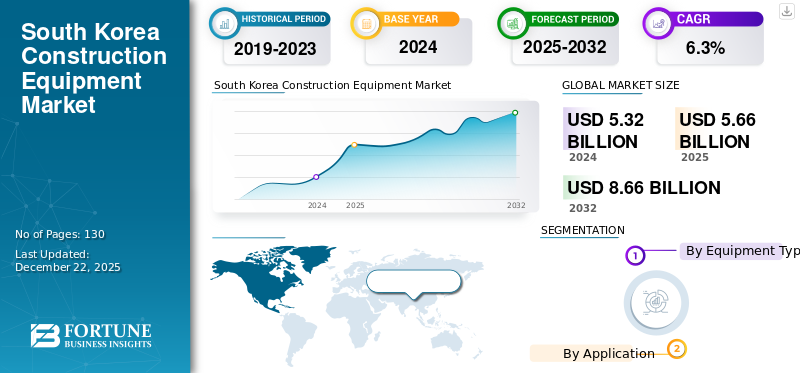

South Korea Construction Equipment Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment), By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The South Korea Construction Equipment market size was worth USD 5.32 billion in 2024 and is estimated to grow to USD 5.66 billion in 2025 and reach USD 8.66 billion in 2032. The market is projected to grow at a CAGR of 6.3% during the forecast period.

Heavy infrastructure spending, urban expansion, port infrastructure expansion, and localized investment in manufacturing facilities are expected to bolster the market growth. In addition, growing infrastructure development for clean energy, such as hydrogen, and renewable energy sector, is expected to influence the South Korea construction equipment market growth. E-commerce and logistics infrastructure to further fuel the market.

- For instance, in June 2025, the South Korea government invested about USD 370 Million in East Coast Hydrogen Industry clusters.

Download Free sample to learn more about this report.

Greenfield investment in South Korea reached USD 13.41 Billion in 2022, witnessing +150% investment growth in comparison to 2021. Huge investments in industrial and green projects are expected to further drive the market demand for construction machinery across the country.

South Korea Construction Equipment Market Trends

Adoption of Smart and Electric Construction Equipment is an Emerging Market Trend

Growing investment in renewable and clean energy infrastructures, further supported by sustainability and carbon emission standards, is resulting in electric equipment sales. Shift toward IoT and AI-based construction equipment to enhance the operational efficiency of construction equipment. Several financing solutions for electric equipment are surging the demand from rental companies, thus bolstering the volume sales for battery-operated equipment.

- For instance, in May 2025, Hyundai deployed its 8 models of heavy-duty electric forklifts in the South Korean for heavy-duty industrial applications.

Key takeaways

|

South Korea Construction Equipment Market Growth Factors

Financial Support and Energy Infrastructure to Surge the Market Growth

Several international and domestic regulatory mandates, such as zero-energy buildings, and government investment in infrastructure, have been introduced to push the adoption of electric and energy-efficient construction equipment. Investment in residential infrastructure, hydrogen city projects, supported by sustainability goals, to further outgrow the products demand for construction equipment across the country.

- For instance, according to the International Energy Agency, South Korea’s average annual clean energy investment between 2021 and 2023 rose by 10% in comparison to 2016-2020.

South Korea Construction Equipment Market Restraints

Increasing Construction Costs and Delayed Projects to Limit the Market Growth

Increased raw material costs, supply chain disruption, and delayed availability are expected to impact the demand for construction equipment in the South Korean market. The delayed availability of finances for projects to further hamper the market for construction equipment in South Korea.

Segmentation Analysis

By Equipment Type

Based on equipment type, the market is divided into Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment.

Rapid urbanization, increasing focus on demolition activities, and modernization of commercial and industrial spaces drives the segment for earthmoving equipment. Earthmoving equipment dominates the market revenue share in South Korea owing to increasing pipeline infrastructure projects, logistics, and material handling facilities.

- For instance, in April 2020, APG, CPP Investments, and ESR Cayman Limited collaborated to establish a new agreement to expand the logistics real estate sector. The investment amounted to about USD 1 billion for new development and expansion projects.

Material handling equipment and cranes are expected to witness strong growth prospects during the forecast period as a result of e-commerce shift, automation, and the expansion of emerging sectors such as semiconductor fabrication and battery plants.

By Application

Based on the Application, the market is divided into Residential, Commercial, and Industrial.

Rising urban density, smart city initiatives, and government housing policies to generate strong demand for compact machinery in the country. Building energy targets and increasing demand for energy-efficient apartments are influencing sales for electric construction equipment across the country.

Green energy projects, including solar grid expansion, hydrogen infrastructure deals, and considerable investment in utility projects to bolster the demand for construction equipment across the industrial sector.

List of Key Companies in the South Korea Construction Equipment Market

HD Hyundai, Doosan Bobcat, and AY Heavy Industries are a few key players in the South Korea Construction Equipment market. A wide array of product offerings, strong dealer and distributor network, collaboration with domestic companies, tech-integrated new product development, investment in research and development, established manufacturing base are a few factors driving the market share for prominent market players.

- For instance, in 2025, Hyundai Construction Equipment completed its 40 years of industry experience in the market, resulting in an established and strong brand presence.

LIST OF KEY COMPANIES PROFILED

- Komatsu (Japan)

- Caterpillar (U.S.)

- Volvo Group (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- HD Hyundai Construction Equipment (South Korea)

- Doosan Bobcat (South Korea)

- DAEMO (South Korea)

- Soosan Heavy Industries (South Korea)

- AY Heavy Industries (South Korea)

- Donghae Machinery (South Korea)

KEY INDUSTRY DEVELOPMENTS

- July 2025: HD Hyundai Infracore and HD Hyundai Construction Equipment collaborated to form a new company that would provide a construction equipment portfolio to its customers across South Korea.

- May 2025: HD Hyundai Construction Equipment established a new manufacturing facility in Ulsan, South Korea.

REPORT COVERAGE

The South Korea Construction Equipment market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the growth in earthmoving equipment, concrete and material handling equipment, and applications. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand for construction equipment.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the South Korean market was worth USD 5.32 billion in 2024.

The market is expected to exhibit a CAGR of 6.3% during the forecast period of 2025-2032.

By Equipment type, the Earthmoving Equipment segment dominates the market in 2024.

HD Hyundai, Doosan Bobcat, and AY Heavy Industries are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us