Absorbable Sutures Market Size, Share & Industry Analysis, By Type (Monofilament and Multifilament/Braided), By Form (Natural and Synthetic), By Application (Gynecology, Orthopedics, Cardiology, General Surgery, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

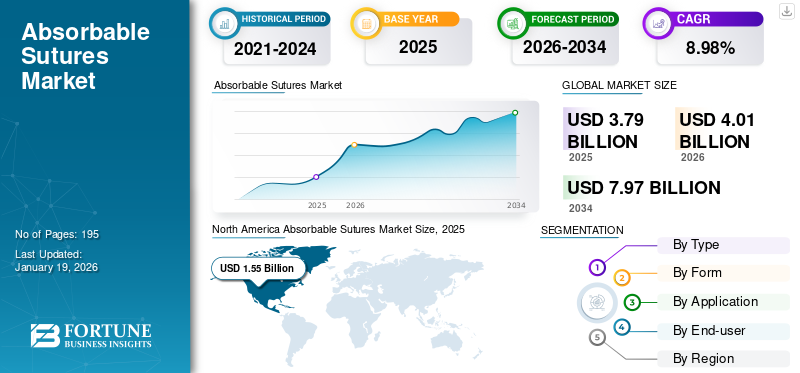

The global absorbable sutures market size was valued at USD 3.79 billion in 2025. The market is projected to grow from USD 4.01 billion in 2026 to USD 7.97 billion by 2034, exhibiting a CAGR of 8.98% during the forecast period. North America dominated the absorbable sutures market with a market share of 40.92% in 2025.

Absorbable sutures are stitches made from materials that body can naturally break down and absorb over time as a wound heals. These sutures are also known as dissolvable stitches or resorbable sutures. These types of sutures do not require removal by medical professionals, making them ideal for internal wounds or surgical sites that are difficult to access after surgery. They can be made from natural materials such as catgut (derived from animal intestines) or synthetic polymers such as polydioxanone, poliglecaprone, and polyglactin.

The rising number of surgeries, including orthopedics, cardiology, gynecology, and others, are driving the demand for resorbable sutures, which is anticipated to fuel the market growth.

- For instance, as per the data provided by the Canadian Institute for Health Information (CIHI) in February 2024, the total C-section rate in Canada was 33.4% in 2023, which means 33.4% of deliveries were done by C-section.

The market comprises of key players such as Johnson & Johnson Services, Inc., Medtronic, B. Braun SE, and others. These companies are increasingly implementing growth strategies such as new product launches, acquisitions, and expanding geographical reach to gain a significant portion of market share.

MARKET DYNAMICS

Market Drivers

Rising Number of Surgeries to Boost Demand for Absorbable Sutures Globally

The high burden of orthopedic surgeries, bypass operations, and cosmetic procedures is increasing the usage of resorbable sutures to enable rapid wound closure, thereby driving the absorbale sutures market growth.

- For instance, the data published by the UC Regents in October 2024 highlighted that approximately 1.3 million knee replacements and up to 760,000 hip replacements are performed annually in the U.S.

- Similarly, according to the data published by the National Center for Biotechnology Information (NCBI) in August 2023, around 400,000 coronary artery bypass graft (CABG) surgeries are conducted each year worldwide.

Furthermore, the geriatric population is higly susceptible to chronic diseases, leading to an increasing number of surgeries, such as angioplasty, joint replacements, and organ transplants. This leads to an increase in the usage of sutures during surgical procedures. Also, the higher efficiency of suturing devices in surgical procedures drives its adoption by healthcare professionals. These additional factors fuel the overall global absorbable sutures market growth.

Market Restraints

Growing Preference for Various Alternatives to Hinder the Market Growth

The growing preference for alternative wound closure methods presents a significant restraint for resorbable sutures adoption. Surgical staples, tissue adhesives, and hemostats are largely preferred in specific surgeries due to its advantages such as rapid application, reduced tissue trauma, and improved cosmetic outcomes.

Staples are preferred in laparotomy and orthopedic procedures for their speed, while adhesives gain traction in dermatological and cosmetic procedures for decreasing scarring. These alternatives are limiting the adoption of resorbable sutures in the market.

- For instance, according to an article published by Unisur Lifecare in June 2024, Stapling's efficiency in wound closure outperforms suturing, particularly in emergency medical interventions and complex surgical procedures.

Therefore, the rising shift of patients toward alternatives to surgical sutures, such as surgical staples, adhesive tapes, and tissue sealants, is anticipated to hinder market growth in the forthcoming years.

Market Opportunities

Rising Focus of Market Players on the Development of Innovative Sutures is Considered as a Significant Opportunity for Market Growth

In recent years, there have been several advancements in resorbable sutures, which has enhanced their efficiency in surgical procedures. Modern resorbable sutures currently feature enhanced tensile strength, superior biocompatibility, and improved absorption profiles, reducing the risk of infection and eliminating the need for suture removal, which leads to better patient outcomes and greater comfort.

