Viscose Staple Fiber Market Size, Share & Industry Analysis, By Type (High Wet Modulus Fiber, Strong Fiber, Modified Fiber, and Others), By Application (Woven, Non-Woven, and Specialty), By End-Use Industry (Textile Apparels, Healthcare, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

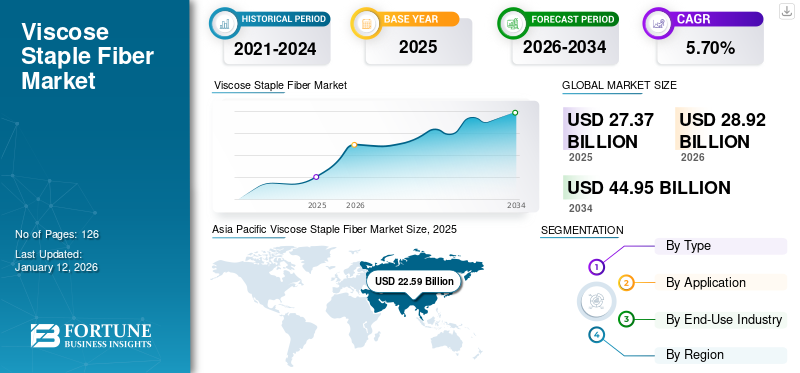

The viscose staple fiber market size was valued at USD 27.37 billion in 2025. The market is projected to grow from USD 28.92 billion in 2026 to USD 44.95 billion by 2034, exhibiting a CAGR of 5.70% during the forecast period. Asia Pacific dominated the viscose staple fiber market with a market share of 83% in 2025. Moreover, the viscose staple fiber in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.6 billion by 2034, driven by its exceptional properties and its image as an sustainable alternative to cotton.

A form of cellulose fiber produced by regenerating natural materials, such as cotton linter or wood pulp is known as Viscose Staple Fiber (VSF). The softness, drapability, and absorbency of these fibers make them a popular material in clothes, home textiles, and other consumer goods. The automotive industry uses fabrics and textiles in various applications including carpets, interior trim & headliners, textile reinforcement in composite parts, and exterior textile parts. Such widespread applications of these fibers and increasing preference for sustainable products are expected to propel market growth.

The COVID-19 pandemic reduced the demand for formal or other types of clothing due to the adoption of a work-from-home culture. During this period, many consumers reduced their spending on non-essential products, such as fashion apparel. Additionally, the demand for VSFs declined due to supply chain disruptions caused by the pandemic, affecting production costs and leading to raw material shortages.

Global Viscose Staple Fiber Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 27.37 billion

- 2026 Market Size: USD 28.92 billion

- 2034 Forecast Market Size: USD 44.95 billion

- CAGR: 5.70% from 2026–2034

Market Share:

- Asia Pacific dominated the viscose staple fiber market with a 83% share in 2025, driven by large manufacturing bases in China and India, and high demand for advanced textiles across industries.

Regional Insights:

- Asia Pacific: USD 23.89 billion in 2026; driven by China and India’s manufacturing base

- North America: Rising automotive and textile applications, strong sustainability policies

- Europe: Technologically advanced automotive sector; key textile hubs in Germany, France, and Italy

- Latin America: Growth supported by domestic demand and government investments

- Middle East & Africa: Driven by population growth and purchasing power

Viscose Staple Fiber Market Trends

Adoption of Recycling and Circularity in Fashion Industry to Create New Growth Opportunities

The shift of the fashion industry toward a circular economy by adopting a closed-loop production process to recycle materials and reduce waste is expected to boost viscose staple fiber market growth. VSFs can be recycled and reused for the production of new fabrics, making them an ideal choice for closed-loop production.

The fashion industry’s circular economy is focusing on using recycled viscose for closed-loop production. Recycled viscose can be manufactured by cutting down old fabrics and spinning the fibers into fresh yarns. This process creates a sustainable source of raw materials for viscose production and reduces the industry’s environmental impact.

The dire need for environmentally friendly and sustainable products will propel the demand for circular fashion. The demand for sustainable fibers, including viscose staple fibers, is expected to increase drastically owing to rising consumer awareness about the environmental impact of clothes. Several manufacturers and recyclers are forming partnerships to incorporate recycled feedstock. Collaborative efforts from all stakeholders in the fashion industry are expected to create new opportunities for the market. Moreover, the shift toward circularity will accelerate the development of innovative technologies for recycling and production. This will create opportunities for the market players to develop sustainable production methods.

