Textile Machinery Market Size, Share & COVID-19 Impact Analysis, By Type (Spinning Machines, Weaving Machines, Knitting Machines, Finishing Machines, and Others), By Application (Garments and Apparel, Household and Home Textiles, Technical Textiles, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

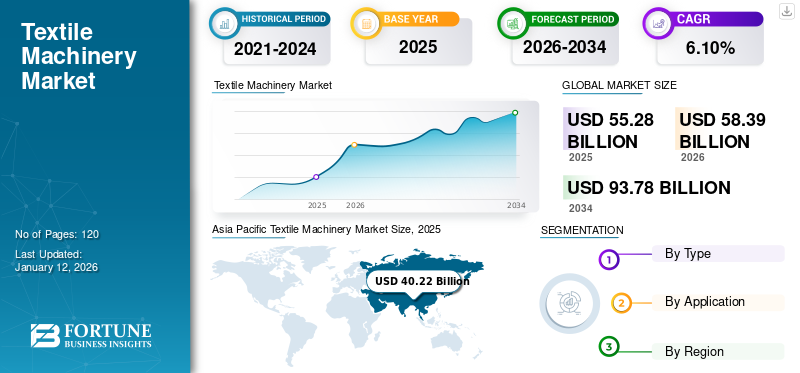

The global textile machinery market size was valued at USD 55.28 billion in 2025. The market is projected to grow from USD 58.39 billion in 2026 to USD 93.78 billion by 2034, exhibiting a CAGR of 6.10% during the forecast period. Asia Pacific dominated the textile machinery market with a share of 72.70% in 2025.

Textile machinery refers to a category of industrial equipment designed for the production and processing of textiles, encompassing various stages from spinning and weaving to dyeing and finishing. The global market, driven by the evolving textile industry, has witnessed steady growth in recent years, characterized by technological advancements, automation, and sustainability considerations.

Key market trends include the increasing demand for energy-efficient machinery, the digitalization of production processes, and a growing emphasis on eco-friendly practices.

Major key players in the industry are focusing on research and development to stay competitive in this dynamic market, which is influenced by factors such as fashion trends, consumer preferences, and regulatory changes. The market's future trajectory is expected to be shaped by innovation, environmental concerns, and shifts in global textile manufacturing hubs.

COVID-19 IMPACT

Disruption in Production Activities Hampered the Market Growth

The COVID-19 pandemic had a multifaceted impact on the global market, causing disruptions in supply chains, reduced investment and demand for machinery, plant shutdowns, a shift in consumer demand toward essential and comfortable clothing, increased adoption of remote maintenance and digitalization solutions, heightened focus on safety and sustainability in manufacturing processes, and an overall climate of uncertainty that influenced cautious machinery procurement strategies. These factors collectively shaped the textile machinery market trends during the pandemic and continue to influence its trajectory.

Textile Machinery Market Trends

Rising Trend of Integration of Industry 4.0 to Boost the Market Growth

An ongoing trend in the global market is the increasing adoption of automation and Industry 4.0 technologies. This trend reflects a broader shift toward smart manufacturing and the optimization of textile production processes. Textile machine manufacturers and textile producers are increasingly embracing automation, robotics, and data-driven technologies in their operations. It allows textile manufacturers to improve the efficiency and productivity of their processes.

Moreover, automated machinery can operate 24/7 with minimal downtime, leading to higher output and reduced labor costs. Automated systems can consistently monitor and control various aspects of textile production, ensuring higher quality and uniformity in the final products. This is particularly important in industries such as fashion and automotive textiles, where quality standards are stringent. Industry 4.0 technologies enable mass customization, allowing textile producers to cater to individual customer preferences efficiently. This is essential in an era where consumers increasingly seek personalized products.

Thus, the ongoing trend of automation and Industry 4.0 integration in the global textile machinery market share can be credited to factors such as higher efficiency, quality, and customization while addressing sustainability concerns.

Download Free sample to learn more about this report.

Textile Machinery Market Growth Factors

Fast Fashion Business Model to Drive the Market Growth

Fast fashion is a transformative driver for the textile machine market, fundamentally altering the way textiles are manufactured and impacting machinery requirements. Fast fashion refers to the rapid design, production, and distribution of affordable clothing collections that respond to current fashion trends. This trend has reshaped the fashion industry and, in turn, the market.