Recent advancements in resorbable sutures include the development of new synthetic polymers such as poly(glycolide-co-l-lactide) (PGA-L) and diacetyl chitin, as well as coatings with antimicrobial agents such as Triclosan. These innovations aim to improve suture durability, reduce infection risk, and enhance wound healing.

- For instance, according to the data published by CosmoDerma in 2023, recent research on a diacetyl chitin-derived absorbable suture showed 63.0% strength retention at 14 days, full absorption by 42 days, and enhanced wound stability with faster tissue repair in rat incisions, matching the efficacy of Vicryl Plus VR.

This increased efficacy of resorbable sutures with novel innovations is expected to drive market expansion in the coming years.

Market Challenges

Post-surgical Complications of Absorbable Sutures are Substantial Challenges Hindering Market Growth

Despite several advancements in resorbable sutures and their high efficacy in different surgeries, the post-surgical complications reported with their usage are expected to challenge the product demand. Post-surgical complications with dissolvable stitches can include infection, wound dehiscence (reopening), and tissue reactions including granuloma formation. Scarring can also occur and sometimes, sutures may be associated with hypersensitivity reactions.

- For instance, according to the data published by the Journal of Biomaterials in September 2024, the early deterioration of the mechanical strength of absorbable surgical sutures can result in serious complications, including wound dehiscence.

Although resorbable sutures generally avoid the need for removal, however they can still pose risks, such as suture-related infections or pseudo infections, which may influence the healthcare professionals to opt for alternative solutions. This shift toward alternative solutions due to post-surgical complications is likely to challenge the market growth over the forecast timeframe.

Absorbable Sutures Market Trends

Introduction of Knotless Absorbable Sutures is an Emerging Trend in the Market

Knotless sutures, particularly those made from absorbable materials, have gained rapid adoption in minimally invasive surgeries such as orthopedic, cardiovascular, and laparoscopic procedures, where precise tension and reduced tissue trauma are critical.

Surgeons globally are favoring absorbable knotless sutures due to their ability to minimize the risk of infection, eliminate the need for suture removal, and provide consistent wound closure without the technical challenges of knot tying.

- For instance, according to the data published by the British Journal of Surgery in October 2022, a comparative study of absorbable knotless barbed sutures versus conventional resorbable sutures for abdominal wall closure in patients undergoing open hernia repairs reported that absorbable knotless barbed sutures significantly reduce the surgical site infections (SSI) compared to conventional sutures, with fewer infections occurring at both 60 and 90 days post-operation.

Additionally, technological advancements, including synthetic bioengineered and antimicrobial-coated resorbable sutures, are further propelling this trend, supported by regulatory approvals and growing surgeon awareness of their clinical benefits. Moreover, the expanding use of robotic-assisted and high-throughput surgeries is probable to accelerate the adoption of knotless absorbable sutures, as these products modernize surgical workflows and reduce the potential of human error.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Multifilament/Braided Segment Dominated the Market Due to Various Advantages Associated with its Application

Based on type, the market is segmented into monofilament and multifilament/braided.

The multifilament segment held a dominating global absorbable sutures market share of 84.70% in 2026. Due to superior handling characteristics and knot security, multifilament resorbable sutures are highly preferred in precise surgical scenarios. These sutures, composed of multiple braided or twisted strands, offer greater flexibility and pliability, making them easier to manipulate during intricate procedures. This is expected to increase their adoption, driving the segment’s growth in the forthcoming years.

- For instance, according to the article published by Peters Surgical in July 2024, braided multifilament sutures are commonly used in cardiac surgery and for securing prosthetic materials due to their superior tensile strength.

The monofilament segment accounted for a substantial market share in 2024. The segment's growth can be attributed to its rising preference due to the lower incidence of infection than the multifilament structure. Moreover, monofilament sutures are widely used in vascular and microvascular surgeries due to their lower friction coefficient, making them easy to pass through tissues. This advantages increases their adoption and supports the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Form

Synthetic to Dominate Market Due to Less Chances of Hypersensitivity Reactions

Based on form, the market is segmented into natural and synthetic.

The synthetic segment held a dominating market share of 74.96% in 2026 and is expected to grow at the highest CAGR during the forecast period. This segment's growth can be attributed to the increasing usage of synthetic absorbable sutures during wound closure, considering its primary benefit of comparatively lower chances of hypersensitivity reactions.

- For instance, according to the study published by the National Center for Biotechnology Information (NCBI) in September 2022, chronic irritant dermatitis, allergic contact dermatitis, and contact urticaria are less likely to occur due to the use of synthetic resorbable sutures such as polyglactin 910 and poliglecaprone 25.

