U.S. Intrathecal Drugs Market Size, Share & Industry Analysis, By Drug (Morphine, Baclofen, Ziconotide, Bupivacaine, Hydromorphone, Clonidine, and Others), By Application (Pain Management and Spasticity), By Distribution Channel (Hospitals Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Country Forecast, 2025-2032

U.S. Intrathecal Drugs Market Size and Future OutLook

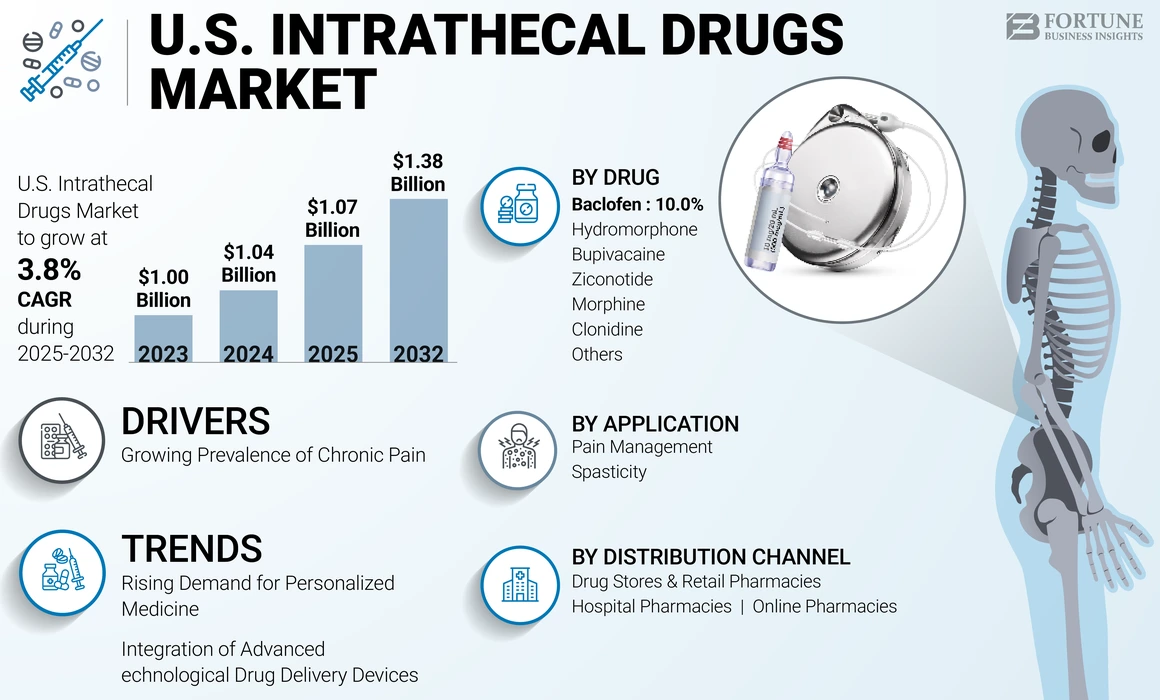

The U.S. intrathecal drugs market size was USD 1.04 billion in 2024. The market is expected to grow from USD 1.07 billion in 2025 to USD 1.38 billion by 2032, exhibiting a CAGR of 3.8% during the forecast period.

Intrathecal drugs are medications administered directly into the intrathecal space of the spinal cord, where cerebrospinal fluid flows. This route elimates the blood-brain barrier and thus allows the drug to reach more effectively toward the central nervous system. Intrathecal drugs are used for pain management, spasticity treatment, anesthesia, and chemoterapy. The rising prevalence of chronic pain diseases and muscle spasticity in the U.S. boosts the growth of the market. Furthermore, the increasing prevalence of pain associated with chronic diseases leads to the increasing prescription of intrathecal drugs by healthcare professionals. Some of the prominent companies in the U.S. intrathecal drugs market are Hikma Pharmaceuticals PLC, Piramal Critical Care, Baxter, and Novartis AG.

