Space Technology Market Size, Share & Industry Analysis, By Offering (Hardware, Software, and Services), By Orbit Type (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Orbit (GEO), and Highly Elliptical and Beyond GEO), By Technology (Launch Systems, Satellite Systems, Ground Systems, and In-Space Infrastructure Systems), By Application (Satellite Communications, Earth Observation and Remote Sensing, Positioning, and Timing, Defense and Intelligence, and Others), By End-user (Government and Civil, Defense and Intelligence, and Commercial), and Regional Forecast, 2026 – 2034

SPACE TECHNOLOGY MARKET SIZE AND FUTURE OUTLOOK

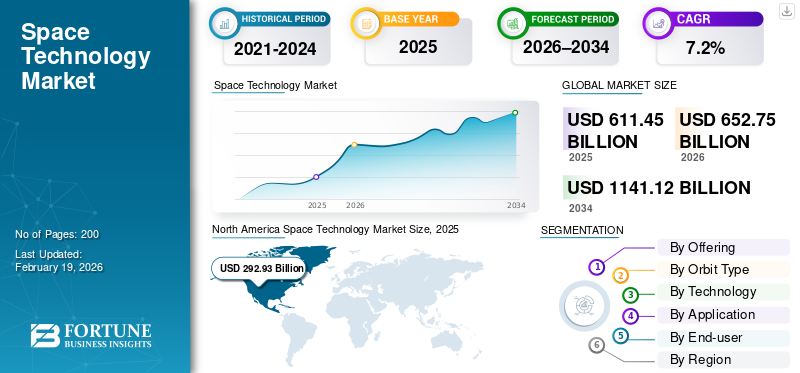

The global space technology market size was valued at USD 611.45 billion in 2025. The market is projected to grow from USD 652.75 billion in 2026 to USD 1,141.12 billion by 2034, exhibiting a CAGR of 7.2% during the forecast period.

The space technology market comprises advanced systems and solutions designed to develop, deploy, and manage satellites, spacecraft, launch vehicles, and space-based infrastructure. These technologies are critical for applications such as satellite communications, Earth observation, navigation, defense, scientific research, and emerging commercial activities such as space tourism and in-orbit manufacturing. As governments, private enterprises, and research organizations increasingly invest in satellite constellations, reusable launch systems, and in-orbit services, demand for sophisticated space technology solutions continues to rise as they enable efficient mission planning, real-time data access, and scalable space operations.

Major players, including Airbus SE, Astra, General Dynamics, and SpaceX, are strengthening their market positions through innovation, strategic partnerships, and investment in AI-driven mission control, reusable launch vehicles, satellite constellations, and scalable in-orbit services. These companies focus on enhancing operational efficiency, reliability, and cost-effectiveness to meet growing global demand.

IMPACT OF GENERATIVE AI

Advancing Data Analytics and Autonomous Operations to Drive Integration of Generative AI in Space Technology

Generative AI is transforming the space industry by accelerating design, development, and data analysis. It enables the automatic creation of optimized spacecraft components, reducing design cycles and costs, while improving in-orbit operations through autonomous navigation and anomaly detection.

In satellite data applications, generative AI enhances Earth observation, predictive analytics, and real-time decision-making across industries such as agriculture, defense, and logistics. By enabling faster innovation, more effective data use, and more efficient mission planning, generative AI is becoming a key driver of competitiveness and technological advancement in the space market.

- For instance, in August 2024, Booz Allen Hamilton successfully deployed a generative AI tool aboard the International Space Station for the first time, using Hewlett Packard Enterprise’s Spaceborne Computer-2. The AI application enables on-orbit data processing, retrieval, and problem-solving without relying on Earth-based internet, paving the way for edge AI capabilities in space missions.

SPACE TECHNOLOGY MARKET TRENDS

Inclination Toward Reusable Launch Systems to Boost Market Growth

Reusable launch vehicles are transforming the economics and accessibility of space by allowing rockets or their components, such as first stages, boosters, or engines, to be recovered and flown multiple times. Traditionally, rockets were single-use, making each launch extremely expensive and limiting the frequency of missions. By reusing critical components, companies can significantly reduce the cost per launch, minimize material waste, and shorten turnaround times between missions.