The natural segment accounted for a substantial market share in 2024. Natural resorbable sutures such as catgut are made from biological materials that break down and are absorbed by the body over time. Due to the greater absorbability of natural sutures, they are widely utilized in ophthalmic, gynecological, and plastic surgeries. These are some of the vital factors driving segmental growth. Moreover, natural sutures are generally less expensive than synthetic options, making them accessible, especially in resource-limited settings.

By Application

Increasing Prevalence of Orthopedic Disorders to Drive the Segment’s Growth

Based on application, the market is segmented into gynecology, orthopedics, cardiology, general surgery, and others.

The orthopedics segment dominated the market share of 28.52% in 2026. The dominance of this segment is mainly attributed to the high burden of orthopedic disorders and the increasing number of orthopedic surgeries such as hip and knee replacement.

- For instance, as per the American Joint Replacement Registry (AJRR) 2024 report published in November 2024, around 3.7 million people underwent arthroplasty procedures across the Americas in 2023.

The gynecology segment accounted for a substantial market share in 2024. The growth of this segment is attributed to a rising number of gynecological procedures such as episiotomy repair, uterine incision closure (cesarean section), pelvic organ prolapse repair, and reconstructive tubal surgery. Resorbable sutures are preferred in such procedures due to their ability to dissolve over time, eradicating the need for suture removal and minimizing tissue reaction.

- For example, as per the data provided by the World Health Organization (WHO) in June 2021, more than 1 in 5 (21.0%) of all childbirths were performed by cesarean section globally in 2020. This proportion of childbirths by cesarean section is expected to increase to 29.0% by the end of 2030.

The general surgery segment held a moderate market share in 2024, owing to the growing demand for absorbable sutures primarily for deep tissue closure and in areas where the need for long-term support is least. They are most commonly used in abdominal surgeries as they provide the necessary support during the early stages of healing and vanish as the tissue strengthens.

The cardiology segment accounted for the second-largest market share in 2024. The growth of this segment is attributed to the increasing usage of resorbable sutures in pediatric cardiac surgeries, specifically for purse strings during cardiopulmonary bypass. Several studies have indicated that using dissolvable stitches in pediatric cardiac surgeries was safe and didn't cause immediate postoperative bleeding. This is predicted to propel the adoption of resorbable sutures in cardiac procedures.

- For example, as per the data provided by the American College of Surgeons in June 2024, more than 40,000 patients undergo pediatric and congenital heart surgery every year in the U.S.

The others segment is anticipated to witness significant growth during the forecast period. This growth can be attributed to the increasing use of resorbable sutures in ophthalmic surgeries, cosmetic surgeries, and others.

By End-user

Hospitals & ASCs to Dominate the Market Due to Higher Number of Patient Visits to the Settings

Based on end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment held a dominating market share of 54.02% in 2026 due higher preference for these settings for surgical interventions. Additionally, the favorable reimbursement scenario due to the tie-up of numerous hospitals with health insurance companies is increasing the surgical volume in these settings. Moreover, the increasing number of ASCs is also expected to fulfill the rising demand for surgical procedures, this fueling the segment growth.

- For instance, according to the data provided by the Centers for Medicare & Medicaid Services (CMS) in September 2024, there are more than 6,300 Medicare-certified ASCs in the U.S.

The specialty clinics segment held the second-largest share in 2024. This growth is mainly attributed to the increasing preference for surgical interventions in specialty clinics due to inclusive, specialized treatment availability and shorter waiting times.

The others segment, including military hospitals, academic clinics, and nursing homes, is anticipated to grow considerably during the forecast period. Increasing number of wound closure procedures have been performed in these settings by using resorbable sutures, driving segmental growth.

ABSORBABLE SUTURES MARKET REGIONAL OUTLOOK

In terms of regions, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Absorbable Sutures Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the absorbable sutures market in 2025, accounting for USD 1.55 billion of the global market. This region is anticipated to grow at the moderate CAGR during the forecast period. Due to the high prevalence of chronic conditions and established healthcare infrastructure, the strong demand for resorbable sutures among U.S. hospitals is probable to fuel the regional market growth in the coming years.

In the U.S., the significant reimbursement for various surgeries in hospitals and ambulatory surgical centers (ASCs) is increasing the surgical volume across the country, which may involve resorbable sutures. This is expected to boost the country’s market growth. The U.S. market is projected to reach USD 1.48 billion by 2026.

- For instance, in November 2023, the Centers for Medicare & Medicaid Services (CMS) released its 2024 final payment rule for ASCs and hospital outpatient departments (HOPD) and finalized the addition of 37 surgical procedures to the ASC-CPL.

