Smart Inhalers Market Size, Share, Trends & Industry Analysis, By Product (Dry Powder Inhaler (DPI) – Based Inhalers and Metered Dose Inhaler (MDI) – Based Inhalers), By Disease Indication (Asthma, Chronic Obstructive Pulmonary Disease (COPD)), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Channel) and Regional Forecast, 2026-2034

Smart Inhalers Market Size & Share

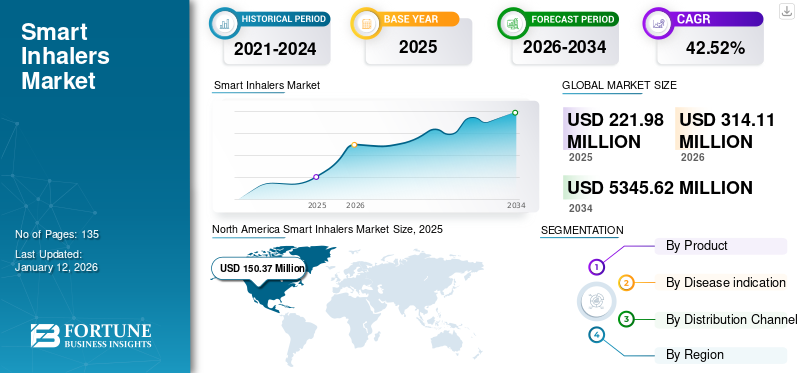

The global smart inhalers market size was valued at USD 221.98 million in 2025 and is projected to grow from USD 314.11 million in 2026 and is projected to reach USD 5,345.62 million by 2034, exhibiting a CAGR of 42.52% during the forecast period. North America dominated the smart inhalers market with a market share of 67.74% in 2025.

Smart inhalers are medical devices that can be connected to a smartphone or any other digital device with the aim to monitor patients’ health updates regularly, specifically for people suffering from respiratory ailments such as asthma and COPD. They are incorporated with sensors that can send a notification to the patient via smart phones alerting about the risks of highly polluted areas or regions with high pollen threat. These devices are designed with sensor technology to automatically tract and monitor drug dosage and also keep a trace of the patient’s diagnosis history. Also, the adoption of these inhalers assists in controlling and regularizing medicinal adherence of the patient. However, the market is at its nascent stage of development, but owing to its associated benefits, the industry is anticipated to exhibit a positive growth trajectory across the forecast period.

Furthermore, certain factors, such as, rising disposable incomes, increasing healthcare expenditure and increasing awareness of connected devices in the developing nations are projected to fuel the smart inhalers market growth by 2032.

Global Smart Inhalers Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 221.98 million

- 2026 Market Size: USD 314.11 million

- 2034 Forecast Market Size: USD5,345.62 million

- CAGR: 42.52% from 2026 to 2034

Market Share:

- Region: North America dominated the market with a 67.74% share in 2025. This leadership is driven by increasing digitalization in the healthcare sector, favorable government policies, a flexible regulatory scenario, and significant private and public funding for smart inhaler technologies.

- By Product: Metered Dose Inhaler (MDI)-based smart inhalers are anticipated to dominate the market. The segment's growth is attributed to the advantages of MDI systems in monitoring and controlling drug dosage and a strong focus from major companies on R&D and manufacturing of novel MDI-based devices.

Key Country Highlights:

- Japan: Market growth is supported by strategic collaborations to introduce advanced digital health platforms. For instance, a partnership between Propeller Health and Novartis aims to connect a digital health platform to specific medications for treating uncontrolled asthma in the country.

- United States: The market is driven by a very high prevalence of respiratory diseases, with more than 25 million Americans suffering from asthma. Growth is also fueled by a favorable regulatory environment, including FDA grants for over-the-counter sales of smart inhaler sensors.

- China: Growth is propelled by strategic collaborations between global and local companies. For example, AptarGroup, Inc. partnered with Sonmol, a Chinese digital respiratory therapeutics company, to develop a digital therapies and services platform targeting respiratory diseases.

- Europe: The market is advanced by the increasing adoption of smart inhalation devices and a growing demand for digital medical devices in key countries such as Germany, the U.K., and France. The strong presence of major vendors in the European market is also a key growth factor.

SMART INHALERS MARKET TRENDS

Download Free sample to learn more about this report.

Increasing Adoption of Digital Technology in Medical Devices will Fuel the Market Growth

Increasing adoption of digital technology in medical devices coupled with the competence of drug delivery devices in treatment measures are projected to augment the market growth during the forecast period. Combined with this, an increasing prevalence of respiratory ailments such as asthma and COPD is estimated to offer considerable opportunity for the increased adoption of digital inhalers during the forecast period. For instance, according to a study conducted by the Centers for Disease Control and Prevention (CDC), in 2016, an estimated 26.5 million people in the U.S. were suffering from asthma. Hence, the aforementioned factors will significantly drive the market growth of these inhalers.

