Sterilization Services Market Size, Share & Industry Analysis, By Service Type (Contract Sterilization Services, Validation Services, and Maintenance), By Delivery Mode (On-Site and Off-Site), By Method (Steam Sterilization, Hydrogen Peroxide Sterilization, Ethylene Oxide Sterilization, and Others), By End-user (Hospitals & Clinics, Pharmaceutical & Medical Device Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

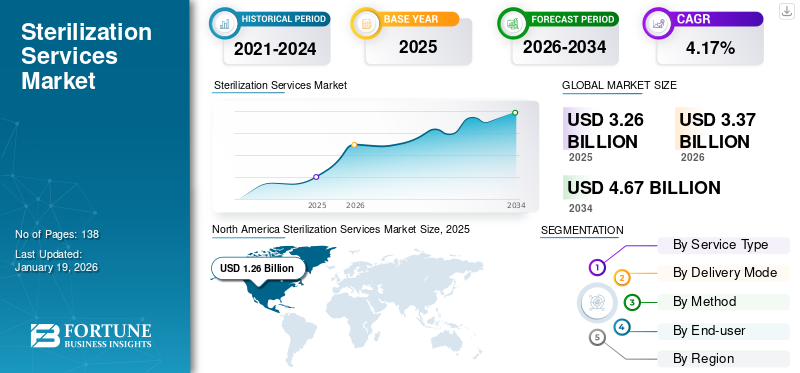

The global sterilization services market size was valued at USD 3.26 billion in 2025. The market is projected to grow from USD 3.37 billion in 2026 to USD 4.67 billion by 2034, exhibiting a CAGR of 4.17% during the forecast period. North America dominated the sterilization services market with a market share of 38.80% in 2025.

In healthcare, sterilization services refer to the processes used to eliminate all forms of microbial life, including bacteria, viruses, and spores, from medical devices, instruments, and other items used in patient care. This is crucial for preventing infections and ensuring patient safety. The increasing prevalence of Hospital Acquired Infections (HAIs) and the rising number of surgeries are driving the need for sterilization of the operating area, patient rooms, and medical devices. Several hospitals and medtech companies are seeking cost-effective solutions to manage their sterilization process through outsourcing. This represents a significant opportunity for service providers, which is anticipated to drive the global market growth during the forecast period. The key players in the market include Steris, Sterigenics U.S., LLC (Sotera Health), and others. These players are focusing on the expansion of their service portfolio to improve their market position.

MARKET DYNAMICS

Market Drivers

Higher Burden of Hospital-Acquired Infections to Fuel Market Expansion

In recent years, the prevalence of Hospital Acquired Infections (HAIs), including surgical-site infections, ventilator-associated pneumonia, catheter-associated urinary tract infections, and others, has increased worldwide. This is driving the need for sterilization and disinfection in healthcare facilities, thereby influencing key players to expand their range of services.

- According to the 2024 statistics published by the Centers for Disease Control and Prevention (CDC), healthcare-associated infections affect about 4.0% of hospitalized patients in the U.S. at any given time.

- Similarly, according to the data published by the ECDC (European Centre for Disease Prevention and Control), the estimated HAI prevalence in the European Union was around 4.3% in 2023, with Italy, Belgium, Portugal, and Sweden among the countries with comparatively higher prevalence.

Moreover, the increasing number of hospital inpatient admissions due to various factors, such as the rising geriatric population across the globe, is also increasing the susceptibility to HAIs in developed and developing countries. This has resulted in the adoption of stricter sterilization protocols for endoscopes, surgical instruments, and reusable medical devices in hospitals and other healthcare facilities. This situation is likely to drive the market expansion in the coming years.

Market Restraints

High Cost of Sterilization Equipment to Hamper Market Growth

Currently, the high costs of sterilization equipment are resulting in the overall expense of sterilization services, thereby limiting their adoption, particularly in emerging nations such as India, China, Mexico, and others. Additionally, the higher maintenance costs of this equipment may restrict the upgrade of advanced models among service providers in emerging countries.

Moreover, the initial manufacturing cost of the advanced products is also increasing with the rising technological advancements by the key market players operating in the market, which is expected to hinder the adoption of the services in developing nations.

- For instance, a 60-liter top loader autoclave can cost around USD 18,000.0 to USD 40,000.0, and a 150-liter top loader can cost between USD 27,000.0 to USD 46,000.0. Also, a 60-liter benchtop autoclave can cost around USD 22,000.0, and a 150-liter front-loading autoclave can cost between USD 32,000.0 and USD 52,000.0.

