U.K. Bubble Tea Market Size, Share, and Industry Analysis, By Type (Black Tea, Green Tea, Oolong Tea, and White Tea), and By Flavor (Fruit Flavor, Original Flavor, Chocolate Flavor, Coffee Flavor, and Others), 2024-2032

KEY MARKET INSIGHTS

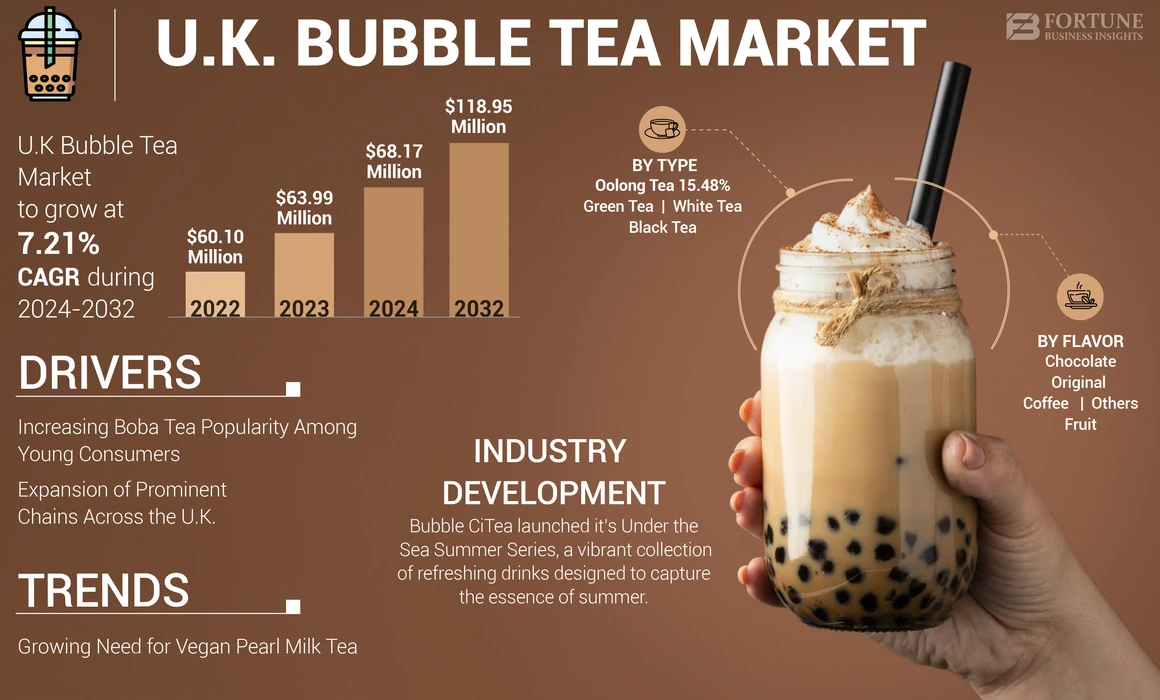

The U.K. bubble tea market size was valued at USD 63.99 million in 2023. The market is projected to grow from USD 68.17 million in 2024 to USD 118.95 million by 2032, exhibiting a growth at a CAGR of 7.21% during the forecast period. A few of the active boba tea makers in the U.K., include Mooboo Bubble Tea, Bubbleology, Chatime, Gong Cha, and Bubble CiTea. These players are concentrating on expanding their customer base, and are introducing new flavorful drinks via collaboration.

Bubble tea, popularly known as boba tea, or pearl milk tea, is a Taiwanese sweet tea based drink, prepared by combining milk, tapioca pearls, tea, and fruit syrup. Originally originated in Taiwan in the 1980s, this drink has rapidly spread to the U.K., driven in part by the large Asian population.

Specifically, in the U.K., pearl boba tea is mainly consumed by Gen Z and millennials, as they cherish visually appealing designs and blends of unique flavors. Moreover, the improved customization of bubble drinks and surging number of health-conscious population contributes to the demand. Health-centric consumers seek variations of boba tea that incorporate fruit or coffee-infused pearl tea.

