Ventricular Assist Device Market Size, Share & Industry Analysis, By Product (Left Ventricular Assist Device, Right Ventricular Assist Device, and Bi-Ventricular Assist Device), By Type of Flow (Pulsatile Flow and Continuous Flow), By Application (Bridge to Transplant (BTT), Bridge to Candidacy (BTC), Destination Therapy (DT), and Bridge to Recovery (BTR)), By End-user (Hospitals & ASCs and Specialty Clinics & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

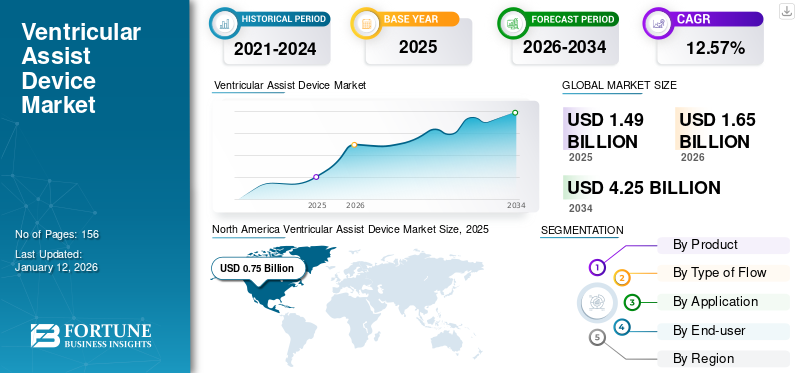

The global ventricular assist device market size was valued at USD 1.49 billion in 2025. The market is projected to grow from USD 1.65 billion in 2026 to USD 4.25 billion by 2034, exhibiting a CAGR of 12.57% during the forecast period. North America dominated the ventricular assist device market with a market share of 50.18% in 2025.

Ventricular assist devices (VAD) are implanted in heart failure patients with severe symptoms to provide them with mechanical circulatory support by pumping blood from the chambers of the heart to the whole body. The increasing prevalence of heart failure has been fueling the demand for these devices globally.

- For instance, as per data published by Journal of Cardiac Failure in 2023, around 6.7 million of Americans aged 20 and above suffer from heart failure. Moreover, this number is expected to reach 8.5 million by 2030.

Furthermore, the market players’ increased focus on R&D initiatives to develop efficient devices is also expected to fuel market growth.

- For instance, in August 2022, Abbott announced the results of the patients implanted with its HeartMate 3 left ventricular assist devices. The patients showed better survival rates with the implantation of this device, which will increase the adoption of the product.

Due to the outbreak of the COVID-19 pandemic, many non-emergency surgeries were put on hold, resulting in a decrease in the number of VAD transplants being conducted. Furthermore, supply chain disruptions also impacted market growth. However, in 2021, the market experienced significant growth compared to the prior year. This was due to the release of lockdown restrictions, resulting in a surge in patients visiting the cardiologist for treatment.

Global Ventricular Assist Device (VAD) Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.49 billion

- 2026 Market Size: USD 1.65 billion

- 2034 Forecast Market Size: USD 4.25 billion

- CAGR: 12.57% from 2026–2034

Market Share:

- North America dominated the ventricular assist device market with a 50.18% share in 2025, driven by the rising prevalence of heart failure and increased adoption of advanced mechanical circulatory support systems.

- By product, the Left Ventricular Assist Device (LVAD) segment accounted for the largest market share due to the increasing number of implantation procedures and strong R&D initiatives by key players focusing on product innovation and efficiency.

Key Country Highlights:

- United States: The country is witnessing significant demand for VADs driven by the rising prevalence of chronic heart failure and increasing focus on technological advancements in mechanical circulatory support systems.

- Europe: Growth is fueled by strong investments in R&D and continuous product innovation, with manufacturers focusing on next-generation implantable heart pumps and collaborative initiatives to enhance product adoption.

- China: Rapid advancements in healthcare infrastructure and favorable government policies aimed at expanding access to advanced cardiac care solutions are driving the demand for ventricular assist devices.

