U.S. Intrathecal Drugs for Post-Operative Pain Management Market Size, Share & Industry Analysis, By Drug Class (Morphine, Baclofen, Ziconotide, Bupivacaine, Hydromorphone, Clonidine, Fentanyl, Sufentanil, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, Pain Clinics, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

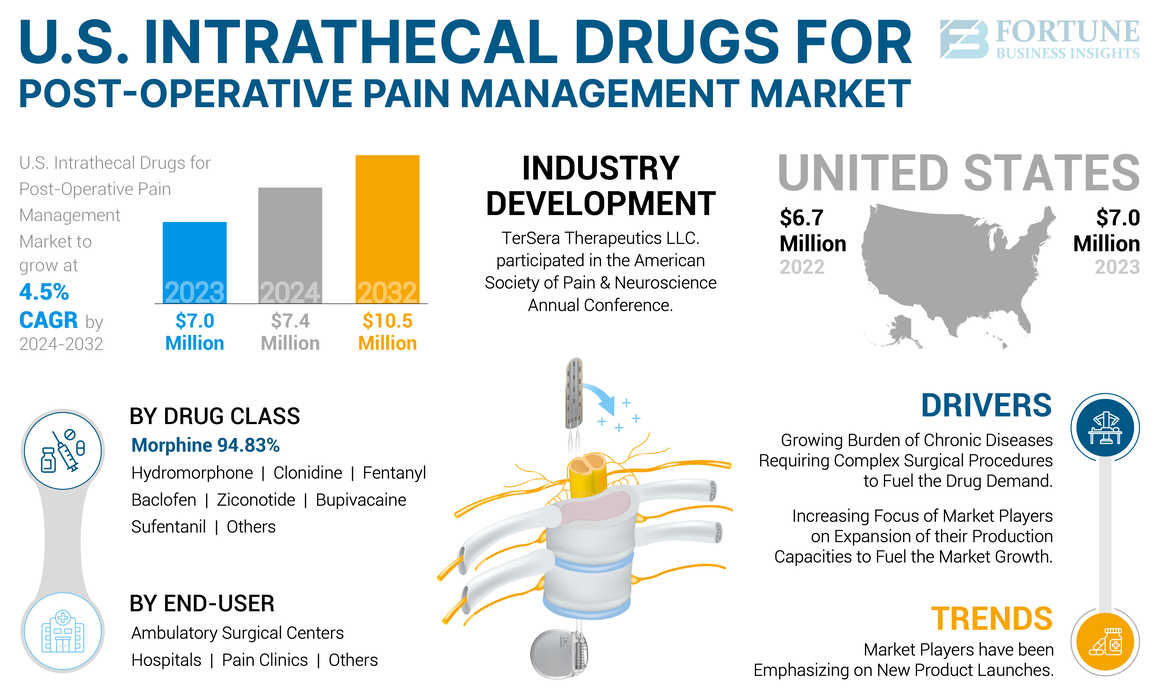

The U.S. intrathecal drugs for post-operative pain management market size was valued at USD 7.0 million in 2023. The market is projected to grow from USD 7.4 million in 2024 to USD 10.5 million by 2032, exhibiting a CAGR of 4.5% during the forecast period.

The severe pain experienced for a temporary period of time after going through surgical procedures such as knee arthroplasty, C-section, organ transplant, and other such surgeries is called post-operative pain. To manage this pain, doctors may prescribe pain management solutions such as oral, intravenous, or intrathecal analgesics.

Intrathecal drugs for post-operative pain management, such as morphine and bupivacaine, among others, are generally administered pre-surgery in the spinal cord area. The increasing number of surgical procedures such as transplants, coronary artery bypass, transurethral resection of the prostate (TURP), hip arthroplasty, knee arthroplasty, organ transplants, and others, have been fueling the market growth in the country.

- As per data published by AnMed in November 2023, in the U.S., around 790,000 total knee replacements and 450,000 total hip replacements are performed annually.

Currently, morphine, baclofen, and ziconotide are the only FDA-approved intrathecal drugs used for post-operative pain management. However, drugs such as bupivacaine, hydromorphone, and clonidine, among others, are also used off-label.

