U.S. Intrathecal Pumps Market Size, Share & Industry Analysis, By Application (Pain Management and Spasticity) By Drug (Morphine, Baclofen, Ziconotide, Bupivacaine, Hydromorphone, Clonidine, and Others), By End User (Hospitals, Ambulatory Surgical Centers, Pain Clinics, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

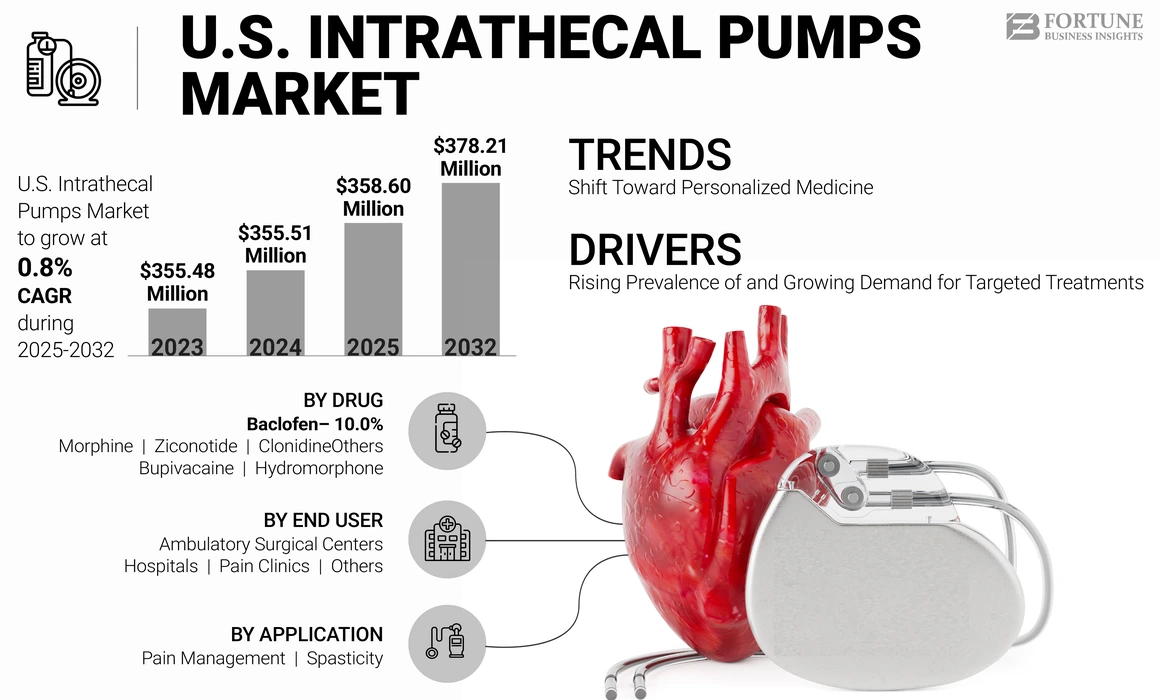

The U.S. intrathecal pumps market size was valued at USD 355.51 million in 2024. The market is expected to grow from USD 358.60 million in 2025 to USD 378.21 million by 2032, exhibiting a CAGR of 0.8% during the forecast period.

Intrathecal pumps, also known as pain pumps, are surgically implanted devices that deliver medication directly to the cerebrospinal fluid surrounding the spinal cord. The pumps are programmed in such a way that they deliver small amounts of medication directly to the central nervous system. This is done by pulling medication from the reservoir and pumping it through the catheter into the spinal cord. Thus, the intrathecal pump is used for delivering medication directly to the spinal cord and nerves as this method is more effective than taking medicine by mouth or intravenously. These pumps are used along with various opioid pain medications, anesthetics for pain management, spasticity management, anesthesia, and chemotherapy. The dosage required for intrathecal administration is much lower than that for the intravenous, intramuscular, and oral routes. Thus, the rising prevalence of chronic diseases and benefits associated with the pumps are expected to propel the U.S. intrathecal pumps market growth.

- For instance, data released by the U.S. Centers for Disease Control and Prevention (CDC) in April 2023 indicated that, in 2021, approximately 51.6 million adults in the U.S. suffered from chronic pain, with 17.1 million experiencing high-impact chronic pain. This scenario has resulted in a rise in the number of physicians prescribing intrathecal pumps, including opioids, which contributes to the market’s growth.

Furthermore, the presence of strong market players, such as Medtronic, with its advanced product offerings in the intrathecal pumps market and robust strategic initiatives to launch advanced products will propel the market’s growth during the forecast period.

