TV Antennas Market Size, Share & Industry Analysis, By Type (Indoor and Outdoor), By Technology (Digital Antenna and Analog Antenna), By Distribution Channel (Online Retailers, Electronic Stores, Big-box Retailers, and Specialty Antenna Shops), By Application (Residential and Commercial), and Regional Forecast, 2026-2034

TV Antennas Market Size

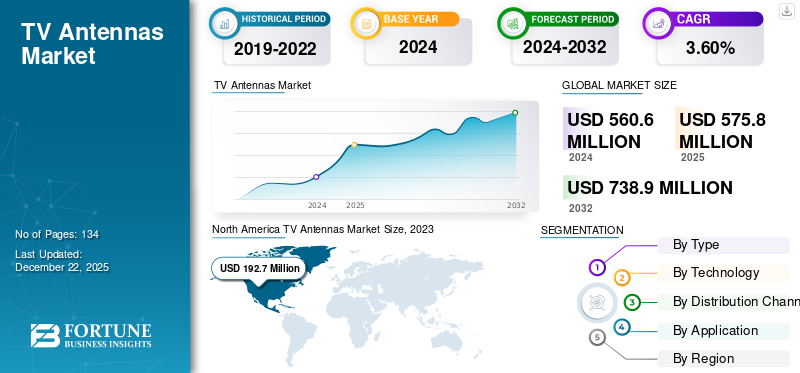

The global TV antennas market size was valued at USD 575.80 million in 2025 and is projected to grow from USD 592.60 Million in 2026 to USD 808.40 million by 2034, exhibiting a CAGR of 4% during the forecast period. North America dominated the global market with a share of 35.40% in 2025.

TV antennas, also known as television antennas, are devices designed to receive over-the-air broadcast television signals from local television stations. These systems capture electromagnetic signals that are transmitted from TV broadcast towers and convert them into electric signals that a television can display as pictures and sounds. The basic function of such products is to provide access to free broadcast television local channels, which eliminates the need for cable and satellite services.

Download Free sample to learn more about this report.

The TV antennas market is experiencing robust growth, driven by government initiatives and investments in expanding television infrastructure. An increasing preference for Over-the-Air (OTA) content among residential and commercial end-users across the globe is driving the demand for high-definition TV antennas in the market. Consumers are seeking ways to reduce their entertainment expenses, and using OTA antennas provides access to free-to-air channels, and the rising number of channels contributes to the growth of the market. Moreover, stringent norms and regulations regarding installing and replacing old antennas across the U.S., Canada, and Mexico have surged the growth of the market. For instance, in November 2023, the Federal Communications Commission (FCC), based in the U.S., impacted the development and adoption of new TV antennas in residential and commercial spaces.

The COVID-19 pandemic had a moderate impact on the industry due to supply chain disruptions, halted manufacturing activities, restrictions on transportation of such products, and the availability of such systems in certain regions. However, the pandemic accelerated online shopping, which created high demand for TV antennas during this period.

TV Antennas Market Trends

Technological Advancements in TV Antennas to Augment Market Growth

The rapid technological advancements in TV antennas have significantly enhanced signal reception, design, and user experience. The switch from analog to digital broadcasting is enabling TV viewers to receive High-Definition (HD) and Ultra-High-Definition (UHD) television signals. The transition to Advanced Television Systems Committee (ATSC) 3.0 has revolutionized the viewing experience by delivering enhanced sound and picture quality while facilitating seamless connectivity with smart TVs and streaming platforms. Compared to ATSC 1.0, ATSC 3.0 offers several benefits, such as higher resolution, better coverage, and interactive features. TV viewers can enjoy immersive sound and 4K Ultra HD picture quality on their TV sets.

TV Antennas Market Growth Factors

Growing Rate of Cable Cord Cutting to Drive Market Growth

The increasing number of consumers are trimming expenditures on cable TV subscriptions and opting for cord-cutting to increase the value of their television experience. One of the primary motivations behind cable cord-cutting is to reduce the monthly expenses of traditional cable and satellite TV packages. According to CableTV, the average monthly cable and satellite TV price in the U.S. increased from USD 395.64 to USD 529.52 from 2012 to 2022. In addition, many OTA broadcasts are available in high-definition (HD), offering better picture quality than traditional cable TV. All these factors are expected to drive the demand for such systems as they are an attractive option for consumers seeking to reduce their TV expenses while maintaining access to essential programs.

RESTRAINING FACTORS

Emergence of Internet-based Television Coupled with Competition from Cable and Satellite Operators Impede Market Growth

The advent of internet-based television and video streaming services is expected to hinder the market growth. These services deliver on-demand content, which is highly attractive to consumers seeking a wide variety of programs and flexibility. The convenience and extensive content libraries offered by streaming services have made them a preferred choice over Over-the-Air (OTA) broadcasts. In addition, the TV antenna market faces stiff competition from alternative technologies, such as cable and satellite TV services. These alternatives offer improved features, such as interactive capabilities and extensive content libraries. An increasing adoption of Smart TVs and streaming devices that offer easy access to internet-based content restricts the demand for these products from various geographies.

