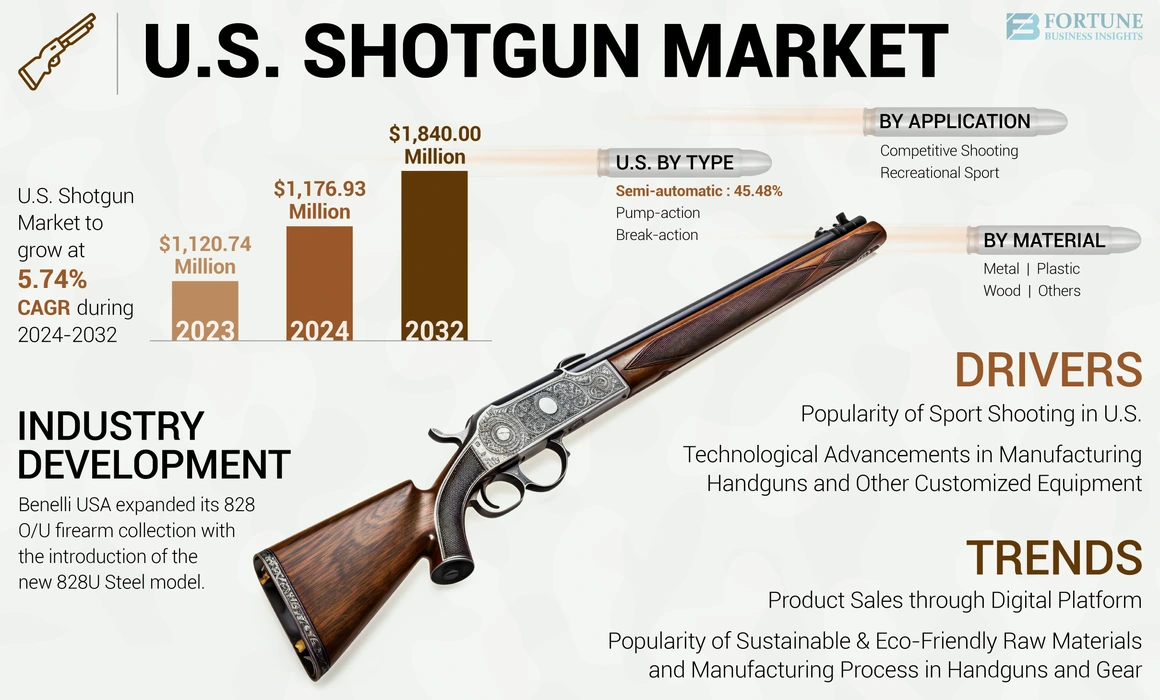

U.S. Shotgun Market Size, Share & Industry Analysis, By Type (Semi-automatic, Pump-action, and Break-action), By Application (Competitive Shooting and Recreational Sport), By Material (Metal, Plastic, Wood, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

The U.S. shotgun market size was valued at USD 1,120.74 million in 2023. The market is projected to grow from USD 1,176.93 million in 2024 to USD 1,840.00 million by 2032, exhibiting a CAGR of 5.74% during the forecast period.

Key players operating in the market are evolving their production process by adopting sustainable and eco-friendly practices. With the rising awareness regarding environmental issues, the manufacturers have started focusing on reducing the ecological footprint of firearms and gear by adopting sustainable alloys and metals, biodegradable and recycled materials, and non-toxic finishes.

Shotguns are a type of firearm available in single-barrel, double-barrel, or combination options. They are used for various purposes, including self-protection, home defense, hunting, and trap and skeet shooting (recreational purposes) and by police.

O.F. MOSSBERG & SONS, INC., Century Arms, Inc., Beretta Holding S.A., Browning International S.A., and RemArms LLC are some of the major players in the U.S. market. These leading companies possess extensive industry experience and offer a wide variety of firearms with multiple features for sport. Additionally, players are emphasizing building solid distribution networks throughout the country to penetrate deeper and reach potential consumers.

