Stern-mounted SONAR Market Size, Share & Industry Analysis, By Application (Commercial and Defense), By Solution (Hardware (Transmitter, Receiver, Control units, Displays, Sensors (Ultrasonic Diffuse Proximity Sensors, Ultrasonic Retro-Reflective Sensors, Ultrasonic Through-Beam Sensors, VME-ADC, and Others), and Others) and Software), By End-user (Line Fit and Retrofit), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

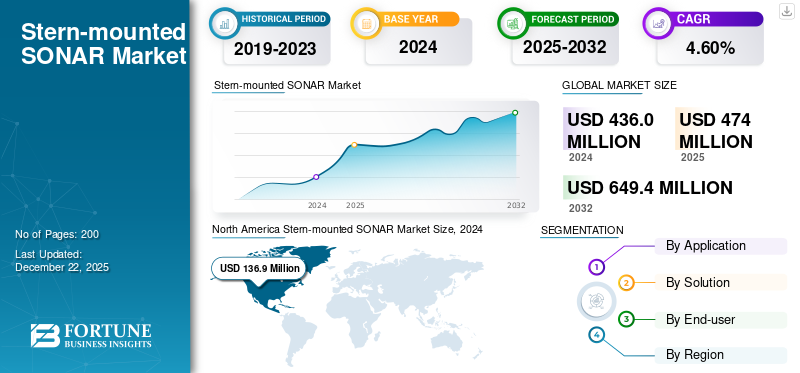

The global stern-mounted SONAR market size was valued at USD 436.0 million in 2024. The market is projected to grow from USD 474 million in 2025 to USD 649.4 million by 2032, exhibiting a CAGR of 4.60% during the forecast period.

Stern-mounted SONAR is water-borne acoustic sensor equipment mounted on the back (stern) of warships and merchant ships for sweeping the undersea space persistently in every direction around them in the contiguous vast space. They are able to detect, identify, and track the following dangers: submarines, Unmanned Underwater Systems (UUVs), naval mines, and divers. Stern-mounted SONAR generally involves active, passive, and side-scan technologies, each serving operational purposes such as Anti-Submarine Warfare (ASW), mine detection, and diver threat evaluation. The largest benefit of this mounting is the ability to scan great volumes of water astern of the vessel with minimal interference from ship-generated noise. This configuration provides all-around coverage during transit or patrol operations. Stern-mounted SONAR is universally applied in defense, seaport security, and commercial vessels for shipping operations as a basic situational awareness to secure navigation and threat avoidance.

The market is expanding with rising marine technology threats and global naval modernization. Rising geopolitical tensions and heightened proliferation of advanced submarines and underwater threats are prompting navies and commercial maritime operators to enhance their underwater surveillance capabilities. Advances in technology, such as sensor sensitivity, digital signal processing, and integration with AI-based analytics, are further enhancing the performance and reliability of stern-mounted SONAR systems. The expanding use of unmanned underwater vehicles (UUVs) and the growing demand for effective mine and diver detection around harbors and coastal waters fuel demand. With aggressive defense spending and a focus on undersea domain awareness, the stern-mounted SONAR market is poised for robust growth across both commercial and military segments.

Major companies operating in the market, such as Thales Group, Lockheed Martin Corporation, and Raytheon Technologies, are leading to a high demand and further market growth in the coming years. These companies are heavily investing in the latest emerging technologies to support and drive operations of the stern-mounted SONAR system, thereby leading to market growth.

MARKET DYNAMICS

MARKET DRIVERS

Rising Maritime Security Threats and Naval Fleet Modernization to Fuel Market Growth

Growing maritime security threats are an imprint trend in 2025, as some of the world's busiest shipping lanes are increasingly targeted by piracy, armed robbery, unauthorized cargo, and illicit fishing, particularly in high-risk areas such as the South China Sea, the Red Sea, and Somali coastal waters.

The expansion of next-generation technologies such as missiles, drones, and hybrid threats such as cyberattacks and unmanned underwater vehicles has added new layers of complexity to securing the maritime domain and has raised the threats faced by commercial and military ships. Confronted with the same, navies globally are prioritizing modernization of the fleet, heavily investing in future-generation vessels, cutting-edge sensor systems, and unmanned platforms to boost situational awareness and enhance operational efficiency.

The modernization process also involves the addition of state-of-the-art stern-mounted SONAR systems and other submersible sensors, which provide comprehensive underwater surveillance and play a critical role in threat elimination within an increasingly contested and dynamic maritime operating environment. This is expected to bolster the stern-mounted SONAR market growth over the forecast period.