- For instance, in October 2025, IIT-Madras-incubated startup Agnikul Cosmos, known for the world’s first single-piece 3D-printed rocket engine, announced plans to develop a reusable launch vehicle (RLV). The goal is to recover the booster stage, which accounts for 70% of launch costs, to make space missions more cost-effective.

This advancement makes space more economically viable for large-scale operators and enables smaller companies, startups, and research institutions to access space at a fraction of previous costs.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Satellite-based Services Drives Market Growth

The increasing demand for satellite-based services is a key driver in the space technology market growth. Modern industries, including telecommunications, defense, agriculture, logistics, and transportation, rely heavily on satellites for reliable global connectivity, accurate navigation, real-time data transmission, and remote sensing capabilities.

With the rapid expansion of broadband internet and the growing deployment of Internet of Things networks, the need for advanced satellite systems has intensified. Furthermore, applications in geospatial intelligence, disaster monitoring, and environmental management are driving the adoption of more sophisticated satellite constellations capable of providing continuous, high-resolution data. For instance,

- India’s satellite-based internet is expanding rapidly, with 1,002 million subscribers and rural penetration at 46 per 100 people. Over 10 private operators and 19 ISRO satellites, such as GSAT-19 and GSAT-N2, are boosting broadband connectivity in underserved areas through initiatives such as BharatNet Phase II and PM-WANI.

This trend creates opportunities for launching new satellites and stimulates demand for satellite manufacturing, launch services, and supporting ground infrastructure.

MARKET RESTRAINTS

High Capital Investment to Restraint Market Growth

The space technology industry is inherently capital-intensive, with the development of rockets, satellites, launch infrastructure, and other space-grade technologies requiring enormous financial investment. For instance, a single orbital launch can cost anywhere from tens to hundreds of millions of dollars, depending on the payload and mission complexity. These substantial costs present a significant barrier to entry, particularly for small or emerging companies that may struggle to secure the necessary funding without substantial government support or private investment. For instance,

- In May 2025, SpaceX’s Starship rocket exploded during its ninth test flight, marking the third consecutive failure. A fuel leak caused the upper stage to spin out of control and break apart during reentry over the Indian Ocean, and no injuries or property damage were reported.

The high capital requirements also influence strategic decisions, forcing companies to prioritize proven technologies over innovative but untested solutions, thereby slowing the industry's overall pace of technological advancement.

MARKET OPPORTUNITIES

In Space Manufacturing to Boost Market Growth

In-space manufacturing (ISM) is emerging as a transOrbit Typeive opportunity in the space technology sector, enabling the production of components, structures, and materials directly in orbit rather than launching them from Earth. Traditional manufacturing on Earth and subsequent launch into space are costly and constrained by payload size, mass limitations, and launch stresses. By contrast, ISM enables the fabrication of large-scale structures, such as satellites, space station modules, and telescope components, in a microgravity environment, where materials can be shaped in ways impossible on Earth.

- For instance, in January 2026, China successfully conducted a metal 3D printing experiment in space using a recoverable payload aboard the reusable suborbital vehicle Lijian-1 Y1. At around 120 km altitude, the equipment autonomously 3D-printed metal parts in microgravity, marking China’s shift from ground-based research to space engineering verification.

This approach reduces launch costs, extends the lifespan of space assets, and enables the development of components too large or complex to fit in conventional launch vehicles. Beyond structural manufacturing, ISM opens the door to producing specialized materials, advanced alloys, and even biological or pharmaceutical products that benefit from microgravity conditions.

Segmentation Analysis

By End-user

Rapid Expansion of Private Sector Activities In Satellite Communications Boosted Commercial Segment Growth

Based on end-user, the market is classified into government and civil, defense and intelligence, and commercial.

Commercial held the majority share in 2025. In 2026, the segment is anticipated to dominate with a 37.6% due to the rapid expansion of private sector activities in satellite communications, Earth observation, broadband connectivity, and launch services. Commercial companies are deploying large satellite constellations and investing in reusable launch systems to reduce costs and increase service availability. The growing demand for space-based data, global connectivity, and private space missions has shifted market momentum toward commercial users, surpassing traditional government-led initiatives.

