Textile Packaging Market Size, Share & Industry Analysis, By Product Type (Polyolefin Woven Sacks, Flexible Intermediate Bulk Containers, Leno Bags, Wrapping Fabric, Jute Hessian, Jute Sacks, Soft luggage, and Others), By End-use (Agricultural, Food and Beverages, Industrial, Construction, Chemicals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

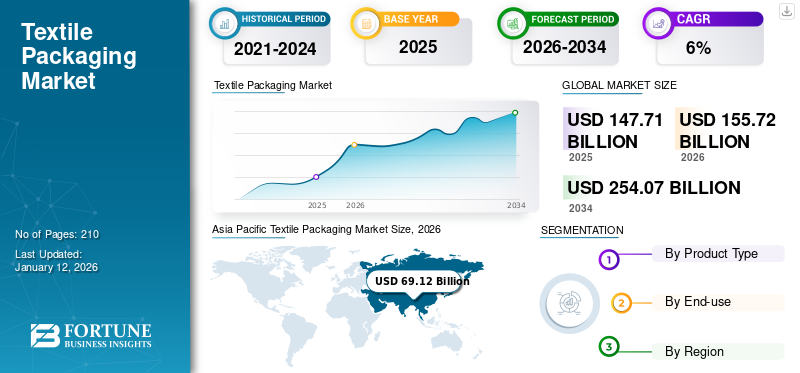

The global textile packaging market size was valued at USD 147.71 billion in 2025. It is projected to be worth USD 155.72 billion in 2026 and reach USD 254.07 billion by 2034, exhibiting a CAGR of 6.31% during the forecast period. Asia Pacific dominated the textile packaging market with a market share of 44.06% in 2025.

The textile packaging market encompasses materials and solutions designed for the secure transport, storage, and presentation of textile products. This sector has experienced significant growth, driven by the increasing demand for sustainable and durable packaging options across various industries.

Textile packaging includes products and goods that can be carried, confined, secured, and stored. The packaging materials are majorly utilized for a variety of agricultural, industrial, and consumer products. The textile packaging is categorized into polyolefin woven sacks, flexible intermediate bulk containers, leno bags, wrapping fabric, jute hessian, and jute sacks. These materials offer durability, good barrier performance, supreme abrasion resistance, excellent tearing, and tensile strength, as well as balanced waterproof properties. Moreover, the lightweight qualities of textile packaging materials, such as spun bond and wet-laid nonwovens, are increasingly being employed in the food business, as well as for packaging medications and electronic devices.

Conitex Sonoco and Sonvigo SA are the leading manufacturers, accounting for the largest global textile packaging market share.

GLOBAL TEXTILE PACKAGING MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 147.71 billion

- 2026 Market Size: USD 155.72 billion

- 2034 Forecast Market Size: USD 254.07 billion

- CAGR: 6.31% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 44.06% share, rising from USD 65.08 billion in 2025 to USD 69.12 billion in 2026.

- By product type: Polyolefin woven sacks dominated for durability and affordability.

- By end-use: Food & beverages held the largest share; industrial followed closely.

Key Country Highlights:

- India: Textile waste recycling initiatives boosting circular economy.

- U.S.: Second-largest textile exporter, strong demand from food & beverages.

- Europe: EU regulations driving biodegradable textile packaging growth.

- Latin America: Automation & digital printing improving efficiency.

- Middle East & Africa: Online shopping surge fueling packaging demand.

MARKET DYNAMICS

MARKET DRIVERS

Shift from Plastic to Biodegradable Packaging Due to Environmental Awareness to Drive Market Growth

As individuals and businesses grow more aware of environmental issues, there is a movement to move away from conventional plastic packaging and towards sustainable options. This trend is additionally bolstered by strict regulations designed to decrease plastic waste, encouraging manufacturers to implement sustainable methods. The textile packaging industry gains from this transition, providing strong, biodegradable alternatives that align with consumer desires and regulatory standards, thereby augmenting the textile packaging market growth.

Globalization Enhances Textile Packaging Efficiency and Reduces Costs, Promoting Market Adaptability

Globalization allows manufacturers to obtain raw materials and production resources from different nations, improving cost-effectiveness and boosting efficiency. This interconnection enables textile packaging firms to serve various markets, modifying their offerings to satisfy local needs while taking advantage of reduced production costs in developing countries. With the reduction of trade barriers, businesses can more readily enter new markets, fostering rapid growth in the textile packaging industry as they adapt to the rising quantity of products being exchanged globally.