Additionally, the market is witnessing trends, such as an increasing shift of patients toward the outpatient settings for intrathecal drug delivery. This transition enhances the patient convenience and accessibility, allowing for more efficient chronic pain management and spasticity management. Furthermore, the integration of telemedicine plays a crucial role in remotely monitoring intrathecal drug therapy, enabling healthcare providers to manage treatments and adjust dosages without necessitating frequent in-person visits. Finally, emerging regulatory trends, including new FDA guidelines and approvals, facilitates the adoption of innovative intrathecal drug delivery systems and therapies.

Impact of COVID-19

During the COVID-19 pandemic, the market witnessed a negative impact in terms of its value. This negative impact was due to disruptions across the healthcare systems caused by the outbreak. Elective procedures, such as intrathecal pump implantation were delayed due to an increased focus on the management of COVID-19 cases. This scenario led to a significant drop in the demand for new devices, such as pumps.

Additionally, several research and development activities for intrathecal pumps were delayed as key resources were redirected to address the pandemic situation. However, the market gradually recovered as the elective procedures resumed, and the adoption of remote monitoring and telemedicine increased, leading to the growth of the market during the forecast period of 2025-2032.

MARKET DYNAMICS

Market Drivers

Rising Prevalence of and Growing Demand for Targeted Treatments to Drive Market’s Growth

The growing prevalence of chronic pain diseases, such as back pain, cancer pain, and pain after a surgical procedure in the U.S. is expected to drive the demand for intrathecal pumps for the effective delivery of drugs.

The long-term management of chronic pain is mainly accomplished with oral analgesics. Still, due to the continuous administration of analgesics, the daily dose can escalate to the point of intolerable side effects or ineffective pain control. Conservative methods failed to demonstrate the proper effect of analgesia, leading to inadequate pain relief. Thus, intrathecal drug delivery systems are used for spine disorders, such as spondylosis and spondylolisthesis or non-spine-related pain disorders, such as rheumatoid arthritis, connective tissue disorders, chronic pancreatitis, and others. Thus, the rising aging population and inefficiency of current treatment methodologies are driving the growth of the U.S. pumps market.

- For instance, according to the data published by the U.S. Centers for Disease Control and Prevention (CDC), approximately 53.2 million American adults over 18 years were diagnosed with arthritis in 2021. Such a large population with this ailment will boost the growth of the market.

Market Restraints

High Cost of Intrathecal Pump Implantation & Side Effects Associated with Intrathecal Drugs to Hinder Market Growth

Despite the rising demand for intrathecal pumps, their high cost and the overall cost of intrathecal drugs administered through these pumps is comparatively higher than that of the other alternative treatment options.

- For instance, the Medtronic SynchroMed Pump costs between USD 13,000 – USD 14,000. Even though reimbursement is given for these devices, there are certain terms and conditions. Thus, such a high cost of the pumps is expected to hinder their adoption and hamper market growth.

Furthermore, side effects, such as cerebrospinal drug leakage, medical device site hematoma, infection, vomiting, weight gain, and urinary retention are the complications associated with overdose of these drugs. This can result in several medical complications that will also affect the market growth during the forecast period.

Market Opportunities

Increasing Adoption of Intrathecal Pumps for Cases Beyond Pain Management to Accelerate Market Growth

The usage of intrathecal drug delivery for new therapeutic areas, such as Parkinson's disease and multiple sclerosis is gaining attention for its ability to provide targeted and sustained release of medicines. Additionally, the increasing prevalence of these diseases and growing demand for targeted therapy options for effective motor symptom control is expected to boost the market's growth during the forecast period.

- For instance, according to the Parkinson's Foundation, approximately 1 million people in the U.S. are living with Parkinson's Disease (PD); this figure is expected to rise to 1.2 million by 2030.

This significant growth of the patient pool creates a need for advanced therapies where oral medications are insufficient. Thus, such scenarios are expected to propel the market expansion in the U.S.

Market Challenges

Limitations Associated With Devices May Restrict Market Growth

Despite the potential benefits of the intrathecal pump device, failure issues and barriers to its adoption among patients are significant challenges to the market’s growth. These pumps have a finite battery life that need a surgical replacement every 5-7 years. Motor dysfunction, blockages, and catheter kinks are the failure issues associated with the pumps that compromise patient safety.

Furthermore, high initial costs, limited insurance coverage, and the fear of surgical interventions are some factors that challenge the market’s growth.

