Industrial Ethernet Connector Market Size, Share & COVID-19 Impact Analysis, By Type (RJ45 Connectors, M12 Connectors, M8 Connectors, and iX Industrial Interface), By Application (Control Cabinets, Robotics, Motor/Motor Controls, Machinery, and Others), Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

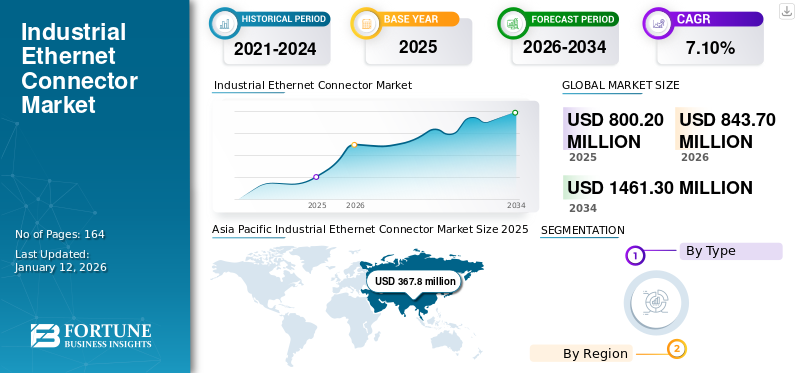

The global industrial ethernet connector market size was valued at USD 800.2 million in 2025 and is projected to grow from USD 843.7 million in 2026 to USD 1,461.30 million by 2034, exhibiting a CAGR of 7.10% during the forecast period. The Asia Pacific dominated global market with a share of 46.90% in 2025. Additionally, the U.S. industrial ethernet connector market is predicted to grow significantly, reaching an estimated value of USD 214.3 Mn by 2032.

Industrial ethernet is a technological innovation in traditional ethernet used for data communication in the industrial sectors. Industrial ethernet technology has a large address space for data communication. Also, it has an IPV6 (Internet Protocol Version 6.0) address and can give access to unlimited participants. It gives coverage for up to 80 km. It has features, such as seamless data transmission, transmitting high-speed data, and being easy to install. Industrial ethernet technology is based on an internet protocol named “ProfiNet (Process Field Network). Industrial ethernet connectors are based on ethernet, such as EtherNet/IP, Ether-CAT, and other network protocols. RJ45 connectors, M12 connectors, M8 connectors, and iX industrial interfaces, are some of the industrial ethernet connectors used on industrial premises.

Global Industrial Ethernet Connector Market Overview

Market Size:

- 2025 Value: USD 800.2 million

- 2025 Value: USD 843.7million

- 2034 Forecast Value: USD 1,461.30 million, with a CAGR of 7.10% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific dominated the market with a 46.90% share in 2025, driven by a strong presence of key players, technological advancements, and significant growth in the automotive sector.

- Fastest-Growing Region: China is experiencing the highest growth due to rising industrial automation, stringent industrial standards, and its position as a major manufacturing hub for electronics and automobiles.

- Type Leader: RJ45 connectors lead the market, widely adopted across the automotive, aerospace, railway, and smart factory sectors for their ability to transfer data at speeds up to 1 GBPS.

- Application Leader: Control cabinets hold the largest market share, valued for their reliable connectivity and ability to withstand harsh industrial temperatures in industries like automotive, railway, and construction.

Industry Trends:

- Increasing Demand for Miniaturization and Compact Designs: As Industrial IoT expands, there is a growing need for smaller connectors that provide high-speed data transmission in space-constrained applications like robotics and collaborative workspaces. Manufacturers are developing miniaturized solutions that are significantly smaller than traditional connectors while maintaining high performance.

Driving Factors:

- Growing Automation in the Automotive Sector: The rise of electric vehicles, autonomous driving, and in-car connectivity is a major growth driver. These technologies require reliable, high-bandwidth communication for systems like battery management, power electronics, and advanced driver assistance, fueling the demand for industrial ethernet connectors.