MARKET RESTRAINTS

Recycling Textiles Struggles with Low Collection Rates and Complex Material Sorting Challenges

The recycling process encounters major obstacles, such as low collection rates for textile waste, which typically hover around 30-35% in areas such as Europe. Moreover, textiles frequently include various materials and contaminants, which renders sorting and processing labor-intensive and expensive. Present recycling technologies lack the sophistication needed to manage these complexities effectively, resulting in low-grade recycled fibers that require virgin materials to be suitable for new textiles. This restriction hinders the development of a circular economy in the textile packaging industry.

MARKET OPPORTUNITIES

Customized Textile Packaging Enhances Brand Identity, Customer Loyalty, and Sales Through Distinct Designs and Personalization

The growing need for tailored packaging options offers a chance in the textile packaging sector concerning branding and customization. Brands are acknowledging that tailored packaging boosts product attraction while also reinforcing brand identity. Customized packaging can produce unforgettable unboxing moments, strengthening customer loyalty and promoting repeat buys. By integrating distinctive designs, hues, and branding features into their packaging, businesses can stand out in a competitive market. This method enables brands to express their principles and visual style efficiently, increasing product visibility and attractiveness to consumers, which, in turn, boosts sales and improves overall brand image.

MARKET CHALLENGES

Sustainable Packaging Costs are Higher, Discouraging Manufacturers and Limiting Market Expansion

Although the demand for sustainable packaging solutions is increasing, the upfront cost for biodegradable and recyclable materials can be significantly greater than that of conventional alternatives. This difference in costs can discourage manufacturers, especially smaller firms, from implementing sustainable methods. Moreover, varying costs of raw materials add to the difficulties of financial planning and may result in unpredictable pricing for final consumers. Consequently, the elevated expenses associated with sustainable textile packaging may hinder market expansion and restrict accessibility for a wider array of companies.

TEXTILE PACAKGING MARKET TRENDS

Digital Textile Printing Enables Customized Packaging, Reduces Waste, and Supports Sustainability in Textile Industries

A significant trend in the textile packaging industry linked to digitalization and intelligent packaging is the growth of digital textile printing technology. This advancement facilitates on-the-spot production, allowing manufacturers to rapidly and effectively develop tailored packaging solutions. Digital printing improves design versatility, enabling brands to include complex patterns and branding features customized to particular consumer tastes. Furthermore, this technology decreases waste by lowering surplus inventory and enabling smaller production batches, which supports sustainability objectives. With the expansion of e-commerce, the need for customized and distinctive packaging solutions establishes digital textile printing as an essential aspect of contemporary textile packaging approaches. Asia Pacific witnessed a textile packaging market growth from USD 65.08 billion in 2025 to USD 69.12 billion in 2026.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The textile packaging market was considerably affected by the COVID-19 pandemic due to supply chain disruptions and changes in consumer behavior. Lockdowns resulted in the closing of factories and a decrease in production capacity, leading to delays in the supply of raw materials and rising costs. On the other hand, there was an increase in the demand for packaged products, especially in the e-commerce market, as shoppers turned to online purchasing for safety considerations. This dual impact caused fluctuations in demand, leading to struggles in some segments while others prospered.

SEGMENTATION ANALYSIS

By Product Type

Polyolefin Woven Sacks Dominate Textile Packaging Due to Durability and Affordability

Based on product type, the market is segmented into polyolefin woven sacks, flexible intermediate bulk containers, leno bags, wrapping fabric, jute hessian, jute sacks, soft luggage, and others.

Polyolefin woven sacks are the dominating segment and holds the largest share in the global textile packaging market. Woven sacks made of polyolefin, especially those crafted from polypropylene (PP), dominate the textile packaging market because of their remarkable durability, lightweight characteristics, and affordability. Their strength and resistance to moisture and chemicals fuel their suitability for a range of applications, such as agriculture and construction. The segment held 30.96% of the market share in 2026.

Flexible intermediate bulk containers hold the second largest share in the market, driven by their versatility and cost-effectiveness. FIBCs are commonly utilized in multiple sectors, such as food, pharmaceuticals, and construction because they effectively store and transport large quantities of materials. Their lightweight construction and ability to be reused enhance their appeal, establishing them as a vital option for contemporary packaging requirements.

By End-use

To know how our report can help streamline your business, Speak to Analyst

With Increasing Consumption of Fresh and Organic Vegetables, there is a Growing Need for Packaging

Based on the end-use, the market is classified into agricultural, food and beverages, industrial, construction, chemicals, and others.

The textile packaging market's largest share is held by the food and beverages end-use segment, fueled by growing consumer demand for convenience and ready-to-eat items. This sector gains from the growing trend of sustainable packaging options since textile materials are frequently biodegradable and environmentally friendly. Furthermore, the increase in online grocery purchases and meal kit subscriptions further drives the need for durable and creative textile packaging solutions in this area. The segment is expected to attain 35.79% of the market share in 2026.

