Smart Textiles Market Size, Share & Industry Analysis, By Type (Active Smart and Ultra Smart), By End Use (Healthcare, Sports & Fitness, Military, Industrial Safety, Fashion & Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

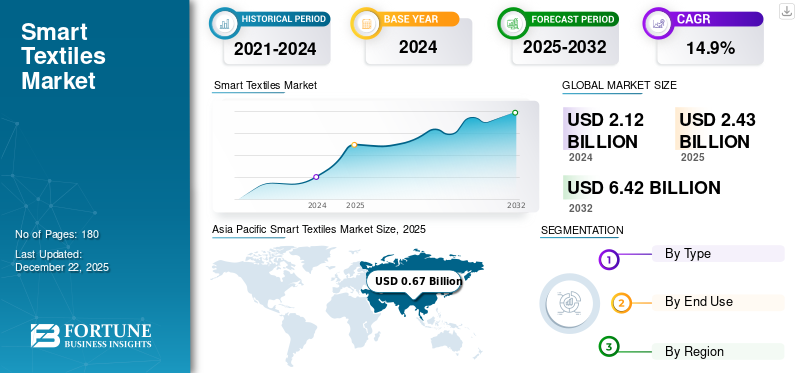

The global smart textiles market size was valued at USD 2.43 billion in 2025 and is projected to grow from USD 2.79 billion in 2026 to USD 8.48 billion by 2034, exhibiting a CAGR of 14.9% during the forecast period. Asia Pacific dominated the smart textiles market with a market share of 28% in 2025.

Smart textiles, also known as electronic or e-textiles, are fabrics that integrate electronic components, sensors, and other advanced materials to function beyond traditional fabrics. These textiles can sense, process, and respond to their environment or the wearer's needs. It directly incorporates electronic components such as sensors, actuators, microcontrollers, and conductive materials into the fabric. Their exceptional features and ability to offer various functionalities are gaining attention from prominent clothing, wearable, and medical device brands, allowing the market to flourish in the upcoming years.

These electronic embedded textiles offer numerous advantages over traditional textiles, including enhanced comfort, functionality, and health monitoring capabilities. They can be used in various applications, from healthcare to sports and fashion, offering real-time data acquisition and personalized experiences. It also offers customized services to meet individual needs and preferences, providing a more tailored experience. Therefore, the growing demand for these high-tech devices in healthcare and the military is set to drive market growth over the forecast period.

APEX Mills, DuPont, Embro, KOB GmbH, and Thermosoft International are a few key players operating in the market. These companies strategically invest in research and development to innovate more aligned products as per market needs.

MARKET DYNAMICS

MARKET DRIVERS

Growing Adoption of E-Textiles in Healthcare Industry to Boost Market Growth

Growing advancements in the healthcare industry are a major driver of the market, particularly due to the increasing demand for wearable health monitors, remote patient monitoring, and other innovative medical solutions. This product can enhance telemedicine capabilities and reduce hospital visits, thus improving patient comfort.

Textiles integrated with sensors enable continuous monitoring of vital signs such as heart rate, temperature, and activity levels, leading to their growing adoption in various healthcare settings. These sensors provide real-time data collection and transmission to healthcare providers, facilitating early detection of health issues and personalized treatment plans.

In addition, telerehabilitation applications are gaining demand as post-operative and elderly patients benefit from smart clothing that sends health metrics to remote physicians. Hence, the need for remote patient monitoring, telemedicine, and long-term disease management tools will boost the smart textiles market growth over the forecast period.

Furthermore, growing product applications in defense for temperature regulation, motion detection, and biometric surveillance will aid the market growth. Military organizations are increasingly seeking smart and innovative products to enhance the capabilities of their personnel, improve operational effectiveness, and reduce casualties. Efficacy of the product to offer features such as temperature control, biometric monitoring, and improved camouflage, supporting military goals to increase operational effectiveness. Therefore, the growing demand for high-tech devices in the military will boost the market growth.

MARKET RESTRAINTS

High Development and Integration Costs May Restrain Market Growth

High development and integration costs, stemming from the complexity and sophisticated technology requirements, significantly limit the adoption of these textiles. This includes the cost of advanced materials, specialized manufacturing processes, and ongoing research and development. Integrating electronics, sensors, and other functionalities into fabrics requires specialized equipment and expertise, increasing production costs.

Additionally, these textiles often utilize high-end materials, including conductive fibers, which are more expensive than traditional textile materials. Electronic components' cost and integration into the fabric further drive up production expenses. As a result, these factors contribute to higher prices for e-textiles, potentially restricting their affordability and widespread adoption, especially in price-sensitive markets.

MARKET OPPORTUNITIES

Growing Product Demand in Sports, Fitness, and Fashion Industries to Provide Lucrative Market Opportunities

The sports and fitness industry is a major driver for the demand for these textiles, as these fabrics offer performance-enhancing features and data collection capabilities for athletes and fitness enthusiasts. Factors, including the growing interest in fitness, wearable technology, and the desire for performance data, fuel this demand.

