Subscription E-commerce Market Size, Share & Industry Analysis, By Subscription Type (Subscription Box, Subscribe and Save, Membership, Media and Publication, Digital/SaaS, and Streaming (Video / Music)), By Application (Media & Entertainment, Food & Beverage, Beauty & Personal Care, Education & Professional Development, Information & Technology, Health & Wellness, and Clothing and Fashion), By Payment Mode (Credit and Debit Cards, Digital Wallets, Bank Transfers, Buy Now, Pay Later (BNPL), and Offline), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

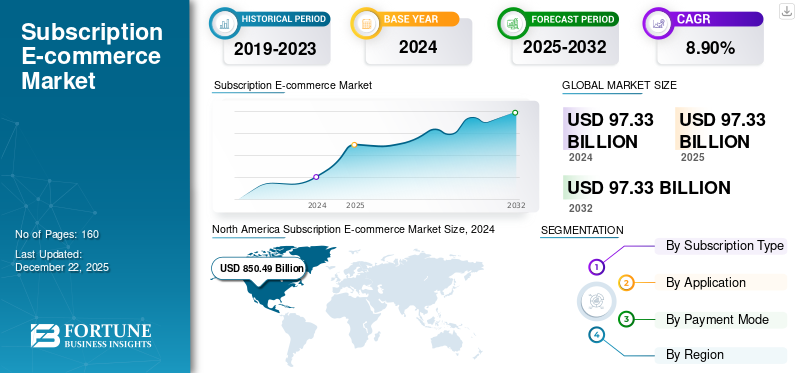

The global subscription e-commerce market size was valued at USD 2,719.54 billion in 2025 and is projected to grow from USD 3,088.71 billion in 2026 to USD 9,051.84 billion by 2034, exhibiting a CAGR of 14.40% during the forecast period. North America dominated the global market with a share of 40.60% in 2025.

Subscription e-commerce is a recurring sales model in which companies sell products or services on a recurring basis (usually weekly, monthly, or quarterly) via an e-commerce platform. Subscribers receive products in a tailored or curated form without the need to repeat orders. It encompasses a broad range of products and services, from video and music streaming to beauty and personal care, meal kits, pet supplies, and grocery delivery. Subscription e-commerce is adopted and enhanced by traditional global brands as well as niche e-commerce-only brands, not only because of the opportunity for recurrent revenues but also for deeper consumer engagement.

The market is witnessing strong momentum driven by internet penetration, mobile commerce adoption, and consumer preference for convenience and personalized experiences. Furthermore, the expansion of omni-channel in retail, coupled with advancements in AI-driven personalization, is reshaping consumer expectations and improving retention rates across major subscription segments.

As mobile commerce becomes ubiquitous retailers are improving their omni-channel offerings and leveraging personalization technology to drive engagement and decrease churn. Major players such as Amazon Inc., Spotify Technology S.A., and Netflix Inc. among others are increasing the speed of last-mile delivery and making subscription plans flexible. Strategic partnerships or alliances with regional players along with innovation on products or services are essential elements shaping the market’s future.

IMPACT OF GENERATIVE AI

AI Integration Enhances Personalization, Retention, and Revenue Optimization

Generative AI is transforming subscription e-commerce through hyper-personalization, customer retention, and repeated revenue models. AI systems process huge datasets involving user interaction, purchase histories, browsing behaviors, and demographics to fulfil high personalization demands for subscription experiences in real time. Such advances reduce the manual curation of products, price determination, and prediction of churn, for faster, data-driven decision-making to increase customer lifetime value.

- In December 2024 Spotify updated its app, where it now leverages Large Language Models (LLMs) to create highly personalized and contextually relevant audio recommendations. This is created by generating personal narratives that provide users with meaningful, friend-like explanations for music, podcast, and audiobook suggestions.

MARKET DYNAMICS

MARKET DRIVERS

Rising Consumer Preference for Convenience and Personalization Market Growth

One of the major drivers of the subscription e-commerce market has been consumers' increasing desire for convenience, customized experiences, and hassle-free purchasing. Digital adoption, and growing disposable incomes have also fueled the market’s growth. While conventional retail relies on one-time purchases, subscription business provides recurring revenue predictability and greater customer loyalty. Personalization powered by artificial intelligence, automated supply-chain infrastructure to manage changing consumer demands, lower churn, as well as maximize the lifetime value of the customer.

- As per a 2022 expert study, personalization programs in retail can drive a 10–15% revenue lift and increase marketing ROI significantly.

MARKET CHALLENGES

High Customer Acquisition Costs and Logistics Complexity Hinder Market Growth

While the subscription e-commerce industry has grown quickly, it is confronted with serious challenges from increasing customer acquisition costs, delivery logistics for the last mile, and growing operational costs associated with personalization technologies and inventory systems. High marketing spend to retain and attract subscribers, especially in saturated markets, impacts profitability for many subscription-based companies and stifles the subscription e-commerce market growth.

This challenge is even more pronounced in emerging and underdeveloped regions, where inadequate logistics infrastructure, higher return rates, and a lack of robust digital payment systems limit the scalability of subscription models.

