U.S. Utility Wires and Cables Market Size, Share & Industry Analysis, By Installation (Overhead, Underground, and Submarine), By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage), By Material (Aluminum and Copper), By Application (Generation & Transmission and Distribution), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

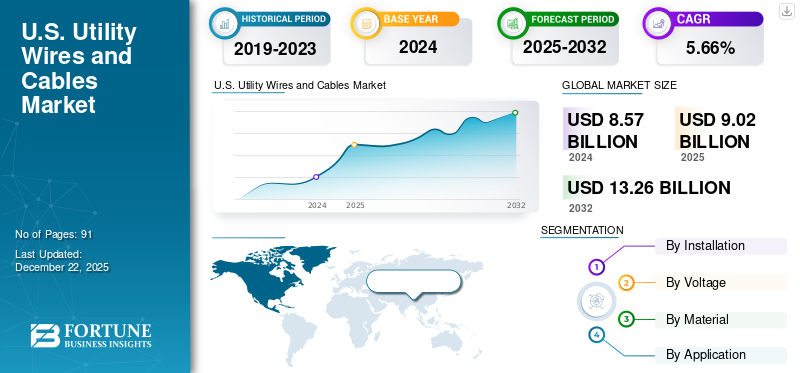

The U.S. utility wires and cables market size was worth USD 8.57 billion in 2024. The market is projected to grow from USD 9.02 billion in 2025 to USD 13.26 billion by 2032, exhibiting a CAGR of 5.66% during the forecast period.

Utility wires and cables play a crucial role in the energy infrastructure of the U.S., facilitating electricity transmission and effective distribution nationwide. The market is anticipated to expand due to investments in infrastructure, integration of renewable energy, modernization of the grid, and advancements in technology.

As the focus on renewable energy sources, including solar and wind, intensifies, there is an increasing demand for efficient transmission and connection of these distributed generation facilities to the primary grid. Utility wires and cables are designed to manage higher voltage levels and longer-distance power transmission, and will become essential to support this transition. In addition, the fiber optic cables are increasingly being integrated into utility wire and cable systems, not as a replacement for power transmission, but as a means to provide high-speed data communication and other services alongside or within existing infrastructure. These factors have been driving market share in recent years.

Prysmian is the leading player in the market. The company designs and manufactures a wide range of electric cables and products and serves all types of commercial and residential wiring circuits. With more than 150 years of experience, the company serves with a wide network across the U.S. and other countries.

Download Free sample to learn more about this report.

U.S. Utility Wires and Cables Market Trends

Growing Focus on Sustainability and Technological Advancements are Recent Market Trends

With technological advancements and awareness about sustainability, the power and cables sector has also embraced and evolved to incorporate these features. The United Nations describes renewable energy as energy that replenishes faster than it is consumed. The most general types consist of solar, wind, geothermal, hydropower, and bioenergy. The U.S. renewable energy market is based on these power sources. In 2023, about 60% of this electricity generation was from fossil fuels—coal, natural gas, petroleum, and other gases, about 19% was from nuclear energy, and about 21% was from renewable energy sources.

The U.S. holds significant growth opportunities for new renewable energy projects to boost the deployment of wires and cables. The government also aims to expand renewable energy production on public lands and waters, comprising a commitment to employ 30 GW of offshore wind by 2030, 15 GW of floating offshore wind by 2035, and a target goal of sanctioning at least 25 GW of onshore renewable energy by 2025. It contains solar, wind, and geothermal projects, as well as gen-tie lines on public lands that are crucial for connecting clean energy projects on both federal and non-federal land to the grid.

MARKET DYNAMICS

MARKET DRIVERS

Growing Need for Grid Modernization Owing to Aging Infrastructure to Support Market Growth

The U.S. has a vast and intricate network for distributing electricity to customers. The complex electricity network depends on a vast network of wires and cables for efficient, reliable transmission and distribution of power; however, this network is facing challenges, owing to the aging infrastructure. To tackle these challenges, grid modernization efforts are being undertaken, which involve upgrading and modernizing the electrical power grid to improve reliability, efficiency, and resilience. Wires and cables are fundamental components of the grid, ensuring reliable and efficient power transmission and distribution. Wires and cables are essential for conducting electricity from power generation sources to consumers. They are key to efficient power transmission and distribution, connecting power plants, substations, and homes.

