U.S. Construction Equipment Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment), By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

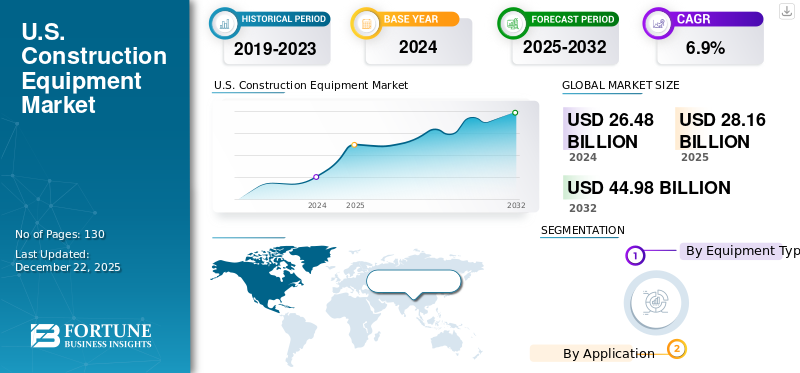

The U.S. Construction Equipment market size was worth USD 26.48 billion in 2024 and is estimated to grow to USD 28.16 billion in 2025 and reach USD 44.98 billion in 2032. The market is projected to grow at a CAGR of 6.9% during the forecast period.

Significant investment in infrastructure, rising commercial and industrial expansion, technology-integrated equipment, growing energy-based large scale projects, and aging infrastructure are few crucial factors driving the construction equipment market share in the U.S. Further, industrial reshoring supported by sustainability mandates also bolsters the construction equipment market growth of excavators, loaders, dozers, and others in the country.

Port activities witnessed significant growth at top ports in the U.S. Growing cargo volumes, rising e-commerce growth, and port infrastructure projects generated considerable demand for earthmoving equipment.

U.S. Construction Equipment Market Trends

Electrification and Rising Demand for Sustainable Machinery to Drive the Market Growth

Government regulations and zero-emission goals are generating significant market growth in the country. Several states in the U.S. have proposed tight emission regulations to support electric construction equipment and meet emission goals. Several key players in the market are introducing battery-powered construction equipment owing to operational advantages such as reduced fuel cost and quieter operation. Contractors and Rental providers focusing on infrastructure and urban development, along with meeting green standards. Owing to this, demand for electric machines is expected to boost during the forecast period.

- For instance, in August 2023, Doosan Bobcat introduced Bobcat T7X, an all-electric compact track loader. The fully battery-powered compact track loader won two innovation awards at CES 2022.

Clean energy investment in the U.S. has grown from 2018 to 2024 and is expected to grow in the coming years, owing to energy infrastructure investment, rising fuel production, and increasing spending on clean fuels

Key takeaways

- In the Construction Equipment type segmentation, Earthmoving Equipment accounted for more than 47% of the U.S. Construction Equipment Market in 2024.

- In the by Application Segment, the Industrial sector is projected to grow at a CAGR of 7.4% in the forecast period.

U.S. Construction Equipment Market Growth Factors

Clean Energy Projects and Data Center Growth to Drive U.S. Construction Equipment Demand

Infrastructure development programs, energy sector expansion, and rising construction of data centers are all supporting the market demand for a wide range of construction equipment. Increasing investments in wind farms, solar energy construction projects, grid expansion, and state-level clean energy projects to generate demand for drilling machines, off-road construction equipment, etc. Increasing digitalization, automation, and adoption of AI are boosting the demand for mega-scale data centers across the country, driving the growth of high-precision equipment.

- For instance, in August 2025, Port KC approved a USD 100 Billion funding to develop 6 data centers in Kansas over a 20-year duration.

U.S. Construction Equipment Market Restraints

Restructured Sourcing Strategies and Supply Chain Disruptions Might Pose a Challenge to Market Growth

U.S. dependency on several components, such as semiconductors, hydraulics, and other to limit the market growth of construction equipment in the country. Reciprocal tariffs, increased geopolitical risks, and trade tensions to further limit the market growth of heavy machinery across the country.

- For example, in 2024, the U.S. imported approximately USD 4.2 billion worth of excavators, shovels, and shovel loaders from Japan, while these products were subject to tariffs ranging between 15% and 20%.

Segmentation Analysis

By Equipment Type

Based on equipment type, the market is divided into Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment.

Material Handling Equipment and Cranes segment are expected to witness the highest growth rate during the forecast period as a result of expanding warehouses, logistics centers, and ports. Aging equipment and investment in electric product portfolios are further resulting in considerable demand for material handling equipment and cranes.

Earthmoving equipment such as loaders, excavators, dozers, and others dominate the U.S. construction equipment market. Expansion of manufacturing facilities, rising number of data centers, investment in public infrastructure, and growing investment in energy projects are expected to drive the demand for compact loaders, excavators, and dozers. EV manufacturing, battery manufacturing plants, and general industrial facilities are further bolstering the growth of loaders, excavators, and compact machines.

- According to the Federal Reserve Bank of St. Louis, private construction spending for manufacturing demanded over USD 2.82 Trillion in 2024, witnessing a double-digit growth in comparison to 2023.

By Application

Based on the Application, the market is divided into Residential, Commercial, and Industrial.

Growing demand for multi-family and single-family homes, rising demographic demand, and investment in residential construction are supported by policy reforms. Several such prominent factors are driving the demand for the products in U.S. residential application, surging the growth of construction equipment. Thereby, residential application dominates the construction equipment market.

- According to the National Association of Home Builders, Multifamily Market Survey (MMS), the multifamily production index saw an increase of seven basis points to 48% year-on-year in 2025.

Rising industrial megaprojects, semiconductor, battery manufacturing, and clean energy infrastructure development will drive the growth of industrial applications in the U.S. market.

List of Key Companies in the U.S. Construction Equipment Market

Caterpillar Inc., John Deere, and Liebherr are a few of the top players, making the market moderately fragmented in nature. Key players in the market are introducing technology-integrated equipment, establishing brand presence, strong dealer and distributor networks, and a collaboration strategy to drive the growth of the U.S. construction equipment market.

- For instance, in July 2024, Komatsu introduced a new demolition excavator portfolio in the U.S. market. The new models included PC290LC-11, PC360LC-11, and PC490LC-11, are straight boom excavators with enhanced reach of about 22%-26% in comparison to standard excavators.

LIST OF KEY COMPANIES PROFILED:

- Caterpillar (U.S.)

- John Deere (U.S.)

- Komatsu (Japan)

- Liebherr (Sweden)

- Terex Corporation (U.S.)

- Manitowoc (U.S.)

- Volvo Construction Equipment (Sweden)

- Hitachi Construction Machinery (Japan)

- JCB (U.K.)

- CNH Industrial (U.K.)

KEY INDUSTRY DEVELOPMENTS

- January 2025: John Deere has introduced autonomous machines, such as new industrial equipment, in Las Vegas at CES 2025.

- April 2025: Caterpillar Inc. has introduced its UHD Ultra High Demolition Hydraulic Excavator at Bauma 2025.

REPORT COVERAGE

The U.S. Construction Equipment market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the growth in earthmoving equipment, concrete and material handling equipment, and application. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand for construction equipment.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market was worth USD 26.48 billion in 2024.

The market is expected to exhibit a CAGR of 6.9% during the forecast period of 2025-2032.

By Equipment type, the Earthmoving Equipment segment is set to lead the market.

Caterpillar Inc., John Deere, and Liebherr are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us