Vacuum Blood Collection Tube Market Size, Share & Industry Analysis By Product Type (Serum Separation Tubes, EDTA Tubes, Plasma Separation Tubes, Heparin Tubes, Rapid Serum Tubes, and Others), By Material (Plastic and Glass), By Application (Serology & Immunology, Coagulation Tests, Blood Routine Examination, and Others), By End User (Hospitals & ASCs, Clinical Laboratories, Blood Banks, and Others), and Regional Forecast, 2026-2034

VACUUM BLOOD COLLECTION TUBE MARKET OVERVIEW

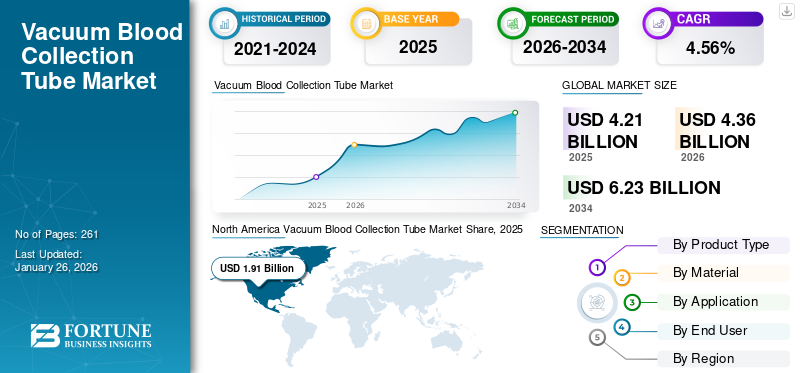

The global vacuum blood collection tube market size was valued at USD 4.21 billion in 2025 and is projected to grow from USD 4.36 billion in 2026 to USD 6.23 billion by 2034, exhibiting a CAGR of 4.56% during the forecast period. North America dominated the vacuum blood collection tube market, accounting for a 45.28% market share in 2025.

A vacuum blood collection tube refers to a product that contains a vacuum, used to collect blood samples from a patient population. The increasing prevalence of chronic diseases, such as infectious diseases, cancer, and others, is resulting in the growing number of patient admissions in healthcare settings. The surging number of patient admissions is resulting in the growing need for routine patient monitoring, testing, and diagnostics, thereby supporting the adoption rate of the product.

- For instance, according to 2025 statistics published by the American Cancer Society, it was reported that about 2.0 million new cancer cases are estimated to occur in the U.S.

Furthermore, the growing initiatives toward improving healthcare infrastructure and diagnostics among governmental organizations are also expected to contribute to the demand for these products. This, along with growing focus toward the integration of technological advancements in these tubes among the key players such as BD, Greiner Bio-One International GmbH, and others, is anticipated to contribute to the global market growth.

Market Dynamics

Market Drivers

Growing Prevalence of Chronic Conditions to Drive Market Expansion

The increasing prevalence of chronic conditions, such as diabetes, cancer, nephrological disorders, cardiovascular diseases, and others among the patient population, is resulting in the growing demand for diagnostic tests, subsequently driving the adoption rate of vacuum blood collection tubes.

- For instance, according to 2024 data published by the Centers for Disease Control & Prevention (CDC), it was reported that about 5% of adults have coronary artery disease in the U.S.

Additionally, the recurring outbreaks of infectious diseases are also a vital contributing factor in increasing the demand for routine diagnostic monitoring among patients. Vacuum blood collection tubes offer several advantages, such as the maintenance of sample sterility, integrity, and compatibility with analyzers, which supports the higher testing volumes among patients.

Therefore, the increasing prevalence of chronic diseases, along with the growing focus of key players on R&D activities to launch novel products, is likely to boost the adoption rate, thereby supporting the global vacuum blood collection tube market growth.

Other Prominent Drivers

- Expansion of hospital and lab infrastructure – A growing number of diagnostic labs and hospitals worldwide boosts product demand.

- Standardization of regulatory requirements – Strict regulatory and clinical standards for blood samples favor vacuum-based collection tubes.

- Recurring consumable demand – Single-use vacuum tubes ensure ongoing replacement cycles.

