Sustainable Manufacturing Market Size, Share & Industry Analysis, By Offering (Recycled Lithium Ion Batteries, Recycled Metals, Recycled Plastics, Recycled Carbon Fiber, Natural Fiber Composites, Bioplastics & Biopolymers, Water Recycle & Reuse, and Others), By Industry (Automotive, Energy & Power, Electronics & Semiconductors, Pharmaceuticals, Aerospace and Defense, Chemicals, Packaging, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

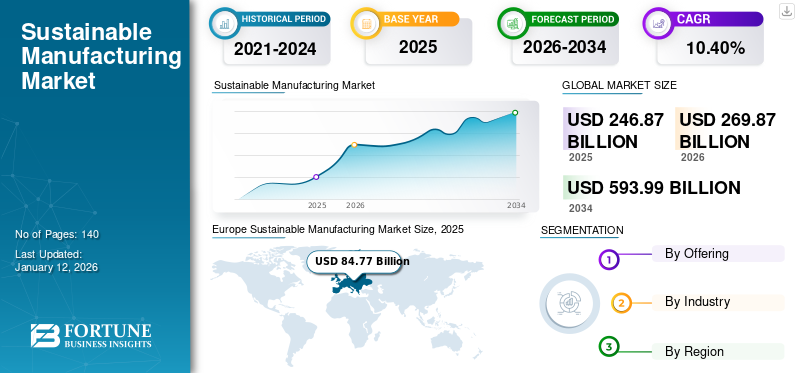

The global sustainable manufacturing market size was valued at USD 246.87 billion in 2025 and is projected to grow from USD 269.87 billion in 2026 to USD 593.99 billion by 2034, exhibiting a CAGR of 10.40% during the forecast period. Europe dominated the global market with a share of 34.30% in 2025.

Sustainable manufacturing is referred to the production of goods through economically feasible processes with less environmental impact. This aids in conserving natural resources, energy and ensuring the well-being and safety of employees, consumers as well as communities. Sustainable production helps in enhancing the sustainability practices and operational effectiveness, thus creating long term value for businesses and society.

The market is growing rapidly with increasing consumer demand for eco-friendly products, surging environmental regulations, and global shift toward circular economy and carbon neutrality. For instance, as per the U.S. Census Bureau, in 2023, around 61% of the U.S. industrialized services embraced green practices, out of which 46% of textile manufacturers employed eco-friendly production procedures. Additionally, technological advancements including integration of renewable energy, waste reduction innovations, and automation further augments the market expansion.

Few renowned key players in the market are 3M, Schneider Electric, Siemens AG, Umicore, Unilever, Veolia, and BASF. These key players are adopting different strategies including investment in energy efficient technologies, adopting life cycle assessment material, and partnership with sustainability focused companies.

MARKET DYNAMICS

Market Drivers

Rising Focus on Circular Economy Drives the Market Development

Increasing focus of companies on circular economy is a major driver for sustainable manufacturing market growth. This aspect focuses on reusing, recycling, and reducing the waste. With the growing municipal and industrial wastes, governments and businesses are pushed to emphasize material recycling and reuse.

- For instance, in 2021, Ireland registered a 10% increase in construction and demolition waste and a 9% surge in packaging This has highlighted the need for reducing waste generation and implement sustainable practices.

Moreover, according to the Ministry of Economic Affairs (MOEA), in 2023, 44% of manufacturing companies across Taiwan used ecological resources. This promotes the increasing investments of manufacturing companies in circular models with resource efficient technologies.

Market Restraints

High Initial Investment and Technology Costs Hampers the Market Growth

Regardless of the increased demand for sustainable manufacturing process, the surge in capital investment, and expenditure for implementing advanced technologies required acts as a major market restraint. Adopting energy efficient equipment, recycling systems and eco-friendly production technologies includes investing a higher upfront costs that can limit small and medium sized businesses in entering the market. Moreover, the dynamic maintenance cost, compliance with strict environmental standards and requirement for skilled labor also slower the adoption rate, thus deterring the market expansion majorly across remote areas.

Market Opportunities

Government Policies and Incentives Offers Lucrative Growth Opportunities

Government programs and supporting regulatory frameworks are crucially accelerating the integration of sustainable manufacturing processes globally. Governments are enabling industries to move toward cleaner and eco-friendly technologies through incentives including grants, tax benefits and subsidies.

- For instance, across India, programs including Zero Defect Zero Effect and Make in India tend to promote eco-friendly manufacturing and responsible utilization of resources. According to pib.gov, around 23,948 MSMEs had registered with intent to adopt the principle of the Zero Defect Zero Effect Scheme (ZED).

Such programs allow enforcement of environmental compliance and fosters innovation as well as competitiveness in sustainable manufacturing.