Modernizing the grid and using advanced cables (including those with carbon cores and aluminum conductors) can reduce line losses and improve the overall reliability of the electricity supply. A modernized grid with resilient wires and cables can withstand severe weather conditions and reduce the frequency and duration of power outages.

Grid modernization enables the integration of larger-scale renewable energy systems, such as wind and solar, into the grid. Improved efficiency and reduced energy losses in the grid, and with modern cables, can lead to lower operational costs for utilities, ultimately benefiting consumers.

Thus, the trend of grid modernization is anticipated to boost the utility wires and cables market in the U.S. during the forecast period.

Expansion of Utility Sector and Government Support to Fuel Market Growth

Government support plays a critical role in the development and expansion of the utility sector. For instance, the Department of Energy's (DOE) Grid Resilience and Innovation Partnerships (GRIP) program provides funding for projects that enhance the resilience of the power grid, addressing threats such as extreme weather and increasing capacity to meet growing demand.

The Demonstration of Energy & Efficiency Developments (DEED) program offered by the American Public Power Association allocates funding for innovative projects aimed at enhancing efficiency, lowering electricity generation expenses, exploring novel technologies, and refining processes.

In October 2024, the Grid Deployment Office (GDO) of the U.S. Department of Energy revealed an investment of USD 1.5 billion across four transmission initiatives via the Transmission Facilitation Program (TFP). The investment will address the financial challenges associated with transmission development, enhance grid reliability and resilience, ease expensive transmission congestion, and provide access to affordable energy.

Overall, such programs help and accelerate the expansion of the utility sector, where wire and cable systems are essential components of power transmission projects, facilitating the safe and efficient transfer of electricity over long distances. These systems are used in various types of power transmission, including overhead lines and underground cables, and are crucial for ensuring the reliability and availability of electricity.

RESTRAINING FACTORS

Fluctuations in Raw Material Prices to Hinder Market Growth

Fluctuations in raw material prices can significantly affect the pace and growth of the industry. The raw materials used in manufacturing utility wires and cables include copper, aluminum, steel, and various polymers. Each of these materials is influenced by different market dynamics, leading to price volatility. Copper is an outstanding conductor of energy and is widely used in various power transmission and distribution applications. However, copper prices are subject to global supply and demand dynamics, geopolitical factors, and currency fluctuations.

Changes in copper prices can directly impact the cost of production for cable manufacturers, leading to price variations in the final transmission systems. The variation in raw material prices can affect investment decisions in the industry. During price fluctuations of raw materials, manufacturers may delay or reconsider expansion plans, leading to a potential slowdown in the U.S. utility wires and cables market growth. The price volatility can impact project timelines in the power sector. Power utilities and infrastructure projects often have long planning and development cycles. Fluctuations in cable prices can disrupt project budgets and timelines, causing delays in executing power transmission and distribution projects.

MARKET OPPORTUNITIES

Integration of Renewable Energy Sources to Create Expansion Opportunities

As the country focuses on shifting toward a low-carbon economy, the role of renewable energy is becoming more significant. The U.S. Energy Information Administration’s Annual Energy Outlook 2022 report estimates that renewables are projected to account for over 40% of electricity generation by 2050. To achieve the renewable energy target, a significant power transmission and distribution infrastructure is essential to support. Renewable energy sources such as solar or wind farms are often located far from populated areas and require long-distance transmission lines. The upcoming trend of offshore energy farms is further anticipated to stimulate the need for submarine cables, and thus has created new opportunities for market players.

A number of policies are in place that are boosting the adoption of renewable energy. The government is also assisting and guiding utility providers in integrating renewable energy in generation and distribution. Further, grid modernization and upgradation are also anticipated to support the utility wires and cables market expansion.

IMPACT OF TARIFF

The impact of tariffs on the biodiesel industry will be significant, as the U.S. utility sector is poised for significant financial pressures due to evolving tariff regulations that are anticipated to impact costs for raw materials and components used for wires and cables manufacturing and deployment.