- Improvement in healthcare infrastructure in emerging countries – Healthcare infrastructure growth in Asia Pacific, Latin America, and Africa creates new opportunities.

Market Restraints

Alternative Technologies to Hinder the Adoption of Products

The growing prevalence of chronic diseases is increasing the demand for routine diagnostic tests among the patient population. However, the adoption of advanced technology is emerging, which is expected to hinder the demand and adoption of these products.

There is a growing preference toward point-of-care testing (POCT), which enables healthcare providers to run diagnostic tests in the outpatient settings without the requirement of large blood samples. These products use a finger-prick method for the collection of blood, reducing the need for venous draws among the patient population.

- For instance, according to a 2020 study published by Europe PMC, it was reported that 93% of respondents believed that POCT could enhance their care and 56% recognized having the same in their home as a top priority.

Additionally, capillary blood collection tubes and other microsampling devices, which include microfluidic collection kits and others, are some of the other devices that require a minimal amount of blood from the patients. These blood collection methods are especially beneficial for patients with chronic diseases such as diabetes and others that require frequent monitoring.

Therefore, all the above factors and the increasing number of key players launching these alternatives are primarily responsible for the limited demand and penetration rate for these tubes and are further anticipated to limit the market growth.

Market Opportunities

Expansion of Routine and Preventive Healthcare to Create Market Opportunities

There is an increasing awareness about the benefits of early diagnosis of diseases, which is escalating the demand for regular health monitoring among individuals. This shift is primarily driven by certain factors such as government strategic initiatives, employer-sponsored wellness programs, and adequate reimbursement policies, among others.

These preventive diagnostic tests include tests for cholesterol, kidney and liver function, vitamin deficiencies, thyroid balance, and others, which require blood samples, subsequently driving the demand for novel blood collection tubes. The increasing awareness initiatives among insurance firms, corporate companies, clinical laboratories, and others are further augmenting the product demand and driving the focus of key players toward R&D activities to develop and launch advanced products in the market.

- In February 2025, the Indonesian Government launched an annual free health-screening, a USD 183.54 million initiative with an aim to prevent early deaths among the patient population.

Market Challenges

Limited Diagnosis in Emerging Countries to Limit the Market Growth

There is an increasing focus on initiatives among governmental organizations to raise awareness about early detection of diseases among the patient population. However, despite the efforts of these settings, there is a rising prevalence of delayed diagnosis of chronic diseases due to various factors, including delayed referrals of patients with chronic diseases, coupled with limited expertise among clinicians to identify chronic conditions, especially in developing nations.

Lack of clinical awareness, limited number of healthcare settings, inadequate reimbursement policies, among others, are some of the crucial factors resulting in delayed specialist care, further leading to the postponement of diagnosis among patients, especially in emerging nations, such as Poland, China, Brazil, among others.

- For instance, according to 2024 data published by Trading Economics, there are about 39.07 hospitals per one million people in Mexico.

Other Prominent Challenges

- Pricing pressure and commoditization are likely to limit market growth.

- Raw material cost volatility for plastics and rubber may hinder product manufacturing.

- Defect and quality risks, such as vacuum leaks or hemolysis are anticipated to hamper the expansion of the market.

Vacuum Blood Collection Tube Market Trends

Increasing Technological Advancements to Boost Product Demand

There is a growing focus on the integration of technological advancements in blood collection products, which is reshaping the industry. The integration of new technology, such as smart labelling, enhanced use of stabilizers, miniaturization of these tubes, and others, is improving the sample integrity, safety, and compatibility with modern laboratory workflows. The increasing number of advantages of these products is contributing to the demand, further leading the focus of prominent players toward research and development initiatives to develop and launch advanced products in the market.

- In July 2025, OraSure Technologies, Inc., launched the HEMAcollect PROTEIN blood collection tube – BCT, a venous blood collection tube with an aim to address the growing demand from proteomic researchers.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Increasing Prevalence of Chronic Disorders Pushed EDTA Segment Dominance in 2024

Based on product type, the market is classified into serum separation tubes, EDTA tubes, plasma separation tubes, heparin tubes, rapid serum tubes, and others.