- For instance, in April 2023, according to the data published by the Centers for Disease Control and Prevention, in 2021, an estimated 51.6 million U.S. adults experienced chronic pain, and 17.1 million adults experienced high-impact chronic pain. Such situations lead to an increase in physician’s prescriptions for intrathecal drugs such as opioids, thereby driving market growth.

Additionally, the doses required for intrathecal administration are much lower than the intravenous, intramuscular, and oral routes to achieve the desired therapeutic effect in the CNS. These drugs offer targeted site delivery with rapid onset of action. Such benefits associated with the intrathecal administration of drugs are expected to propel the growth of the market.

Impact of COVID-19:

During the COVID-19 pandemic, the market witnessed a slower growth as there were a limited number of patients receiving intrathecal drugs. This was particularly due to the reduction in the number of accidents and trauma cases, and also due to the decline in the number of surgical procedures in the U.S. However, the market witnessed a resurgence after the pandemic, and is expected to grow steadily during the forecast period from 2025-2032.

MARKET DYNAMICS:

Market Drivers:

Growing Prevalence of Chronic Pain to Boost Market Growth

The primary factor driving the expansion of the U.S. market is the rising prevalence of chronic pain-related conditions. An aging population and the increasing incidence of chronic diseases result in higher rates of chronic pain conditions and subsequently drive the increased adoption of intrathecal drugs.

- For instance, in February 2024, according to the data published by the National Cancer Institute, around 20.0% to 50.0% of cancer patients experience pain, while approximately 80.0% of patients who have advanced-stage cancer are suffering from moderate to severe pain. Such a high prevalence of pain associated with chronic disease drives the U.S. intrathecal drugs market growth.

Market Restraints:

Side Effects & Complications Associated with These Drugs to Hamper Market Growth

Despite the advantages associated with intrathecal drug delivery, some side effects hampers the growth of the market. These include cerebrospinal drug leakage, medical device site hematoma, infection, vomiting, weight gain, urinary retention, sedation, and others. Additionally, the high risk of overdose can result in several medical complications.

- For instance, the overdose of intrathecal clonidine administration is associated with a risk of severe rebound systemic hypertension, oxygen desaturation, dry mouth, bradycardia, and headache.

High Treatment Cost and Limited Availability of Treatment Centers to Hinder Market Growth

In recent years, the rising prevalence of chronic diseases has increased the demand for medications, including intathecal therapies. However, the market faces challenges, such as adverse drug reactions, the high cost of drugs and devices, and reduced adoption.

- For instance, according to the data published by Amneal Pharmaceuticals LLC., the annualized post-implant societal cost ranges from USD 12,233 to USD 20,049 for the patients receiving intrathecal baclofen (ITB/0 therapy for spasticity.

Additionally, the limited presence of specialized centers to offer intrathecal drug therapy is another factor that impedes the adoption of the therapy.

Market Opportunities:

Surge in R&D Activities to Present Significant Growth Opportunities

With the increasing burden of chronic pain and muscle spasticity in the U.S., the demand for intrathecal drugs is expected to increase steadily in the coming years. This is growth supported by the presence of advanced healthcare facilities and infrastructure for the management of neuropathic pain and chronic pain conditions. The presence of active regulatory and reimbursement policies is expected to propel the adoption of the therapy during the forecast period.

Furthermore, the presence of key market players with strong investments in research and development (R&D) is critical for advancing drug formulations and delivery devices tailored to pain management. The key companies' R&D prioritizes the development of products for patient-specific needs and alternative therapeutic modalities for pain management and spasticity management, propelling the growth of the market in the country.