Market Trends

Shift Toward Personalized Medicine is a Prominent Market Trend

Intrathecal therapies treat critical conditions, such as spinal cord injuries and CNS infections; precision medicine tailors medical treatments and interventions to individual characteristics, such as genetic makeup, lifestyle, and environment. Thus, this approach enhances intrathecal therapies for complex neurological disorders, such as Parkinson’s, where personalized solutions make the treatment more effective. Thus, with rising demand for personalized medicine and gene therapy, intrathecal drug delivery plays a crucial role in targeted drug administration and improving patient outcomes.

- For instance, in March 2024, Nexus Pharmaceuticals LLC launched Baclofen Injection, US. It is administered intrathecally to treat patients with multiple sclerosis, cerebral palsy, spinal cord injuries, and other conditions that result in muscle spasms.

Download Free sample to learn more about this report.

TRADE PROTECTIONISM

The U.S. intrathecal pumps market might be affected by high tariffs and regulations that impact the import of medical devices and components. The country’s healthcare policies, particularly those related to Medicare, Medicaid, and private insurance, play a crucial role in determining the adoption and reimbursement rates for intrathecal pumps. This directly impacts patients’ access to these devices. Such policies also affect trade and influence the market’s growth.

RESEARCH AND DEVELOPMENT

Advancements in precision drug delivery, biocompatibility, and smart connectivity drive the U.S. intrathecal pumps market growth. Future research and development efforts are focusing on user-friendly miniature devices with the integration of Artificial Intelligence (AI).

Also, the increasing adoption of artificial intelligence in pumps to optimize drug delivery schedules and dosages for easy use and patient comfort is prompting medical device companies to develop advanced devices. Additionally, the rising demand for personalized medicines and real-time monitoring will boost the development of innovative devices. Increasing indications, such as non-opioid pain management and regenerative medicine will further enhance the market’s growth potential. These innovations may improve patient outcomes while addressing affordability and accessibility challenges.

SEGMENTATION ANALYSIS

By Application Analysis

Rising Prevalence of Chronic Pain Diseases and Product Launches to Propel Product Use in Pain Management

Based on application, the market is divided into spasticity and pain management.

The pain management segment held a significant U.S. intrathecal pumps market share in 2024. The rising prevalence of chronic pain diseases in the country and increasing cases of overdose and opioid dependence will propel the demand for intrathecal pumps for faster drug delivery and immediate pain relief. Additionally, the rising focus of key players on launching intrathecal drugs for pain management will boost the segment’s growth during the forecast period of 2025-2032.

- For instance, in July 2024, TerSera Therapeutics LLC announced the 2024 Polyanalgesic Consensus Conference (PACC) guideline, reinforcing the role of PRIALT (ziconotide) for the treatment of severe chronic pain. This guideline recommended PRIALT as a first-line treatment option for chronic pain.

The spasticity segment is expected to grow during the forecast period. The rising prevalence of stroke and spinal injuries leading to muscle spasticity is propelling the demand for targeted drug treatments and a sustained drug delivery for a longer time via pumps. Thus, such scenarios will promote the segment’s growth.

By Drug

Demand for Morphine Increased to Manage Pain Effectively

Based on drug, the market is divided into morphine, baclofen, ziconotide, bupivacaine, hydromorphone, clonidine, and others.

The morphine segment held a significant U.S. intrathecal pumps market share in 2024. Utilization of this drug in the management of chronic pain, especially cancer and post-surgical pains, is a key market trend. Thus, morphine has been the drug of choice for use in the intrathecal drug delivery systems. Additionally, the focus of key players to launch new products with morphine will boost the segment’s growth.

- For instance, in March 2019, Piramal Critical Care announced the launch of MITIGO (Morphine Sulfate Injection, USP – Preservative-free) in 10 mg/ml and 25 mg/ml concentrations for patients with intractable chronic pain in the U.S. market.

The bupivacaine segment holds the second-largest share of the U.S. intrathecal pumps market. The increasing adoption of this drug as a pain relief agent during the lower abdomen procedures and labor & delivery is propelling the segment’s growth.

Ziconotide, baclofen, clonidine, hydromorphone, and other segments are expected to grow during the forecast period. Increasing prevalence of chronic diseases, such as spasticity and chronic pain is leading to a robust demand for these drugs, which will used in intrathecal delivery. Such scenarios will promote the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By End User

Shift of Patients’ Preference to Hospitals to Boost Hospital Segment Growth

Based on end user, the. market is segmented into hospitals, ambulatory surgical centers, pain clinics, and others.

