Pulp and Paper Market Size, Share & Industry Analysis, By Category ((Wrapping & Packaging (Food & Beverage Packaging, Healthcare Packaging, Personal Care Packaging, and Others), Printing & Writing (Books and Publishing, News Print, & Others), Sanitary, and Others)), and Regional Forecast, 2026-2035

Pulp and Paper Market Size Overview

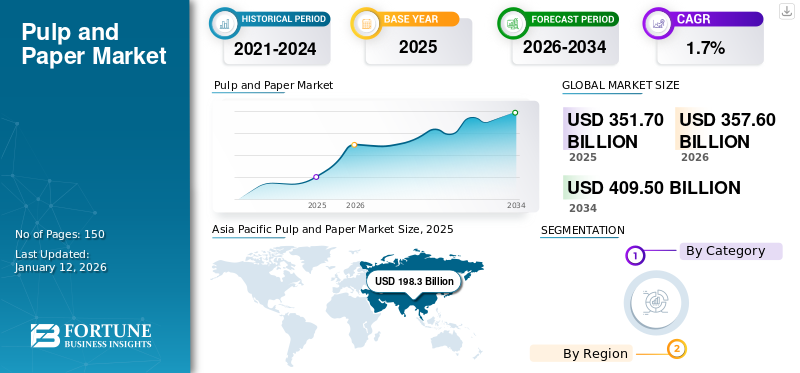

The global pulp and paper market size was valued at USD 351.7 billion in 2025 and is projected to grow from USD 357.6 billion in 2026 to USD 416.56 billion by 2035, exhibiting a CAGR of 1.7% during the forecast period.

Pulp is the material derived from wood, fiber crops, waste paper, and rags. Pulp is processed to manufacture paper and paperboard. The global pulp and paper industry holds its significance by being the foremost industry relying on forests. The major raw materials, such as wood, along with alternative materials, including wheat straw, bamboo, and rice husk, are utilized for the manufacturing of paper. The growing adoption of paper as a paper packaging material, wrapping paper, printing paper, writing paper, rolls, tissue paper, and specialty papers is expected to boost the market growth. The pulp and paper manufacturing and supply industry is labor-intensive and plays a vital role in socio-economic development. Moreover, the government's growing initiative for sustainable environmental development is expected to fuel the market growth of pulp and paper.

Smurfit WestRock, International Paper, Oji Holdings Corporation, UPM, and Nine Dragons Worldwide (China) Investment Group Co., Ltd are key players of pulp & paper operating in the industry.

Pulp and Paper Market Trends

Rapid Penetration of Online Retail in Emerging Economies to Fuel Demand for Paper Packaging

Growing penetration of smartphones, along with the internet, has surged online retailing in emerging economies, such as India, China, Southeast Asian countries, Brazil, and others. Nowadays, many consumers prefer to buy online food, groceries, cosmetics, and many other goods due to their busy lifestyles and hectic schedules. Such factors lead to a surge in the adoption of packaging materials for the transportation of these goods, along with safety and security. Furthermore, the rising need for eco-friendly solutions in retail packaging to avoid the adverse effects of waste plastic packaging, coupled with growing government regulations in packaging to come up with sustainable solutions, is further boosting the adoption of paper packaging. The demand is mainly attributed to the ideal characteristics of paper & pulp packaging, such as being convenient for logistics, lightweight, environment-friendly, cost-effective, and biodegradable. Hence, the growing expansion of online channels, along with supportive regulations, is expected to augment the adoption of paper bags and corrugated boxes and fuel the market growth rates during the projected timeframe. Asia Pacific witnessed a pulp and paper market growth from USD 193.97 billion in 2024 to USD 198.3 billion in 2025.

Market Dynamics

MARKET DRIVERS

Increasing Paper Recycling Activities by Companies to Foster Product Adoption

Paper recycling is a well-established and capital-intensive industry. Companies involved in the recycling of other materials find paper recycling to be a helpful addition to their services. It supports entrepreneurs in services, including collection, sorting, and transportation.