To know how our report can help streamline your business, Speak to Analyst

The EDTA tubes segment held the largest market share in 36.96% 2026. The growth is primarily driven by the increasing prevalence of chronic conditions such as cancer and others among the patient population, resulting in a growing number of hematology procedures and increasing demand for EDTA tubes globally. This, along with the increasing focus of key players toward R&D activities to introduce novel EDTA tubes, is further likely to support the segmental growth.

- According to statistics published by Macmillan Cancer Support, it was reported that the number of people living with cancer has increased from 3.0 million in 2020 to 3.5 million in 2025.

The serum separation tubes segment is expected to grow at a CAGR of 5.0% over the forecast period.

By Material

Increasing Product Launches Led to the Dominance of the Plastic Segment

Based on material, the market is bifurcated into plastic and glass.

The plastic segment dominated the market in 85.56% 2026. In 2025, the segment is anticipated to dominate with an 85.4% share. The dominant share is due to the increasing benefits of plastic blood collection tubes, such as precise volumes, safe, convenient, among others, resulting in growing demand for novel products in the market. This, coupled with increasing focus among major players toward acquisitions and collaborations to increase their brand presence, is expected to support the segmental growth.

- For instance, in January 2023, MHT Mold & Hotrunner Technology partnered with KEBO AG to develop a PET complete blood collection tube with an aim to cater to the growing demand among their customers.

The glass segment is expected to grow at a CAGR of 3.9% over the forecast period.

By Application

Increasing Prevalence of Liver & Kidney Disorders Led to the Dominance of the Others Segment

On the basis of application, the market is segmented into serology & immunology, coagulation tests, blood routine examination, and others. The others segment includes clinical chemistry, molecular diagnostics, and others.

The others segment dominated the global market in 2024. By application, the others segment held a share of 47.5% in 2024. The growth is primarily due to the rising prevalence of chronic conditions such as liver diseases, kidney diseases, among others, resulting in an increasing demand for novel products such as serum separating tubes, and others in the market.

- For instance, according to a 2023 study published by the Journal of Hepatology, about 83.7% of patients were suffering from metabolic dysfunction associated with liver disorder among 9,606 patients.

The serology & immunology segment is set to flourish at a growth rate of 4.2% during the forecast period.

By End-user

Increasing Number of Clinical Laboratories Led to the Segment’s Dominance

Based on end user, the market is segmented into hospitals & ASCs, clinical laboratories, blood banks, and others.

The clinical laboratories segment dominated the market in 43.69% 2026. The increasing prevalence of chronic conditions, growing number of patient admissions, rising number of clinical laboratories are some of the factors supporting the growth of the segment in the market. Furthermore, the segment is set to hold a 43.5% share in 2025.

- For instance, according to 2024 statistics published by WebFx, it was reported that there are about 320,000 clinical laboratories in the U.S.

In addition, the hospital & ASCs segment is projected to grow at a CAGR of 3.9% during the study period.

Vacuum Blood Collection Tube Market Regional Outlook

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Vacuum Blood Collection Tube Market Share, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025, valued at USD 1.91 billion, and also took the leading share in 2026 with USD 1.98 billion. The dominance of the region is due to various factors, such as the growing prevalence of chronic conditions, increasing number of diagnostic tests, rising technological advancements in vacuum blood collection tubes, adequate reimbursement policies, growing number of healthcare settings such as clinical laboratories and hospitals, and increasing number of product launches among key players, among others. In 2026, the U.S. market is estimated to reach USD 1.79 billion.

- For instance, according to 2025 data published by the American Hospital Association (AHA), there are about 6,093 hospitals in the U.S.