Increasing adoption of these products in industrial applications, such as automotive and telecommunication, drives market growth. In addition, growth in the automotive industries and the number of e-vehicles, cars, and bikes sold across the globe are factors driving the industrial ethernet connector market growth. For instance, according to the Source of MarkLines, the number of vehicles sold in India grew by 4.5% from 2021 to 2022. Such growth in the number of vehicles sold, which provides lucrative opportunities for manufacturers of ethernet connection, fuels the demand for ethernet, and drives the market growth.

COVID-19 IMPACT

Halted Industrial Production and Manufacturing Operations During COVID-19 Pandemic Hampered Market Growth

The COVID-19 pandemic has created significant disruption for manufacturers across their offices and production facilities. Lockdown restrictions and government-imposed regulations have disrupted the supply chain, and logistics activities have impacted the manufacturing company’s operation across several countries. The pandemic had initially negatively impacted industrial manufacturing, majorly affecting supply chain and distribution activities. With challenging times for industrial manufacturing, end-market users are adopting technology and connectivity solutions to optimize the processes.

During the pandemic, manufacturing has increasingly grown across various sectors, including agriculture, electrical utilities, mining, oil & gas, transport, and logistics. The COVID-19 pandemic showed the importance of the Internet of Things in most businesses to optimize their value chains. The pandemic has made businesses realize the importance of IoT in industries owing to secure and reliable networks. Although the market has shown a drop during the COVID-19 crisis, with a large number of manufacturing companies focusing on process optimization, operational efficiency, and automation, the demand for industrial ethernet technology is projected to show significant market growth over the projected period. Small and medium scale companies are subjected to an incline toward industrial ethernet technology, creating a huge demand for connectors across geographies.

Industrial Ethernet Connector Market Trends

Increasing Demand for Miniaturization and Compact Designs to Trigger Market Growth

With rising developments in Industrial IoT, the number of sensors, actuators, and other electronic components is increasing to make a reliable connection. Several manufacturing companies focus on developing miniature-sized ethernet connectors with large data transmission abilities. For instance, in 2019, HIROSE Electric developed a series of iX connectors for space-constrained industrial applications that require a high-speed data signal transmission of up to 10Gbps. The iX range of connectors can be used in ethernet and non-ethernet applications.

Additionally, the deployment of robotic systems is growing rapidly in more flexible applications, such as collaborative workspaces, creating a strong demand for miniaturized ethernet connectors. Manufacturing companies are concentrating on developing rugged connectors with small sizes that have higher efficiency in data transmission between connected devices. For instance, in September 2019, the iX ethernet connector developed by HIROSE Electric had a socket size up to 70% smaller than a traditional RJ45 ethernet connector. Such factors boost the demand for machine-to-machine connection devices, increasing the market share.

Asia Pacific Industrial Ethernet Connector Market Size 2021-2034 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Industrial Ethernet Connector Market Growth Factors

Growing Automation in the Automotive Sector to Boost Market Growth

Ethernet connectors connect electronic circuit modules, sensors, and control systems. Electrification and connectivity are the current trends in the automotive industry for managing high-speed, high-bandwidth, and data transmission. The number of interconnections is growing as data transmission is increasing progressively. The rising adoption of autonomous vehicles drives the demand for ethernet connectors across the automotive industry. Ethernet connectors are further involved in connected car technologies, which require reliable and efficient communication systems such as battery management systems, power electronics, and other automotive infrastructure.

The IEA report shows electric car sales doubled to 6.6 million units in 2022. The strong growth for EVs across several countries is projected to create strong demand for ethernet connectors in the automotive sector. Furthermore, rising awareness about safe car driving, supportive government regulations, and rising technological advancements in the automotive sector are a few factors driving the ethernet connectors market. All such aforementioned factors drive the market growth.

RESTRAINING FACTORS

Data Security and Cybersecurity Threats to Limit Market Growth

Data security has been a prominent factor that might limit ethernet network connectivity's market growth. Due to rising virus and other malware attacks on devices, cybersecurity threats may negatively affect the market. Several industries, such as healthcare, energy, and utilities, are prone to cyber-attacks. Cybersecurity attacks might disrupt the data flow between systems or devices.