As per the American Forest & Paper Association, 67.9% of recycled paper was consumed in the U.S. in 2022, maintaining a steady recycling rate compared to 2021. The paper recycling requirements differ by state in this country. The U.S. states, including Pennsylvania, Wisconsin, Rhode Island, New Jersey, and the District of Columbia, have made rules that all paper grades must be recycled. In California, businesses must recycle newspapers, and in Connecticut, all trash generators need to recycle white and colored office paper, newspapers, and periodicals. South Dakota, Maine, and Virginia have also made specific obligatory paper recycling laws. The adoption of supportive laws for paper recycling is projected to increase recycling activities and further boost the pulp and paper market growth.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Increasing Ingress of Digital Media in News and Education Fields is Regressing the Market Potential

The newsprint sector has experienced the most direct impact from digital media proliferation. As online news platforms, social media, and digital subscriptions become primary news sources, demand for physical newspapers and magazines has declined sharply. This shift reflects broader changes in media consumption patterns, where consumers increasingly prefer accessing news through smartphones and tablets rather than print publications. The convenience of digital archives and searchable content further diminishes the value proposition of physical newsprint.

The emergence of COVID-19 has been a vital factor in the spread of digital media. The distribution network of newspapers and print media was severely affected in countries announcing lockdowns. Furthermore, many people avoided contact with such media to avoid the risk of contracting COVID-19. Many people shifted their preference to digital platforms such as websites, apps, and social media for reading news and other information.

The industry's digital transformation is fundamentally changing workforce requirements by creating demand for digital native equipment's. However, this shift creates challenges in retaining institutional knowledge, while often perceived earlier in a traditional way in books & papers.

MARKET OPPORTUNITIES

Growing Demand for Sanitary Products Due to Increasing Hygiene amongst Customers to Create Market Opportunity

The pulp and paper market is growing at a rapid pace due to rising adoption in the manufacturing of sanitary products, which have become essential in modern society. The growth is primarily driven by factors such as increasing awareness of hygiene and personal care, rising disposable incomes, and rapid urbanization. The paper consumption has witnessed a steady increase over the years. Major applications in sanitary applications include toilet paper, facial tissues, napkins, and feminine hygiene products. As populations grow and living standards improve, the demand for these products is expected to continue rising. Additionally, advancements in technology have led to the development of more absorbent, soft, and environmentally friendly sanitary products, further stimulating market growth. Moreover, the shift toward sustainable practices has encouraged the use of recycled paper and the adoption of environmentally friendly pulp production methods, contributing to the overall growth of the market.

MARKET CHALLENGES

Increasing Deforestation and Water Crisis to Create Market Challenge

Paper industries consume a considerable amount of wood from forests. According to the Food and Agricultural Organization, from 2000 to 2015, there was a net decrease in the forest area of 3.3 million hectares. Also, governments mandated strict regulations on the sourcing of wood from forests. In addition, paper is one of the largest water-consuming industries. In general, to manufacture A4-size paper sheets, manufacturers need around 20 liters of water. Therefore, with increasing deforestation and water crisis, managing continuous raw material and resource supply is a key challenge for the growth of the market.

IMPACT OF COVID-19

During the COVID-19 pandemic, the leading applications of paper, such as news print, printing, and writing, were adversely disrupted owing to the continuous decline in demand from the end-users. However, the adoption of personal care & hygiene products, including tissue paper, increased due to growing safety & hygiene practices by the consumer to avoid the spread of the COVID-19 virus. As a result, leading tissue manufacturers globally increased their focus on meeting the demand for tissue papers from healthcare facilities.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Protectionist measures, such as tariffs and subsidies, can support nascent industries but may lead to inefficiencies and higher consumer costs. Geopolitical tensions disrupt supply chains, as seen in the Russia-Ukraine conflict, which has increased raw material costs and logistical challenges. Environmental policies are also influenced by geopolitical pressures, promoting bio-based materials and cleaner manufacturing. The debate between free trade and protectionism continues, with free trade advocates emphasizing efficiency and larger markets, while protectionists highlight job protection and industrial development. Overall, the industry must balance protectionist measures with global competitiveness to navigate these complex dynamics effectively.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

The pulp and paper industry is undergoing significant transformation, driven by sustainability, digitalization, and innovation. Key research and development (R&D) trends include the adoption of alternative fibers, such as bamboo and hemp, to reduce environmental impact, advanced recycling technologies to minimize waste, and smart manufacturing powered by Industry 4.0 technologies such as IoT, AI, and robotics. These advancements enhance efficiency, automate processes, and improve product quality. Additionally, the industry is focusing on biodegradable packaging solutions and eco-friendly materials to meet consumer demand for sustainability. Collaborative R&D efforts are also increasing as companies seek partnerships to optimize resources and drive innovation in this evolving sector.