- According to the International Trade Administration (ITA), the role of cross-border e-commerce as a portion of total online transactions continues to grow, highlighting the importance of having an effective regionally based logistics infrastructure. For example, in Sub-Saharan Africa, transportation costs are 50% to 75% higher than in other developing regions, making last-mile delivery an ongoing issue for subscription-type firms.

MARKET OPPORTUNITIES

Rapid Expansion of Internet and Mobile Commerce in Emerging Economies Bolster Market Growth

The current high pace of internet growth and mobile commerce in developing markets offers a major opportunity to expand subscription e-commerce offerings. Asia Pacific, South America, and Sub-Saharan Africa, which have robust digital adoption, enlarging middle-class populations, and rising disposable incomes fuel the urgency for personalized subscription offerings across verticals such as beauty, meal kits, and digital entertainment.

- For instance, the e-Conomy SEA 2024 report by Google, Temasek, and Bain & Company points out that Southeast Asia’s digital economy will expand 15% YoY in 2024 to USD 263 billion of Gross Merchandise Value (GMV), with revenues increasing 14% to USD 89 billion. Profits have increased 2.5 times over the last two years to USD 11 billion. It is driven by video commerce, which has become 20% of the e-commerce GMV, versus just below 5% in 2022. This trend highlights a huge opportunity for subscription solutions built for digital-first consumers.

SUBSCRIPTION E-COMMERCE MARKET TRENDS

Digital Transformation and AI-Driven Platforms Accelerate the Market

In recent years, the ramp-up of digital commerce infrastructure and personalized tools based on artificial intelligence has been reshaping the subscription e-commerce market. Companies have been shifting away from standardized subscription solutions to intelligent adaptive systems that can anticipate consumer taste and stock more effectively. This shift has been supported by the growing momentum of machine learning algorithms and generative AI that learn behavioral, transactional, and demographic inputs to craft more engaging and profitable subscription experiences.

- Spotify is set to launch "Music Pro," in 2025 at an additional cost of up to USD 5.99 per month over its current premium subscription. This will include perks for superfans, with special first access to concert tickets, AI remixing tools, and higher-fidelity lossless audio.

Download Free sample to learn more about this report.

Segmentation Analysis

By Subscription Type

High Demand for Streaming Services Contributed to Segmental Growth

On the basis of subscription type, the market is classified into subscription box, subscribe and save, membership, media and publication, digital/SaaS, and streaming (video/audio).

Streaming held the largest market with a share of 28.84% in 2026, subscription e-commerce market share in 2026. Growth in global internet penetration, smartphone adoption, and a growing consumer appetite for on-demand content are fueling the growth of this segment. Key platforms will continue to grow their library, invest in localized content, and incorporate AI-led personalization techniques to encourage user engagement and limit churn.

- In April 2025, Naver bundled Netflix’s Standard with Ads plan into its Naver Plus Membership at the same price point per month, resulting in a 1.5times increase in subscriber sign-ups for the membership program.

To know how our report can help streamline your business, Speak to Analyst

By Application

Growing Personalized Content Preferences and Streaming Demand Drives Media & Entertainment’s Dominance

Based on application, the market is segmented into media & entertainment, food & beverage, beauty & personal care, education & professional development, information & technology, health & wellness, and clothing and fashion.

The media and entertainment segment held the dominating position with a share of 30.92% in 2026 owing to their sustained growth of video and music streaming services because of their exclusive and localized content. Services such as Netflix, Disney+, and Spotify continue to dominate recurring digital spending, supported by bundled offerings and regional partnerships, in turn driving the segment growth.

- In March 2025, in India, Bengali OTT platform Hoichoi unveiled Hoichoi TV+, a hybrid content format that delivers TV-style episodic storytelling on demand. Offering multi-episode releases at regular intervals, Hoichoi TV+ is a fresh alternative to traditional television formats.

The beauty & personal care segment is set to flourish with a growth rate of 16.9% growth across the forecast period.

By Payment Mode

Rising Digital Wallet Adoption Redefines Payment Preferences in the Market

In terms of payment mode, the market is categorized into credit and debit cards, digital wallets, bank transfers, buy now, pay later (BNPL), and offline.

Digital wallets dominate the subscription e-commerce global market with a share of 48.52% in 2026, and highest growth rate. Their dominance stems from the seamless use of digital wallets on streaming, retail, and lifestyle subscription platforms, which has been further catalyzed by quick adoption by the regions of Asia-Pacific, North America, and Europe.

- For instance, in 2024, Apple introduced new features for Apple Pay developers, including the ability to complete recurring payments using merchant tokens and offer detailed order tracking in the Wallet app. According to Business of Apps, Apple Pay has 785 million active users worldwide.

The credit and debit cards segment is expected to grow at a CAGR of 17.4% over the forecast period.

Subscription E-commerce Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Subscription E-commerce Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025 valuing at USD 1,104.13 billion and also took the leading share in 2026 with USD 1,202.31 billion. The factors fostering the dominance of the region include high internet penetration, established digital infrastructure, and strong consumer adoption of subscription-based models across streaming, personal care, and meal kit services. In 2025, the U.S. market is estimated to reach USD 989.84 billion.