Thereby, industries using ethernet communications are prone to such malware attacks, creating hindrances in the demand for ethernet systems. Attackers may attempt to hamper this data to manipulate industrial processes, cause equipment failures, or introduce safety hazards. Additionally, with the rise in cyberattacks over the past decade, data security has become a central concern among industrial users and vendors, restraining the market growth. All such factors provide restraints for the growth of the market.

Industrial Ethernet Connector Market Segmentation Analysis

By Type Analysis

RJ 45 Connector to Dominate the Market Owing to Increasing Demand across Industries

Based on type, the market is segmented into RJ45 connectors, M12 connectors, M8 connectors, and iX industrial interface.

The RJ45 connectors segment dominates the market and is projected to grow with the highest CAGR of 6.3% during the forecast period. This is attributed to the growing requirement in automotive, aerospace, railway, and smart factory applications. It has several advantages, such as the ability to transfer huge volumes of data from 10/100 MBPS to 1 GBPS transmission speed.

The M12 connectors and M8 connectors segments are expected to exhibit substantial growth owing to their capability to transfer huge volumes of data from 100 MBPS to 10 GBPS and their ability to work under extremely harsh industrial environments.

The iX industrial interface segment is anticipated to grow significantly during the forecast period as it is a technologically advanced product requiring less space than RJ45 connectors. It can be helpful for industrial sectors such as the automotive, railway, and manufacturing sectors. All such factors mentioned above contribute to the market growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Capacity to Work Under High Industrial Temperatures to Lead Control Cabinets Growth

Based on application, the market is segmented into control cabinets, robotics, motor/motor controls, machinery, and others.

The control cabinets segment dominates the market and is projected to grow with highest growth during the forecast period. Control cabinets segment is also expected to dominate the market due as it operates under extremely harsh temperatures and has reliable connection. It is used for various industrial sectors such as automotive, railway, and construction sectors.

The robotics segment is projected to witness potential growth of 6.0% due to rising demand for ethernet connectors from automotive and manufacturing sectors. In automotive sector, RJ45 and M12 connectors are largely utilized in these applications.

Motor/motor controls and machinery segments are projected to grow with potential growth, owing to increasing the number of connected devices and switches to operate data transfer at high bandwidth.

Also, the others segment includes shares contributed by PLC and input-output stations. Due to increasing machinery and related application demand, the application will grow moderately during the forecast period.

REGIONAL INSIGHTS

The market report covers an in-depth scope and deep-dive analysis of five main regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Industrial Ethernet Connector Market Size 2025 (USD million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to hold the largest industrial ethernet connector market share over the forecast period due to several key regional players, good product offerings, and technological advancements implemented by key players operating in the market. In addition, growth in the automotive sector and increasing sales of automotive cars, bikes, and trucks, which subsequently increase the demand for these connectors, drive the market growth in this region. For instance, according to the India Brand Equity Foundation (IBEF), the export of automobiles increased by 35.9% from 2021 to the fiscal year 2022.

China Witnesses Fastest Growth Owing to Increasing Manufacturing Activities

China dominates the market and is anticipated to grow with the highest growth of 7.1% during the forecast period, owing to rising industrial standards and growing industrial automation across China. Also, China is one of the largest manufacturing hubs for electronics and automotive devices. In addition, key players are planning to invest in research & development activities to launch new technologically advanced industrial ethernet connector products for the manufacturing and automotive sectors. Such factors drive the growth of the Asia Pacific market.

To know how our report can help streamline your business, Speak to Analyst

The North America market is anticipated to grow moderately during the forecast period due to technological advancement, presence of key industries, and increasing demand for ethernet connectors among various industry verticals such as automotive, aerospace, and railway. Also, major players, such as Amphenol Corporation, Hubbell Incorporated, and Belden Incorporated, across North America are engaged in providing new products and business expansion as key developmental strategies to improve their geographical presence across North America.