Download Free sample to learn more about this report.

Viscose Staple Fiber Market Growth Factors

Increasing Product Demand from Fashion & Apparel Industry to Drive Market Growth

Viscose staple fiber is a highly versatile material that is widely adopted in the fashion & apparel industry. Increasing consumer preference toward sustainable materials has driven the demand for this fiber in the fashion & apparel sector. Viscose staple fiber is used as a substitute for cotton or polyester due to its favorable properties, such as good breathability, high moisture absorbency, and comfort.

The growing use of VSPs in the fashion and textile industries has made them an ideal choice among consumers due to the comfort and softness they offer. It is often used in suits, jackets, sportswear, and ties. The cost-effectiveness of these fibers makes them suitable substitutes for natural fibers, such as silk and cotton. These properties have increased the demand for viscose staple fibers among clothing manufacturers. The increasing preference for these fibers in the fashion industry is boosting their demand. These fibers are broadly available and produced in large quantities, making them an easy-to-source material for several end-users.

Rising disposable income, changing buying practices of consumers, and shifting fashion trends are driving the expansion of the apparel industry. A range of high-quality textiles and garments are produced using VSFs. As a result, expansion of the apparel industry is expected to drive the demand for VSFs. Moreover, versatility, affordability, eco-friendliness, and growing awareness about sustainable fashion are key factors increasing fiber demand significantly in the apparel & fashion industry.

Growing Product Adoption in the Healthcare Sector is Expected to Present Significant Growth Opportunities

Developing countries are improving health & hygiene standards, supporting the growth of medical textiles. Due to the exceptional properties of VSF, it is considered suitable for medical textiles. Due to its higher moisture and liquid adsorption and lower impurity content, it has been receiving acceptance in healthcare textiles in recent years. It is majorly employed in making non-woven products in the medical industry for surgical and non-surgical applications. Growing demand for non-woven products, such as baby diapers, hospital gauze, sanitary napkins, bandages, and others, is expected to boost market growth. Moreover, a continuously developing value chain is anticipated to support growth as per the global trends in the Meditech industry.

RESTRAINING FACTORS

Environmental Issues Caused by VSF’s Production Process to Hamper Market Growth

Viscose staple fiber has gained significant traction as a sustainable alternative to polyester or cotton. Although this fiber is sourced from cellulose (wood pulp), its production process raises several environmental issues, such as high energy consumption, water pollution, deforestation, and overuse of chemicals during production.

The primary threat impeding the market’s growth is deforestation, as the fiber is produced from wood pulp sourced from natural forests rather than sustainably harvested trees. Harvesting trees and plants, such as sugar cane, bamboo, beech, pine, and eucalyptus leads to deforestation, which hampers the local ecosystem, biodiversity, and climate. Furthermore, the production of VSF is energy-intensive as it involves processes, such as spinning, weaving, filaments (spinneret), and knitting. The fossil fuels used in energy generation contribute to greenhouse gas emissions.

To overcome these environmental issues, various manufacturing companies are developing sustainable networks, such as sourcing wood pulp from a certified supplier, creating a less water & energy-intensive production process, and utilizing renewable energy.

Viscose Staple Fiber Market Segmentation Analysis

By Type Analysis

Strong Fiber Led the Market Due to its Wide Usage Across Various Sectors

Based on type, the market is segmented into high wet modulus fiber, strong fiber, modified fiber, and others.

The strong fiber segment accounted for the largest market share 44.85% in 2026 and is expected to remain the leading segment during the forecast period. Strong viscose fibers are generally used as an alternative to cotton fibers due to their comparatively lower production cost. These fibers are highly preferred for manufacturing apparel and fabrics for medical, industrial, and domestic applications. As this fiber is made from organic materials, they are superior to synthetic fibers, including polyester. The rising demand for organic and sustainable materials will drive the segment’s growth.

The modified fiber segment is expected to record the fastest CAGR during the forecast period owing to the increasing demand for reinforced fabrics. Modified fibers are mostly used to improve the electrical, physical, and mechanical properties of various materials and composites.