One of the key ways fast fashion influences the global market is through the demand for agility and flexibility. In traditional textile manufacturing, processes were optimized for long production runs of standardized garments. However, fast fashion necessitates quick turnarounds, with manufacturers constantly introducing new designs to align with evolving consumer tastes. This requires textile machinery that can swiftly adapt to different fabric types, colors, and styles, often within tight production schedules. Manufacturers need versatile equipment that can efficiently handle frequent changeovers and produce small to medium-sized batches of textiles.

Moreover, the fast fashion phenomenon is intricately linked to the rise of e-commerce. Online retailers, typified by companies such as Zara and ASOS, have championed the concept of "see now, buy now." This means consumers expect to purchase newly showcased collections immediately, putting immense pressure on manufacturers to meet the fast-paced production demands of the e-commerce fashion industry. Textile machines, such as cutting and sewing equipment, digital fabric printing machines, and automated material handling systems, must be technologically advanced and adaptable to support quick turnaround times, aligning with the rapid e-commerce-driven supply chain.

Therefore, fast fashion is a pivotal driver for the textile machinery market growth.

RESTRAINING FACTORS

High Capital Investment May Hamper the Market Growth

One notable restraint affecting the global market is the high initial capital investment required for modern, technologically advanced machinery. Textile manufacturing equipment, especially the latest generation of machinery equipped with automation, digitization, and sustainable features, often comes with a substantial price tag. This high capital requirement poses challenges for both established textile manufacturers looking to upgrade their equipment and new entrants seeking to enter the industry. Small and medium-sized enterprises (SMEs) may find it particularly challenging to access the financial resources needed to invest in state-of-the-art machinery, potentially limiting their ability to compete effectively in a rapidly evolving market. Thus, the high initial capital investment required for modern textile machines represents a notable restraint in the industry, especially for SMEs and new entrants.

Textile Machinery Market Segmentation Analysis

By Type Analysis

Finishing Machines Segment to Dominate the Global Market Due to the Wide Application

Based on type, the market is segmented into spinning machines, weaving machines, knitting machines, finishing machines, and others.

Among these, the finishing machines segment is expected to hold the largest market share of 29.29% in 2026 and second-highest CAGR over the forecast period due to the critical role of these machines in enhancing the appearance, quality, and performance of textiles, aligning with consumer demands for finished products with superior aesthetics and functionality.

The spinning machines segment, which includes machinery for converting raw fibers into yarns, a foundational step in textile production, holds the highest CAGR and second-largest market share in the global market. The demand for advanced spinning machines, especially those that support the processing of eco-friendly and sustainable fiber, is on the rise due to environmental and consumer awareness.

The knitting machines are essential for the production of knit fabrics used in clothing and textiles. This segment has seen a notable growth due to the popularity of knitted garments in the fashion industry. Moreover, circular knitting machines, flat knitting machines, and seamless knitting machines have witnessed advancements, offering manufacturers greater flexibility in design and production.

Weaving machines also play a pivotal role in fabric production by interlacing warp and weft yarns. This segment witnesses steady demand driven by both traditional textile manufacturing and technical textiles used in various industries.

The others segment typically includes specialized and auxiliary machines as well as accessories of textile machines.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Garments & Apparel to Fuel Market Demand Due to Constant Evolution of Fashion Trend

Based on application, the market is divided into garments and apparel, household and home textiles, technical textiles, and others.

The garments and apparel segment is a powerhouse within the market and is consistently expected to hold the largest textile machine market share of 55.88% in 2026. This segment primarily consists of machinery used in the production of clothing, including shirts, pants, dresses, and fashion apparel.The segment’s leadership in the market is driven by the constant evolution of fashion trends, consumer demand for customization and rising global demand.

Following closely is the household and home textiles segment, which holds the second largest share in the global market. This category includes machinery used to manufacture textiles for bedding, upholstery, curtains, towels, and various home furnishing items.

The technical textiles segment is gaining prominence due to its applications in industries such as automotive, aerospace, healthcare, and construction. The segment is expected to hold the highest CAGR over the forecast period as machinery used to produce technical textiles, such as airbags, medical textiles, geotextiles, and automotive textiles, is witnessing increased demand.

REGIONAL INSIGHTS

The market has been analyzed across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific Textile Machinery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominates the global textile machine market, holding the largest share. It is also the fastest growing showcasing highest CAGR over the forecast period region. This region is the epicenter of textile manufacturing, with countries such as China, India, and Japan playing pivotal roles. The Japan market is projected to reach USD 6.58 billion by 2026 and the India market is projected to reach USD 3.58 billion by 2026. The booming textile industry, fueled by a large labor force, abundant raw materials, and cost-effective production, drives significant demand for textile machinery. In addition, the region's focus on sustainable manufacturing and digitalization is shaping the adoption of advanced machinery.

