Solid Welding Wires Market Size, Share & Industry Analysis, By Material Type (Steel, Copper, Aluminum and Aluminum Alloys, and Others), By Application (Automotive, Building & Construction, Heavy Engineering, Railway & Shipbuilding, Oil & Gas, and Others (Aerospace, etc.)), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

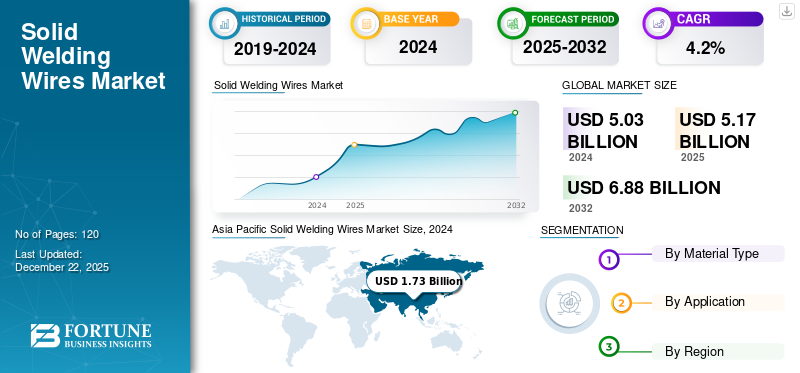

The global solid welding wires market size was valued at USD 5.03 billion in 2024 and is projected to grow from USD 5.17 billion in 2025 to USD 6.88 billion by 2032, exhibiting a CAGR of 4.2% during the forecast period. The Asia Pacific dominated global market with a share of 34.39% in 2024.

Solid wires find their extensive application in welding application across diverse industries. Automotive, construction, aerospace, oil and gas, marine equipment, and other heavy industry equipment prominently driving the market growth. Solid wires offer various benefits such as consistent welding, reduced post-cleanup activities, and offers faster welding speed. Furthermore, solid wires emit less smoke and fumes compared to other types of welding wires. Solid wires are made using a wide range of materials such as carbon steel, aluminum, nickel, tungsten, steel, etc. Emerging applications such as robotics, and renewable energy to further enhance the global market share. Robotics, renewable energy, and electric vehicles are witnessing strong growth across regions owing to rising investments, and awareness about sustainability. Rapid urbanization, growing investment in smart factories, and considerable investment in the real estate and infrastructure sectors fuel the growth of the market.

Download Free sample to learn more about this report.

Key players such as KOBE Steel, Ltd., ESAB, Ador Welding Ltd., etc. are striving to develop advanced materials-based solid wires owing to increasing awareness of the environmental impact, and stringent regulatory policies. For instance, in April 2025 Böhler Welding introduced the EMK Ultra Portfolio of copper solid wires. The new welding wires portfolio offers arc stability and enhanced productivity.

Temporary shutdowns, reduced production capacity, and disrupted supply chains are few of the factors that limited the market growth during the COVID-19 pandemic period. Halt at construction sites, lowered demand, financial limitations, etc. resulted in reduced demand in the COVID year. However, in post-pandemic years the resumption of production facilities and manufacturing operations generated market demand for solid wires. The market rebounded to its pre-pandemic levels as a result of the resumption of construction industry and manufacturing activities and is projected to steadily grow over the forecast period.

Solid wires market demand to witness low impact owing to reciprocal tariffs. The reciprocal tariffs that might be imposed on several welding equipment and consumables result in slow growth of the solid wires market. However, reduced demand for solid wires due to increased cost would further impact the sales of wires in price-sensitive regions.

- According to International Trade Center 2024, the U.S. represents approximately 3.6% of the global exports of steel alloy or stainless steel wires.

MARKET DYNAMICS

STAINLESS WELDING WIRES MARKET TRENDS

Stainless Steel Welding Wires to Gain Momentum Owing to Corrosion Resistance Properties

Stainless steel wires provide high corrosion resistance and minimal oxidation that enhances the durability of solid wires making them widely applicable across industries. Due to the high tensile strength and increased durability of stainless steel wires along with temperature and heat resistance, solid steel wires are preferable solutions in a wide array of applications. Furthermore, stainless steel with varying ranges of grades is available across regions making it versatile for various end users.

MARKET DRIVERS

Growing Industrial Sector and Investment in Real Estate to Boost the Solid Wires Demand

Solid welding wires are largely driven by increasing demand from the automotive, oil and gas, construction, and metal fabrication industries. Industrial automation, adoption of advanced welding processes, and smart welding technologies further boost the market for solid wires in welding applications. Increased demand for consistent and high quality welding is driving the demand for robotics automation. Growing oil and gas refineries, and increasing investment in robotics, real estate, and automation across industries to drive the market for solid wires.