The High Wet Modulus (HWM) viscose fiber is used in knitted outerwear and undergarments. The superior washing performance of HWM interlock fabrics makes them an attractive option over cotton. Viscose fibers serve as an excellent cost-effective substitute for cotton, hence, their high use in the clothing industry.

By Application Analysis

Product Use Increased in Woven Applications Due to Its Cost-Effectiveness

In terms of application, the market is segmented into woven, non-woven, and specialty.

The woven segment dominated the viscose staple fiber market share 64.87% in 2026. Woven fabrics are generally cost-effective, lighter, and sturdier than non-woven and knitted fabrics. The growing demand for reliable, high-performance, and durable fabrics from various industries will drive the preference for woven fabrics.

Bonding fibers manufacture non-woven fabrics through different methods, such as heat treatment, chemical or mechanical adhesion, or sometimes both. Non-woven fabrics have comparatively higher resilience, bacterial protection capabilities, and washability. Moreover, these fabrics can be modified to improve certain features including thermal & electrical insulation, liquid repellency, impact resistance, and flame retardancy.

To know how our report can help streamline your business, Speak to Analyst

By End-Use Industry Analysis

Textile Apparels Emerged as Major End-Users Due to Rising Product Adoption in Fashion Industry

On the basis of end-use industry, the market is segmented into textile apparels, healthcare, automotive, and others.

The textile apparels segment accounted for the largest market share 61.17% in 2026. Viscose Staple Fibers (VSF) are widely used to manufacture apparels and the fabrics produced using VSFs are soft, comfortable, highly absorbent, wrinkle-free, and cost-effective. Increasing demand for comfortable apparels from the fashion industry is expected to significantly drive segment growth.

In the healthcare industry, VSFs are used to produce medical textiles. They are preferred in absorbent pads and other materials used in surgical applications owing to their high absorbency, softness, and safe nature.

These fibers are used in the production of automotive textiles that are utilized in transportation systems and vehicles, such as cars, airplanes, trains, buses, and marine vehicles. The rising automotive production and rapid industrialization are expected to drive the adoption of textiles in automobiles, further supporting the demand for this fiber.

REGIONAL INSIGHTS

Based on geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Viscose Staple Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is the leading region in the global market and it was valued at USD 23.89 billion in 2026. China and India have a large manufacturing base for viscose fibers. The rapid expansion of industries in these developing countries will drive the market’s growth in Asia Pacific. Furthermore, increasing demand for textiles from various end-use industries will boost the demand for viscose staple fibers in the region. China is the leading country in Asia Pacific owing to the increasing demand for advanced textiles from various industries. The Japan market is projected to reach USD 0.5 billion by 2026, the China market is projected to reach USD 17.2 billion by 2026, and the India market is projected to reach USD 3.02 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America is expected to register significant growth of USD 1.98 Billion in 2026, due to the rising product demand from automotive and textile applications. The increasing need for essential goods, including clothes and hygiene products, and initiatives by the regional governments to support the adoption of sustainability are key factors leading the market’s growth. The market’s expansion in the U.S. and Canada is associated with the rising demand for automotive textiles. The U.S. market is projected to reach USD 1.6 billion by 2026.

Europe

Europe is the leading region in the global market and it was valued at USD 1.86 billion in 2026. In Europe, Germany accounted for the largest market share USD 0.51 Billion in 2026. Germany is the most technologically advanced market for automobiles. The increasing expenditure capacity of consumers will cause a considerable expansion of the country's automotive industry and will positively influence market growth. The U.K., France, and Italy, have a major influence on the demand for these fibers in Europe. The U.K. and France have strong textile manufacturing plants and a competitive fashion industry centered in Paris, London, and Milan. Germany market is projected to reach USD 0.51 billion by 2026.

Latin America

Latin America is the leading region in the global market and it was valued at USD 0.52 billion in 2026. Latin America is expected to grow significantly due to the rising demand for fabrics for various end-use applications and rapid industrialization. Growing demand for fabrics from domestic and industrial sectors is driving the regional market’s growth. Various initiatives implemented by the governments to increase production activities are expected to boost market growth in the region. For instance, in February 2021, Paraguay’s Ministry of Industry and Commerce made an investment worth USD 1.1 million in the industrial sector to promote clothing, textiles, and footwear industries, among other areas linked to assembly procedures.