Europe is anticipated to grow at an adequate rate owing to Industry 4.0 technologies that have gained traction across various European industries, including automotive, aerospace, machinery, chemicals, food & beverages, and metal and mining. These sectors leverage automation, data analytics, and IoT to enhance productivity, optimize supply chain management, improve quality control, and enable customization. Such practices implemented in industrial premises contributed positively to market growth.

South America and the Middle East & Africa markets are expected to have a decent rise, owing to the rising adoption of the Internet of Things across a wide range of industries such as oil & gas, mining, and urbanization, and increasing demand for optimization of manufacturing facilities.

KEY INDUSTRY PLAYERS

Prominent Players Emphasize Strategies to Improve the Overall Market Presence

Prominent players, such as Amphenol Corporation, Rockwell Automation, TE Connectivity, Belden Inc, Halo Electronics, and Eaton Corporation, are adopting product development, product launch, business expansion, and acquisition as vital developmental strategies to intensify market competition and improve the product portfolio through diversified locations. For instance, in January 2020, HIROSE Electric partnered with Amphenol Corporation to introduce iX industrial ethernet connectors for several applications such as factory and process automation, machine-to-machine communication, robotics, sensors, and human interface devices.

List of Top Industrial Ethernet Connector Companies

- Amphenol Corporation (U.S.)

- Belden Incorporated (U.S.)

- Harting Technology Group (Germany)

- Hirose Electric Co Ltd (Japan)

- Hubbell Incorporated (U.S.)

- LAPP Group (Germany)

- Phoenix Contact (U.S.)

- Siemens AG (U.S.)

- TE Connectivity (Switzerland)

- Weidmuller GmbH & Co. KG (Germany)

KEY INDUSTRY DEVELOPMENTS

- April 2023: Harting Technology Group launched a new “Captain IX” ethernet connector for industrial applications. It is enabled with technologies, including industrial 4.0 and the Industrial Internet of Things (IIOT). It is used for RJ45 connectors and M12 connectors. It is suitable for the automotive and railway industries.

- August 2021: Amphenol Corporation launched a new iX industrial series of connectors. It is a next-generation industrial ethernet connector for factory and process automation, human interface devices, and robotics sectors. It is small compared to 70% with an RJ45 connector. This connector can transfer data at high transmission speed upto 10 Gbps. It enabled CAT6 and CAT7 protocols to transfer huge amounts of data across industrial applications.

- June 2021: Provertha Connectors, Cables & Solutions GmbH based in Germany launched a new M12-Mini X Code industrial ethernet connector into the market. It can transfer data at a high transmission speed of 10 Gbps. It is able to work under industrial temperatures from – 400 C to 850 C. It enables shock and vibration protection. It is specifically designed for mobile automation and railway applications.

- March 2020: Hirose Electric Co. Ltd partnered with Amphenol Corporation to introduce iX industrial connector for several applications such as factory and process automation, machine-to-machine communication, robotics, sensors, and human interface devices.

- August 2019: HIROSE Electric developed a series of iX connectors for space-constrained industrial applications that require a high-speed data signal transmission of up to 10 Gbps. The iX range of industrial ethernet connectors can be used in both ethernet and non-ethernet applications.

REPORT COVERAGE

The research report covers a detailed analysis of the types and applications of the product. It provides information about leading players in the industrial ethernet connector and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Thousand Units) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

According to our insights from the report, the market is expected to be valued at USD 1,461.30 million by 2034.

In 2025, the market was valued at USD 800.2 million.

The market is estimated to have a remarkable CAGR of 7.10% during the forecast period.

RJ45 connectors segment is expected to lead the market.

The rising adoption of ethernet connectors in industrial applications and increasing penetration of industrial connectors drive the market growth.

Dalian Special Steel Products Co. Ltd., BAHCO-Snap Europe, Lenox Tools, and Bichamp Cutting Technology Co. Ltd. are some of the top companies operating in the global market.

Asia Pacific is expected to hold the largest market share.

Based on application, the control cabinets segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us