MARKET RESTRAINTS

Supply Chain Disruption Issues to Limit Market Expansion

Supply chain disruption poses the biggest threat to the stern-mounted SONAR business, with manufacturers continually finding it difficult to locate vital components such as advanced sensors, electronic modules, and specialized raw materials used in system development and production. Disruptions are largely driven by geopolitical tensions, global conflicts, and economic recession, which can stop production activities, reduce shipbuilding rates, and hinder the installation and replacement of SONAR equipment. The COVID-19 pandemic, for example, led to widespread lockdowns and manpower shortages, worsening supply chain congestion, and causing delays in naval and commercial traffic.

Technical constraints also limit the scope of market expansion since stern-mounted SONAR equipment is susceptible to performance constraints such as signal interference, depth-related constraints, and reduced resolution under adverse underwater conditions. Factors, including water salinity, temperature gradients, ambient underwater noise, and reverberation, can degrade detection range and accuracy. Moreover, physical mounting and integration of SONAR systems into ships require additional engineering and often involve compromise in terms of cost, efficiency, and operation safety, further complicating widespread adoption and deployment.

MARKET OPPORTUNITIES

Increasing Oil & Gas expansion to Impact Market Growth Positively

Petroleum and gas exploration increasingly depends on fixed-mounted SONAR systems for accurate underwater mapping, obstacle detection, and safe subsea navigation across difficult subsea terrain. The systems allow operators to accurately delineate underwater topography, locate oil and gas reserves, and evaluate pipeline and infrastructure conditions, thereby minimizing exploration expenses and environmental risks.

As exploration moves into deeper and more complicated areas, the requirement for ultra-high-definition sonar imaging and real-time data processing is augmented. The incorporation of AI and ML capabilities further enhances stern-mounted SONAR functionalities. These technologies enable advanced pattern recognition, automated anomaly detection, and predictive analysis. Machine-learning and artificial intelligence-based models analyze huge volumes of audio data to identify natural seabed characteristics from potential threats to enable informed decision-making and efficiency in operations. The integration of technology is revolutionizing underwater exploration, making it more cost-effective, cleaner, and secure.

Download Free sample to learn more about this report.

STERN-MOUNTED SONAR MARKET TRENDS

Automation and Integration of Advanced Threat Warning to Boost Market Growth

One of the emerging stern-mounted SONAR trends is the automation and integration of advanced threat warning and classification systems, particularly for detecting mines and torpedoes. Emerging stern-mounted sonar systems such as Ultra's Sea Searcher™ and Atlas Elektronik's ASO series now include background-running automatic torpedo detection and classification capabilities, delivering real-time threat alerts with low false alarm rates. They utilize active and passive modes, electronic beam stabilization, and sector-limited transmissions to optimize detection performance in bad weather and make up for ship motion.

- North America witnessed stern-mounted SONAR market growth from USD 126.5 Million in 2023 to USD 136.9 Million in 2024.

Another key trend is the adoption of open system architectures and high-power commercial-off-the-shelf (COTS) signal processing that allows easier integration with other onboard defense suites, such as torpedo defense and anti-submarine warfare suites. The driving force behind these innovations is the need for multi-domain situational awareness, quick response capabilities, and improved survivability of naval fleets via automated threat detection and machine-assisted decision-making. These capabilities are quickly becoming central to the future of stern-mounted SONAR systems.

Segmentation Analysis

By Application

Rising Naval Security Concerns and Fleet Modernization Boosted Defense Segment

Based on application, the market is classified into commercial and defense.

The defense segment accounted for the dominant stern-mounted SONAR market share and is expected to grow at the highest CAGR in the coming years. This growth is driven by rising naval security concerns, naval investment, and naval fleet modernization initiatives. The stern-mounted SONAR technology is used critically in anti-submarine warfare (ASW), mine detection, and surveillance to provide enhanced submarine detection and submarine tracking, underwater vehicle detection, and mine detection behind naval ships. The operational relevance of below-sea situational awareness, in light of rising geopolitical tension, has nudged governments into creating high-resolution, high-processing signal next-generation SONAR technology with AI-infused analysis. As navies around the world are eager to update their fleets with newer warships, stern-mounted SONAR technologies are becoming a preferred solution due to their ability to deliver optimum operational performance coupled with enhanced maritime security in contested waters.

The commercial segment is expected to witness steady growth in the forecast period. The increasing adoption of stern-mounted SONAR systems in commercial operations is driven by the expansion of sea activities such as international shipping, offshore oil and natural gas exploration, fishing, and ocean research. Stern-mounted SONAR technology provides essential functions such as safety navigation, underwater barrier detection, and seabed surveying that are essential to commercial shipping vessels operating in increasingly crowded and regulated seas. Rising demand for noise and reliable underwater information has been triggered by increases in offshore construction and the need for pipeline inspection, collision prevention, and environment watch. Technical innovations, particularly in imaging resolution, signal processing, and integration with unmanned craft, are also lowering expenses and improving accessibility. These innovations are driving market development and enabling wider adoption across commercial sectors.