Segmentation Analysis

By Category

To know how our report can help streamline your business, Speak to Analyst

Wrapping & Packaging Segment to Hold Largest Market Share Owing to Increasing Adoption of Paper Packaging

Based on category, the market is segmented into wrapping & packaging (food & beverage packaging, healthcare packaging, and personal care packaging, and others), printing & writing (books and publishing, news print, and others), sanitary, and others.

Owing to the increased adoption of paper-based packaging materials, the wrapping & packaging segment is expected to hold a dominant pulp and paper market share during the forecast period. Rapid penetration of the global e-commerce and retail sector has created a huge demand for both wrapping & packaging paper. For instance, the adoption of paper bags has emerged as a cheap and potential substitute for plastic bags. Also, with rising environmental awareness, both consumers and manufacturers in developing economies are adopting paper packaging products. The segment held 5.51% of the market share in 2026.

The sanitary segment is projected to register healthy growth during the forecast period, backed by rising disposable income and awareness of personal hygiene in emerging economies.

Printing & writing segment declining in developed countries due to increasing emphasis on digitization and digital marketing. The printing & writing segment is expected to hold a 26.2% share in 2024.

PULP AND PAPER MARKET REGIONAL OUTLOOK

Based on region, the market for pulp and paper is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Pulp and Paper Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the leading region and is projected to dominate the global market for pulp and paper during the forecast period. The market size in Asia Pacific accounted for USD 198.3 billion in 2025 and USD 202.1 billion in 2026. In this region, China is the largest manufacturer and consumer of the product globally. China is set to stand at USD 122.9 billion in 2026. Additionally, the rising adoption of pulp and paper-based products, improving lifestyles, and healthier economic growth will provide lucrative opportunities for paper-based products in the country. India is anticipated to be valued at USD 27.2 billion in 2026, while Japan is set to reach USD 14.1 billion in the same year.

- In China, the printing & writing segment is estimated to hold a 21.2% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third largest market set to be valued at USD 48.2 billion in 2026. The region has a matured market for pulp and paper products and is expected to grow at a slow CAGR during the forecast period. The presence of large-scale companies in the North America region, such as International Paper, Georgia-Pacific Corporation, and WestRock, is creating a competitive environment, owing to the rising consumption of fast-moving consumer products, thereby leading to increasing demand for packaging paper in the U.S. However, the printing & writing segment is projected to indicate falling demand over the forecast period in the U.S. In Canada, most of the forest products industry, including paper, is concentrated in Quebec and Ontario. Recyclability is becoming necessary for packaging manufacturers in Canada, posing a challenge for products incorporating polymer-based coatings used for waterproofing paper packaging. Currently, there is a noticeable shift toward using recyclable protective coating on paper, which is expected to gain traction in pulp and paper throughout the forecast period. The growing concern about the non-recyclability of plastic is also driving paper usage in the country. The U.S. market is poised to grow with a valuation of USD 44.5 billion in 2026.

Europe

Europe is the second-largest consumer of paper in the global market expected to hold USD 67.5 billion, exhibiting a CAGR of 2.3% during the forecast period (2026-2035). Also, the region holds the second-largest share in the production of paper. Recycling paper-based products to achieve sustainable goals is the key trend in the market. The U.K. market is expanding, estimated to reach a market value of USD 6.3 billion in 2026. The growing awareness of plastic pollution, a push toward sustainable alternatives, along with rising investment in technologies and processes that enable efficient resource use and lower emissions, is contributing to the sustainable future of the country. Moreover, the rapid growth of online shopping on account of the booming e-commerce sector is increasing the need for packaging materials, particularly corrugated boxes and paper-based solutions. Germany is likely to gain USD 15.3 billion in 2026, while France is estimated to be worth USD 6.89 billion in 2025.