Furthermore, lower healthcare expenditure and per capita income of emerging countries are expected to hinder their ability to adopt advanced sterilization technologies, further impacting their compliance with global standards and prevention of hospital-acquired infections. Additionally, the operation of modern equipment requires skilled professionals with specialized training, and shortages of skilled personnel can slow operational scalability.

Market Opportunities

Untapped Markets Present Opportunity for Development

Recently, the market in emerging countries is experiencing significant growth, driven by the growing awareness of innovative service technologies, the entry of prominent players, and the increasing prevalence of hospital-acquired infections. This is also due to the fact that consumers in India and China are demanding high-quality and technologically advanced services that are available in developed countries. These markets offer high potential for service providers as healthcare facilities are shifting toward modernization, such as outsourcing their sterilization processes. Additionally, the initiatives among governmental and non-governmental organizations to raise awareness about infection control measures are also driving the demand for sterilization services.

Moreover, increasing demand for technology-advanced sterilization services, such as electron-beam services, and others in these countries is driving the focus of prominent companies toward acquisitions and mergers among the other players with an aim to expand their geographical presence globally. This is anticipated to offer the opportunity for the major companies to cater to untapped markets in developing regions worldwide. For instance, in October 2022, BD partnered with Raja Ramanna Centre for Advanced Technology (RRCAT) for the sterilization of one of its medical devices, Venflon Pro, by Electron Beam (e-beam) technology at RRCAT’s facility.

Market Challenges

Regulatory Barriers and Compliance Challenges to Limit Market Growth

In several countries, stringent regulatory barriers and critical compliance requirements may complicate the landscape of sterilization equipment and services. Health authorities and regulatory bodies such as the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) inspect these services, which mandate stricter standards for validation, maintenance, and process control.

Standards set by the Environmental Protection Agency (EPA) require sterilization service providers to comply with strict guidelines, particularly regarding the use of sterilization agents, such as ethylene oxide (EtO). EPA has studied that lowering the amount of EtO used per sterilization cycle for medical devices is a necessary mitigation measure for new medical devices. This reduces workers' levels of exposure to EtO while continuing to meet FDA requirements for sterility assurance. For instance, according to 2025 data published by the U.S. Environmental Protection Agency (EPA), the EPA has determined it necessary to implement a maximum EtO concentration limit of 600mg/L for new sterilization cycles by 2035.

These regulations are set with the objective of increasing environmental sustainability and safety. However, they can also create operational challenges for many service providers, requiring significant investment in advanced systems and technologies. This situation is expected to limit the adoption of sterilization services, thereby hindering the global sterilization services market growth.

Sterilization Services Market Trends

Technological Advancement in Sterilization Techniques

Currently, there has been a shift in preference toward technologically advanced sterilization technologies among service providers to address the limitations of traditional methods and offer improved safety, efficiency, and environmental sustainability.

These advanced techniques, such as hybrid steam-gas sterilization and superheated dry steam technology, ensure complete sterilization and further reduce moisture risks. Electron beam sterilization technology offers faster, safer, and more efficient results than conventional methods. This technology uses high-energy electrons to sterilize medical devices, which further eliminates the requirement for chemical agents or high temperatures.

Automation in medical device sterilization further improves efficiency by incorporating features such as automated loading and unloading, self-adjusting parameters, and barcode tracking for compliance. Such advantages of these advanced techniques are driving the focus of service providers toward the installation of advanced systems worldwide. In December 2024, BGS Beta-Gamma-Service installed a high-power Electron Beam (e-beam) accelerator at its first sterilization facility in the U.S.

Download Free sample to learn more about this report.

Segmentation Analysis

By Service Type

Contract Sterilization Services Segment Dominates Due to Increasing Trend of Outsourcing Sterilization

Based on service type, the market is segmented into contract sterilization services, validation services, and maintenance.

The contract sterilization services segment held the largest market with a share of 48.93% in 2026. This share is attributed to the increasing trend of outsourcing sterilization in the healthcare industry, which is influencing key players to expand the range of contract sterilization services in various regions.

- For instance, in November 2021, STERIS announced that it became the first contract sterilizer accepted into the FDA’s Ethylene Oxide Sterilization Master File Pilot Program, streamlining regulatory processes for medical device manufacturers.

The validation services segment accounted for a lower share of the global market. The presence of standard guidelines for healthcare practices in developed countries is driving the adoption of sterilization services, as it provides a crucial process for ensuring medical devices and pharmaceuticals, as well as patient safety.