By Solution

Emergence of Advanced SONAR In Smaller Ships and Drones Boosted Hardware Segment Growth

Based on the solution, the market is divided into hardware and software.

The hardware segment accounted for the largest share of the market in 2024 and is expected to grow at the highest CAGR in the coming years. Sophisticated stern-mounted SONAR systems, including high-powered transducers, multi-beam arrays, and micro-integrated systems, facilitate precise classification and tracking of submarines, underwater vehicles, and mines under difficult conditions. Advances in global naval power, maritime trade, and the operation of autonomous ships all drive the need for tough, reliable hardware with increased detection range and all-weather, day-and-night operability. Technological improvements in sensor miniaturization and ruggedization have allowed more advanced SONAR to be deployed in smaller ships and drones, further fueling market growth. With ongoing increases in maritime defense concerns and underwater resource exploration, investment in next-generation hardware remains fundamental to operational success and market expansion.

Software will continue to account for a considerable share of the market. Stern-Mount SONAR software solutions are advancing rapidly, driven by the integration of artificial intelligence (AI), machine learning (ML), and advanced signal processing. These technologies enhance the processing of complicated acoustic signals, automate threat detection, and reduce false alarms to raise situational awareness for defense and commercial customers. Current SONAR software supports real-time 3D imaging, fusion, and integration with onboard command systems, enabling applications spanning from anti-submarine warfare to seabed mapping and navigation. The shift to autonomous and remotely operated ships has heightened the need for intelligent software capable of adaptive decision-making and evolving ASW capability over time. With shipping enterprises becoming data-intensive and more sophisticated, investment in state-of-the-art software products is critical to ensure optimum efficacy, efficiency, and flexibility for stern-mounted SONAR systems.

By End-User

Vast Global Fleet of Submarines and Surface Ships Encouraged Retrofit Segment Growth

Based on the end-user, the market is divided into line fit and retrofit.

The retrofit segment accounted for the largest share of the market in 2024. This growth is being driven by the enormous global fleet of submarines and surface ships that need upgrades to address emerging underwater threats. A considerable number of vessels, naval and merchant operators, are extending their operational life by fitting the latest stern-mounted SONAR technology, enabling increased detection, tracking, and information processing. Such changes are most common in regions experiencing defense budget growth and where aging fleets are being refurbished amid rising geopolitical tensions and regulatory requirements. As modular SONAR technology continues to advance and the ease of integration increases, retrofitting is now cost-effective with little downtime. Retrofitting has therefore become a cheap alternative for operators to enhance vessel efficiency and security without the cost of purchasing new vessels.

The line fit segment will hold a considerable share of the market and is expected to grow at the highest CAGR in the coming years. Line fit end-user growth in the market is largely propelled by fresh naval ship and commercial ship acquisitions that require sophisticated underwater detection technology from the beginning. As maritime security threats increase and naval modernization initiatives gain momentum worldwide, defense authorities and shipyards are emphasizing the integration of advanced SONAR technology into the ship construction process. This integration improves vessel operation effectiveness as per the evolving defense requirements. The procedure streamlines the retrofit installation, reduces future retrofitting expenses, and facilitates simple interfacing of other onboard systems. Additionally, the rise of autonomous maritime operations and the expansion of shipping are fueling demand for line-fit SONAR systems, as newly built vessels are designed to incorporate the latest in surveillance and navigation technologies to improve safety and efficiency.

Stern-mounted SONAR Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Stern-mounted SONAR Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market with the largest share. The industry in North America is growing fast, backed by high defense expenditures, continuous naval modernization, the presence of prime defense contractors, and cutting-edge research centers. The U.S. dominates the region, emphasizing naval superiority through continuous upgrades in SONAR equipment for anti-submarine warfare, mine detection, and underwater surveillance. Demand is further driven by offshore oil and gas exploration and marine science sectors, both of which require sophisticated SONAR solutions. The regional focus on protecting maritime borders and securing strategic underwater resources further drives adoption, reinforcing North America’s position as the dominant market globally.