Europe and Asia Pacific

Other regions, such as Europe and the Asia Pacific, are expected to witness considerable growth during the forecast period. Over the study period, the European region is projected to record a growth rate of 4.1% and touch a valuation of USD 0.82 billion in 2025. This is due to the increasing number of test volumes and demand for specialized tubes, resulting in a rising focus of key players to establish R&D facilities to develop and introduce novel products in the market. Backed by these factors, countries such as the U.K., Germany, and France are expected to record the valuation of USD 0.11 billion, USD 0.19 billion, and USD 0.11 billion respectively in 2026. After Europe, the vacuum blood collection tube industry in the Asia Pacific is estimated to reach USD 0.69 billion in 2025 and secure the position of the third-largest region in the global market. In the region, India is estimated to reach USD 0.03 billion while China is estimated to reach USD 0.15 billion in 2026.

Latin America and the Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness moderate growth in this market. The Latin America market, in 2025, is set to record USD 0.43 billion as its valuation. The increasing prevalence of chronic conditions and demand for technologically advanced products drive product adoption in these regions. In the Middle East & Africa, the GCC market is set to touch a value of USD 0.16 billion in 2025.

Competitive Landscape

Key Industry Players

Growing Number of Product Launches among Major Players to Support their Dominance

A robust product portfolio of advanced vacutainers, coupled with a strong geographical presence nationwide, is one of the vital factors contributing to the dominance of these companies in the market. BD, Greiner Bio-One International GmbH, and Cardinal Health emerged as major players in the market in 2024. Furthermore, the rising focus of key players on R&D activities to develop and introduce novel products is likely to contribute to their vacuum blood collection tube market share.

- For instance, in March 2024, BD launched BD Vacutainer UltraTouch Push Button Collection Set with an aim to minimize pain among the patient population in India.

Other key players, including Advin Health Care, and others, are also growing, primarily due to their rising initiatives toward acquisitions and collaborations with other players to increase their brand presence in the market.

List of Key Vacuum Blood Collection Tube Companies Profiled:

- BD (U.S.)

- Cardinal Health (U.S.)

- Advin Health Care (India)

- Greiner Bio-One International GmbH (Germany)

- SARSTEDT AG & Co. KG (Germany)

- AdvaCare Pharma (U.S.)

- Hindustan Syringes & Medical Devices Ltd. (India)

- SEKISUI CHEMICAL CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS

- September 2025 – BD announced the conduction of clinical and non-clinical studies and update of 510(k) submissions for its BD Vacutainer product with an aim to strengthen its product portfolio.

- July 2025 – KBMED received the U.S. FDA-approval for its vacuum serum-separating tubes with an aim to strengthen its product portfolio in the U.S.

- February 2024 – Cangzhou Fukang Medical Supplies Co., Ltd., launched a new blood collection tube with an aim to strengthen its product portfolio.

- June 2023 – Husky Technologies installed the integrated ICHOR injection molding system for blood collection tube (BCT) production in India. This helped the company in strengthening its presence.

- October 2022 – BD collaborated with Magnolia Medical Technologies, Inc., with an aim to reduce blood culture contamination to help improve testing accuracy and ultimately improve clinical outcomes in U.S. hospitals.

REPORT COVERAGE

The market report provides a detailed market analysis and focuses on key aspects such as leading companies, product type, material, application, and end user. Besides this, the global report offers insights into the market trends, and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth and advancement of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.56% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Material

By Application

By End User

By Region North America (By Product Type, By Material, By Application, By End User, and by Country)

Europe (By Product Type, By Material, By Application, By End User, and by Country/Sub-region)

Asia Pacific (By Product Type, By Material, By Application, By End User, and by Country/Sub-region)

Latin America (By Product Type, By Material, By Application, By End User, and by Country/Sub-region)

Middle East & Africa (By Product Type, By Material, By Application, By End User, and by Country/Sub-region)

Rest of the Middle East & Africa (By Material) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.21 billion in 2025 and is projected to reach USD 6.23 billion by 2034.

In 2025, the North America regional market value stood at USD 1.98 billion.

Growing at a CAGR of 4.56%, the market will exhibit steady growth over the forecast period (2026-2034).

By product type, the EDTA tubes segment led the market in 2025.

The rising prevalence of chronic conditions is a major factor driving the market growth.

BD and Greiner Bio-One International GmbH are the major players in the global market.

North America dominated the market share in 2025.

The growing prevalence of chronic conditions and increasing technological advancements are some of the factors expected to boost the adoption of the product globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us