MARKET DRIVERS

Increasing Prevalence of Chronic Respiratory Diseases to Propel Growth of Market

The increasing prevalence of acute respiratory diseases, such COPD and as asthma across the globe is creating considerable amount of opportunities for the growth of the smart inhalation devices market. For instance, in 2015 as per the Global Burden of Disease, the prevalence of COPD increased by an estimated 14.7% across 1990-2015. Moreover, there is a steady shift of preference from traditional drug delivery devices to smart drug delivery equipment’s owing to their possession of superior benefits.

Rising importance on preventive care is one of the major factors expected to boost their adoption during the projected period. In 2015, The Lancet Respiratory Medicine, reported that the adoption of digital inhalers amongst the asthma suffering children in New Zealand increased up to 84.0% during 2014 to 2015. Hence, such initiatives supported the market growth of smart inhalers across the forecast period.

Superior Procedural Outcomes of Smart Inhalation Devices to Augment Growth

Digital inhalers can be linked with smart phones with the help of Bluetooth, enabling dosing remainder and dose monitoring mechanisms. Additionally, these equipment’s offer patient education tools that minimize the errors in dosing actions, resulting into a decrease in hospitalization and treatment expenses. For instance, in 2016, Propeller Health, stated that, patients who used this type of inhalers witnessed more than 60.0% reductions in the doctor visits. Additionally, widely increasing R&D activities are expected to offer more facilities to the patients, which will eventually drive the smart inhalation devices market by 2032.

MARKET RESTRAINT

Presence of Substitute Manual Inhalers Might Restrict Market Growth

Despite the increasing benefits of smart inhalers, presence of manual inhalers as a substitute product might hamper market growth up to a certain extent. Moreover, dearth of awareness among the population of developing economies pertaining to the usage of digital inhalers is another considerable factor hampering the market expansion of smart inhalers during the forecast period.

SMART INHALERS MARKET SEGMENTATION ANALYSIS

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Usage of MDI-based Smart Inhalers, owing to its Efficiencies, Dominated the Global Market

Based on product type, the market is segmented into MDI-based Inhalers and DPI-based inhalers. The DPI is a device that transfers medication to the lungs in the form of a dry powder. Rather than a chemical propellant to push the medication out of the device, the DPI releases the drug based on the inhalation capacity of the patient. There are multiple dose devices that can hold up to 200 doses. The segment is estimated to hold a stable amount of this market share, owing to the increasing prevalence of chronic respiratory ailments across the globe. However, there were few drawbacks associated with the usage of DPI, such as irregular drug dosage, but the increasing investments by various market players to rectify its technical issues will considerably support stable market growth of this type of inhalers during the forecast period.

The metered dose inhaler (MDI)–based smart inhalers segment dominated the digital inhalers market in 2026, accounting for 68.86% of the market with a size of USD 216.3 million. These smart inhalers consist of a canister containing drugs that fits into a boot shaped mouthpiece. The medication dosage is released into the lungs of the patient by pushing the canister into the boot. The advantages associated with the use of MDI are that it helps assist in monitoring and controlling of drug amount to be dispersed as per need. The segment is also anticipated to exhibit lucrative growth across the forecast period owing to the fact that the major companies are focusing on R&D activities to manufacture such novel technology incorporated medical devices. For instance, In November 2024, Lupin announced the launch of ADHERO, a novel smart metered-dose inhaler. The inhaler is intended to help patients with acute respiratory ailments to track their MDI usage and facilitate improved adherence to therapy. Hence, the aforementioned factors will significantly support smart inhalers market growth during the projected period.

By Disease Indication Analysis

Increasing Prevalence of Asthma across the Globe to Aid Dominance of the Segment

Based on disease indication, the market is segmented into asthma and chronic obstructive pulmonary disease (COPD). The asthma segment held the majority share of the market in 2026, accounting for 57.99% of the market with a size of USD 182.13 million. High growth is attributable to the rising prevalence of asthma across the globe. Increasing patient pool will significantly drive the segmental growth during the forthcoming period. For instance, according to the Centers for Disease Control and Prevention (CDC), 1 in 13 people have asthma in the U.S. It shows that more than 25 million Americans are suffering from asthma. Hence, the growing prevalence of asthma, coupled with increasing awareness among the population about the risk of this disease will strongly propel adoption of smart inhalers market across the forecast timeframe.

COPD segment is estimated to experience lucrative compound annual growth rate across the forecast period. It is a progressive lung disease that hinders airflow. High growth of the segment is attributable to the increasing adoption of smart inhalers for the regular monitoring of the disease. Additionally, the growing prevalence of COPD across several economies of the world will further augment the market growth of smart inhalers.

By Distribution Channel Analysis

High Accessibility of Hospital Based Pharmacies for the Patient Pool to Enable Dominance of the Segment

The hospital pharmacies segment is estimated to hold considerable market revenue across the forecast timeframe and is expected to exhibit a lucrative growth during the forthcoming years. Hospital pharmacies are easily accessible to the patient population undergoing treatments in the hospital settings. Moreover, various smart drug delivery devices companies are in distribution partnership with such hospital pharmacies. Hence, the aforementioned factors will strongly suggest a positive growth trajectory for the hospital pharmacy based smart inhaler market during the projection period. Moreover, growing initiatives by the government to implement smart medical devices in such settings will further propel segmental growth.