Europe

Europe is the second-largest market due to increased investments in naval fleet upgrades, the retrofitting of autonomous ship technology, and the equipping with sophisticated threat detection systems. The U.K., France, and Germany are upgrading maritime systems to enhance security and operational efficiency. The region's emphasis is on integrating AI, sensor fusion, and 3D imaging into SONAR platforms for military and business use. Additionally, EU efforts to secure critical infrastructure and adhere to changing maritime regulations are further driving the adoption of products.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region with the highest CAGR over the forecast period. This growth is fueled by renewed investment in the stern-mounted SONAR systems, driven by increased defense expenditure, border tensions, and increasing domestic warship manufacturing in nations such as China, South Korea, and Japan. The region’s focus on naval modernization and the safeguarding of vital sea lanes is generating enormous demand for advanced SONAR systems. The merchant shipping industry is expanding, fueled by increased deliveries and automation of vessel equipment onboard. The adoption of new technology and growth in offshore exploration activities further contribute to the region's strong market growth.

Rest of the World

The market in the rest of the world region is expected to witness considerable growth in the near future. In the Middle East & Africa, the market's growth is fueled by growth in marine commerce, vessel overhauls, and the necessity to safeguard key sea lanes and offshore oil and gas infrastructure. In Latin America, the stern-mounted SONAR industry is supported by efforts to protect extended coastlines, ports, and offshore resources from illegal activities and environmental threats. Additionally, increased seaborne trade and ship refits, especially in Brazil and other coastal nations, are creating demand for SONAR systems refurbishment and new installations.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies are Leveraging Advanced Technology to Maintain Their Dominating Position in Market

The stern-mounted SONAR market is characterized by the presence of key players in the defense and ocean technology sectors, each using advanced technology to secure a competitive edge. Some of these key players include Kongsberg Gruppen, Thales Group, Raytheon Technologies, Lockheed Martin, L3Harris Technologies, and Teledyne Technologies. Market growth is underpinned by defense spending, naval modernization initiatives, and growing demand for underwater surveillance across both military and civilian domains. Firms are also looking into scalable and modular solutions to counter disparate classes of boats, ranging from large naval vessels to small patrol boats. The competitive landscape is shaped by strategic partnerships, R&D spending, and geographical expansion, all of which define this highly dynamic and innovation-driven industry.

LIST OF KEY STERN-MOUNTED SONAR COMPANIES PROFILED

- ASELSAN A.Ş. (Turkey)

- ATLAS ELEKTRONIK INDIA Pvt. Ltd. (India)

- DSIT Solutions Ltd. (Israel)

- EdgeTech (U.S.)

- FURUNO ELECTRIC CO., LTD. (Japan)

- Japan Radio Co. (Japan)

- KONGSBERG (Norway)

- Lockheed Martin Corporation (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- NAVICO (Norway)S

- Raytheon Technologies Corporation (U.S.)

- SONARDYNE (U.K.)

- Teledyne Technologies Incorporated. (U.S.)

- Thales Group (France)

- Ultra (U.K.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Marshall secured a long-term contract from Thales U.K. to manufacture and support components for sonar systems utilized by the Royal Navy. The agreement, which ranges from 2025 to 2039, covers Sonar 2076 components utilized on Astute-class submarines and incorporates the Sonar 2087, currently in service on Type 23 frigates and arranged for the upcoming Type 26 frigates and export variants.

- March 2025: French defense-electronics OEM Thales won a contract to supply the complete sonar and acoustics suite for the Royal Netherlands Navy’s Orka-class submarine fleet, being built by Maritime Group.

- April 2024: The S. Navy unveiled a new-generation submarine featuring the world’s first silent caterpillar drive, marking a leap in stealth propulsion. Based on magnetohydrodynamic drive technology, this innovation elevates acoustic stealth, making American submarines significantly harder to detect, potentially redefining requirements for SONAR systems and underwater threat detection capabilities.

- July 2023:K. naval forces unveiled the acquisition of five Type 2150 SOANAR systems for integration into Type 26 frigates. The advanced sonar systems are designed to provide the active or passive detection of submarine threats, while also enhancing maintenance efficiency by extending operational intervals between servicing.

- December 2020: The Australian Government's Future Submarine Program progressed with the signing of a contract for the design of the Submarine’s primary underwater sensor. The contract was signed with Thales U.K. Ltd, through Lockheed Martin Australia, for the development of the outboard flank array and associated partnering with the Australian industry.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.60% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Solution

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 436 million in 2024 and is projected to reach USD 649.4 million by 2032.

In 2024, the market value in North America stood at USD 136.9 million.

The market is expected to exhibit a CAGR of 4.60% during the forecast period (2025-2032).

By application, the defense segment led the market.

Rising maritime security threats and naval fleet modernization are driving market growth.

Major companies operating in the market such as Thales Group, Lockheed Martin Corporation, and Raytheon Technologies.

North America dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us