China holds the largest market share in the Asia Pacific region in the global textile machine market. This dominance is a testament to China's status as a textile manufacturing powerhouse. The country's textile industry benefits from a robust infrastructure, a vast labor force, access to abundant raw materials, and a competitive cost structure. Furthermore, China's textile sector is rapidly adopting technological advancements, including automation, digitalization, and sustainable practices, to stay ahead in an increasingly competitive global market. As a result, the country not only serves its domestic textile needs but also plays a pivotal role in shaping the market's dynamics on a global scale. China market is projected to reach USD 24.11 billion by 2026

To know how our report can help streamline your business, Speak to Analyst

North American

North American market is characterized by innovation and a growing emphasis on technical textiles. The U.S. and Canada have well-established textile industries, particularly in technical textiles used in aerospace, healthcare, and automotive applications. There is a demand for machinery in the region that can produce high-performance textiles, meeting stringent quality standards. The U.S. market is projected to reach USD 3.89 billion by 2026.

Europe

European market is driven by a focus on sustainability and automation. European countries such as Germany, Italy, and Turkey are known for their high-quality textile machine manufacturing. Sustainability concerns and regulations are driving the adoption of eco-friendly machinery, while automation and digitalization are enhancing efficiency in textile production in the region. The Belgium market is projected to reach USD 1.17 billion by 2026, while the Germany market is projected to reach USD 1.43 billion by 2026.

Middle East & Africa

The Middle East & Africa show potential for growth in the textile machine market. While textile manufacturing in this region is not as extensive as in the Asia Pacific, it is steadily expanding, particularly in countries such as Turkey and Egypt. The demand for machinery is influenced by the region's efforts to diversify its economy and meet domestic textile needs.

South America

South America textile machine market is characterized by a mix of established textile industries and emerging markets. Countries such as Brazil have a significant textile manufacturing presence, driving the demand for modern machinery. The region also sees opportunities to produce eco-friendly textiles and meet growing consumer demand for sustainable products.

KEY INDUSTRY PLAYERS

Market Players Focus on Innovative Solutions to Boost Machinery Performance

Key market players, such as Rieter, Murata Machine, Itema Group, and Trützschler Group, are consistently introducing innovative solutions to improve machinery performance and sustainability. They have a robust international presence, serving textile manufacturers worldwide and contributing to global textile machine market growth and competitiveness.

List of Top Textile Machinery Companies

- A.T.E. Private Limited (India)

- Murata Machinery (U.S.)

- Rieter (Switzerland)

- Itema Group (Italy)

- Qingdao Jingtian Textile Machinery Co., Ltd (China)

- OC Oerlikon (Switzerland)

- Trützschler Group (Germany)

- Savio Macchine Tessili S.p.A (Italy)

- Toyota Industries Corporation (Japan)

- SHIMA SEIKI MFG., LTD (Japan)

KEY INDUSTRY DEVELOPMENTS

- December 2022: Yamuna Machine Works launched three new state-of-the art knitting machines for Indian customers.

- November 2022: Neuenhauser Group acquired Ontec’s textile machinery unit with an objective to expand their textile machinery portfolio.

- June 2022: Trützschler Group partnered with Texnology to launch T-SUPREMA, a needle-punching production line for technical textiles, such as geotextiles, automotive fabrics, and filters, using steel needle web bonding.

- January 2021: Mayer Braidtech, a wholly-owned company subsidiary, announced that it has merged with Mayer & Cie. GmbH & Co. KG, Albstadt. With this merger, the circular knitting machine manufacturer formally completed the integration of Mayer Braidtech GmbH at the company’s Albstadt headquarters.

- April 2020: Camozzi launched the new radial grippers Series CGSY designed to guarantee consistent performance every time, even across a wide range of applications, at the highest levels of productivity.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the market report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights Inc. says that the market is projected to reach USD 93.78 billion by 2034.

In 2026, the market was valued at USD 58.39 billion.

The market is projected to grow at a CAGR of 6.10% during the forecast period.

Based on type, the finishing machines segment is expected to lead the market during the forecast period.

Fast fashion business model is driving the growth of the market.

A.T.E. Private Limited, Murata Machinery, Rieter, Voltas Textile Machinery, Qingdao Jingtian Textile Machinery co.,Ltd, OC Oerlikon, Trutzschler Group, Savio Macchine Tessili S.p.A, and Toyota Industries Corporation are the top players in the market.

Asia Pacific dominated the textile machinery market with a share of 72.70% in 2025.

By application, the technical textiles segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us