SUSTAINABLE MANUFACTURING MARKET TRENDS

Expansion of Electric Vehicles and Renewable Energy Sectors Has Emerged as a Prominent Market Trend

The increase in development of renewable energy and electric vehicles infrastructure offers a significant opportunity for the market. This has led to a surged demand for lightweight metals, lithium-ion battery recycling and low carbon footprints materials that are used in EVs and clean energy equipment, thus creating new avenues to invest in sustainable practices.

- For instance, according to pib.gov, the EV-Ready India dashboard has forecast a 45.5% Compounded Annual Growth Rate (CAGR) in electric vehicles between calendar year (CY) 2022 and CY 2030, increasing from annual sales of 6,90,550 electric two-wheelers (E2Ws) in 2022 to 1,39,36,691 E2Ws in 2030.

Moreover, government incentives and corporate sustainability programs are also focusing on adoption of circular production practices, thus offering an option to capture emerging high growth segments and innovate to manufacturers.

SEGMENTATION ANALYSIS

By Offering

Increasing Demand for Steel, Copper, and Aluminium Feedstock Boosts Recycled Metals Segment Growth

Based on offering, the market is segmented into recycled lithium ion batteries, recycled metals, recycled plastics, recycled carbon fiber, natural fiber composites, bioplastics & biopolymers, water recycle & reuse, and others.

In 2026, recycled metals segment held the largest sustainable manufacturing market with a share of 24.86% in 2026 and with a revenue share of USD 56.72 billion. This growth is driven by the increasing demand for steel, copper, and aluminium feedstock, conventionally collected at a large scale, from heavy industries and manufacturing process. These raw materials are gathered through established scrap collection networks, creating higher material value and lower processing costs as compared to base production. Such factors collectively make recycled metals crucial in circular input for construction, automotive and capital goods manufacturers.

Recycled Lithium ion batteries segment held the highest CAGR of 13.61% in 2024. This is due to the growing adoption of EVs and grid scale storage, creating an increased end-of-life volume. This also strengthens the regulatory compliance and promotes producer responsibility schemes. Increase in the value of critical minerals such as nickel, cobalt, and lithium are leading to a surge in investments in commercial level recycling technologies and supply chain adoption.

To know how our report can help streamline your business, Speak to Analyst

By Industry

Increasing Demand for Integrating Bioplastics and Recycled Metals Drive the Automotive Segment Growth

The market is divided into automotive, energy & power, electronics & semiconductors, pharmaceuticals, aerospace and defense, chemicals, packaging, and others, based on industry.

Among these, the automotive segment dominated the market with a revenue share of USD 47.91 billion in 2024. This growth is attributed to the rising demand contributing 21.60% globally in 2026, for integrating bioplastics, recycled metals, and energy efficient production systems in automotive sector. Additionally, automakers have also established mature circular supply chains for aluminum, steel, and plastics, driven by the OEM sustainability commitments and regulatory carbon targets. Moreover, the rapid shift toward EVs and lightweight materials is also accelerating the adoption of sustainable manufacturing practices across component production and vehicle design.

On the other hand, the energy & power segment held highest CAGR of 12.1% in 2024. This segment is growing due to expansion of renewable infrastructure and decarbonization policies resulting in an increased demand for sustainably produced components. This sector is transitioning toward wind, solar and storage technologies leading to an increased use of recycled metals and low carbon materials used in equipment manufacturing. Moreover, strong policy programs promoting clean energy and circular resource use across different power infrastructure are augmenting the segment growth.

SUSTAINABLE MANUFACTURING MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

Europe Sustainable Manufacturing Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The North America market is growing substantially and held a share of USD 62.47 billion in 2023 and USD 67.15 billion in 2024. This growth is due to the rising emphasis on sustainability. Increasing support from the government by implementing strict rules and surging investments in green technologies bolster the market growth. In particular, the U.S. is encouraging companies to adopt new manufacturing practices to enhance its brand value. The U.S. leads the North American market with an expected revenue share of USD 58.52 billion in 2025.

Europe

The Europe dominates the market with a revenue contribution of USD 84.77 billion in 2025 and is expected to contribute USD 91.72 billion in 2026. This growth is attributed to the long-standing industrial base, generous public financing and circular economy regulations have boosted the adoption of industrial waste reuse, recycled feedstock, and low carbon manufacturing across chemicals, metals, and automotive sectors. Additionally, the strengthening upstream recycling infrastructure, active corporate ESG commitments and large producer responsibility schemes also increases the demand for sustainable manufacturing. U.K., Germany, and France are some of the major contributors to the market growth with an expected revenue share of USD 15.77 billion, USD 24.59 billion, and USD 7.89 billion respectively by 2026.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific held the highest CAGR of 12.78% in 2024 and is expected to reach a revenue share of USD 76.17 billion in 2026. This growth is due to rapid industrialization, rising EV manufacturing and large-scale electrification, driving the demand for battery recycling, retrofit services and low carbon materials. Additionally, violent national targets for coordinated industrial policies, renewable capacity, and increasing local manufacturing of green technologies enables faster capacity addition and strong near-term demand. India and China are the major contributors for the market growth with an expected revenue share of USD 11.43 billion and USD 27.88 billion by 2026 and the Japan market is projected to reach USD 15.64 billion by 2026