The maintenance accounted for the second-largest share in 2024. The segment’s growth is attributed to the increasing deployment of sterilization equipment in hospitals and medtech companies, which may need routine maintenance to function properly.

To know how our report can help streamline your business, Speak to Analyst

By Delivery Mode

Off-site Dominates Market Due to its Cost-Effectiveness and Specialized Facilities

Based on delivery mode, the market is segmented into on-site and off-site.

The off-site segment dominated the global sterilization services market with a share of 70.32% in 2026 and is expected to expand at the fastest CAGR during the forecast period. The dominance of the segment is mainly due to its several advantages, such as flexibility to handle large volumes of instruments, potentially lower capital costs for the facility, and access to specialized equipment and expertise. This is driving the adoption of off-site sterilization services across the globe.

- For instance, in October 2024, Steris mentioned that off-site reprocessing ensures safe, compliant reprocessing of medical devices, reducing the burden on hospitals and improving patient care.

The on-site segment accounted for a lower share of the global market in 2024. This delivery mode offers potentially faster turnaround time for sterile supplies, closer control over the sterilization process, and potentially reduced transportation costs. This is driving its demand among service users, which is anticipated to propel the segment’s growth.

By Method

Steam Sterilization Leads Due to Increasing Launch of Steam Sterilizers

Based on method, the market is segmented into steam sterilization, hydrogen peroxide sterilization, ethylene oxide sterilization, and others.

The steam sterilization segment held a dominating market with a share of 65.26% in 2026. The growth is attributed to the high adoption rate of steam sterilization services by many healthcare settings and industries, as it provides a reliable and cost-effective way to kill microorganisms, including bacteria, viruses, and spores, ensuring patient safety and product quality. Additionally, the increasing launch of steam sterilizers by prominent players is contributing to the higher capacity of steam sterilization service providers in the market.

The hydrogen peroxide segment is expected to register a substantial CAGR in the forthcoming years. Healthcare facilities are seeking scalable solutions for sterilization and decontamination of their spaces and instruments. Hydrogen peroxide sterilization services offer several advantages, including broad-spectrum efficacy, the ability to penetrate complex surfaces, and compatibility with various materials. These benefits make it a preferable method, which is expected to drive the segment's growth.

- For instance, in October 2021, STERIS launched two new integrated VHP (Vaporized Hydrogen Peroxide) facility decontamination systems, enhancing rapid and effective sterilization for large spaces. This innovation increased service-providing capability for large spaces in healthcare facilities.

By End-user

Hospitals & Clinics to Dominate Due to Rising Cases of HAIs in These Settings

Based on end-user, the market is segmented into hospitals & clinics, pharmaceutical & medical device manufacturers, and others.

The hospitals & clinics segment held a dominating share with a share of 60.29% in 2026 owing to increasing cases of Hospital Acquired Infections (HAIs), which are propelling the demand for sterilization services in these settings. Moreover, the increasing use of surgical instruments is also driving the need for instrument reprocessing, which is expected to fuel the segment’s growth.

The pharmaceutical & medical device manufacturers segment accounted for the second-largest share of the global market in 2024. The increasing requirement for the sterilization of devices among medical device manufacturers is encouraging key players to expand their service-providing facilities.

- For instance, in September 2021, Sterigenics U.S., LLC and Nelson Labs opened a significantly expanded, state-of-the-art microbiological testing laboratory and increased sterilization capacity in Wiesbaden, Germany, to meet growing demand from the European medical device and pharmaceutical industries.

The others segment held a lower share in 2024. The growing demand for maintenance of sterilization equipment in academic institutions such as pharmaceutical and microbiology colleges, as well as other settings, is expected to fuel the segment’s growth in the forthcoming years.

STERILIZATION SERVICES MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America to Dominate Global Market Owing to High Incidence of Diabetes

North America

North America Sterilization Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 1.26 billion in 2025 and USD 1.31 billion in 2026. The growth is mainly due to the high penetration of sterilization services in key countries such as the U.S. and Canada, owing to significant investments in disinfection and sterilization processes in the region’s healthcare sector.

In the U.S., the increasing number of surgeries in the country’s hospitals is driving the need to prevent Hospital Acquired Infections (HAIs) in these settings. This is stimulating the prominent players to expand the range of their services in the country. The U.S. market is projected to reach USD 1.22 billion by 2026.

- For instance, in September 2024, BGS announced its expansion plans for the U.S. market with fully automated E-Beam irradiation at its new location in Pittsburgh. The aim is to establish a safe and effective alternative to gamma and EtO sterilization for medical devices. The operations at this site are expected to begin in mid-2025.

