U.S. Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (Machine Learning, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

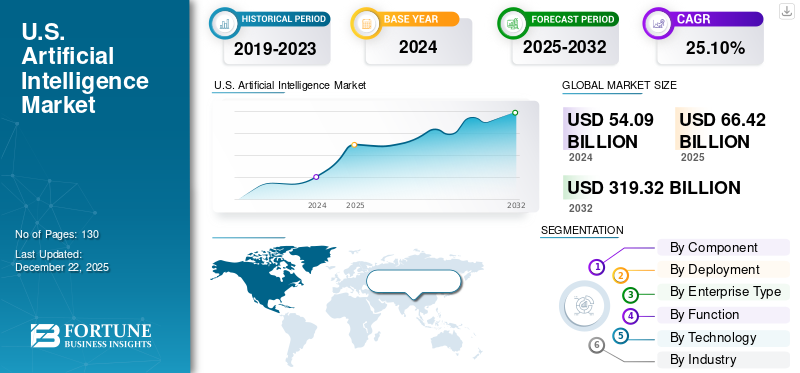

U.S. artificial intelligence market size was valued at USD 54.09 billion in 2024. The market is projected to grow from USD 66.42 billion in 2025 to 319.32 billion by 2032, exhibiting a CAGR of 25.10% during the forecast period.

By 2025, the U.S. had reshaped itself into the global leader in artificial intelligence due to unprecedented levels of innovation, continued activity from venture capitalists, and progress in developing a digital infrastructure. AI had progressed from a purely experimental phase to being deployed on a massive, detailed scale, touching nearly every industry in the U.S.: healthcare, finance, defense, and energy. Federal policies continued to develop in a supportive environment. The federal government did not intervene but instead supported advances in AI through deregulation, infrastructure investment, or public-private partnerships.

Impact of Generative AI

The Generative Artificial Intelligence sector has a key role in determining the direction of the U.S. AI market. The technology's ability to produce text, images, code, and other content is driving innovation across multiple industries. It is enabling organizations to optimize their operations, improve customer engagement, and develop digital products. For instance,

- According to the Project on Workforce, in August 2024, nearly 40 % of U.S. adults aged 18 to 64 used generative AI; 28 % of employed respondents used it at work, and about one in nine workers integrated it into their daily routines.

The evolution has also accelerated investment in AI infrastructure and tools, particularly by technology power players. In addition, generative AI is also driving workforce trends as demand for AI literacy and the emergence of new positions dedicated to training and oversight emerge.

Impact of Reciprocal Tariffs

Reciprocal tariffs can both support and impede the U.S. AI industry. Tariffs could defend domestic hardware production but also raise the price of imports including GPUs and advanced chips.

- For instance, suppose the U.S. places a tariff on AI chips from Taiwan due to reciprocal tariffs faced by American manufacturers. In that case, U.S. companies building AI models are likely to see prices increase and project delays.

This could hinder innovation, especially for startups, and decrease U.S. competitiveness in the global race for AI. In the long run, these tariffs threaten to alter supply chains that are vital for AI development.

U.S. Artificial Intelligence Market Trends

Active Federal AI Policy and Deregulation to be Key Driver for Market Growth

The U.S. federal government has identified artificial intelligence as a market-defining engine of future economic growth and national security. To facilitate and accelerate AI innovation, the government has announced an AI Action Plan, which is focused on removing regulatory burdens and expediting the approval process for AI-related infrastructure projects. For instance,

- The White House’s AI Action Plan (July 2025) outlines three pillars: accelerate innovation by easing regulations and expanding access to AI resources, build infrastructure with stronger energy, workforce, and cybersecurity capacity, and lead globally by exporting U.S. AI systems and setting international standards.

More precisely, the initiative prioritizes expedited permits and safety guidelines and will expedite the deployment of AI technology across sectors.

Key takeaways

- The U.S. artificial intelligence market is projected to be worth USD 319.32 billion in 2032.

- In by component segmentation, software accounted for around 50.2% of the U.S. Artificial Intelligence Market in 2024.

- In the by deployment segmentation, cloud is projected to grow at a CAGR of 26.6% in the forecast period.