Commercial is expected to witness the highest Compound Annual Growth Rate (CAGR) of 8.1% during the forecast period as private investment in space technology continues to accelerate. The rapid expansion of satellite internet services, increasing adoption of space-based data by industries, and falling launch costs are encouraging new entrants and business models.

To know how our report can help streamline your business, Speak to Analyst

By Offering

High Cost and Critical Importance of Physical Components Fueled Hardware Segment Growth

Based on offering, the market is divided into hardware, software, and services.

Hardware held the majority share in 2025 and is anticipated to dominate in 2026 with a 54.3% due to the high cost and critical importance of physical components such as satellites, launch vehicles, propulsion systems, payloads, and ground equipment. Space missions are fundamentally asset-intensive, requiring precision-engineered hardware that must withstand extreme space conditions and ensure long-term reliability. Large capital investments in satellite manufacturing and launch hardware significantly outweigh spending on software and services, contributing to the dominant share of the segment.

Software is expected to witness the highest Compound Annual Growth Rate (CAGR) of 11.8% during the forecast period.

By Orbit Type

Proliferation of LEO Satellites Cementing Low Earth Orbit’s Market Leadership

Based on orbit type, the market is categorized into low earth orbit (LEO), medium earth orbit (MEO), geostationary orbit (GEO), and highly elliptical and beyond geo.

Low Earth Orbit holds the majority share by application in 2024. In 2025, the segment is anticipated to dominate with a 60.4% due to its suitability for high-speed communications, Earth observation, and real-time data services. LEO enables lower latency, higher data transmission rates, and cost-effective satellite deployment, making it ideal for large commercial constellations. The increasing deployment of broadband and imaging satellites in LEO is driving sustained demand for this orbit type.

Low Earth Orbit is expected to witness the highest Compound Annual Growth Rate (CAGR) of 9.2% during the forecast period due to the rapid deployment of large satellite constellations for broadband internet, IoT connectivity, and Earth observation services. Declining launch costs, shorter satellite development cycles, and the ability to upgrade or replace satellites more frequently make LEO attractive for commercial operators.

By Technology

Rapid Increase In Satellite Launches And Constellations Boosted Ground Systems Segment Growth

Based on technology, the market is segmented into launch systems, satellite systems, ground systems, and in-space infrastructure systems.

Ground systems held the majority share in 2025. In 2026, the segment is anticipated to dominate with a 45.3% as they are essential for controlling, monitoring, and managing space assets throughout their operational lifecycle. These systems include ground stations, mission control centers, data processing facilities, and communication networks that enable real-time tracking, data reception, and command execution. With the rapid increase in satellite launches and constellations, continuous investments in scalable and secure ground infrastructure are necessary, driving strong demand for ground systems.

In-Space infrastructure systems are expected to witness the highest compound annual growth rate (CAGR) of 7.9% during the forecast period.

By Application

Growing Reliance on Connectivity Solutions Positioning Satellite Communications as the Dominant Application Segment

Based on application, the market is segmented into satellite communications, earth observation and remote sensing, navigation, positioning and timing, defense and intelligence, science and exploration, and others.

Satellite communications holds the majority share by application in 2024. In 2025, the segment is anticipated to dominate with a 38.7% share, as broadband internet, television broadcasting, maritime and aviation communications, and emergency connectivity rely heavily on satellite networks. The growing need to connect remote and underserved regions, along with the expansion of commercial satellite constellations, is reinforcing the dominance of satellite communications within the segment.

Satellite communications is expected to witness the highest compound annual growth rate (CAGR) of 8.8% during the forecast period as demand for global connectivity, high-speed internet, and secure communication networks continues to expand. The increasing adoption of satellite broadband for remote areas, maritime and aviation connectivity, and disaster recovery is driving rapid growth.

Space Technology Market and Regional Outlook

By geography, the market is categorized into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Space Technology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds majority in the space technology market share as it combines deep technological expertise with a thriving private space ecosystem. Companies such as SpaceX, Blue Origin, and Lockheed Martin have pushed innovations such as reusable rockets, high-capacity satellites, and rapid launch services, creating capabilities unmatched elsewhere. Strong government support from agencies such as NASA and the Department of Defense, including funding, contracts, and regulatory frameworks, accelerates commercialization while de-risking investments.

This mix of private innovation, public backing, and well-established supply chains allows North America to capture the largest market share and stay ahead in both commercial and strategic space initiatives.