Europe

Europe held the second-largest share in 2024. The growth is attributable to the presence of key players focused on expanding their sterilization services in the U.K., Germany, and France, making it accessible to regional healthcare facilities. The UK market is projected to reach USD 0.20 billion by 2026, while the Germany market is projected to reach USD 0.24 billion by 2026.

- For instance, in May 2022, Sterigenics U.S., LLC introduced Noxilizer’s Nitrogen Dioxide (NO₂) sterilization technology at its Petit-Rechain, Belgium facility, enabling ultra-low temperature sterilization for sensitive drug-device combination products and expanded its advanced service offerings.

Asia Pacific

Asia Pacific is expected to showcase the highest CAGR during the forecast period. Key players are shifting their focus toward the expansion of their facilities in emerging countries, such as India. Additionally, the high incidence of HAIs in this region is also encouraging the key players to undertake such initiatives. The Japan market is projected to reach USD 0.14 billion by 2026, the China market is projected to reach USD 0.17 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

- For instance, according to the data published by the NCBI in November 2023, around 10.0-20.0% of admitted patients of India are affected by .

Latin America and Middle East & Africa

The Latin America and the Middle East & Africa sterilization services market share was lower in 2024. The increasing campaigns to eliminate and prevent such infections in the region's healthcare facilities are expected to support the region's market growth. Moreover, standard regulatory frameworks and guidelines set by health authorities for sterilization facilities are expected to enhance the quality of service, attracting more customers in these regions.

- For instance, as recorded in May 2025, ETO sterilization facilities in Brazil are required to obtain proper licensing and authorization from ANVISA before commencing operations in the country.

COMPETITIVE LANDSCAPE

Key Market Players

Strong Focus on Facility Expansions Led to Dominance of STERIS in 2024

The market is semi-consolidated with key players such as STERIS accounting for the largest global sterilization services market share in 2024 with their wide range of service portfolio. The dominance of the company is attributed to certain factors, such as a growing focus on the expansion of its services portfolio.

- In April 2024, STERIS expanded its processing facility to add an X-ray sterilization service for medical device companies in China.

Similarly, the growing focus toward facility expansion of prominent players such as Sterigenics U.S., LLC (Sotera Health) and others to cater to the growing demand among healthcare service providers is anticipated to enhance their market share.

Furthermore, Ecolab and other players are increasing their focus on acquisitions and mergers to expand the reach of sterilization services in the market.

LIST OF KEY STERILIZATION SERVICES COMPANIES PROFILED

- STERIS (U.S.)

- Sterigenics U.S., LLC (Sotera Health) (U.S.)

- Medistri SA (Switzerland)

- Xenex Disinfection Services Inc. (U.S.)

- Ecolab (U.S.)

- E-BEAM Services, Inc. (U.S.)

- BGS (Germany)

- VPT Rad, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – STERIS established a new Ethylene Oxide (EO) processing facility with an aim to support medical device manufacturing in Malaysia.

- March 2025 – Sterigenics U.S., LLC signed an agreement to acquire Nordion for around USD 727.0 million. Nordion will operate as a standalone company within Sterigenics U.S., LLC, ensuring a stable supply of Cobalt-60 for gamma sterilization.

- May 2024 – Life Science Outsourcing (LSO) expanded its ethylene sterilization capacity with the addition of 3M Steri-Vac GS8X Sterilizer/Aerator chambers to increase its presence in the U.S.

- May 2023 – E-BEAM Services, Inc. introduced STAT sterilization validation services to expedite the validation process for medical device and pharmaceutical manufacturers as per the requirements.

- January 2023 – Ionisos acquired a facility from Studer Cables AG in Switzerland to increase its electron beam capacity for providing sterilization services.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, competitive landscape, service type, delivery mode, method, and end-user. Additionally, it covers market dynamics and insights into the latest market trends and highlights key industry developments. In addition, it consists of several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.17% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

|

|

By Delivery Mode

|

|

|

By Method

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.26 billion in 2025 and is projected to record a valuation of USD 4.67 billion by 2034.

The market will exhibit a steady CAGR of 4.17% during the forecast period of 2026-2034.

By service type, the contract sterilization services segment will lead the market during the forecast period.

The rising prevalence of Hospital Acquired Infections (HAIs) across the globe and the rising number of surgeries are driving the market.

STERIS, Sterigenics U.S., LLC (Sotera Health), and Ecolab are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us