The retail pharmacies segment demonstrated significant growth in 2026, accounting for 37.70% of the market with a size of USD 118.41 million. High growth is attributable to the increasing number of retail pharmacies across the globe. Moreover, the increasing efforts by various smart inhaler manufacturing companies to establish partnership agreements with retail pharmacies in order to start over-the-counter sales of these devices will further propel the segmental growth. Also, the growing number of FDA approvals pertaining to over-the-counter sales of digital inhalers is another important growth fostering reason. For instance, in April 2018, Adherium announced the FDA grant for over-the-counter sales of its digital inhaler sensor for AstraZeneca ‘s asthma inhalation device.

REGIONAL ANALYSIS

North America Smart Inhalers Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market of smart inhalers is segmented into North America, Europe, Asia Pacific, and the rest of the world. The market size in North America stood at USD 150.37 million in 2025. The U.S. is projected to showcase lucrative growth due to factors such as increasing digitalization in the healthcare sector coupled with favorable government policies, and flexible regulatory scenario. Moreover, increasing private and public funding pertaining to smart inhalers will further propel regional growth across the forecast period. Hence, such factors are responsible for the positive growth of the market in North America. The US market is projected to reach USD 199.6 million by 2026.

In terms of Asia Pacific, the market is projected to grow at a lucrative rate, owing to the increasing number of vendors penetrating the untapped emerging Asian economies. Moreover, increasing spending pertaining to healthcare IT development in the emerging countries will further propel regional growth. The Japan market is projected to reach USD 13.58 million by 2026, the China market is projected to reach USD 5.62 million by 2026, and the India market is projected to reach USD 3.98 million by 2026.

In Europe, the increasing adoption of smart inhalation devices and growing demand for digital medical devices in Germany, the U.K., & France, owing to a need to enhance the patient experience are attributable to the growth of smart inhalers market in this region. Also, high growth is due to the presence of major vendors operating in the European market. The United Kingdom market is projected to reach USD 18.6 million by 2026, while the Germany market is projected to reach USD 7.55 million by 2026.

KEY INDUSTRY PLAYERS

Core Focus on Research and Development Activities by Adherium and Propeller Health to Strengthen Their Market Position

The global market is at its nascent stage of development. Also, a great number of companies operate actively here. Cohero Health Inc. and Adherium, Propeller Health, are anticipated to lead the market. Certain factors, such as emphasis on research & development activities, ownership of technology, and robust focus on the consolidation of distribution channels can be attributed for the players to hold prominent smart inhaler market share. Also, players such as AstraZeneca plc, GlaxoSmithKline, Novartis AG, and others are vigorously contributing in the smart inhalers segment owing to their strong brand presence and well-established marketing channels.

LIST OF TOP SMART INHALERS COMPANIES:

- Adherium

- Propeller Health

- Cohero Health Inc.

- GlaxoSmithKline

- AstraZeneca plc

- Novartis AG

- 3M Company

- Teva Pharmaceuticals

- Vectura Group

- Others

KEY INDUSTRY DEVELOPMENTS:

- August 2020 - Propeller Health collaborated with Novartis to connect the digital health platform to Enerzair and Atectura Breezhaler medications and will start distributing in Japan to treat uncontrolled asthma. Company’s digital health sensor will help people in Japan to manage their health condition by using Propeller app on the patient’s smartphone.

- April 2020 - AptarGroup, Inc., and Sonmol, a Chinese digital respiratory therapeutics company, collaborated together for developing a digital therapies and services platform which targets respiratory and other diseases. This collaboration will help to focus on early detection and prevention measures for chronic respiratory diseases to bolster the case for smart inhalers & connected devices as platforms to improve health conditions in patients.

- February 2020 - Teva Respiratory, LLC, a part of Teva Pharmaceutical Industries Ltd. made an announcement that the company has received the approval for ArmonAir Digihaler (Inhalation Powder) from U.S. Food and Drug Administration. It is delivered through Teva’s Digihaler device. It is specified for the treatment of asthma in patients 12 years and older.

REPORT COVERAGE

The report offers comprehensive data regarding various insights of the market. Some of them are competitive landscape, growth drivers, regional analysis, restraints, and other related aspects. It further offers analytical insights of the digital inhalers estimations and market trends to exemplify the forthcoming investment outcomes. The data gathered from several sources are quantitatively evaluated from 2024 to 2032 to provide the financial competency of the market. The data gathered in the report has been collected from various secondary and primary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product

|

|

By Disease indication

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 221.98 million in 2025 and is projected to reach USD 5,345.62 million by 2034.

In 2025, the market value stood at USD 221.98 million.

Growing at a CAGR of 42.52%, the market will exhibit lucrative growth in the forecast period (2026-2034).

Metered Dose Inhaler (MDI)-based inhalers segment is expected to be the leading segment in this market during the forecast period.

Increasing prevalence of chronic respiratory ailments across the globe is the key factor driving the market.

Adherium is the leading player in the global smart inhalers market.

North America dominated the market share in 2025.

Superior procedural outcomes of these inhalers are likely to drive the adoption of smart inhalers solutions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us