UK Bubble Tea Market Overview

Market Size:

- 2023 Value: USD 63.99 million

- 2024 Value: USD 68.17 million

- 2032 Forecast Value: USD 118.95 million, with a CAGR of 7.21% from 2024–2032

Market Share:

- Segment Leader: Black tea-based bubble teas dominated the market in 2023 due to their traditional flavor profile and consumer preference.

- Fastest-Growing Type: Popping boba is the fastest-growing sub-segment, projected to grow at a CAGR of 10.8%, reaching USD 22.8 million by 2030.

- Regional Focus: Major metropolitan areas like London, Manchester, and Birmingham are key growth hubs due to dense youth populations and high foot traffic.

Industry Trends:

- Customization Craze: Consumer preference for personalized drinks with choices of toppings, sweetness levels, and bases is driving innovation.

- Social Media Influence: Viral TikTok and Instagram trends are boosting footfalls and brand awareness for bubble tea shops.

- Health & Eco Awareness: Rising demand for low-sugar options and eco-friendly packaging (e.g., reusable cups and straws).

- Automated Operations: Chains are adopting digital ordering systems, inventory analytics, and automation for consistency and efficiency.

Driving Factors:

- Gen Z & Millennial Appeal: Aesthetic drinks and customizable flavors are highly popular among younger demographics.

- Retail Expansion: Brands like Gong Cha, Mooboo, and Chatime are rapidly opening new outlets across the UK, especially in shopping districts and student zones.

- Cultural Integration: Bubble tea has become a part of mainstream UK café culture, providing non-alcoholic social spaces.

- Low Startup Barriers: Comparatively low capital requirement (around £30,000) for launching a store encourages entrepreneurship.

- Flavor Innovations: Continuous launches of new combinations like fruit infusions, matcha, and brown sugar varieties attract repeat customers.

MARKET DYNAMICS

Market Drivers

Increasing Boba Tea Popularity Among Young Consumers to Contribute to Market Growth

The pearl milk tea is specifically targeted toward young consumers who prefer to consume drinks that are available in various colors, flavors, and textures. These drinks are packed in transparent plastic cups, which helps consumers obtain a visual impression of the drinks they are consuming. As young consumers are specifically drawn toward aesthetically pleasing products, the demand for such drinks is expected to remain popular in the future. Young consumers, especially females in the U.K. want to consume unique and aesthetically appealing products that can be posted on social websites. Posting videos and photos of new boba drinks on such websites helps make products popular and trendy and increases brand awareness and recognition among consumers. Research indicates that a significant proportion of U.K. consumers are buying these drinks due to their popularity on social media platforms.

Expansion of Prominent Chains Across the U.K. to Boost Market Expansion

In the U.K., boba tea is recognized as a widespread phenomenon, led by the remarkable growth of prominent chains such as Gong Cha, Chatime, Mooboo Bubble Tea, and Bubbleology. The pearl milk tea industry is still emerging in the U.K. market, with bubble tea shops growing at university cafes and on trendy high streets. In order to gain a competitive advantage, leading global chains of boba drinks, such as Gong Cha, Chatime, and Sharetea, are concentrating on attracting new consumers across the U.K. market. Likewise, the trend of coffee-infused pearl milk tea is also experiencing an all-time high demand, especially after the pandemic phase in the U.K. As a result, the prominent Asian players and local players in the U.K. market are trying to expand their number of outlets, which can satisfy individual’s cravings and aid in gaining strong profits. For instance, in August 2024, CUPP, one of the well-known pearl milk tea brands in the U.K., announced the opening of its new store on Croydon High Street in England.

Market Restraint

Raw Material Fluctuations in the U.K. Obstructs Market Potential

One of the critical factors responsible for the slow growth of the U.K.’s bubble milk tea industry is the sudden fluctuations in raw material costs. The production of boba-based tea mainly depends on specific components such as tea leaves and tapioca pearls. Prices volatility in these ingredients, owing to import restrictions, torrential rains, and other abiotic factors, lead to supply chain disruptions and raises overall operational costs. As a result, these challenges can hamper the production capacity of tapioca-based tea and limit the availability of boba drinks for U.K. consumers.