During the COVID-19 pandemic, the U.S. intrathecal drugs for post-operative pain management market experienced a decline in its value. The decline was observed as several non-emergency procedures were postponed to control the spread of the virus in the hospitals and clinics of the country. However, the market experienced significant growth in 2021 and 2022 due to an increase in the number of surgical procedures.

U.S. Intrathecal Drugs for Post-Operative Pain Management Market Trends

Market Players have been Emphasizing on New Product Launches

The increasing number of surgical procedures such as hip replacement, coronary artery bypass, and spinal surgeries has been fueling the demand for these drugs in the country. This is further supplemented by increasing awareness regarding the efficacy of intrathecal drugs such as morphine and bupivacaine in post-operative pain management.

Therefore, market players have increased their focus on new product launches to fulfill the increasing demand for intrathecal drugs for post-operative pain management.

- For instance, in April 2024, Baxter launched Ropivacaine Hydrochloride injection in the U.S. market. Ropivacaine is indicated in adults to produce local or regional anesthesia for surgery and acute pain management.

Download Free sample to learn more about this report.

U.S. Intrathecal Drugs for Post-Operative Pain Management Market Growth Factors

Growing Burden of Chronic Diseases Requiring Complex Surgical Procedures to Fuel the Drug Demand

In the case of chronic diseases such as colorectal cancer, heart failure, coronary artery disease, and benign prostatic hyperplasia, if the condition gets severe, surgeries are the ultimate treatment option. These surgeries require intrathecal drugs for post-operative pain management.

- For instance, for benign prostatic hyperplasia, the ultimate treatment option is surgery, which involves the displacement or removal of the obstructing adenoma of the prostate.

The increasing prevalence of these chronic diseases has been fueling the demand for intrathecal drugs for post-operative pain management.

- For instance, colorectal cancer is among the top 10 cancers by incidence in the U.S. and is also the second leading cause of death related to cancer in the country. According to the American Cancer Society (ACS), colorectal cancer would be responsible for an estimated 53,000 deaths in the U.S., with an annual incidence of around 106,590 cases in 2024.

Increasing Focus of Market Players on Expansion of their Production Capacities to Fuel the Market Growth

The demand for intrathecal drugs has been growing significantly with the rising number of complex surgeries in the country. To fulfill this demand, market players have escalated their emphasis on the expansion of their production capacities.

- For instance, in July 2020, Piramal Pharma, through its subsidiary Piramal Critical Care, partnered with Medivant Healthcare, the U.S.-based pharmaceutical outsourcing facility, to overcome the shortage of injectable drugs in U.S. hospitals.

The increasing emphasis of market players on increasing the accessibility of their products has also been fueling the U.S. intrathecal drugs for post-operative pain management market growth.

RESTRAINING FACTORS

Risk Factors Associated with the Use of Intrathecal Drugs May Limit the Market Growth

The rising awareness regarding the efficacy of intrathecal drugs for post-operative pain management has been fueling the market growth. However, there are certain risk factors associated with the use of intrathecal drugs that limit their usage for post-operative pain management.

For instance, the intrathecal administration of opioids for post-operative pain management causes certain side effects such as drug reaction, edema, nausea, constipation, and others.

Furthermore, the intrathecal administration of these drugs can also cause side effects such as vomiting, weight gain, urinary retention, sedation, alteration of memory or mood, and headaches.

Moreover, the serious side effects associated with the intrathecal administration of opioids can be respiratory depression. For instance, as per the research study published by John Wiley and Sons, Inc. in March 2022, out of the six patients who received intrathecal morphine for post-operative pain management, four patients experienced respiratory depression, and out of those four patients, three experienced somnolence and one experienced hypotension along with respiratory depression.

All these factors have been limiting the adoption of intrathecal drugs, thereby hindering the market growth.

U.S. Intrathecal Drugs for Post-Operative Pain Management Market Segmentation Analysis

By Drug Class Analysis

Strong Efficacy of Morphine for Post-Operative Pain Management to Drive Segment Growth

On the basis of drug class, the U.S. intrathecal drugs for post-operative pain management market is segmented into morphine, baclofen, ziconotide, bupivacaine, hydromorphone, clonidine, fentanyl, sufentanil, and others.