- In the enterprise type segmentation, large enterprises accounted for around 64.2% of the market in 2024.

- In the by function segmentation, risk is projected to grow at a CAGR of 27.4% in the forecast period.

- In the technology, machine learning accounted for around 36.5% of the market in 2024.

- In the industry segmentation, healthcare is projected to grow at a CAGR of 32.6% in the forecast period.

U.S. Artificial Intelligence Growth Factors

Increasing Use of AI in Consumer Applications to Boost Market Growth

AI is now a standard feature of the normal consumer journey and facilitates experiences in both convenience and personalization. AI features are now intrinsic in the experiences we all desire in our technology, including natural language voice assistants, recommendation engines, facial recognition for device security, home automation, and AI-enabled cameras.

As consumers become increasingly accustomed to interactions using these technologies, expectations for intelligent, responsive, and smooth experiences also rise leading to U.S. artificial intelligence market growth. For instance,

- According to Shopify, 69% of U.S. households own at least one smart device.

U.S. Artificial Intelligence Market Restraints

Reliability and Scalability Challenges Hinder Market Growth

Businesses are now leaning more on AI tools to boost productivity and manage operations. But many organizations are experiencing some challenges around the consistent reliability of these tools when scaled. Known reliability issues include machine outages and operational challenges, leading to employees not using the machines to their fullest potential to complete complex tasks of duration. For instance,

- According to HR Drive, in a survey of over 1,000 senior executives, 95% have invested in AI, but only 14% have aligned their workforce, technology, and growth strategies. Additionally, 45% of CEOs report that most employees resist or are openly hostile to AI adoption.

U.S. Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

The software segment holds the largest U.S. artificial intelligence market share. The adoption of AI tools and services such as machine learning platforms, NLP, and computer vision platforms drives the growth. The value of this segment is boosted due to growing demand for AI-as-a-Service and cloud integration, as well as growing interest in customizable enterprise solutions in every industry.

The hardware segment is projected to grow at the highest CAGR, as the rising demand for AI chips, including GPUs and TPUs, growing data center infrastructure, and increasing need for high-performance computing to support advanced AI models, drive its growth.

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

Cloud-based deployment dominates the U.S. AI market and is expected to maintain the highest growth rate in the coming years. The high degree of optimization it provides, as well as the lower upfront capital costs and large-scale AI workloads, also contribute to the growth of cloud-based deployment. Overall, the cloud will appeal to enterprises irrespective of size. They will also provide businesses with ease of access to pre-trained models, APIs for developers, and scalable infrastructures that eliminate the need for planning and execution. With continued investments from major tech firms in cloud-AI integration, this segment is set to remain at the forefront of the market’s expansion. For instance

- In June 2025, Amazon plans to invest at least USD 20 billion in Pennsylvania to expand its AI and cloud computing infrastructure, creating 1,250 new high-skilled jobs and supporting thousands more in the AWS data center supply chain.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large enterprises continue to lead the U.S. AI market due to their ability to invest in advanced technologies and integrate AI at scale. Their focus on data-driven decision-making, operational efficiency, and innovation gives them a strong edge in deploying AI across complex systems and high-impact use cases.

Small and medium-sized enterprises are emerging as they are able to invest in advanced technologies and face less difficulty integrating AI solutions at scales that smaller organizations might not even imagine. Large organizations prioritize data-driven decisions, operational efficiencies, and innovation, allowing them to deploy AI across complex systems in use cases with high impact.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

In the U.S. AI market, the service function holds the largest share, driven by the increasing need for AI implementation, consulting, and maintenance. Companies are turning to AI service companies for specialized services, system optimization, and continuing to improve their AI models. Services are now also an important aspect of AI adoption and deployment for organizations across many different sectors. For instance,

- In April 2025, Capgemini expanded its partnership with Google Cloud to enhance customer experience (CX) using agentic AI. The collaboration will create AI solutions for industries such as telco, retail, and financial services to improve customer interactions and boost productivity.