Market Challenge

Strong Dependency on Imports for Boba Tea Production Impedes Market Momentum

The U.K. market is witnessing a massive demand for different flavored pearl tea, a trend expected to intensify in the upcoming years. However, the reliance on imports for primary ingredients such as tapioca pearls, especially from Asian countries, can obstruct manufacturers' potential in the U.K. market. Moreover, the situation was adversely hampered during the pandemic due to the closure of ports and borders. Thus, such dependency on imports can hinder the manufacturing process and limit product availability.

Market Opportunity

Surge in Foodservice/Quick Service Restaurant Can Improve the Intake of Boba Tea

The growing availability and accessibility of pearl milk tea via organized retailing, such as cafes and tea shops, creates enormous opportunities for captivating a broad consumer base. In this modern era, the U.K. population is searching for alternatives to traditional tea and coffee, gravitating toward flavorful and appealing beverages such as bubble drinks. However, boba tea originated in Taiwan, its popularity is easily visible on the menus of QSR and food service restaurants. The U.K.’s food service industry is witnessing a surge in the number of boba cafes and tea stores selling a range of pearl milk tea. In order to cater to diverse consumer preferences, chefs are preparing a range of innovative boba milk such as coffee, chocolate, and fruit-infused boba tea.

U.K. BUBBLE TEA MARKET TRENDS

Growing Need for Vegan Pearl Milk Tea is the Current Trend

The trend of veganism has experienced substantial growth in the last few years, and the U.K. nation is no exception to this movement. The growing importance of plant-centric products and the rising prevalence of lactose intolerance are the prominent factors supporting the demand for vegan products. In order to cater to the lactose-intolerant population, manufacturers in the U.K. are trying to introduce boba tea, which is made with plant-centric ingredients such as oat milk, coconut milk, and soy milk. For instance, in March 2024, SPI West Port, a California–based food & beverage firm, announced the launch of their latest RTD boba tea via their brand, “Jenji.” This tea is available in various flavors, such as matcha and strawberry latte, and is distributed in the U.K. through its partner, Unione Trading Europe. Such evolving trends are promoting the U.K. bubble tea market growth.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic negatively hampered the U.K.’s economy and disrupted almost every industry, where this industry was no exception. Prior to the pandemic, pearl milk tea shops were emerging all over the U.K. nation and were highly popular, especially amongst young office workers and college students. However, in 2020, the U.K. government imposed a nationwide lockdown to control the transmission of the virus, which impacted the supply chain in areas ranging from procurement of raw ingredients to logistical activities. Moreover, stringent home confinement regulations led to the closure of food service restaurants, universities, and workplaces, further affecting boba tea production and sales.

SEGMENTATION ANALYSIS

By Type

Black Tea Dominated the Market Owing to its Flavor Profile

Based on type, the market is segmented into black tea, green tea, white tea, and oolong tea.

Out of all these categories, the black pearl milk tea segment led the market in 2023, securing the top position in the market. In the U.K., black pearl milk tea is mainly enjoyed by individuals, mostly with milk, which sets the drink apart from other varieties of teas. Assam pearl tea and Earl Grey boba tea are a few of the popular types of black tea–based boba drinks consumed in the U.K. market, especially due to their flavor. Moreover, the improved availability and accessibility of black tea in the U.K., has made it a staple, often perceived as one of the “normal teas” by the population.

The green boba tea segment ranked second in the U.K. market and is expected to soar at a higher pace in the upcoming years. Initially introduced as a luxury item, pearl green milk tea has since become a popular choice due to its health benefits and distinct taste. Green tea is prepared from unoxidized leaves of the camellia sinensis plant, with sencha and matcha being the most common types. Owing to such benefits, consumers in the nation are looking for a fusion of green tea with tapioca pearls, which can suffice their cravings as well as provide health benefits.

To know how our report can help streamline your business, Speak to Analyst

By Flavor

Fruit Flavor Led the Market Due to its Health Advantages

On the basis of flavor, the U.K. market is divided into fruit flavor, original flavor, chocolate flavor, coffee flavor, and others.

Amongst all, the fruit flavor segment dominated the U.K. bubble tea market share in 2023, generating the maximum market share. Boba drink, infused with fruits, has been recognized as a fancy drink in the U.K., offering a healthy and refreshing substitute for coffee and tea. In this era, the inhabitants of the U.K. market are moving toward the trend of veganism and are seeking healthier boba tea options, which can provide additional benefits apart from traditional ones.