- For instance, Indian Oil Corporation collaborated with Trafigura in May 2025. The deal amounted to about USD 1.3-1.4 billion and supplied LNG for over a five-year period.

MARKET RESTRAINTS

Availability of Several Substitute Products and Increased Raw Material Cost Limited the Market Growth

Solid welding wires are easily substituted with other types of welding wires including flux-cored wires, electrodes, and other welding consumables which might limit the growth of the market. Increased raw materials cost and limited availability of skilled workforce in the welding applications, would further restrain the solid welding wires market growth.

MARKET OPPORTUNITIES

Robotics and Renewable Energy to Demand Advanced Materials-based Solid Wires

The renewable energy sector is witnessing strong growth over the forecast period as a result of rising awareness about environment-friendly energy solutions supported by regulatory policies. The adoption of precise welding techniques using robotic technology and lightweight welding consumables are prominently gaining traction in the market. End users such as robotics and the renewable sector require highly efficient and sustainable consumables with advanced materials which would propel the growth of solid welding wires. Green energy projects and the adoption of technology will generate strong market demand for efficient and cost-effective welding consumables.

- For instance, ALTERRA has funded over USD 100 million to Evren company in India. The funding is expected to support the construction of solar, battery storage, and wind projects.

Segmentation Analysis

By Material Type

Steel Solid Wires to Dominate the Market Due to their Various Range in Applications

Based on material type, the market is classified into steel, copper, aluminium, and aluminium alloys, others. Other segments include solid wires made of tungsten, nickel, and other alloys.

Steel solid wires account for the highest revenue market share in the global market owing to their wide range of applications across marine equipment, industrial machinery, construction, and automotive sectors.

Steel solid wires include carbon steel, and stainless steel which are largely used in welding applications across industries. Metal welding is mostly required in automotive, construction, and other industries. Steel welding consumables are largely applicable for vehicle body parts, bridges, buildings, oil and gas pipelines, ship hulls, etc. Moreover, easy availability and affordability of steel minimizes the cost of manufacturing for end users. Therefore, several end-users preference remains to carbon or stainless steel for welding purposes.

However, there are other material-based solid wires such as aluminum alloys, copper, nickel alloys, tungsten, etc. Prominent market players are developing advanced material-based wires to comply with regulatory standards and meet sustainability targets. Copper, aluminum alloys, nickel, and other types of materials are gaining traction for welding applications across regions.

- For instance, in May 2023 Nippon Steel introduced two different types of steel that are lightweight offering corrosion resistance, and can be used in C4-C5 corrosion zones.

By Application

Heavy Engineering to Cater Highest Revenue Market Share as a Result of Large Welding Application

Based on application, the market is segmented into automotive, building & construction, heavy engineering, railway & shipbuilding, oil & gas, and others. Other segments include aerospace food processing, pharmaceuticals, chemical processing, etc. Heavy engineering to account for highest revenue market share as a result of increasing demand for welding applications.

Smart manufacturing processes, adoption of automation, and technology advancements are largely driving the market for precision welding. The heavy engineering segment includes the development of heavy machinery, mining machinery and equipment, and agricultural equipment. Growing demand for high-strength alloys, and assembly of complex components to boost strong market opportunities for welding consumables including solid wires.

Automotive, construction and infrastructure development, transportation infrastructure, oil and gas sector are significantly driving the market demand for welding wires owing to increasing investment, and demand for critical components. Welding wires find their application in welding materials including road infrastructures, solar panels, wind turbines, etc. Several such specialized applications of welding wires to enhance durability.

Solid Welding Wires Market Regional Outlook

By region, the market is classified into North America, Europe, Asia Pacific, Middle East and Africa, and South America. Asia Pacific to dominate the solid welding wires market owing to rapid urbanization and adoption of automation across industries.

Asia Pacific

Asia Pacific Solid Welding Wires Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific catered to the highest revenue market share accounting for more than one-third of the solid welding wires market. Electrification of vehicles, rapid urbanization, and investment in emerging sectors including semiconductor and renewable energy propel the growth of the market in the region. Growing demand for robotics, and the rising adoption of automation in manufacturing facilities to further drive the market for welding wires in the region. Government-supported investments and upcoming initiatives such as Japan’s 6th Strategic Energy Plan by manufacturing hubs will further fuel the market revenue.

- For instance, according to the International Energy Agency in May 2024 renewable energy generation grew from 21% to 26% from 2018 to 2022 as a result of Japan’s investment in energy projects, offshore wind projects, and supporting initiatives by the government.

North America

The renewable energy sector, semiconductors, electric vehicles, battery manufacturing, additive manufacturing, and robotics, are a few of the emerging sectors in the North American market generating significant demand for solid welding wires. As Industry 4.0 and IoT trends continue to grow in the region, especially in the U.S. market, the increasing adoption of robotic welding, and automated welding systems to witness huge growth over the forecast period. The precision welding process allows smooth welding and increased deposition rate owing to which the market for solid welding wires to experience strong growth over the upcoming years in the region.