U.S. Space Technology Market

Based on North America’s strong contribution and the U.S. dominance within the region, the U.S. market can be analytically approximated at around USD 251.78 billion in 2025, accounting for roughly 41.2% of sales.

Europe

Europe is projected to record a growth rate of 6.4% in the coming years and reach a valuation of USD 121.87 billion in 2025 as it emphasizes collaboration, sustainability, and advanced engineering rather than relying solely on private companies. Programs led by the European Space Agency, combined with coordinated efforts across countries such as France, Germany, and Italy, are driving innovation in reusable launch systems, satellite constellations, and high-precision Earth observation. European startups and mid-sized aerospace firms are also rapidly expanding capabilities in niche areas such as in-orbit servicing, small satellites, and secure communications.

U.K Space Technology Market

The U.K. market in 2025 reached around USD 23.98 billion, representing roughly 3.92% of global revenues.

Germany Space Technology Market

Germany’s market reached approximately USD 19.55 billion in 2025, equivalent to around 3.19% of global sales.

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR and reach a valuation of USD 155.34 billion in 2025. The region is rapidly expanding due to rapidly expanding government space programs, increasing private sector participation, and rising demand for satellite services across densely populated regions. Countries such as India, China, Japan, and South Korea are investing heavily in satellite navigation, Earth observation, and launch vehicle development, while fostering local startups and manufacturing capabilities. The region’s large and growing consumer base drives demand for broadband connectivity, IoT, and geospatial services, creating opportunities for commercial satellite constellations.

Additionally, governments are supporting public-private partnerships and technology transfer initiatives, enabling faster innovation and cost-effective solutions. This combination of strategic investment, market demand, and emerging entrepreneurial ecosystems positions Asia-Pacific for the fastest growth in the global market.

Japan Space Technology Market

The Japanese market in 2025 reached around USD 19.97 billion, accounting for roughly 3.26% of global revenues.

China Space Technology Market

China’s market is expected to be one of the largest worldwide, with 2025 revenues estimated at around USD 84.00 billion, representing roughly 13.73% of global sales.

India Space Technology Market

The Indian market in 2025 stood at around USD 28.92 billion, accounting for roughly 4.73% of the global space technology market share.

South America and the Middle East & Africa

The Middle East and Africa region is expected to grow at the second-highest CAGR in the space technology market. It is due to a combination of strategic national ambitions, regional collaboration, and untapped commercial opportunities. Governments in the region are investing heavily in sovereign satellite programs to enhance communications, monitoring, and defense capabilities, while establishing space agencies and innovation hubs to foster local talent and startups. Partnerships with international aerospace firms are accelerating technology transfer, enabling the development of homegrown satellite manufacturing and launch capabilities.

South America is expected to experience stable growth in the market due to gradual investments in satellite technologies programs, infrastructure development, and regional cooperation.

GCC Space Technology Market

The GCC market reached around USD 11.08 billion in 2025, representing roughly 1.81% of global space technology revenues.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Partnerships to Expand their Businesses

The market players are improving their product portfolios due to the increasing demand for more accurate health-tracking products. They are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the world.

LIST OF KEY SPACE TECHNOLOGY COMPANIES PROFILED

- Airbus SE (France)

- Astra (U.S.)

- Ball Corporation (U.S.)

- Blue Origin LLC (U.S.)

- Boeing (U.S.)

- General Dynamics (U.S.)

- Honeywell Internal Inc. (U.S.)

- ICEYE (Finland)

- Lockheed Martin (U.S.)

- Maxar Technologies (U.S.)

- Northrop Grumman (U.S.)

- Safran S.A. (Germany)

- SpaceX (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2026: Azista Space announced the groundbreaking of a new state-of-the-art electro-optical (EO) payload manufacturing facility in Gujarat. The facility would focus on the design, development, integration, and testing of EO payloads for Earth observation satellites, supporting applications such as agriculture, disaster management, defense, and climate monitoring, while strengthening India’s indigenous space manufacturing ecosystem and creating skilled employment.

- January 2026: University of Toledo physicists are researching antimony chalcogenide-based solar cells as a promising technology for space applications. Supported by funding from the Air Force Research Laboratory, the study highlights the material’s strong radiation resistance compared to conventional space solar cells. However, further efficiency improvements are needed before it can be adopted for future space missions.