TV Antennas Market Segmentation Analysis

By Type Analysis

Indoor Antennas Dominate Owing to their Several Benefits Over Outdoor Antennas

Based on type, the market is divided into indoor and outdoor.

As per our analysis, indoor antennas dominated the market with a share of 68.85% in 2026 and is anticipated to grow at a substantial rate during the forecast period. It is owing to their compact size, ease of installation, improved signal quality, smart control, and compatibility with modern TV modes including indoor HDTV and 4K. This segment held 69% of the market share in 2024.

Outdoor antennas are projected to grow steadily due to rising demand for cord-cutting services, increasing TV ownership, and the rising popularity of high-definition and ultra-definition content necessitating high-quality antennas for optimal reception.

By TechnologyAnalysis

Digital Antennas Observed Substantial Growth Owing to Government Mandates to Update Analog to Digital

Based on technology, the market is segmented into digital antenna and analog antenna.

As per our estimates, digital antennas segment dominated the market with a share of 77.69% in 2026 and is anticipated to grow at the highest growth rate during the forecast period. Many countries have mandated the switch from analog to digital broadcasting devices, which drives the TV antennas market growth. Moreover, they offer several advantages, such as being compact, easy to install, and offering high bandwidth capacity from 50 to 80 miles. This segment is expected to capture 78% of the market share in 2025.

Analog antennas are anticipated to grow decently, owing to continuous innovation in design, signal processing, and smart features. Moreover, they offer several advantages, such as improved signal reception, long durability, waterproofness, compatibility with modern TVs, and have bandwidth capacity of 20 to 30 miles. This segment is likely to register a significant CAGR of 3% during the forecast period (2025-2032).

By Distribution ChannelAnalysis

Online Retailers Lead owing to Availability of Various products along with Competitive Pricing

Based on distribution channel, the market is segmented into online retailers, electronic stores, big-box retailers, and specialty antenna shops.

As per our analysis, online retailers segment dominates the market with a share of 35.89% in 2026 and is projected to grow moderately due to its offering of a wide range of products, competitive pricing, and convenient shopping experiences. Also, factors such as 24/7 support, and availability of products through online platforms fuels the growth of the market. This segment is set to gain 36% of the market share in 2025.

Electronics stores are projected to grow steadily owing to the availability of products, the ability to provide hands-on experience, and the ability to provide training and expert support. This segment is predicted to register a CAGR of 4% during the forecast period (2025-2032).

Big-box retailers are projected to grow moderately during the forecast period owing to their large physical stores and online shopping options.

Specialty antenna shops are anticipated to grow decently during the forecast period, owing to the strong availability of antenna products and providing custom installation & technical support.

By Application Analysis

Residential Applications are Increasing with Rising Adoption of TV Antennas in Single Homes, Apartments, and Multi-family Homes

Based on application, the market is classified into residential and commercial.

As per our analysis, the residential sector dominated the market in terms of revenue share of 73.84% in 2026, and is anticipated to grow at the highest growth rate due to increasing sales of high-definition and ultra-high-definition television. Moreover, government initiatives for providing subsidies and awareness campaigns supporting the transition to digital TV services, and the TV antenna demand, which drives the segment growth. Moreover, rising adoption of such systems from single homes, and multi-homes among residential sectors to drive the market growth. this segment is estimated to capture 48% of the market share in 2025.

The commercial sector will grow steadily with a CAGR of 3% during the forecast period due to growth in the hospital and tourism industries, which in turn creates the demand for such products and fuels market growth. The commercial market requires customized and scalable solutions tailored to specific applications and environments.

REGIONAL INSIGHTS

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America TV Antennas Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 203.9 million in 2025 and USD 210.4 million in 2026, due to the increasing number of cord-cutters, ongoing transition to digital broadcasting, and rising sales of TV devices, which, in turn, rising adoption of such systems for high-definition content to drive the growth of the market. Moreover, the strong presence of key players, such as Voxx International Corporation Inc., King Connect, and Winegard Company across the U.S., Canada, and Mexico, drive the growth of the market. The U.S. market is likely to hit USD 148.1 million in 2026.

U.S. is Set to Dominate Owing to Rising Rate of Cable Cord Cutting

The U.S. contributes the largest TV antennas market share due to the growing rate of cable cord-cutting technology in the U.S., which fuels the demand for more products to drive market growth. Increasing sales of high-definition and 4K televisions boost the demand for antennas capable of delivering high-quality signals.