The risk function is expected to experience the highest growth rate, as organizations are focused on adopting AI-driven tools and processes to handle the emerging risks of cyber threats, financial fraud, regulatory compliance, etc. New challenges increasingly confront organizations, so relevant AI solutions that can mitigate problems proactively are gaining traction in the face of unsolved problems, driving the segment's growth.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine learning (ML) will capture the largest share of the total market and is expected to grow with the highest CAGR due to its relatively fast uptake across a number of industries. As the primary technology that extracts useful insights out of big datasets and improves various processes, ML will form the basis for AI-based solutions not only in finance and healthcare but also in retail, and more.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities, and education.

The BFSI sector holds the largest share in the U.S. AI market, largely due to its extensive use of AI for tasks including fraud detection, customer service automation, and data-driven decision-making. With the growing need for efficiency, accuracy, and risk management, financial institutions are heavily investing in AI to enhance operational workflows and deliver personalized customer experiences.

Meanwhile, the healthcare industry is projected to reach the highest growth in AI adoption. AI technologies, including diagnostic tools, predictive analytics, and personalized treatments, are increasingly transforming healthcare operations. For instance,

- In May 2025, Oracle, the Cleveland Clinic, and G42 partnered to create an AI-powered global healthcare platform. The initiative aims to enhance patient care, precision medicine, and public health management through AI, data analytics, and intelligent clinical applications

List of Key Companies in the U.S. Artificial Intelligence Market

The U.S. AI market continues to evolve through the efforts of pioneering companies that are driving innovation, enterprise adoption, and global competitiveness. IBM is advancing AI governance and trustworthy AI with robust frameworks that help enterprises implement ethical and explainable systems at scale.

NVIDIA remains at the forefront of AI infrastructure, powering the training and deployment of advanced models with its high-performance GPUs and specialized computing platforms. DataRobot is enabling end-to-end AI automation for businesses, offering tools that streamline model development, deployment, and monitoring across various industries.

Microsoft Corporation is deeply integrating AI into its product ecosystem, particularly through Azure and Copilot, while also supporting foundational research and enterprise cloud-based AI services. Together, these companies reflect the U.S. market’s emphasis on scalable solutions, responsible innovation, and leadership in both foundational technology and real-world AI applications.

LIST OF KEY U.S. ARTIFICIAL INTELLIGENCE COMPANIES PROFILED

- IBM Corporation (U.S.)

- Nvidia Corporation (U.S.)

- DataRobot, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Google LLC (U.S.)

- Amazon (U.S.)

- Blue River Technology Inc. (U.S.)

- OpenAI Corporation (U.S.)

- Scale AI (U.S.)

- Agira Technology (U.S.)

- AIBrain (U.S.)

- Clarifai Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

August 2025: Google announced it would invest an additional USD 9 billion in Virginia by 2026 to expand its cloud and AI infrastructure, reinforcing its commitment to AI development in the U.S. The move highlights ongoing big tech investment in AI amid growing global competition.

January 2025: Accenture announced the acquisition of CyberCX to enhance its cybersecurity in the SU.S. with a strong focus on AI-driven security platforms. This acquisition combines Accenture’s advanced AI capabilities with CyberCX’s regional expertise, helping clients build resilience against evolving cyber threats in an increasingly AI-dependent world.

REPORT COVERAGE

The market report offers an in-depth overview of a highly advanced and evolving landscape, highlighting key technological breakthroughs, funding patterns, and strategic moves by major industry players. It examines the broad integration of AI across sectors, including healthcare, defense, finance, and manufacturing, with a growing focus on generative AI applications, scalable infrastructure, and ethical deployment. The report also explores the role of leading tech companies, top-tier research institutions, and a vibrant startup ecosystem in shaping innovation. Additionally, it analyzes federal policy developments, workforce readiness, and cross-sector partnerships that are reinforcing the U.S.’s position as a global hub for AI leadership and commercialization.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 25.10% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

Frequently Asked Questions

Fortune Business Insights says that the U.S. Artificial Intelligence market was worth USD 54.09 billion in 2024.

The market is expected to exhibit a CAGR of 25.10% during the forecast period of 2025-2032.

By industry, the BFSI industry is set to lead the market.

IBM, Microsoft, Google, and Nvidia are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us