Market Dynamics

Market Drivers

Increasing Popularity of Sport Shooting in U.S. to Drive Market Growth

The rising interest of individuals participating in sport shooting in the U.S. is the major reason boosting the U.S. shotgun market growth. According to the National Shooting Sports Foundation, Inc. (NSSF), adult participation in sport shooting in America increased by 24.1% from 2009 to 2022. Furthermore, during that period, the adult population's sport shooting participation grew from 34 million to over 63.5 million. In 2022, 17%of all adults who participated in shooting sports were beginners, and there has been a 42% growth since 2020, reflecting a similar demographic pattern as seen in firearm purchasers. The growing inclination of women toward sports shooting in the U.S. is expected to fuel the product demand. According to the NSSF 2020 report, women made up 30% of the shooting sports community, in which 6 million women participated in target shooting alone.

Technological Advancements in Manufacturing Handguns and Other Customized Equipment to Trigger Product Demand

Technological advancements in precision engineering, improved materials, and smart features contribute to the development of high-performance sports guns to meet the evolving consumer demands. Furthermore, innovations such as adjustable triggers, auto-loading, electronic sights, and recoil management systems improve shooting accuracy and comfort, attracting both experienced and new shooters. In this respect, industry participants have been emphasizing new product launches to stay competitive. For instance, in March 2022, O.F. MOSSBERG & SONS, INC., which specializes in gun manufacturing, such as handguns, revolvers, and rifles, launched the optic-ready 940 Pro Tactical 8-shot auto-loading shotgun.

Market Restraints

Strict Firearms Regulations to Restrict Market Growth

Strict government rules and restrictions limit the accessibility and gun ownership in the U.S. Furthermore, the strict law enforcement agencies and inflexible regulations related to buying, selling, and use of sports rifles create barriers for potential buyers. These laws involve mandatory background checks, licensing requirements, and limitations on the types of firearms allowed, which result in making the buying process more complicated and can discourage individuals from participating in shooting sports. According to the current federal law, 40% of guns are sold through a federally licensed dealer in the U.S., and the dealer must perform a background check before selling the firearm to the consumer.

U.S. SHOTGUN MARKET TRENDS

Product Sales through Digital Platform to Emerge as Prominent Trend Throughout Forecast Period

Increasing internet penetration is one of the major factors that has enhanced online shopping in the country. Shopping online allows consumers to buy various goods and services in a short period and provides a convenient method of paying. Moreover, online shopping offers more product options, price comparison features, free shipping, ratings and reviews of products, and others, which further attract a large consumer base.

Rising Popularity of Sustainable & Eco-Friendly Raw Materials and Manufacturing Process in Handguns and Gear to Propel Market Growth

The increasing adoption of green gun manufacturing processes by adopting energy-efficient production techniques, water conservation strategies, and waste reduction programs is reducing the environmental impact associated with gun production. In addition, the implementation of energy-saving practices such as LED lighting and efficient machinery in the gun manufacturing process results in reducing the operational cost and environmental impact and contributes to a greener future.

Segmentation Analysis

By Type

Growing Popularity of Shooting Sports to Accelerate Semi-Automatic Gun Sales

On the basis of type, the market has been divided into semi-automatic, pump-action, and break-action.

The semi-automatic guns segment dominated the U.S. shotgun market share in 2023. These guns are one of the most popular among shooters in North Carolina. These handguns allow shooters to fire multiple shots in quick succession without needing to chamber a new round after each shot manually. Moreover, several semi-automatics are usually designed to absorb recoil better than pump-action handguns, allowing shooters to maintain better control and accuracy over successive shots, especially during fast-paced shooting.

Pump-action is projected to grow at the highest CAGR from 2024-2032. The mechanical simplicity of pump action guns makes them less prone to failures and malfunctions. In addition, their robustness, simplicity, and reliability increase their adoption among end users. The product is also flexible in terms of ammunition and can cycle both heavy and light loads, making it suitable for various shooting scenarios.