- In June 2024, Thermo Fisher Scientific Inc. expanded its central laboratory operations in Wisconsin and Kentucky with an aim to serve the biotechnology and pharmaceutical

Asia Pacific

Asia Pacific, South America, and Europe are anticipated to witness a notable growth in the coming years. Asia Pacific is estimated to reach USD 977.74 billion in 2026, securing third position and will depict the fastest growth. India and China are estimated to reach USD 46.3 billion and 551.7 billion in 2026 respectively. This is primarily due to the rapidly expanding middle class, increasing mobile commerce penetration, and rising demand for affordable, flexible subscription models. The Japan market is projected to reach USD 93.4 billion by 2026.

Europe

During the forecast period, Europe is projected to record the growth rate of 14.25%, which is third highest and touch the valuation of USD 671.64 billion in 2026. Backed by increasing demand for curated beauty boxes, premium streaming services, and meal kit deliveries, the U.K. is anticipated to record the valuation of USD 222.6 billion in 2026, Germany to hit USD 135.4 billion in 2026, and France at USD 94.82 billion in 2025.

South America

South America holds the second-highest growth potential, led by Brazil and Argentina with their improving payment infrastructure and growing digital wallet usage. The region is set to record USD 134.52 billion. Rising high smartphone usage and growing e-commerce investments are gradually shaping the subscription landscape in the Middle East & Africa, where GCC is set to attain USD 40.15 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Diverse Subscription Models and Expansive Logistics Networks Propel Market Leadership

The subscription e-commerce market globally reveals a semi-consolidated nature with a few multinational giants combined with many emerging firms. The firms use their broad product offerings, tech capabilities, and robust distribution networks to have a competitive advantage. Strategic alliances, mergers and acquisitions, and innovation in customer interaction models are at the core of their leadership in the market.

Amazon.com Inc., Walmart Inc., Apple Inc., Netflix, Inc., The Home Depot Inc., The Kroger Co., and The Walt Disney Company are among the leading players. These companies benefit from their established e-commerce ecosystems and subscription-based offerings such as recurring household essentials, streaming services, and premium membership programs. Their global presence, robust logistics networks, and ability to integrate diverse subscription services across product categories reinforce their dominance. Also, these companies are actively investing in digital infrastructure, personalization technologies, and strategic partnerships to expand their subscriber base and enhance customer lifetime value.

LIST OF KEY SUBSCRIPTION E-COMMERCE COMPANIES PROFILED

- Amazon Inc. (U.S.)

- Costco Wholesale Corporation (U.S)

- Apple Inc. (U.S.)

- The Kroger Co. (U.S)

- Snap Inc. (U.S)

- Netflix, Inc. (U.S.)

- Spotify Technology S.A. (Sweden)

- Walmart Inc. (U.S.)

- Chewy, Inc. (U.S.)

- The Walt Disney Company (U.S.)

- The Home Depot Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Amazon has introduced three major AI innovations to enhance delivery speed and accuracy: Wellspring, a generative AI mapping technology improving location accuracy for drivers; an AI-powered demand forecasting model optimizing product availability; and agentic AI enabling robots to understand natural language commands and perform complex tasks autonomously, all aimed at improving customer experience and operational efficiency.

- March 2025: The Guangzhou Tianhe Software and Information Industry Association (China) and E-commerce Gateway Pakistan (Pvt.) Ltd, signed a memorandum of understanding (MoU) to enhance cooperation in respect of information technology (IT) and e-commerce. The collaboration focuses on jointly promoting ITCN Asia 2025, and exemplifies the intention of both respective countries to enhance and deepen cooperation in the digital economy.

- March 2025: Amazon rolled out an AI-driven tool to enable users to better manage, tailor, and optimize their subscription purchases, improving convenience and enhancing recurring order experiences.

- September 2024: Alphabet Inc.'s YouTube joined forces with Shopee to launch a new feature of online shopping in Indonesia, looking to expand it to the rest of Southeast Asia. The feature enables viewers to buy products on display on YouTube via embedded links to Shopee, Sea Ltd.'s e-commerce site, as competition heats up with TikTok's competing service.

- July 2024: The U.S.-based marketplace platform company Fiverr International Ltd. acquired AutoDS. The acquisition is intended to enhance Fiverr's e-commerce services by including AutoDS's automation tools for dropshipping and a subscription-based revenue model.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.40% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Subscription Type

|

|

By Application

|

|

|

By Payment Mode

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3,088.71 billion in 2026 and is projected to reach USD 9,051.84 billion by 2034.

In 2025, the market value stood at USD 2,719.54 billion.

The market is expected to exhibit a CAGR of 14.40% during the forecast period of 2026-2034.

The streaming (video / music) segment led the market by subscription type.

The key factors driving the market are rising consumer preference for convenience and personalization, and others.

Amazon Inc., Apple Inc., Netflix Inc., The Walt Disney Company, The Home Depot Inc., are some of the prominent players in the market.

North America dominated the market in 2025 by holding the largest share.

By application, the beauty & personal care segment is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us