Latin America

Latin America is the fourth largest market expected to gain USD 23.10 billion in 2026. The region is expected to show positive growth in the global market during the forecast period. In Latin America, Mexico is expected to register the fastest growth in the market. Increasing merger & acquisition activities and investment in the paper packaging sector increase the demand for paper in Mexico. Though per capita paper packaging consumption in Mexico is less than in the U.S. and many European countries, paper packaging consumption is expected to increase rapidly in the next decade.

Middle East & Africa

In the Middle East & Africa, GCC and South Africa are expected to provide growth opportunities for paper-based products owing to the growing paper and packaging industry. In Africa, the pulp and paper industry is experiencing growth due to rising literacy rates and increasing investments in education, which are driving demand for writing and printing paper. The expansion of the retail sector and growing consumer spending are further boosting the need for packaging solutions. Additionally, many countries are investing in local paper production capacity to reduce reliance on imports. Sustainability concerns are also shaping the market, with a gradual shift toward eco-friendly and recycled paper products. The GCC market is set to be valued at USD 2.30 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Key Companies’ Focus on Sustainability to Gain Competitive Edge Drives Market Growth

Smurfit WestRock, International Paper, Oji Holdings Corporation, UPM, and Nine Dragons Worldwide (China) Investment Group Co., Ltd. are the key players in the market. These companies are making major investments in developing additives that address evolving demands for sustainability and performance.

Efficient use of resources to meet increasing demand from consumers is an important factor in the pulp and paper market. All leading paper producers are engaged in balancing the supply-demand scenario in the global paper industry. Currently, through its subsidiaries, the U.S.-based International Paper is the leading producer of paper in the world. The company offers different paper grades such as commercial printing papers, converting papers, digital papers, office papers, and specialty papers. The company is committed to strengthening people's lives by using available resources responsibly and efficiently.

LIST OF KEY MARKET PLAYERS PROFILED IN THE REPORT

- International Paper (U.S.)

- Domtar Corporation (U.S.)

- Georgia-Pacific LLC (U.S.)

- Nine Dragons Worldwide (China) Investment Group Co., Ltd. (China)

- Billerud AB (Sweden)

- UPM (Finland)

- Svenska Cellulosa Aktiebolaget SCA (Sweden)

- Oji Holding Corporation (Japan)

- Sappi Ltd (South Africa)

- Nippon Paper Industries Co., Ltd. (Japan)

- Smurfit WestRock (Ireland)

KEY INDUSTRY DEVELOPMENTS

- March 2025: UPM Specialty Papers and Orkla Suomi introduced a sustainable paper-based wrapper for Panda Milk Chocolate, replacing traditional polypropylene plastic packaging.

- March 2025: Billerud recently launched ConFlex HeatSeal, a recyclable and heat-sealable paper packaging material aimed at replacing plastic in various packaging applications. This innovative product is designed to meet high demands for sealing performance while enhancing recyclability, aligning with the growing trend toward sustainable packaging solutions.

- January 2025: International Paper finalized its acquisition of DS Smith, valued at approximately USD 7.2 billion. The merged entity will be headquartered in Memphis, Tennessee, which is International Paper's original location, and will also establish a European headquarters in London, the former base of DS Smith.

- December 2024: Georgia-Pacific is set to invest USD 90 million in its Crossett, Arkansas mill to enhance its consumer tissue business. This expansion will increase the capacity for producing high-quality bath tissue, including the popular Angel Soft brand. Initial production from this investment is anticipated to commence in 2026.

- September 2023: International Paper has completed the sale of its 50% interest in Ilim SA, the holding company for its Ilim joint venture, to its JV partners for USD 484 billion in cash. The company also sold its outstanding shares in JSC Ilim Group to its JV partners for USD 24 billion in cash and divested other non-material residual interests associated with Ilim. With these transactions, International Paper has fully divested all of its ownership interests in Ilim.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies and categories. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2035 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2035 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 1.7% from 2026-2035 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Segmentation |

By Category

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global pulp and paper market size was USD 357.6 billion in 2026 and is projected to record a valuation of USD 416.56 billion by 2035.

The market is expected to grow at a CAGR of 1.7% during the forecast period.

The wrapping & packaging segment is expected to be the leading category in the market.

The increasing demand for eco-friendly packaging and personal care products drives market growth.

Asia Pacific dominated the market in 2025.

Rising adoption of sanitary products is a key factor driving product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us