On March 12, 2025, the U.S. imposed tariffs of 25% on Canadian steel and aluminum products. Aluminum imports to the U.S. mainly come from Canada, China, UAE, and Mexico. Thus, tariffs imposition on these countries will highly affect the market as aluminum is the most utilized material for overhead transmission lines. U.S. manufacturers will incur additional costs, which are likely to influence the wires and cables market.

Further, the Commerce Department has also been directed to investigate in accordance with section 232 of the Trade Expansion Act to assess the impact on national security from imports of copper. Copper is another critical raw material widely used in underground and submarine cables. Any unfavorable outcome in the investigation can have an added adverse impact on the market.

SEGMENTATION ANALYSIS

By Installation

Lower Maintenance Cost and Flexibility Boosted Overhead Segment Growth

By installation, the market is segmented into overhead, underground, and submarine.

The overhead segment dominated the market, owing to the cost-effectiveness and ease of installation offered by them. For power transmission and distribution, overhead wires are generally preferred for long distances, and they also offer scalability to meet growing energy demands, where the solution can be expanded by adding more poles and cables.

The underground segment is expected to grow at a faster rate over the forecast period, owing to enhanced safety and reliability offered by it in urban infrastructures. Underground cables are less susceptible to weather-related power disruptions, such as storms or high winds, which can otherwise impact overhead lines.

Submarine installations are anticipated to be favored, owing to increasing focus on offshore renewable energy projects, where submarine cables play a crucial role in transmitting offshore energy from offshore projects to substations on land for further utilization.

By Voltage

Enhanced Safety and Cost Effectiveness Fueled Low Voltage Segment Growth

By voltage, the market is segmented into low voltage, medium voltage, high voltage, and extra-high voltage.

The low voltage segment accounted for the dominant market share. Low voltage cables are widely used in utility wires and cables due to their safety, cost-effectiveness, and suitability for various applications, particularly in local power distribution and data transmission. They are less prone to causing electrical hazards and are more adaptable for intricate network setups.

The extra-high voltage segment is anticipated to grow at the fastest rate during the forecast period, owing to ongoing upgradation and modernization of power grids and related infrastructure, where high loads of power are required to manage. The extra-high voltage can transmit more power for the same cable size and number of conductors. This is crucial for meeting growing electricity demands and in areas with high power consumption. In November 2024, the U.S. Department of Energy’s (DOE) Office of Electricity (OE) selected four groundbreaking high-voltage direct current (HVDC) transmission research and development projects. About USD 11 million will be provided in funding, which is anticipated to help reduce transmission system costs by 35 percent by 2035.

The medium voltage segment is also anticipated to grow owing to its increasing requirement in transmitting electricity from substations to various destinations, including industrial plants, commercial buildings, and residential areas.

To know how our report can help streamline your business, Speak to Analyst

By Material

Excellent Conductivity & Durability to Boost Aluminum Demand

By material, the market is segmented into aluminum and copper.

The aluminum segment accounted for a dominant market share and is anticipated to showcase the fastest growth in the coming years. Aluminum wires and cables are widely used in the utility sector for their excellent electrical conductivity, low weight, and cost-effectiveness. They are a primary choice for power transmission and distribution, including overhead lines and local power distribution lines, due to their superior conductivity-to-weight ratio.

Copper wires and cables are also extensively used in underground and submarine cables. Copper wires and cables are extensively used in the utility sector for various applications, primarily due to their high electrical conductivity and durability.

By Application

Improvement in Power Infrastructure Boosts Expansion of Generation & Transmission Application

By application, the market is segmented into generation & transmission and distribution.

The generation & transmission segment held the highest U.S. utility wires and cables market share. The growth of the segment is influenced by the expansion of power generation and transmission infrastructure, which includes investments in smart grids, upgrading existing power transmission systems, and other factors.

The distribution is anticipated to be the fastest-growing segment during the forecast period, owing to rapid urbanization and infrastructure development projects are significant drivers of demand for wires and cables. These projects require extensive wiring for power distribution, lighting, and other essential services.