The hospitals segment held a dominant share of the U.S. market in 2024. The rising number of patients suffering from chronic diseases, such as strokes, cancers, and brain injuries in hospitals and the presence of skilled professionals for installing the pumps with the required medical training and accuracy will boost the segment’s growth. Furthermore, the rising number of hospitals in the country will boost the segment’s growth in the market.

- For instance, according to the American Hospital Association, U.S. Hospital Statistics 2024, there are 6,120 hospitals in the U.S.

On the other hand, the ambulatory surgical centers segment held the second-largest market share. ASCs come with several benefits, such as the presence of an advanced healthcare infrastructure and highly trained and experienced medical professionals. Also, the procedures performed in an ASC usually do not require an overnight stay and can be performed safely in an outpatient setting. Additionally, the presence of many ambulatory surgery centers in the U.S. will boost the segment’s growth.

Additionally, many ambulatory surgery centers in the U.S. aim to boost the adoption of intrathecal pumps, thereby fueling the segment’s growth.

- In December 2022, according to the Ambulatory Surgery Center Association, there were 6,200 Medicare-certified ASCs in the U.S. Such a substantial number of ASCs is expected to drive the segment’s progress during the forecast period.

Furthermore, the pain clinics and others segments are expected to grow during the forecast period. A rising number of clinical studies to launch new drugs for pain management is expected to boost the segment’s growth.

Future Outlook

The U.S. intrathecal pump market is poised to grow during the forecast timeframe. The rising prevalence of chronic pain disorders, cancers, and neurological conditions, combined with an increasing focus of key players on advancing their product offerings with strategic initiatives and funding, will propel the market’s growth in the future.

Furthermore, technological advancements are enhancing product efficacy through improved drug delivery systems and smart monitoring capabilities, making intrathecal pumps an attractive alternative to opioids for pain management. Increased focus on effective pain management strategies, coupled with strategic collaborations among key players, further propels the market expansion. Additionally, the growing awareness and acceptance of intrathecal therapy among healthcare professionals and patients are likely to increase its adoption. However, challenges, such as potential complications, ongoing management needs, and varying reimbursement policies remain critical considerations for the market's future. Overall, the outlook for the intrathecal pump market remains positive, promising improved patient care and quality of life.

KEY INDUSTRY PLAYERS

Strategic Activities and Robust Product Portfolio by Key Players to Help Them Maintain their Market Position

The competitive landscape reflects a highly consolidated structure. Medtronic, Tricumed Medizintechnik GmbH, and Flowonix Medical Inc. are the major players operating in the U.S. intrathecal pumps market. Medtronic has a strong presence in the market due to its strategic activities and strong product portfolio.

- For instance, in May 2022, a survey was published by the American Society of Pain and Neuroscience (ASPN) in the National Center for Biotechnology Information (NCBI), in which it stated that the majority of healthcare professionals use pumps manufactured by Medtronic for their patients to manage chronic pain and spasticity.

LIST OF KEY MARKET PLAYERS PROFILED:

- Medtronic (Ireland)

- Tricumed Medizintechnik GmbH (Germany)

- Flowonix Medical Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Medtronic announced the U.S. Food and Drug Administration (FDA) approval of SynchroMed III intrathecal drug delivery system for patients with chronic pain, cancer pain, and severe spasticity.

- May 2022: Flowonix Medical, Inc. partnered with Miratech Medical to distribute its targeted drug delivery products. Under the new agreement, Miratech would become the sole U.S. distributor for Flowonix’s product line, including its flagship implantable drug infusion pump, the Prometra II.

- February 2020: Flowonix Medical, Inc. received the U.S. Food and Drug Administration (FDA) approval to market the Prometra II Programmable Pump System for use with intrathecal baclofen.

REPORT COVERAGE

The report focuses on an industry overview and market dynamics, such as drivers, restraints, opportunities, and trends. In addition, it provides information related to the prevalence of key diseases and an overview of the new devices by the market players. Furthermore, the U.S. market analysis also focuses on key industry developments and new product launches by key companies. In addition, the impact of COVID-19, as well as a detailed company profile and the industry overview during the pandemic, are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 0.8% from 2025-2032 |

|

Segmentation |

By Application

|

|

By Drug

|

|

|

By End User

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market value stood at USD 355.51 million in 2024 and is projected to reach USD 378.21 million by 2032.

The market is expected to exhibit a CAGR of 0.8% during the forecast period of 2025-2032.

By drug type, the morphine segment is projected to lead the market.

Factors, such as the increasing prevalence of chronic diseases and technological advancements in intrathecal pumps are expected to drive the market’s growth.

Rise in personalized medicine development for intrathecal administration is the key trend in the market.

Medtronic is one of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us