U.S. to account for the highest solid welding wires market share in the North American region in 2024. EV and battery manufacturing, increasing investment in 3D printing and additive manufacturing along with increased private investments to attract the market demand for solid welding wires.

- For instance, According to Environmental Defense Fund in January 2025, a total of USD 200 billion were invested in electric vehicle manufacturing in the last 10 years.

Europe

Europe region to witness stable growth owing to several factors including demand for multistoried buildings, growing industrial facilities in the Eastern European countries, and investment in the green energy sector. Several such factors drive the demand for solid wires across the region.

- For instance, European Union countries have invested about USD 110 Bn in Energy projects in the year 2023 according to European Investment Bank.

Middle East & Africa

Middle East & Africa to gain market traction as a result of oil and gas industries, and the metal and mining sector. Middle Eastern countries are diversifying their revenue generation across different sectors including solar energy projects, large construction, and mobility infrastructure. Several such projects bring strong market opportunities for the welding wires in the region.

- In March 2025, Dubai Electricity and Water Authority (DEWA) invited several International Energy Storage System Developers for submission of proposal to develop 1,600MW 7th phase of Mohammad bin Rashid AI Maktoum Solar Park.

South America

South American market to witness significant growth in the solid welding wires market as a result of investment in mining equipment, energy projects, and battery systems. The market will be further driven by government initiatives and supporting policies.

- In January 2025, Grenergy a Spain-based Energy company released its plans to invest about USD 1.6 billion in Oasis Atacama Project in Chile. The development of new PV Energy Systems and battery energy storage is further supported by government policy initiatives.

COMPETITIVE LANDSCAPE

Key Industry Players

Lightweight Materials-based Solid Welding Wires and Sales Networking Strategy to Boost the Market

The global solid welding wires market is highly fragmented with a significant number of players in the market. A few of the names include ESAB, KOBE Steel Ltd., and Voestalpine Böhler Welding, which are prominent market shareholders at the global level. Several market participants including manufacturers, distributors, suppliers, and trade partners are collaborating to penetrate untapped regions. For instance, in December 2024 Weldings Alloy Group and Meltio underwent a strategic partnership to meet growing customer demands for 3D printing systems and laser-based processes.

Manufacturing companies are also focusing on emerging sectors such as 3D printing, additive manufacturing, solar energy plants, battery manufacturing, etc. to expand and diversify their revenue stream along with conventional sectors including oil and gas, automotive, etc.

LIST OF KEY SOLID WELDING WIRES COMPANIES PROFILED

- Lincoln Electric (U.S.)

- ESAB (U.S.)

- Voestalpine Böhler Welding (Austria)

- KOBE Steel Ltd. (Japan)

- Ador Welding Ltd. (India)

- Kiswel Ltd. (South Korea)

- Chosun Welding Co., Ltd. (South Korea)

- Gedik Welding (Turkey)

- Capilla Welding Materials GmbH (Germany)

- FSH Welding Group (France)

KEY INDUSTRY DEVELOPMENTS

- October 2024: ESAB launched OK Autrod 42 LSW, a solid wire coated with copper in two-different diameters in Florida, U.S.

- October 2024: Fortius Metals has attracted an investment of about USD 5 Mn. The company is striving to develop next-gen high-performance wire alloys for additive manufacturing applications.

- June 2024: Voestalpine Bohler Welding has introduced ECOspark solid wires to enhance productivity and sustainability for a wide range of end users.

- September 2023: National Standard introduced its NS ARC brand for welding wire portfolio. The brand website and welding lab will focus on providing solid wires for industrial and power applications.

- September 2021: Hobart Brothers LLC has launched its Octagonal Exacto-Pak™ (X-Pak™) drum for its newly launched metal-cored wire to minimize costs and enhance operational productivity.

- June 2021: Hobart Brothers LLC introduced a new range of welding wires named FabCOR® Edge™ XP metal-cored wire. The new metal-cored wire was introduced to enhance productivity and minimize maintenance work.

REPORT COVERAGE

The global solid welding wires market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of malocclusion in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions and number of orthodontists in key countries. The report covers detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.2% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 5.03 billion in 2024 and is projected to reach USD 6.88 billion by 2032.

In 2024, the market value stood at USD 1.73 billion.

The market is expected to exhibit a CAGR of 4.2% during the forecast period.

The steel-based solid welding wires led the market.

Growing industrial sector and investment in real estate market to boost the solid wires demand.

Lincoln Electric, ESAB, and Kobe Steel Inc. are few of the top players in the market.

Asia Pacific dominated the revenue market share in 2024 accounting for around one-third of the market

Heavy engineering to cater highest revenue market share rate as a result of large welding application.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us