Industrial end-use does account for the second largest portion of the textile packaging market, propelled by the rising need for robust and effective packaging solutions in multiple sectors. This sector gains advantages from the expansion of industries such as chemicals, pharmaceuticals, and construction, where strong packaging is crucial for securely transporting bulk materials.

Agricultural segment is predicted to grow with a substantial CAGR of 5.48% during the forecast period (2026-2034).

TEXTILE PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is dominating the global market.

Asia Pacific

Asia Pacific Textile Packaging Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Online Shopping Boosts Demand for Effective Textile Packaging Solutions for Secure Delivery

The Asia Pacific dominated the market with a valuation of USD 65.08 billion in 2025 and USD 69.12 billion in 2026. The rising trend of online shopping in the Asia Pacific has resulted in a heightened need for effective and protective packaging options to guarantee the secure delivery of products. With consumers demanding fast and dependable shipping, companies are embracing textile packaging solutions such as flexible intermediate bulk containers and reusable package bags to improve their logistics processes. This trend is additionally reinforced by increasing disposable incomes and urban growth, which are leading to greater consumer expenditures on packaged goods, thus enhancing the textile packaging market in the area. The market in China is increasing and is expected to reach USD 26.17 billion in 2026.

- According to the latest publication by The Economic Times, in July 2024, Mumbai-based waste management firm ReCircle entered the textile waste management vertical with a target to process 570 million tonnes (MT) of textile waste in 12 months. The company recently launched Project Extra Life to tackle India’s textile waste problem and build a more sustainable circular economy.

India is projected to reach a market value of USD 12.30 billion in 2026, while Japan is estimated to be worth USD 7.45 billion in the same year.

North America

Consumers and Companies Prioritize Sustainable Materials, Driving Market Growth in North America

North America is the second largest market expected to gain USD 39.88 billion in 2026, exhibiting a CAGR of 25.74% during the forecast period (2026-2038). With consumers and companies placing greater importance on environmental responsibility, there is a notable movement toward sustainable materials, including fabrics that are biodegradable and can be reused. This trend is driven by increased awareness of plastic pollution and regulatory demands to lessen plastic waste. Firms are embracing textile packaging to improve their brand identity and satisfy consumer demands for sustainability, which is fueling expansion in the textile packaging industry across multiple sectors, especially in food and beverages, where eco-friendly practices are increasingly crucial. The U.S. market is expanding, anticipated to hit USD 34.12 billion in 2026.

- According to The National Council of Textile Organizations (NCTO), the U.S. industry is the second largest exporter of textile-related products in the world. Fiber, textile, and apparel exports combined were USD 29.7 billion in 2021.

Europe

EU Regulations Promote Sustainable Practices, Driving Biodegradable Textile Packaging Growth

The Europe region is the third dominating region in the global market anticipated to reach USD 31.32 billion in 2026. The European Union has established strict regulations focused on minimizing plastic waste and encouraging environmentally friendly practices, including the Circular Economy Action Plan. The U.K. market continues to grow, estimated to be valued at USD 31.3 billion in 2026. This initiative motivates manufacturers to utilize sustainable materials and practices, driving the industry toward biodegradable and recyclable textile packaging solutions. As consumers grow increasingly environmentally aware, companies are required to adhere to these regulations while satisfying consumer demand for eco-friendly products, thus boosting the expansion of the textile packaging market in the area. Germany is set to reach USD 9.89 billion in 2026, while France is poised to stand at USD 6.17 billion in the same year.

- As per the European Parliament, global textile production was 58 million tonnes in 2000, and in 2020, it was 109 million tonnes and is projected to grow to 145 million tonnes by 2030.

Latin America

Businesses Adopt Automation and Eco-friendly Technologies to Enhance Efficiency and Competitiveness

Latin America is the fourth dominating region foreseen to hit USD 9.04 billion in 2026. In this region, businesses are progressively embracing automation, digital printing, and intelligent packaging options to improve efficiency and lower expenses. These technological innovations allow producers to create high-quality, tailored textile packaging that satisfies changing consumer needs. Moreover, investments in cutting-edge equipment and eco-friendly practices are aiding businesses in enhancing productivity while reducing their environmental footprint. The region's textile sector's adoption of these technologies enhances its competitive edge in the global market, effectively addressing trends such as sustainability and personalized packaging solutions.