Market Challenges:

Regulatory Hurdles and High Costs Pose Challenges to Market Growth

The U.S. intrathecal drug market faces several challenges, including significant regulatory hurdles, such as the lengthy FDA approval process for new formulations and delivery systems, which delays clinical trials and market entry. Safety concerns, particularly the potential for misuse or overdose of potent drugs such as opioids, further hinder market growth. Additionally, high costs and economic barriers limit patient access, especially among low-income groups, due to inadequate insurance coverage. Furthermore, the shortage of trained professionals capable of administering and monitoring these therapies, along with limited access to specialized centers, poses a challenge for market growth.

U.S. INTRATHECAL DRUGS MARKET TRENDS

Rising Demand for Personalized Medicine Is a Prominent Trend

Precision medicine tailors medical treatment and interventions to individual characteristics such as genetic makeup, lifestyle, and environment. This approach enhances the effectiveness of intrathecal therapies, especially in complex conditions such as neurological disorders, chronic pain, and cancer. Additionally, intrathecal therapies are used for treating critical conditions such as spinal cord injuries and CNS infections, where personalized solutions make the treatment more effective.

Furthermore, increasing research activities for incorporating personalized approaches for pain management is expected to propel market growth.

- For instance, in January 2024, researchers from the University of Cincinnati Gardner Neuroscience Institute launched a clinical trial applying a personalized approach to pain management with an aim to improve post-surgical pain, reduce opioid dependence, and reduce the length of hospital stays. Such studies are expected to propel the adoption of intrathecal drugs for personalized approaches and further bolster market growth.

Integration of Advanced Technological Drug Delivery Devices to Bolster Market’s Growth

The increasing demand for drug delivery systems such as smart pumps and wearable delivery systems is streamlining the administration process of intrathecal drugs. These technologies helped to improve patient outcomes by providing precise drug dosages, real-time monitoring, and better adherence to treatment protocols, making them a prominent trend in the U.S. intrathecal drugs market.

Additionally, increasing product launches by key players for more convenient drug delivery is expected to boost market growth.

- For instance, in October 2023, Medtronic announced the approval of SynchroMed III intrathecal drug delivery system by the U.S. Food and Drug Administration (FDA) for patients with chronic pain, cancer pain, and severe spasticity.

Other Prominent Trends:

Integration of Telemedicine and the Incorporation of Regenerative Medicine through Intrathecal Therapy

The U.S. intrathecal drug market trend is witnessing a significant transformation with the emergence of stem cell therapy as a groundbreaking treatment option for neurological and spinal disorders. An innovative approach within this market involves the intrathecal application of stem cells, which entails direct injection into the cerebrospinal fluid (CSF). This method enables the stem cells to circulate through the CSF, effectively reaching the brain and spinal cord, positioning it as a promising treatment for various central nervous system conditions.

Additionally, the market is witnessing trends such as an increasing shift toward outpatient settings for intrathecal drug delivery. This transition enhances patient convenience and accessibility, allowing for more efficient management of chronic pain and other conditions. The integration of telemedicine plays a crucial role in remotely monitoring intrathecal drug therapy, enabling healthcare providers to manage treatments and adjust dosages without necessitating frequent in-person visits. Finally, developing regulatory trends, including new FDA guidelines and approvals, are facilitating the adoption of innovative intrathecal drug delivery systems and therapies.

Download Free sample to learn more about this report.

Trade Protectionism and Its Impact on the Market

High tariffs on imported intrathecal drugs can disrupt supply chains and increase costs. However, robust patent laws are crucial for fostering innovation despite the challenges posed by generic drugs and biosimilars. Additionally, global trade policies and international agreements significantly influence the U.S. healthcare and pharmaceutical industries.

Research and Development in the U.S. Intrathecal Drugs Market

Pharmaceutical and biotech companies are increasingly focusingly on the development of biologic gene therapies to manage chronic conditions treated with intrathecal drugs. Additionally, studies are going on to launch combination drugs for intrathecal administration. The integration of biologics and nanotechnology in drug formulation has the potential to enhance drug solubility and bioavailability, potentially reducing side effects and improving therapeutic outcomes. Furthermore, fostering collaboration between pharmaceutical companies, academic institutions, and healthcare providers can facilitate the exchange of knowledge, leading to the development of advanced therapies.