- January 2026: NASA’s umbrella-like ADEPT entry system successfully transitioned from research to commercial use and is now being adapted for slow-speed spacecraft for future lunar and Mars missions. Developed at NASA’s Ames Research Center and flight-tested in 2018, the lightweight deployable aerobrake is attracting interest from commercial space companies, including plans for cargo delivery and Earth-return applications.

- January 2026: GE Aerospace received a USD 1.40 billion contract from the U.S. Naval Air Systems Command to supply Lots 9-13 of T408 turboshaft engines for the Marine Corps’ CH-53K King Stallion helicopters. The engines provide 7,500 shaft horsepower, improved fuel efficiency, and greater reliability, enabling the CH-53K to carry heavier payloads over longer ranges.

- January 2026: Airbus Defence and Space and Hisdesat signed an agreement to commercialize radar imagery and applications from the upcoming PAZ-2 satellites. The twin satellites, led by the Spanish Ministry of Defence, will replace the current PAZ satellite, offering improved image resolution up to 10 centimeters, wider daily coverage, and near-real-time data availability within five minutes.

- November 2025: Saab made a strategic USD 10 million investment in space technology company Pythom, which is developing lightweight and rapidly deployable rockets. The move supports Saab’s strategy to strengthen space and national security capabilities, accelerate innovation, and enhance Sweden’s role in resilient and flexible space launch infrastructure.

- September 2025: Hyderabad-based space technology startup Cosmoserve Space raised USD 3.17 million in a pre-seed funding round, one of the largest at the ideation stage in India’s space sector. Founded by former ISRO scientist Chiranjeevi Phanindra, the company is developing autonomous robotic spacecraft to tackle the growing problem of space debris, with backing from investors including Alan Rutledge, Ram Shriram, AUM Ventures, and Shakti VC.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.2% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering, Orbit Type, Technology, Application, End-user, and Region |

|

By Offering |

· Hardware · Software · Services |

|

By Orbit Type |

· Low Earth Orbit (LEO) · Medium Earth Orbit (MEO) · Geostationary Orbit (GEO) · Highly Elliptical and Beyond GEO |

|

By Technology |

· Launch Systems · Satellite Systems · Ground Systems · In-Space Infrastructure Systems |

|

By Application |

· Satellite Communications · Earth Observation and Remote Sensing · Navigation, Positioning, and Timing · Defense and Intelligence · Science and Exploration · Others (Human Spaceflight and Tourism) |

|

By End-user |

· Government and Civil · Defense and Intelligence · Commercial |

|

By Region |

· North America (By Offering, Orbit Type, Technology, End-user, and Country) o U.S. (By End-user) o Canada (By End-user) o Mexico (By End-user) · South America (By Offering, Orbit Type, Technology, End-user, and Country) o Brazil (By End-user) o Argentina (By End-user) o Rest of South America · Europe (By Offering, Orbit Type, Technology, End-user, and Country) o U.K. (By End-user) o Germany (By End-user) o France (By End-user) o Italy (By End-user) o Spain (By End-user) o Russia (By End-user) o Benelux (By End-user) o Nordics (By End-user) o Rest of Europe · Middle East & Africa (By Offering, Orbit Type, Technology, End-user, and Country) o Turkey (By End-user) o Israel (By End-user) o GCC (By End-user) o North Africa (By End-user) o South Africa (By End-user) o Rest of Middle East & Africa · Asia Pacific (By Offering, Orbit Type, Technology, End-user, and Country) o China (By End-user) o India (By End-user) o Japan (By End-user) o South Korea (By End-user) o ASEAN (By End-user) o Oceania (By End-user) o Rest of Asia Pacific |

Frequently Asked Questions

According to Fortune Business Insights, the global market value stood at USD 611.45 billion in 2025 and is projected to reach USD 1,141.12 billion by 2034.

In 2025, the market value stood at USD 292.93 billion.

The market is expected to exhibit a CAGR of 7.2% during the forecast period (2026-2034).

By end-user, the commercial segment led the market.

Rising demand for satellite-based services is a key factor driving market growth.

Airbus SE, Astra, General Dynamics, and SpaceX are the major players in the global market.

North America dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us