- Japan: The increasing geriatric population and high incidence of cardiovascular diseases, combined with a strong focus on innovative healthcare technologies, are supporting the market growth for VADs.

Ventricular Assist Device Market Trends

Increasing Technological Developments to Fuel the Demand for Mechanical Circulatory Support System

Technological advancements in the healthcare industry are assisting healthcare professionals to record and monitor clinical data regularly through artificial intelligence with minimal errors. The high-performance capabilities of artificial intelligence (AI) algorithms will transform the market outlook.

AI can be helpful in determining the risk of cardiovascular diseases, which can be used to enhance risk prediction and treatment among patients. It can also be utilized during surgeries to analyze the patient’s anatomy, risk factors, history of disease, and others, which can enhance the results of the surgeries.

In cardiothoracic surgery, machine learning algorithms can outperform standard operative risk scores in predicting intra-hospital mortality after cardiac procedures. Thus, the development of technology in cardiac procedures is likely to propel ventricular assist devices adoption.

Technological developments in medical devices have enhanced the efficiency of these devices. Thus, the rate of infection through the devices is reduced simultaneously. Latest devices, such as HeartMate III and DuraHeart, have features such as lower rotational speeds, smaller sizes, higher efficiency, and enhanced anatomic design. In October 2019, Medtronic received the U.S. Food and Drug Administration (FDA) for its new fully implantable device named HVAD systems. The LVAD is fully implanted without a cable line extending to a power source outside the body. It provides mechanical circulatory support to patients with weakened hearts and helps pump oxygenated blood from the left ventricle into the ascending aorta. Thus, the development of these effective devices in the market is expected to propel the market growth during the forecast period.

Download Free sample to learn more about this report.

Ventricular Assist Device Market Growth Factors

Increasing Prevalence of Heart Failure to Increase the Demand for VAD

Heart failure is one of the leading causes of mortality worldwide, affecting more than 1-2% of the population in western countries. According to the American Heart Association (AHA), the prevalence of heart failure is expected to increase at a significant growth rate by 2030 in the U.S., and is projected to reach over 8 million patients. In 2020, globally, more than 5.5 million individuals were affected by heart failure. Old-age people are at high risk of HF. Therefore, the increasing geriatric population has also been fueling the disease prevalence.

When medications are not very effective in the disease treatment and heart transplantation is not feasible, mechanical circulatory support devices are also used to assist cardiac circulation, which is used either to partially or to completely replace the function of a failing heart, mechanical support systems include VAD, Total Artificial Heart (TAH), extracorporeal Membrane Oxygenator (ECMO) Pumps, and Intra-Aortic Balloon Pumps (IABP).

The increasing prevalence and rising death cases due to the failure of the heart have increased the demand for VAD, as it can be used for both bridges to transplant as well as destination therapy.

Furthermore, to fuel the increasing demand for VAD, market players have been focusing on new product launches and the expansion of their production capacity. For instance, in June 2021, Abbott expanded the supply of its ventricular assist device, HeartMate 3, to fuel the growing demand.

The global market is anticipated to grow significantly due to the high prevalence of chronic diseases during the forecast period.

Long Waiting Periods for Heart Transplants Globally to Surge Product Demand

As the incidence of heart failure increases globally, the demand for heart transplantation has increased significantly. However, the unavailability of adequate heart donors to meet the demand has globally resulted in a shortage crisis. As per the data published by Health Resources & Services Administration in March 2022, around 105,800 patients are on the waiting list for heart transplants.

Ventricular assist devices are important tools for managing heart failure as Destination Therapy (DT) and Bridge-To-Transplantation (BTT). DT and BTT are the treatments performed for end-stage heart failure. The U.S. Food and Drug Administration (USFDA) approved the LVADs for patients with end-stage heart failure as destination therapy. Also, for BTT, Heartmate III, HVAD, and Heartmate II are approved by USFDA. Organ shortages, the increasing number of heart failure patients, and technological advances in mechanical circulatory support have increased demand for these devices.

The significant gap between the supply and demand of heart donors is expected to fuel the market growth in the coming years.

