatings are critical for pipelines and offshore platforms, with contracts such as Perma-Pipe’s USD 15 million deal in the Middle East & North Africa (MENA) highlighting regional demand. Dubai’s smart city initiatives and Saudi Arabia’s Vision 2030 may drive the adoption of self-cleaning and solar-reflective coatings. However, slower adoption is due to economic volatility, although creating niche opportunities in the energy and construction sectors. The GCC market is predicted to be worth USD 0.31 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Implement Product Development Strategy to Maintain Their Dominance in Market

The Sherwin-Williams Company, 3M, AkzoNobel N.V., DuPont, and PPG Industries, Inc. are the key players in the market. Major investments by companies are in developing additives that address evolving demands for sustainability and performance. Furthermore, companies have formed partnerships to develop new products and gain competence. Partnerships with raw material suppliers and metal manufacturers are the strategies market players use to increase their presence globally and maintain their mark in the competition.

LIST OF KEY SMART COATING COMPANIES PROFILED

- 3M (U.S.)

- AkzoNobel N.V. (Netherlands)

- Axalta Coating Systems LLC (U.S.)

- DuPont (U.S.)

- Hempel AS (Denmark)

- Jotun Group (Norway)

- NEI Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- RPM International Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2024 – AkzoNobel expanded its portfolio with Resicoat EV powder coatings, designed for electric vehicle components to enhance insulation, corrosion resistance, and thermal management.

- November 2023 – Covestro AG launched Impranil CQ DLU, a bio-based polyurethane dispersion with 34% plant-derived carbon, targeting sports, automotive, and technical textiles. This replaces petroleum-based alternatives while maintaining durability.

- October 2022 – Apex Auto Care (2022) unveiled self-healing ceramic coatings (Self Heal Plus and Heal Light) that repair scratches at 60°C, offering a durable alternative to traditional films.

- February 2022 – Sherwin-Williams acquired AquaSurTech, a Canadian company specializing in eco-friendly coatings for building products, to strengthen its sustainable solutions portfolio.

- September 2021 – PPG Industries introduced Sigma Sailadvance NX, an antifouling smart coating for marine applications, leveraging nanotechnology to reduce drag and improve fuel efficiency.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, functions, and end-use industries. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Growth Rate |

CAGR of 17.7% from 2026 to 2034 |

|

Segmentation |

By Function

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 8.34 billion in 2025 and is projected to record a valuation of USD 36.22 billion by 2034.

Recording a CAGR of 17.7%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

By end-use industry, the building & construction segment led the market in 2025.

Asia Pacific held the highest market share in 2025.

Rapid urbanization and infrastructure development is driving market growth.

Superior functional properties over traditional coatings are expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us