- According to OEM Magazine, flexible plastic is the most used packaging in Latin America's food industry, and confectionery, bakery, and pasta are thought to offer the best volume growth opportunities until 2023, at 8.6 billion units. Confectionery and savory snacks - the leading applications for flexible plastic – have pack type sizes ranging from below 5g to over 2.5kg.

Middle East & Africa

Middle East and Africa's Online Shopping Growth Boosts Demand for Packaging Solutions

The Middle East & Africa is experiencing a notable rise in online shopping, resulting in a greater need for creative and effective packaging solutions that guarantee product safety while being transported. With retail sales increasing in countries such as Saudi Arabia, this rise presents opportunities for textile packaging producers to create tailored solutions that meet the changing demands of consumers. The focus on ease and sustainability additionally drives this market expansion, which is in agreement with worldwide trends.

- As per the latest publication by Capillary Technologies India Limited, with an estimated USD 8.3 billion in sales, which is projected to grow to USD 48 billion by 2022, the Middle East presents a massive untapped opportunity for pure-play e-commerce retailers as well as traditional players who want to establish an online presence.

Saudi Arabia is anticipated to grow with a valuation of USD 2.20 billion in 2026.

IMPACT OF TRADE PROTECTIONISM ON THE TEXTILE PACKAGING INDUSTRY

Trade policies and protectionist measures can impact the import and export of textile packaging materials, affecting global supply chains and pricing strategies. Companies must navigate these challenges to maintain competitiveness in the international market.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The market report also highlights the key developments by the manufacturers.

Major players in the industry include Mondi Group, Amcor plc, Berry Global Inc., Stora Enso, Constantia Flexibles, and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

Some of the Key Companies Profiled in the Report:

- Sonoco Products Company (U.S.)

- Sonvigo SA (Switzerland)

- Acme Bag Company (U.S.)

- NATco Global (U.S.)

- NONWOVEN FABRICS (India)

- Beaulieu Technical Textiles (Belgium)

- Gorup Cheviot (India)

- Gloster Ltd. (India)

- Texplast Industries (India)

- Nobletex Industries Ltd. (India)

- Sackmakers Ltd. (U.K.)

- Plastipak Packaging Inc. (U.S.)

- Mondi Group (U.K.)

- Berry Global Group, Inc. (U.S.)

- Amcor Plc (Australia)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Greif, an industrial packaging product and service provider announced the opening of its new intermediate bulk container (IBC) manufacturing facility in Malaysia.

- August 2024: UNIFI, Inc., a leading innovator in recycled and synthetic yarn, announced the launch of two new products, making its circular REPREVE® offering the largest portfolio of regenerated performance polyester in the world. Powered by the Company’s proprietary Textile Takeback™ process, UNIFI® now offers white-dyeable filament yarn and a revolutionary insulation material, ThermaLoop™, representing a major leap forward in scalable textile-to-textile recycling.

- May 2023: Flexsack introduced a new product, an environmentally friendly flexible intermediate bulk container (FIBCs) made from 30% recycled PP. The firm additionally mentioned that the item was the first recycled FIBC in North America, and the PCR bags are sourced from India at a revenue cost comparable to standard PP bags.

- May 2023: Packem Umasree launched sustainable FIBC jumbo bags made from PET or PCR. The bags are equipped with lifting loops or straps that allow for easy handling and movement. Apart from these, they are also advantageous in transporting bulk materials and convenient storage with the collapsible option.

- January 2020: Hindalco Industries partnered with Jute Corporation of India to create India’s first recyclable aluminium-foil-laminated jute bags for Tirumala Tirupati Devasthanams (TTD). This trust manages the Tirumala Venkateswara Temple in Andhra Pradesh.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In December 2024, the International Finance Corporation (IFC) announced a USD 50 million investment in Kuçukçalik Tekstil Sanayi ve Ticaret AS (Kuçukçalik), a home textiles manufacturer operating in Turkiye and Egypt. The loan comprises USD 30 million from IFC’s account and USD 20 million from IFC’s Managed Co-Lending Portfolio Program (MCPP).

REPORT COVERAGE

The market research report provides a detailed market analysis. The textile packaging market overview also focuses on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.31% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By End-use

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 147.71 billion in 2025.

The market is likely to grow at a CAGR of 6.31% during the forecast period.

The polyolefin woven sacks segment is expected to lead the market in the forecasted period.

The market size of Asia Pacific stood at USD 65.08 billion in 2025.

The shift from plastic to biodegradable packaging due to environmental awareness is driving the demand.

Some of the top players in the market are Smurfit Kappa, LC Packaging International BV, Coveries Holding SA, T&B Containers Ltd., Raptis Pax Pty. Ltd., and others.

The global market size is expected to record a valuation of USD 254.07 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us