SEGMENTATION ANALYSIS

By Drug

Increasing Demand for Morphine for Pain Management Boosted Morphine Segment Growth

Based on drug, the market is divided into morphine, baclofen, ziconotide, bupivacaine, hydromorphone, clonidine, and others.

The morphine segment dominated the U.S. market due to the proven efficacy of morphine in managing chronic pain, especially cancer-related and post-surgical pains. Morphine has been the drug of choice for intrathecal drug delivery systems.

- For instance, as per the survey published by the American Society of Pain and Neuroscience (ASPN), morphine is preferred by the majority of the physicians engaged in treating chronic pain in the country.

Bupivacaine held the second-largest U.S. intrathecal drug market share. It is a local anesthetic agent used for managing malignant and nonmalignant spine pain. Increasing demand for bupivacaine for lower abdomen procedures and as a pain relief agent during labor and delivery is expected to propel the growth of the segment.

Baclofen, ziconotide, hydromorphone, clonidine, and others are expected to grow considerably during the forecast period. The growth of the segment is augmented by the increasing prevalence of chronic diseases such as spasticity and pain, leading to rising demand for intrathecal delivery. Such factors are expected to further promote the growth of these segments.

To know how our report can help streamline your business, Speak to Analyst

By Application

Pain Management Segment Led due to Rising Demand for Intrathecal Drugs

Based on application, the market is bifurcated into pain management and spasticity.

The pain management segment held the dominant U.S. intrathecal drugs market share in 2024. The dominant share of the segment is due to the rising prevalence of chronic pain-related diseases in the country. This has resulted in higher demand for intrathecal drugs, which offer faster drug delivery and immediate pain relief.

- For instance, according to data published by the U.S. Pain Foundation in 2022, around 50 million Americans were living with chronic pain. Pain is the major reason individuals seek healthcare and is the primary cause of long term disability in the country.

The spasticity segment accounted for a substantial share in 2024 owing to the high prevalence of spasticity in the country and thus increasing the demand for drug therapy.

- For instance, in December 2022, according to the American Academy of Physical Medicine & Rehabilitation’s Spasticity Summit report, approximately 795,000 people experiences strokes each year in the U.S., with spasticity affects approximately 35.0% of stroke patinets.

Such a rising number of cases propel the adoption of the drug and the growth of the segment in the market.

By Distribution Channel

Technological Advancements in the Hospiatl Pharmacy Management to Propel the Segment’s Growth in the Market

In terms of distribution channel, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies.

The hospital pharmacies accounted for the largest share of the U.S. intrathecal drugs market in 2024. The dominance of the segment is attributed to the greater adoption of these drugs in hospital settings for chronic diseases such as stroke, cancer, and brain injury in hospitals. The prevelance of these conditions boost the adoption of intrathecal drugs in hospitals, propelling the growth of the segment in the market. Additionally, the rising adoption of pharmacy automation solutions for medication management will propel the growth of the hospital pharmacies segment in the U.S.

For instance, in December 2024, Swisslog Healthcare, a robotic medication management solution, partnered with BD. This collaboration aimed to deliver hospital pharmacies an innovative end-to-end medication management solution by integrating robotics with BD's inventory management and workflow software. Such advancements in the sector aimed to boost the segment's growth.

The drug stores & retail pharmacies segment accounted for a prominent share of the U.S. market. The growth of the segment is due to the wide availability of product at these channels. However, the presence of a large number of pharmacies and drug stores in the country propels the growth of the segment in the market.

The online pharmacies segment is projected to expand during the forecast period. This growth can be attributed to the wide availability of prescription medications through these channels, along with enhanced support services and convenience for patients. Additionally, the increasing adoption of technology and e-commerce platforms in the U.S. is contributing to the segment's growth.