To know how our report can help streamline your business, Speak to Analyst

By Application

Physical Benefits and Mental Well-Being Prompted by Recreational Sports is Expected to Uplift Segment’s Growth

Based on the application, the market has been segregated into competitive shooting and recreational sport.

The recreational sport application segment dominated the market in 2023 and is projected to continue growing at the highest CAGR during the forecasted years. The increasing popularity of recreational sports, notably among youth, provides a break from the hectic lifestyle. Unlike professional sports, recreational sports emphasize enjoyment and social interaction. It also allows individuals to be involved in physical activities that are fun and improve their overall fitness level and well-being, which increases consumer interest in them and drives segmental expansion.

The competitive shooting application segment is likely to grow at a steady pace in the near term. The growing consumer knowledge regarding the various advantages of competitive shooting, including increased concentration, balance, arm & wrist strength, fine motor skills, hand/eye coordination, and developing self-discipline, will likely increase participation in the near term and contribute to the segment growth.

By Material

Technological Advancements In Precision Engineering And Improved Material Quality To Lead Metal Segment Growth

In terms of materials, the market has been segmented into metal, plastic, wood, and others.

The metal segment dominated the global market in 2023. Stainless steel is one of the most commonly used metals in firearm manufacturing. These guns are typically preferred for their anti-corrosive features. They are also strong and durable and can be engraved using different techniques with various attractive designs, such as floral themes and hunting scenes. These factors make stainless steel a popular choice among end users. Aluminum-based guns are likely to gain popularity in the U.S. in the foreseeable future. Superior adaptability, precision, corrosion resistance, material consistency, fatigue resistance, toughness, strength, and ductility make aluminum an ideal metal or material preference in guns.

The plastic material segment is predicted to hold a significant market share in the coming years. Plastic muskets are preferred for their lightweight features and weatherproofing ability. Unlike metal, plastic variants do not transfer cold or heat, making them more convenient. The rising knowledge regarding these multiple advantages of plastic has made it a preferred material among manufacturers for firearm application.

U.S. Shotgun Market Outlook

The growth of the U.S. shotgun industry is majorly driven by increasing concerns regarding personal safety and crime rates, which have fueled the demand for firearms as a means of self-defense. Moreover, with heightened awareness about personal protection, a significant number of U.S. citizens view gun ownership as essential for ensuring safety at home and in public, thus fueling the market growth. According to the National Shooting Sports Foundation, Inc. (NSSF), a U.S. Firearm Trade Association, in 2021, there were 5.4 million first-time gun buyers in the U.S.

The growing number of new gun owners countrywide fuels the market growth. According to the National Shooting Sports Foundation, Inc. (NSSF), a U.S. Firearm Trade Association, in 2023, there were 4.3 million first-time gun buyers compared to 4.2 million first-time gun buyers in 2022 across the U.S. Additionally, the increasing popularity of outdoor recreational activities, such as hunting & growing sports participation in shooting sports in the U.S. fuels the market growth. Several major players are focusing on launching new products. For instance, In September 2024, Sturm, Ruger & Company, Inc., a U.S.-based firearm manufacturer, launched its new Ruger LC Carbine chambered in 10mm Auto. According to the company, the new gun features an aluminum free-float handguard, QD attachment points, and a full-length Picatinny rail.

Competitive Landscape

Key Industry Players

Key Market Players Are Boosting Their Presence by Engaging More in Revolver Industry

The competitive landscape section offers insights into various competitive rivalries across the U.S. This includes an overview of each company, their financial performance, revenue generation, market potential, investments in research and development, new initiatives, strengths and weaknesses, product and brand portfolios, product launches, mergers and acquisitions, and their applications. The data provided focuses specifically on the companies' engagement within the revolver industry.