Europe

The Europe region accounted for the second-largest share of the market in 2024. This market growth is largely attributable to the high burden of operations, including orthopedic surgeries, which is expected to increase the adoption of resorbable sutures. The UK market is projected to reach USD 0.13 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

- For instance, according to the data published by the British Orthopedic Association in May 2022, over 42,000 orthopedic operations were performed in 2022 in England.

Asia Pacific

The market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The increasing focus of market players on new product launches is driving the growth in this region. The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

- For instance, in August 2023, Healthium Medtech announced the launch of TRUMAS, a range of dissolvable stitches specifically designed to address challenges faced during suturing in minimal-access surgeries.

Latin America

The market in Latin America is expected to grow at a considerable CAGR during the forecast period. This is largely attributed to several cosmetic procedures being performed in Latin American countries. As the number of cosmetic procedures increases, the use of sutures to perform these procedures also increases.

- For instance, as per the data provided by the International Society of Aesthetic Plastic Surgery (ISAPS) in June 2024, around 87,215 and 60,489 rhinoplasty procedures were performed in Brazil and Mexico, respectively, in 2023.

Middle East & Africa

The Middle East & Africa market is anticipated to grow at a stagnant CAGR during the forecast period. This market gowth is primarily attributed to the increasing prevalence of chronic diseases, such as orthopedic diseases, cardiovascular diseases, ophthalmic diseases, and many others.

COMPETITIVE LANDSCAPE

Key Industry Players

Rising Focus of Market Players on Receiving Regulatory Approvals to Enhance Their Product Offerings in the Market

The market consists of key players, such as B. Braun SE, Medtronic, Genesis Medtech, and Johnson & Johnson Services, Inc., among others, providing resorbable sutures across the globe. The growing focus of these key players on receiving regulatory approvals for new product launches is one of the important factors contributing to their substantial position in the market.

- For example, in September 2023, Genesis MedTech secured approval from China’s National Medical Products Administration (NMPA) for the launch of its resorbable sutures with antibacterial protection.

The other companies operating in the market are Kono Seisakusho Co., Ltd., DemeTECH Corporation, Teleflex Incorporated, Meril Life Sciences Pvt. Ltd., and Dolphin Sutures. These players focus on enhancing product supply by signing distribution agreements with local distributors to increase their product offerings in the market.

LIST OF KEY ABSORBABLE SUTURES COMPANIES PROFILED

- Braun SE (Germany)

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Genesis Medtech (Singapore)

- Internacional Farmacéutica S.A (Mexico)

- Kono Seisakusho Co.,Ltd. (Japan)

- DemeTECH Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- Meril Life Sciences Pvt. Ltd. (India)

- Healthium Medtech Limited (India)

- Dolphin Sutures (India)

KEY INDUSTRY DEVELOPMENTS

- November 2024 - Orion Sutures, a surgical suture manufacturing company, announced its presence at the MEDICA 2024 conference in Dusseldorf, Germany. During the event company was present at booth no. B66-1 to create awareness about its resorbable sutures among consumers.

- October 2024 - Orion Sutures announced its presence at Africa Health 2024, a medical conference held in South Africa. During the event company was present at stall no. H2.E17 to create awareness about its dissolvable stitches among consumers.

- February 2024 - Novo Integrated Sciences, Inc. and Clinical Consultants International, LLC (CCI), a Novo wholly-owned subsidiary, announced the signing of a consulting services agreement with Futura Surgicare Pvt Ltd, an India-based leading manufacturer of wound closure and surgical products that are marketed and distributed in over 70 countries worldwide under the trade name “Dolphin Sutures.” This agreement was made to introduce high-quality dolphin sutures to the North American market.

- November 2023 - Peters Surgical announced its new distribution partnership with Vertice Healthcare to expand its sutures offering in the South African market.

- May 2023 - Boz Medical was resent at the 18th Istanbul Oral and Dental Health Devices and Equipment Fair IDEX 2023. During the event, the company was present at booth D14 to showcase all its surgical products, including absorbable sutures, to enhance brand presence in the global market.

REPORT COVERAGE

The global market report provides a detailed competitive landscape and market insights. It focuses on key aspects such as competitive landscape, type, form, application, end-user, and region. In addition to the global absorbable sutures market size, it offers market dynamics and insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 8.98% from 2026-2034 |

|

Unit |

Value (USD billion) |

| Segmentation |

By Type

|

|

By Form

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.01 billion in 2026 and is projected to record a valuation of USD 7.97 billion by 2034.

In 2025, the market value stood at USD 1.55 billion.

The market will exhibit a steady CAGR of 8.98% during the forecast period.

By type, the multifilament/braided segment will lead the market during the forecast period.

The increasing number of surgical procedures is one of the main factors driving the market growth.

B. Braun SE, Medtronic, Genesis Medtech, DemeTECH Corporation, and Teleflex Incorporated are the major players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us