RESTRAINING FACTORS

High Cost Associated with the Use of VAD to Limit its Adoption

The limited availability of heart donors and the increasing prevalence of heart donors have increased the penetration of these devices. However, the high costs associated with the implantation of these devices have been limiting their adoption.

- For instance, in the U.S., Left Ventricular Assist Devices (LVAD) implantation surgery costs around USD 175,000 - USD 200,000.

Such high costs associated with the implantation of these devices have been restricting their adoption by the patient population globally.

Sometimes these devices might stop working efficiently after the implantation. For instance, VAD might not pump blood effectively, or the power supply might fail. These problems require immediate medical attention and may require the pump to be replaced. Such factors limit the product penetration.

Therefore, the high costs and other complications associated with the device might limit the device’s adoption in the forecast period.

Ventricular Assist Device Market Segmentation Analysis

By Product Analysis

Increasing Implantations to Surge Growth of the LVAD Segment

Based on product, the market is segregated into Left Ventricular Assist Device (LVAD), right ventricular assist device, and bi-ventricular assist device.

The LVAD segment accounted for the highest market with a share of 87.10% in 2026 due to the number of implantation procedures amongst patients globally. Market players are focusing on developing these devices for patients with heart failure and other cardiovascular diseases, as they help the heart to function typically by supporting the chambers of the heart in patients.

- For example, in February 2020, Abbott bagged the Breakthrough Device designation from the U.S. FDA for its in-development Fully Implantable Left Ventricular Assist System (FILVAS).

The Biventricular Assist Device (Bi-VAD) segment registers a significant share in the market. The efficiency of Bi-VADs over LVADs is higher in patients diagnosed with chronic decompensated heart failure as they help in the efficient heart ventricles working. These devices help the left and right ventricles move blood through the heart. Thus, the above mentioned benefits are responsible for the adoption of bi-ventricular assist devices and are anticipated to fuel the growth of the market during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Type of Flow Analysis

High Efficiency Associated with the Use of Continuous Flow Devices to Surge Segment Growth

Based on type of flow, the market is segmented into pulsatile flow and continuous flow.

The continuous flow segment held a significant market with a share of 88.81% in 2026. due to the benefits of continuous flow. Continuous flow devices have benefits such as lower maintenance, minimal noise, rare replacements, and a few moving parts. The benefits of continuous flow devices have been increasing their demand among physicians and researchers. To meet the demand in the market, the major players, such as Heart Inc., launched DuraHeart LVAD, a continuous flow device.

The pulsatile flow segment is projected to grow at a substantial CAGR. Pulsatile flow devices have become an accepted therapy as a bridge to transplantation to support patients suffering from chronic heart failure. As a pulsatile flow, systems can closely mimic blood flow characteristics within the heart and vasculature system.

By Application Analysis

Increasing Awareness About the Importance of Diagnostic Testing to Drive Market Growth

In terms of application, the market is segmented into Bridge to Transplant (BTT), Bridge to Candidacy (BTC), Destination Therapy (DT), and Bridge to Recovery (BTR).

The Destination Therapy (DT) segment accounted for the highest market with a share of 45.75% in 2026., owing to a rise in final-stage cardiac failure incidences. DT is an alternative to transplant that can improve functional capacity, extend patients' lives, and relieve symptoms of heart failure. LVADs have their application as destination therapy for the treatment of patients who cannot undergo heart transplantation. The limited availability of heart donors and complications associated with heart transplantation surgeries fueled the segments’ growth.

However, the Bridge to Transplant (BTT) segment is growing at a higher growth rate during the forecast period. Devices in the bridge to transplant therapy are used for a limited period till the patient receives a donor for a heart transplant. These devices are used for a short time, so the complications are less for patients.

By End-user Analysis

Hospitals & Ambulatory Surgery Centers (ASCs) to Register Higher CAGR Owing to Demand in Surgical Procedures

In terms of end-user, the market is segmented into hospitals & ASCs and specialty clinics & others. The hospitals & ASCs segment is expected to hold the dominant share in the market contributing 65.95% globally in 2026 during the forecast period due to increase in hospital stays of patients undergoing heart surgeries such as device placement or implant procedures.