Coffee flavor experienced the highest CAGR in the market and is anticipated to grow at a higher extent in the near term. The rising popularity of coffee as a health-benefiting beverage and surging demand for indulgent experiences are the pivotal factors contributing to coffee-based boba tea consumption. In the U.K. market, the younger generation is the target group that is inclined toward trying flavored boba drinks, including coffee-infused milk tea.

U.K. Bubble Tea Market Regional Outlook

In the U.K., pearl milk tea has been a concept for decades but has recently started to captivate the attention of the broader population in the past five years. Consumers in the nation are focusing more on experiential services and products, where boba tea plays a remarkable role owing to its customization feature. Moreover, the robust demand for Asian cuisine and beverages across the U.K., coupled with the rising need for alcohol-free substitutes, has made boba tea a prominent and preferred choice for consumption. In addition, the popularity of pearl milk tea continues to grow in the nation, with young females studying at universities or earning, being the target consumers, boosting the trend. The drink’s social appeal, broad spectrum of flavors, and refreshing taste support the rising allure.

COMPETITIVE LANDSCAPE

Key Industry Players

To know how our report can help streamline your business, Speak to Analyst

U.K. Players Are Focusing on Expansion to Establish their Position in the Market

Active players in the U.K. market, include Mooboo Bubble Tea, Bubbleology, Chatime, Gong Cha, and Bubble CiTea. These players are trying to expand their base in the U.K. market by opening new boba tea stores to cater to the evolving consumer requirements. However, boba drink originated in Taiwan, its demand is increasing in other nations, including the U.K. To attain a strong brand image, both local and renowned global chains are opening new outlets/stores across the U.K. market.

List of Key Market Companies Profiled:

- Mooboo Bubble Tea (England)

- Bubbleology (U.K.)

- Bubble CiTea (England)

- CHATIME (Taiwan)

- Gong Cha (Taiwan)

- PresoTea (Taiwan)

- Sharetea (U.S.)

- Tiger Sugar (China)

- Xing Fu Tang (Taiwan)

- Yummy Town (Cayman) Holdings Corporation (Happy Lemon) (China)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Bubble CiTea, a prominent pearl milk tea producer in the U.K., launched it’s Under the Sea Summer Series, a vibrant collection of refreshing drinks designed to capture the essence of summer. The new range is available at various locations, including Chantry Place, Bullring, and Brent Cross.

- June 2024: Bubbleology, the U.K.-based popular boba drink brand, launched its first energizing boba tea in collaboration with Red Bull, marking a significant innovation in the beverage market. This new offering, known as the Red Bull Watermelon Boba Infusion, features unique elements designed to enhance the drinking experience.

- June 2024: Gong Cha, a renowned Taiwanese international pearl milk tea chain, officially opened a new location in Norwich. This new pearl milk tea shop adds to Gong Cha's expanding presence in the U.K., with another store set to open in Bristol shortly.

- November 2023: Tiger Sugar, the popular Taiwanese boba-drink chain, opened its first store in Sheffield. This development marked a significant milestone for the brand, which garnered a cult following since its inception in Taichung, Taiwan, in 2017.

- November 2023: Bubble CiTea, a well-established producer boba tea in the U.K., opened a new location at Teesside Park, bringing the authentic taste of Taiwanese pearl milk tea to shoppers in the area. This marked an expansion for the brand, which is known for its customizable drinks featuring chewy tapioca balls, often referred to as 'boba' or 'pearls.

REPORT COVERAGE

The market report includes quantitative and qualitative insights into the market. It also offers a detailed U.K. bubble tea market analysis of the sizing and growth rate for all possible market segments. Various key insights presented in the market research report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and market trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 7.21% from 2024 to 2032 |

|

Segmentation |

By Type

|

|

By Flavor

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 63.99 million in 2023.

The market is expected to grow at a CAGR of 7.21% during the forecast period.

The black tea segment led the market in 2023.

Increasing popularity of boba tea amongst young consumers and emphasis on expansion of customer base augments the market.

Mooboo Bubble Tea, CHATIME, Gong Cha, and Bubbleology are few of the top players in the market.

Raw material costs in the U.K. obstruct market potential.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us