Future Outlook

The U.S. intrathecal drug market is poised for significant growth over the next 5 to 10 years owing to the rising prevalence of chronic pain disorders, cancer, and neurological conditions requiring advanced pain management solutions. Additionally, the integration of precision medicine, genetic profiling, and advanced drug delivery systems is expected to propel market growth during the forecast period. Furthermore, increasing focus of key players in the market to advance product offerings through strategic initiatives and funding is likely to propel market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Activities and Robust Product Portfolio of Key Market Players to Maintain their Market Position

In terms of competitive structure, the market has is fragmented with Hikma Pharmaceutical PLC, Piramal Critical Care, and Amneal Pharmaceuticals LLC as some of the prominent players in the U.S. intrathecal drugs market. With robust product portfolio and expanded research and development activities aimed at launching new products are expected to maintain their market positions.

Other important players include Baxter, Novartis AG, TerSera Therapeutics LLC, Mylan N.V., Pfizer Inc., Inc., and others. The rising focus of the companies on the introduction of innovative products with specific strategic initiatives and gaining approvals are anticipated to boost their presence in the U.S. market during the forecast period.

LIST OF KEY MARKET PLAYERS PROFILED:

- Hikma Pharmaceuticals PLC (U.K.)

- Piramal Critical Care (India)

- Baxter (U.S.)

- Novartis AG (Switzerland)

- TerSera Therapeutics LLC (U.S.)

- Mylan N.V.(U.S.)

- Pfizer Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: TerSera Therapeutics LLC. announced the 2024 Polyanalgesic Consensus Conference (PACC) guideline, reinforcing the role of PRIALT (ziconotide) for the treatment of severe chronic pain. This guideline recommended PRIALT as a first-line treatment option for chronic pain.

- March 2024: Nexus Pharmaceuticals LLC launched Baclofen Injection, which is administered intrathecally to treat patients with multiple sclerosis, cerebral palsy, spinal cord injuries, and other conditions that result in muscle spasms.

- January 2022: Amneal Pharmaceuticals LLC acquired Saol Therapeutics Baclofen franchise that includes Lioresal, an intrathecal baclofen product delivered through an implantable intrathecal pump.

- December 2021: Hikma Pharmaceuticals PLC launched Bupivacaine HCl Injection, USP in 0.25%, 0.5% and 0.75% concentration, available in 10mL and 30mL doses.

- March 2019: Piramal Critical Care announced the launch of MITIGO (Morphine Sulfate Injection, USP – Preservative-free) in 10 mg/mL and 25 mg/mL concentrations for patients with intractable chronic pain in the U.S. market.

REPORT COVERAGE

The U.S. intrathecal drugs market report focuses on an industry overview and market dynamics, such as the drivers, restraints, opportunities, and trends. In addition to this, the market provides information related to the prevalence of key diseases, overview and pipeline analysis of the new drug developed by market players. Furthermore, the U.S. market analysis also focuses on key industry developments and new product launches in the market by key companies. In addition, the impact of COVID-19 pandemic, detailed company’s profile, and the industry overview are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 3.8% from 2025-2032 |

|

Segmentation |

By Drug, Application, and Distribution Channel |

|

ByDrug |

· Morphine · Baclofen · Ziconotide · Bupivacaine · Hydromorphone · Clonidine · Others |

|

By Application |

· Pain Management · Spasticity |

|

By Distribution Channel |

· Hospital Pharmacies · Drug Stores & Retail Pharmacies · Online Pharmacies |

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 1.04 billion in 2024 and is projected to reach USD 1.38 billion by 2032.

The market is expected to exhibit a CAGR of 3.8% during the forecast period.

The morphine segment led the market.

The contributing factors, such as the increasing prevalence of chronic diseases and technological advancements, are key factors driving market growth.

The rise in personalized medicine development for intrathecal administration is the key trend in the market.

Hikma Pharmaceutical PLC, Piramal Critical Care, and Amneal Pharmaceuticals LLC are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us