Textiles with embedded sensors can monitor heart rate, body temperature, movement, and other physiological data, providing valuable insights to athletes and fitness enthusiasts. This data can be used to analyze training routines, identify areas for improvement, and optimize performance, leading to better results. According to the Rock Health Digital Health Consumer Adoption Survey, around 44% of Americans own wearable health-tracking devices such as smartwatches or smart rings to track their health metrics.

In addition, the future of fashion is increasingly entangled with technology, and these textiles are playing a key role in this transformation, offering a compelling vision of the future of fashion. For instance, companies including Google and Levi's with Project Jacquard, Under Armour, Tommy Hilfiger, Samsung, Ralph Lauren, and Nike have already started using e-textiles in their final products. Therefore, the growing demand for the product in the sports, fitness, and fashion industries is set to offer lucrative opportunities in the market.

SMART TEXTILES MARKET TRENDS

Integration of Internet of Things (IoT) in Smart Textiles to Drive Market Growth

Integration of Internet of Things (IoT) capabilities into garments is revolutionizing apparel by transforming them into intelligent systems. In 2024, more than 40% of smart textile adoption is driven by health trackers, smart uniforms, and performance wear. Garments gather real-time biometric, environmental, and behavioral data with embedded sensors and wireless connectivity.

Industries such as fitness, defense, and emergency response are adopting these technologies for real-time feedback and intervention. IoT enables manufacturers to incorporate real-time data on customer preferences into the production process, allowing for customized products and designs. It also facilitates quick design and production of customized apparel, minimizing waste and errors during the sample phase. Therefore, integrating IoT in these textiles will drive market growth in the foreseen period.

Download Free sample to learn more about this report.

IMPACT of COVID-19

The COVID-19 pandemic adversely impacted business operations in numerous ways, including the temporary suspension of production, which caused disruptions in the supply chain. Lockdown measures have hampered production operations in various sectors, reducing the market’s growth in 2020. Additionally, as the cash reserves were primarily focused on dealing with the pandemic, the market experienced fewer investments in the same year. However, sectors including sports & fitness, military, and healthcare still passed smoothly through COVID-19, allowing the market to recover rapidly in 2021.

Segmentation Analysis

By Type

Active Smart Segment Dominated Market Owing to Its Wide Adoption and High-Performance Features

On the basis of type, the market is segmented into active smart and ultra smart.

The active smart segment held the largest global smart textiles market with a share of 92.47% in 2026. This type is widely adopted due to its high-performance features over other types of textiles, which are limited to sensing capabilities. The active smart type can sense and react to pressure, temperature, and various other parameters embedded through fabric sensors. Also, the massive demand for active smart textiles is driven by advancements in wearable technology, health monitoring, and military applications.

The ultra smart segment is poised to grow significantly during the forecast period due to growing usage of advanced, performance-oriented materials that go beyond active smart textiles by adding capabilities, including energy generation, artificial intelligence integration, and reflective features. While active e-textiles primarily focus on sensing and responding to environmental stimuli, ultra-e-textiles are capable of adapting and self-modifying, making them more innovative in terms of their characterization. Its application scope for adaptive clothing for patients, adaptive camouflage, and protective gear will likely fuel the segment's growth in the long-term forecast.

By End Use

To know how our report can help streamline your business, Speak to Analyst

Healthcare Segment to Dominate Market, Owing to Growing Demand for Real-Time Monitoring Medical Devices

Based on end use, the market is segmented into healthcare, sports & fitness, military, industrial safety, fashion & entertainment, and others.

The healthcare segment is likely to dominate the market contributing 35.48% globally in 2026. The growing demand for advanced materials in healthcare, mainly due to modernization and the need for real-time monitoring of medical devices, has fueled the adoption of the product in the healthcare industry. These textiles can be used to monitor vital signs, detect early warning signs of diseases, and facilitate telemedicine, allowing the industry to capture a major revenue share of the market.

The sports & fitness segment is anticipated to showcase significant growth, owing to the growing consumer preference for health monitoring devices to track heartbeat, oxygen level, sleep pattern, and other aspects, making them ideal for sports apparel. Innovations in materials, including microfiber technology, offer waterproofing, breathability, and temperature regulation, enhancing comfort and functionality in sports apparel. The demand for these products is growing rapidly. Thus, the segment is anticipated to experience faster growth compared to any other segment.

The demand for these textiles in industrial safety applications is rapidly growing, driven by the need for improved worker protection. As workers deal with different hazardous and unpredictable industrial environments, the need for safe protective garments is natural. The product offers advanced functionalities, including real-time monitoring of vital signs, early warning of hazardous substances, and the ability to adapt to changing conditions, making it an ideal choice to meet the necessary safety measures.

SMART TEXTILES MARKET REGIONAL OUTLOOK

The market is categorized by geography into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Smart Textiles Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market size stood at USD 0.67 billion in 2025 and is predicted to register the highest CAGR during the forecast period. The region will grow rapidly due to various factors such as government policies promoting high-performance materials, such as the Production Linked Incentive (PLI) scheme for technical textiles in India, which encourages domestic manufacturing and innovation. Particularly in China, the nation's strong manufacturing capabilities, government support, and increasing consumer demand for health and fitness-related technologies will create a progressive environment for market growth. The Japan market is projected to reach USD 0.12 billion by 2026, the China market is projected to reach USD 0.44 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

North America

North America accounted for the largest market in 2024. North America is a hub for technological innovation and is a prominent early adopter of wearable technology, including smartwatches and fitness trackers. Strong technological infrastructure, high adoption of wearable technology, and a robust market for health and fitness applications have created high demand for the product in 2024. Government support for R&D, particularly in healthcare and defense, also supports the regional growth.