Middle East and Africa

The market in Middle East and Africa is expected to register significant growth of USD 0.67 Billion in 2026. In the Middle East and Africa, growing population and rising purchasing power are the major factors driving the product demand from the textile industry.

List of Key Companies in Viscose Staple Fiber Market

Key Firms Adopt Business Expansion Strategies to Gain Competitive Edge

Sateri, Lenzing Group, Kelheim Fibers GmbH, and Xinjiang Zhongtai Chemical Co., Ltd. are some of the key producers operating in the market. These major players are involved in product innovation, capacity improvement, acquisitions, and collaborations to expand their product range. They are also focusing on incorporating novel technologies to improve efficiency and curb wastewater production during production processes.

For instance, Grasim Industries Limited announced that its Nagda unit would become the first production unit to achieve zero liquid discharge in the MMCF industry. Grasim will incorporate membrane processes to recycle and clean wastewater. Furthermore, in a move toward renewable energy, companies, such as LENZING Group are switching to green electricity at its Chinese subsidiary Lenzing Nanjing Fibers and Indonesian subsidiary PT. South Pacific Viscose (SPV). The electricity at these plants is generated solely from renewable sources and specialize in the production of branded specialty viscose fibers.

LIST OF KEY COMPANIES PROFILED:

- Grasim Industries Limited. (India)

- LENZING Group (Austria)

- Tangshan Sanyou Group Xingda Chemical Fiber Co.Ltd (China)

- Sateri Holdings Limited (China)

- Kelheim Fibers GmbH (Germany)

- Xinjiang Zhongtai Chemical Co., Ltd. (China)

- Kayavlon Impex Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 - Kelheim Fibres GmbH and Santoni Spa joined forces to develop a sustainable and advanced menstrual underwear from superior-quality performance viscose fiber and advanced machine technology. The product comprises a softer outer layer and an inlay part made from superior wood-based fibers.

- November 2022 - The LENZING Group completed a milestone of 300,000 tons of LENZING ECOVERO branded fibers production with the target to double the production capacity by 2023 due to rising demand.

- March 2022 - Birla Cellulose and Renewcell, a textile-to-textile recycling innovator, signed a letter of intent to engage in a long-term commercial collaboration. The agreement confirmed the supply of high-quality Liva Reviva textile fibers made using Circulose, Renewcell’s 100% recycled textile raw material.

- July 2021 - Sateri continued its partnership with Infinited Fiber Company, a textile fiber technology group, and invested USD 35.7 million. The collaboration reflects Sateri’s commitment toward circular, closed-loop, and climate-positive cellulosic fibers.

- May 2021 - Sateri announced an agreement to acquire the viscose fiber business of Funing Aoyang Technology Co., Ltd as part of its growth strategy to increase its market footprint. The acquisition will increase Sateri’s production capacity to more than 1.8 million tons.

- September 2020 - Sateri collaborated with DuPont to develop a new fabric known as StretchCosy. The new fabric is a blend of Sateri’s EcoCosy and DuPont’s Sorona well suited for sportswear and fashion.

REPORT COVERAGE

The research report provides detailed market analysis and focuses on crucial aspects, such as leading companies, types, applications, end-user industries, and products. Additionally, it provides quantitative data regarding volume & value, market analysis, research methodology for market data, insights into the market trends, vital industry developments, and competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.70% during 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 28.92 billion in 2026 and is projected to reach USD 44.95 billion by 2034.

In 2026, the Asia Pacific market value stood at USD 23.89 billion.

Recording a CAGR of 5.70%, the market will exhibit rapid growth during the forecast period of 2026-2034.

By end-use industry, the textile apparels segment led the market in 2026, with the largest market share.

Increasing demand for product in the fashion & apparel industry is a key factor driving market growth.

Asia Pacific dominated the viscose staple fiber market with a market share of 83% in 2025.

Sateri, Lenzing Group, Kelheim Fibers GmbH, and Xinjiang Zhongtai Chemical Co., Ltd. are the leading players in the market.

Recycling and circularity in the fashion industry will create new opportunities for the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us