The morphine segment dominated the market in 2023. The segment’s dominance is attributed to the longer half-life of the drug class.

- For instance, as per a study published by Elsevier Ltd. in June 2023, around 0.1-0.15 mg of intrathecal morphine can provide post-operative analgesia for as long as 20-48 hours.

Moreover, the bupivacaine segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to its increasing adoption in surgeries, such as total abdomen hysterectomy, which require analgesic effects for shorter durations.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Increasing Number of Hospital Admissions for Effective Treatment is Responsible for the Segment’s Dominance

Based on end-user, the market is segmented into hospitals, ambulatory surgical centers, pain clinics, and others.

The hospital segment dominated the market in 2023. The segment’s dominance is attributed to the increasing number of hospital admissions for effective treatment.

- For instance, as per data published by the American Hospital Association, in 2022, there were around 33.6 million hospital admissions in the U.S., experiencing an increase of 1.0% from 2020.

Moreover, the others segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is attributed to the increasing focus of research institutes on conducting clinical trials to study the safety and efficacy of intrathecal drugs for post-operative pain management.

KEY INDUSTRY PLAYERS

Increasing Focus of Market Players on Strengthening their Brand Presence to Fuel Revenue Growth

Key players such as Piramal Pharma Limited (Piramal Group), Baxter, and Hikma Pharmaceuticals PLC accounted for a significant U.S. intrathecal drugs for post-operative pain management market share in 2023. The robust presence of these industry players is due to their focus on consolidating their brand presence in the market.

- For instance, in January 2024, Hikma Pharmaceuticals PLC participated in the 42nd Annual J.P. Morgan Healthcare Conference conducted in San Francisco, U.S. This participation enhanced the company’s reputation in the U.S. market.

Moreover, other players such as Viatris Inc., Pfizer Inc., and Amneal Pharmaceuticals LLC have been focusing on improving their production capacity to fulfill the increasing demand for intrathecal drugs.

LIST OF TOP U.S. INTRATHECAL DRUGS FOR POST-OPERATIVE PAIN MANAGEMENT COMPANIES:

- Piramal Pharma Limited (Piramal Group) (India)

- Baxter (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Viatris Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- Fresenius SE & Co. KGaA (Germany)

- TerSera Therapeutics LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024 – TerSera Therapeutics LLC. participated in the American Society of Pain and Neuroscience Annual Conference. This conference provided the company with an excellent opportunity to engage with healthcare professionals, share insights on pain management therapies, and explore potential collaborations in the field of neuromodulation.

- June 2024 – Amneal Pharmaceuticals LLC announced that it had participated in the 2024 Jefferies Healthcare Conference. Through this conference, the company provided data regarding its pipeline products, marketed products, and their sales. Participation in this conference created awareness regarding its products.

- March 2024 – Amneal Pharmaceuticals LLC was present at the 26th Annual Global Healthcare Conference conducted in Miami, U.S. Participation in this conference enhanced the company’s brand image in the market.

- February 2024 – Pfizer Inc. invited the general public and investors for listening to a webcast of a discussion with Chief Financial Officer and Executive Vice President, David Denton, at the TD Cowen at the 44th Annual Healthcare Conference. Such strategic moves strengthened the company’s brand presence in the U.S. market.

- January 2024 – Hikma Pharmaceuticals PLC participated in the 42nd Annual J.P. Morgan Healthcare Conference conducted in San Francisco, U.S. This participation enhanced the company’s reputation in the U.S. market.

REPORT COVERAGE

The report provides a detailed competitive landscape and market insights. This research report also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as the launch of new solutions in the market. Furthermore, the report covers regional analysis of different market segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market growth.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.5% from 2024-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Drug Class

|

|

By End-user

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 7.0 million in 2023 and is projected to reach USD 10.5 million by 2032.

The market is predicted to exhibit a CAGR of 4.5% during the forecast period.

By drug class, the morphine segment is the leading segment as it led the market in 2023.

The rising burden of chronic diseases and increasing number of hospital admissions are key factors fueling the market growth.

Piramal Pharma Limited (Piramal Group), Baxter, and Hikma Pharmaceuticals PLC are among the significant players operating in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us