COMPETITIVE LANDSCAPE

Key Industry Players

Acquisition and Business Expansion are Major Strategies Adopted by Market Players

The market is experiencing significant growth, driven by increased infrastructure development, urbanization, growing demand from data centers, and the transition to renewable energy sources. In addition, wire and cable companies are primarily focusing on acquisitions and business expansion to boost their revenue. For instance, in July 2024, Prysmian completed the acquisition of Encore Wire Corporation. The acquisition will bolster Prysmian's leading status in North America. Prysmian stands to gain from improved cross-selling possibilities, along with the efficiency and innovation found in Encore Wire's distinct production, distribution strategies, and service quality. Additionally, the deal enhances the significance of the North American division in Prysmian's global presence.

Also, in July 2024, LS GreenLink USA, Inc., the American branch of the South Korean cable manufacturing firm LS Cable, revealed plans to build a new subsea cable manufacturing plant at the Deep-Water Terminal Site in Chesapeake, with an investment of USD 681 million.

LIST OF KEY U.S. UTILITY WIRE AND CABLE COMPANIES PROFILED

- Southwire Company (U.S.)

- Belden Inc. (U.S.)

- Encore Wire Corporation (U.S.)

- Prysmian Group (U.S.)

- Nexans (U.S.)

- LS Cable and System (U.S.)

- Superior Essex Inc. (U.S.)

- Houston Wire & Cable Co. (U.S.)

- American Wire Group (U.S.)

- Cerrowire LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: RTE, the Transmission System Operator in France, awarded a three-year agreement for the supply of high-voltage and extra-high-voltage underground cables to Prysmian Group. The agreement also includes the provision of accessories and installation support, and manufacturing of cables will take place in the group’s France, Italy, and Netherlands facilities.

- May 2024: Hitachi Energy teamed up with Pattern Energy, a company focused on renewable energy, to assist with the SunZia Transmission Project. This initiative links the 3,515-megawatt SunZia Wind project located in New Mexico to Arizona and other western states, making it one of the largest wind energy projects in the U.S. utilizing HVDC connections. The agreement includes service solutions for the HVDC link, incorporating Hitachi Energy's HVDC Light technology to enhance the availability of renewable energy to residences and businesses in the region.

- March 2024: Hitachi Energy and Grid United, a company specializing in electrical transmission, revealed a partnership aimed at providing high-voltage direct current (HVDC) technology for Grid United’s transmission initiatives that will link the eastern and western power grids in the U.S.

- July 2023: Prysmian Group launched Prysmian PRYSOLAR, the most innovative cable solution for solar power generation. Solar cables, also known as solar photovoltaic cables or solar PV cables, are specifically designed cables used in photovoltaic systems, in which they play a critical role: solar cables are used to transmit the electrical power generated by solar panels and serve as a conduit where the electricity travels, connecting the components of the whole circuit and ensuring the efficient and safe flow of power and hence the effective functioning of solar power installations.

- August 2022: Prysmian Group launched its first 525KV extruded submarine full cable system for HVDC applications. Their cable technology will allow an increase in the maximum transmission capacity of the bi-pole system up to more than 2.5GW.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, installation, voltage, material, and application. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the increased market growth in recent years. It focuses on key aspects, such as an overview of technological advancements. Additionally, it includes an overview of the reimbursement scenario for industry, the government initiatives with high efficiency in the U.S., key industry developments such as mergers, partnerships, and acquisitions, and the impact of tariffs on the market. Besides this, the report also offers insights into the market trends and highlights key industry dynamics.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.66% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Installation

|

|

By Voltage

|

|

|

By Material

|

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says the U.S. market for utility wires and cables was worth USD 8.57 billion in 2024.

The market is expected to exhibit a CAGR of 5.66% during the forecast period.

By voltage, the 100KV-250KV segment leads the market.

Prysmian Group, Nexans, Sumitomo Corporation, and Furukawa Electric Co Ltd are the top players in the market.

Fortune Business Insights says the U.S. market will be worth USD 13.26 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us