Asia Pacific

Asia Pacific is the third largest market set to reach USD 135.3 million in 2025 and is projected to grow at substantial growth during the forecast period due to government initiatives to support digitization activities across China, India, and Japan, among others, which fuels the adoption of such products and the growth of the market. The Chinese market is poised to gain USD 50.7 million in 2026. For instance, in October 2023, according to the Australian Government Department of Foreign Affairs and Trade, the Australian government planned to invest around USD 68 billion in expanding the Indo-Pacific Broadcasting Strategy for the next five years (2024 to 2028). India is expected to reach USD 20.9 million in 2026, while Japan is anticipated to hold USD 26.4 million in the same year.

Europe

Europe is the second largest market anticipated to be valued at USD 147.2 Million in 2025, registering a significant CAGR of 3% during the forecast period (2025-2032). Europe is expected to grow moderately during the forecast period, owing to stringent government regulations mandating the installation of such products across each country, managing spectrum allocation, and setting standards for TV broadcasting and reception equipment, fueling the market growth. The U.K. market continues to expand, projected to reach a market value of USD 24.9 Million in 2026. Furthermore, the integration of smart home technology and the development of multi-purpose antennas (TV + 5G) across buildings in the European region fuel the growth of the market. Germany is set to grow with a valuation of USD 31.1 million in 2026, while France is expected to reach USD 20.6 million in the same year.

Middle East & Africa

The Middle East & Africa is the fourth largest market poised to be worth USD 52.7 Million in 2025. The Middle East & Africa and South America are anticipated to grow at decent growth during the forecast period, a consumer shift from analog to digital broadcasting, rising demand for high- and ultra-high-definition content, government initiatives to enhance digital infrastructure, and rising urbanization and disposable income of end users are some of the factors driving the growth of the market. The GCC market is set to stand at USD 34.6 million in 2025.

KEY INDUSTRY PLAYERS

Major Players are Deploying Product Launch Strategies to Intensify Market Competition

Key players, such as Voxx International Corporation, Antop, Antennas Direct, August International Ltd, and Alcad Electronics, among others, engaged in adopting product launch, product development, and acquisition as key developmental strategies to fuel the growth of the market. For instance, in April 2022, Alcad introduced a new terrestrial TV antenna, LTE700, for the market. It can operate with 5G connectivity. Moreover, it incorporates the usage of a rejection filter in the symmetrize. It offers several advantages, such as high-speed channel connectivity, rejection of more than 30 decibels, and speeding up the installation capacity.

List of Top TV Antennas Companies:

- VOXX International Corporation (Terk Corporation) (U.S.)

- Fracarro Radioindustrie SRL (Italy)

- Televes (Spain)

- Antop (China)

- Iskra (Slovenia)

- Alcad Electronics (Spain)

- Antennas Direct (U.S.)

- KING Connect (U.S.)

- August International LTD (U.K.)

- Winegard Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Antenna Experts, a company that designs and develops innovative antenna solutions for various applications, announced the launch of digital antennas in the U.S. to address the increasing demand for high-quality video and audio content of TV sets. These digital TV antennas cover a wide bandwidth that ensures good performance in adverse weather conditions.

- October 2023: Mohu, a TV Antenna manufacturer, and FreeCast, a digital media distribution company, announced a distribution agreement to integrate FreeCast’s streaming services with Mohu’s TV antennas.

- September 2023: The Phoenix Suns, the American professional basketball team, announced the TV antenna giveaway to help fans watch games on local television. This move was intended to make the game more accessible and build the future of the National Basketball Association (NBA).

- November 2022: Scripps Networks registered 30% more TV antenna sales in 13 markets where it launched a marketing campaign. The company said the USD 20 million campaign was part of the efforts to promote both old and new ways of accessing free and ad-supported TV.

- August 2022: Intellian Technologies, Inc., a manufacturer of communication equipment, announced the launch of antennas to improve the TV experience for those onboard maritime vessels. This TV antenna features Intellian’s WorldView Technology for seamless TV viewing experiences.

REPORT COVERAGE

The report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on type, technology, distribution channel, application, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4% from 2026 to 2034 |

|

Unit |

Value (USD Million) and Volume (Thousand Units) |

|

Segmentation |

By Type

By Technology

By Distribution Channel

By Application

By Region

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 575.80 million in 2025.

The market is expected to reach USD 808.40 million by 2034.

The market is projected to grow at a CAGR of 4% during the forecast period (2026-2034).

The indoor segment is expected to lead the market over the forecast period.

Increasing cable cord-cutting and rising demand for TV antennas from rural and remote areas are the driving factors for the market growth.

VOXX International Corporation (Terk Corporation, RCA), Fracarro Radioindustrie SRL, Televes, Antop, Iskra, Alcad Electronics, Antennas Direct, King Connect, August International Ltd, and Winegard Company are the leading companies in this market.

North America holds the highest share of the market.

Technological advancements in TV antennas fuels market growth.

Based on technology, digital antennas are projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us