The specialty clinics & others segment is expected to grow at a higher CAGR during the forecast period due to increased number of specialty clinics and rise in number of physicians in developed and emerging countries. This is projected to support the market growth during the forecast period.

REGIONAL INSIGHTS

North America Ventricular Assist Device Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 0.75 billion in 2025. The dominance of this regional market is attributable to the growing prevalence of cardiovascular diseases in the region. Moreover, an increasing number of collaborations and agreements amongst the key players emphasizing the development of this market have been fueling the adoption of these devices in the region. The U.S. market is projected to reach USD 0.81 billion by 2026.

Europe held the second-largest share in the market and is expected to grow at a significant CAGR owing to rising investments in the market coupled with newer product launches. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

- For instance, in January 2021, CorWave raised an investment of USD 40 million and is focusing on the development of an implantable heart pump (LVAD) based on a breakthrough technology called the wave membrane pump.

Thus, through increasing investments, key players of the market are emphasizing on the adoption of these devices, which is projected to boost its demand in the region.

The market in Asia Pacific exhibited the highest CAGR owing to advancements in healthcare facilities and favorable government policies. Medical device companies are making investments in the region for these devices to increase their adoption in the market, which is projected to boost the market growth. The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.04 billion by 2026, and the India market is projected to reach USD 0.02 billion by 2026.

Latin America and the Middle East & Africa accounted for a comparatively lower share of the market owing to lack of awareness about these devices and recent developments in the healthcare sector. Moreover, awareness programs initiated by government organizations led to increased diagnosis and treatment rates for heart failure in these countries, fueling the demand for these devices.

Key Industry Players

Companies with Strong Sales of VAD to Hold Key Ventricular Assist Device Market Share

Abbott and ABIOMED are among the prominent players in the market and captured a considerable global market share in 2024.

Abbott accounted for a significant global market share. This is due to the company’s strong sales of the devices. Moreover, the company has a strong focus on strategic initiatives with an aim to expand its product offerings globally.

Other players present in the market are Berlin Heart and Jarvik Heart, Inc. Their focus is on receiving approval from regulatory bodies to expand the product portfolio and strengthen the market shares during the forecast period.

Moreover, companies, such as CH Biomedical, Inc. and Calon Cardio-Technology Ltd, have their products in the R&D stage. The launch of these products is expected to grab significant market shares in the coming years.

List of Top Ventricular Assist Device Companies:

- Berlin Heart (Germany)

- ABIOMED (U.S.)

- Abbott (U.S.)

- Jarvik Heart, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 – Jarvik Heart, Inc. conducted a clinical trial for their ventricular assist device named as Jarvik 2015 with an aim to strengthen its product portfolio.

- September 2022 – Abbott acquired Walk Vascular, LLC. Walk Vascular, LLC is a medical device company involved in developing a minimally invasive mechanical aspiration thrombectomy system to eliminate blood clots.

- September 2021 – Abbott partnered with Cereno Scientific to use cutting-edge monitor device – CardioMEMS technology in an upcoming Phase II study with CS1 for the treatment of the rare disease pulmonary arterial hypertension and thrombotic indications.

- February 2020 - Abbott announced the winning of a breakthrough device designation for a fully implantable LVAD with an aim to increase its brand presence.

- February 2019 – Jarvik Heart, Inc. presented a fully implanted ventricular assist device at the National Research Center for Cardiac Surgery in Astana, Kazakhstan to increase its brand presence.

REPORT COVERAGE

The research report provides a detailed competitive landscape. It includes the number of VAD implantation and key industry developments such as partnerships, mergers, and acquisitions. Additionally, it focuses on key points such as new product launches in the market. Furthermore, the report covers a regional analysis of different segments, company profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights contributing to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.75% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Type of Flow

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 1.65 billion in 2026 to USD 4.25 billion by 2034.

The market is expected to exhibit a CAGR of 12.57% during the forecast period (2026-2034).

The left ventricular assist device segment is set to lead the market by product.

The key factors driving the market are increasing prevalence of heart failure and rising penetration of ventricular assist devices.

Abbott and ABIOMED are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us