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 11.81 billion and USD 9.44 billion respectively in 2025. This growth is driven by increase in government programs that support green industry, rising adoption of renewable industry and advancements in technology. GCC countries are predicted to have a market share of USD 5.27 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players Innovating Green Technologies Leads to their Dominating Market Positions

The sustainable manufacturing industry is extremely competitive with different market players operating in the market. These include 3M, Schneider Electric, Siemens AG, Umicore, Unilever, Veolia, and BASF. Such companies implement different strategic initiatives including investment in new green technologies, innovating in machine components and others to sustain the market competition.

LIST OF KEY SUSTAINABLE MANUFACTURING COMPANIES PROFILED

- 3M (U.S.)

- Schneider Electric (France)

- Siemens AG (Germany)

- Umicore (Belgium)

- Unilever (U.K.)

- Veolia (France)

- BASF (Germany)

- The Dow Chemical Company (U.S.)

- General Electric (U.S.)

- Toyota (Japan)

- Evalueserve SEZ Pvt. Ltd. (India)

- Clairvolex IP Solutions Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- In August 2025, The Department of Environment and Natural Resources – Environmental Management Bureau (DENR-EMB), in partnership with the United Nations Development Programme (UNDP) and with financial support from the Global Environment Facility (GEF), launched a new project titled “Reduction of Persistent Organic Pollutants (POPs) and Unintentional POPs (UPOPs) through Integrated Sound Management of Chemicals” in Quezon City.

- In November 2024, TSMC marked a significant milestone in sustainable manufacturing with the inauguration of the Taichung Zero Waste Manufacturing Center. During the ceremony, TSMC also signed a Memorandum of Understanding (MOU) on carbon capture with the Ministry of Environment. The event was attended by representatives from TSMC's green technology collaborators Chang Chun Petrochemical, Transcene, and Li Ying Environmental Technology, supply chain partners, academic institutions, industry associations, and the government.

- In July 2024, The Manufacturing Technology Centre (MTC) announced that it has made a huge investment in a sustainable additive manufacturing hub. The aim of this funding is to facilitate the creation of net zero products with complete circularity. It has established a new hub equipped with polymer and ceramic additive manufacturing machines which are particularly tailored for the production of net zero products.

- In March 2024, NatureWorks LLC disclosed the expansion of its biopolymers manufacturing capacity to address increasing demand for green packaging

- In November 2023, EDF in joint venture with REEL opted Veolia’s technology solutions, for the design, manufacture, and installation of mobile units. The purpose of this selection is to treat contaminated water in case of a nuclear mishap.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the sustainable manufacturing market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 10.40% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Offering, Industry, and Region |

|

By Offering |

· Recycled Lithium Ion Batteries · Recycled Metals · Recycled Plastics · Recycled Carbon Fiber · Natural Fiber Composites · Bioplastics & Biopolymers · Water Recycle & Reuse · Others |

|

By Industry |

· Automotive · Energy & Power · Electronics & Semiconductors · Pharmaceuticals · Aerospace and Defense · Chemicals · Packaging · Others |

|

By Region |

· North America (By Offering, Industry, and Country/Sub-region) o U.S. (By offering) o Canada (By offering) o Mexico (By offering) · Europe (By Offering, Industry, and Country/Sub-region) o U.K. (By offering) o Germany (By offering) o France (By offering) o Italy (By offering) o Spain (By offering) o Rest of Europe · Asia Pacific (By Offering, Industry, and Country/Sub-region) o China (By offering) o Japan (By offering) o India (By offering) o South Korea (By offering) o Southeast Asia (By offering) o Rest of Asia Pacific · South America (By Offering, Industry, and Country/Sub-region) o Argentina (By offering) o Brazil (By offering) o Rest of South America · Middle East & Africa (By Offering, Industry, and Country/Sub-region) o GCC (By offering) o South Africa (By offering) o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 269.87 billion in 2026 and is projected to reach USD 593.99 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 10.40% during the forecast period.

Rising Focus on Circular Economy drives the market growth.

3M, Schneider Electric, Siemens AG, Umicore, Unilever, Veolia, and BASF are some of the top players in the market.

The Europe region held the largest market share.

Europe was valued at USD 84.77 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us