List of Key Companies Profiled In The Report

- F. MOSSBERG & SONS, INC. (U.S.)

- Century Arms, Inc. (U.S.)

- Beretta Holding S.A (Luxembourg)

- Browning International S.A. (Belgium)

- RemArms LLC (U.S.)

- American Tactical (U.S.)

- Connecticut Shotgun Manufacturing Company (U.S.)

- KelTec (U.S.)

- Heritage Manufacturing, Inc. (U.S.)

- Kolar Arms (U.S.)

- Caesar Guerini USA (U.S.)

- ZOLI USA (U.S.)

- Henry RAC Holding Corp. (U.S.)

- Serpent Arms (U.S.)

- Retay USA (U.S.)

Key Industry Developments

January 2023: O.F. MOSSBERG & SONS, a U.S.-based firearm company, launched its new SA-28 Field Synthetic Autoloader shotgun. According to the company, the new shotgun is built for days afield and at the range busting clay.

January 2023 – Benelli USA, a Maryland, U.S.-based handguns company, expanded its 828 O/U firearm collection with the introduction of the new 828U Steel model. The new model is technologically advanced and features 12- and 20-gauge. It also includes Benelli Surface Treatment on the receiver, barrels, and lock plate, which provides superior corrosion protection and makes the product suitable for harsh environments.

January 2023 – Stoeger Industries, a U.S.-based firearms company, announced that it had improved the features of its handgun collections, P3000 and M3000. The new M3000 line features recoil pads, removable cheek pieces, and customization options. The P3000 handguns include improved ergonomics and integrated swivel studs.

October 2022: O.F. Mossberg & Sons, Inc., a U.S.-based firearms manufacturer, received the 2020 Caliber Award for the best new shotgun for its 940 JM Pro competition shotgun. The product features a slim profile forend, gas-operating system, adjustable stock, operating controls, oversized loading port, Briley extended chokes, and HIVIZ® TriComp sight system.

September 2022 – Chapuis Armes, a French gun manufacturer, exhibited its sporting side-by-side and over-under handguns at the Dallas, Texas, U.S.-based Beretta Gallery. Guests were invited to view the products and meet the executives from the company’s facility in France.

Investment Analysis and Opportunities

Increasing Brand Investment and Collaboration with Different Stakeholders to Provide Market Opportunity

Manufacturers are emphasizing advanced gun manufacturing techniques, which have enabled the development of high-performance guns, using new projectiles, powder, and casing to improve accuracy and reduce recoil. Furthermore, innovations such as adjustable triggers, auto-loading, electronic sights, and recoil management systems improve shooting precision and comfort, attracting both experienced and new shooters. In this respect, industry participants have been focusing on new product launches to stay competitive. Moreover, the availability of customization options and accessories in handguns provided by players helps cater to individual needs and preferences, positively influencing the U.S. shotgun market statistics.

Report Coverage

The U.S. shotgun report analyzes the market in-depth and highlights crucial aspects such as prominent companies, competitive landscape, and shotgun product segmentation based on types, application usage areas, and material used. Besides this, the U.S. shotgun research report provides insights into the market trends. It highlights significant industry developments along with sporting clay-related statistics in the U.S. market and product adoption trends in North Carolina. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.74% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Application

By Material

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. shotgun industry size was USD 1,176.93 million in 2024 and is anticipated to record a valuation of USD 1,840.00 million by 2032.

Fortune Business Insights says that the global market value stood at USD 1,120.74 million in 2023.

The U.S. shotgun industry will exhibit a CAGR of 5.74% during the forecast period.

By type, the semi-automatic shotgun type segment dominated the market in 2023.

The increasing popularity of sport shooting in the U.S. and technological advancements in manufacturing processes drive the growth of the shotgun industry in the country.

O.F. MOSSBERG & SONS, INC., Century Arms, Inc., Beretta Holding S.A., Browning International S.A., and RemArms LLC are some of the leading players in the U.S. market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us