The U.S. is identified as a leading country due to its massive military expenditures and huge healthcare network. The U.S. market is USD 0.89 billion by 2026 and is projected to generate sales revenue of USD 2.04 billion by the end of 2032.

Europe

Europe is another prominent region in the market, where increased focus on technical textiles is one of the main driving factors. Growing demand for sustainable and eco-friendly products and the region's established textile industry create a perfect blend for the market to flourish in the upcoming years. Furthermore, Europe's emphasis on circular economy and sustainability initiatives drives the development of smart textiles with enhanced durability, moisture-wicking, and integrated sensing capabilities. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.2 billion by 2026.

Latin America

The Brazil market dominates the Latin America region. Brazil might not be a leading innovator in all technological fields, but its robust economy and large consumer base create an environment where textile innovation, including smart textiles, can thrive. Additionally, Brazil's active patent system and efforts to streamline the patent application process further contribute to the country's prominence in smart textile patents.

Middle East & Africa

The presence of major economies such as the GCC and South Africa primarily drives the Middle East region's industry. The adoption of these textiles in the Gulf Cooperation Council (GCC) region is growing due to increasing demand for functional and superior-quality products in various sectors, including healthcare, military and defense, and sports and fitness. The region is showing increasing interest in smart textiles, driven by both technological advancements and a growing focus on sustainability.

South Africa's "R-CTFL Value Chain Master Plan to 2030" aims to revitalize the domestic textile industry by promoting local manufacturing and consumption through the "Buy Local" campaign and other initiatives. Such initiatives will also give confidence to invest in high-value products such as e-textiles.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies are Investing in Research & Development to Promote Product Adoption

Major players such as APEX Mills, DuPont, Embro, KOB GmbH, and Loomia are investing in research & development to explore and promote the adoption of smart textiles. Companies focus on technological advancements, integrating smart features into various products, and addressing market trends such as sustainability and consumer demand for wearable technology. Companies also focus on developing such textiles for various applications, including fitness trackers, smart clothing, and healthcare devices. For instance, Hexoskin has developed a shirt capable of monitoring biometric data continuously. Google worked with Levi Strauss to develop Project Jacquard smart jean jackets. These companies will assist the market to expand throughout the forecast period.

LIST OF KEY SMART TEXTILE COMPANIES PROFILED

- APEX Mills (U.S.)

- DuPont (U.S.)

- Embro (Germany)

- KOB GmbH (Germany)

- Loomia (U.S.)

- SEFAR (Switzerland)

- Texible (Austria)

- Thermosoft International (U.S.)

- Wave Company (South Korea)

- Xenoma (Japan)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Graphene-X launched a new product named ThermAdapt GX-Merino Heated Jacket. The innovative outerwear features self-regulating heating technology, the comfort of merino wool, and a modular design, offering a versatile alternative that can replace multiple layers with just one adaptable solution.

- October 2023: Japanese apparel start-up Xenoma Inc. and Japan Aviation Electronics Industry, Ltd. (JAE) collaborated to develop connectors for commercialization. Xenoma has been developing smart apparel that uses stretchable wiring, and the company needs reliable connectors to complete it. Hence, the company believes that with the help of JAE, it can tackle this challenge.

- April 2023: Researchers from the University of Cambridge discovered that flexible displays and smart fabrics can be produced at a lower cost. This can be achieved with greater sustainability by integrating electronic, optoelectronic, sensing, and energy fiber components using standard industrial looms typically used for traditional textiles. Their findings, published in Science Advances, suggest that smart textiles could be a viable substitute for larger electronic devices in various industries, including automotive, electronics, fashion, and construction.

- April 2020: Two prominent Japanese firms, Murata Manufacturing and Teijin Frontier, collaborated to create the first-ever piezoelectric fabric named Pieclex. This innovative material generates electrical energy and demonstrates antimicrobial properties when subjected to movement. Moreover, the companies founded a joint venture called Pieclex Co., Ltd. to focus on this new fabric's research, development, manufacturing, and sales.

REPORT COVERAGE

The market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, type, and end use. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.9% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By End Use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.79 billion in 2026 and is projected to reach USD 8.48 billion by 2034.

Growing at a significant CAGR of 14.9%, the market will exhibit considerable growth over the forecast period (2026-2034).

Based on end use, the healthcare segment is expected to lead the market over the forecast period.

Growing adoption of e-textiles in healthcare to boost market growth

APEX Mills, DuPont, Embro, KOB GmbH, and Loomia are a few leading players in the market.

The Asia Pacific held the largest share of the global market in 2025.

Growing demand for smart materials from the healthcare and military industries is anticipated to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us