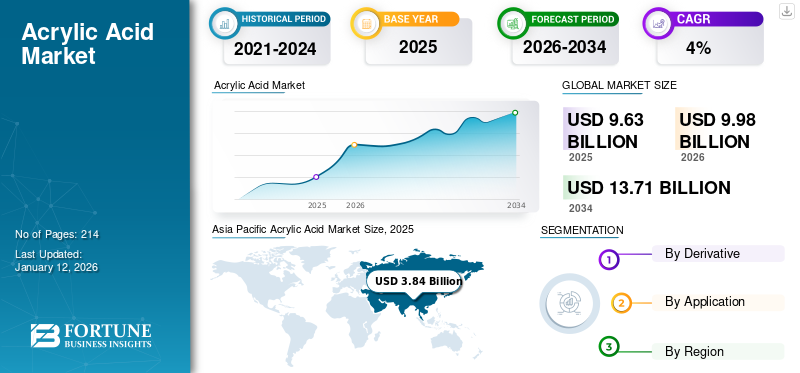

Acrylic Acid Market Size, Share & Industry Analysis, By Derivative (Acrylic Esters, Acrylic Polymers, and Others), By Application (Paints & Coatings, Adhesives & Sealants, Textiles, Personal Care Products, Water Treatment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global acrylic acid market size was valued at USD 9.63 billion in 2025. The market is projected to grow from USD 9.98 billion in 2026 to USD 13.71 billion by 2034 at a CAGR of 4.0% during the 2026-2034 forecast period. Asia Pacific dominated the acrylic acid market with a market share of 40% in 2025.

Acrylic acid is a colorless, volatile liquid organic compound. It is the simplest form of unsaturated carboxylic acid, composed of a vinyl group directly bonded to a carboxyl group. This structure enables high reactivity, particularly in polymerization processes that form important derivatives such as acrylates and polyacrylic acid used in paints, adhesives, and superabsorbent polymers.

The increasing number of building activities and urbanization worldwide heightens the need for acrylic-based paints, coatings, adhesives, and sealants due to their durability, UV resistance, and weathering performance. Also, it is used to produce SAPs found in baby diapers, adult incontinence products, and feminine hygiene items. Rising global birth rates and aging populations are fueling this demand. BASF SE, NIPPON SHOKUBAI CO., LTD., Arkema S.A., LG Chem Ltd., Shanghai Huayi Acrylic Acid Co., Ltd. are the key players operating in the market.

MARKET DYNAMICS

ACRYLIC ACID MARKET TRENDS

Shift Toward Bio-Based and Alternative Feedstock Routes Drives the Market Growth

Bio-based acrylic acid (bio-AA) made from renewable feedstocks, including glycerol, sugars, or 3-hydroxypropionic acid (3-HP), can reduce its global warming potential by up to 60% compared to conventional propylene-based methods when using purified crude glycerol from biodiesel production.

Major producers, including BASF, Arkema, LG Chem, and Evonik, are investing in R&D partnerships for the commercialization of bio-acrylic acid, particularly in Europe and North America. Meanwhile, Asia-Pacific economies are emerging as scalable production hubs for bio-based materials.

MARKET DRIVERS

Expanding Demand from the Coatings, Adhesives & Sealants, and Textiles Industry Drives Market Growth

End-use growth in coatings, adhesives & sealants, as well as textiles, is a leading demand driver for the acrylic acid market growth, as acrylic esters and polymers impart improved durability, flexibility, and weather resistance to finished products.

The global shift toward low-VOC, water-based formulations further increases the market share of acrylic-based coatings, due to the rising production of eco-friendly and high-performance products.

Acrylic esters are crucial components of high-performance adhesives and sealants used in packaging, automotive assembly, electronics, and building products, offering fast curing, strong, flexible bonds, and weather/chemical resistance. In textiles, acrylic-based polymers serve as finishing and coating agents, enhancing wrinkle resistance, dye retention, softness, and long-term durability in clothing, upholstery, and technical fabrics.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Health, Safety, and Handling Concerns Significantly Restrain Market Expansion

Acrylic acid is highly corrosive to skin, eyes, and mucous membranes, often causing severe burns or respiratory irritation upon contact or inhalation. Prolonged exposure can lead to permanent tissue damage or pulmonary complications; therefore, strict occupational safety measures such as neoprene gloves, chemical-resistant clothing, and respiratory equipment are essential.

The compound is also toxic to aquatic life, complicating environmental compliance and wastewater management for industrial facilities. Thus, despite strong demand, health and handling hazards act as key restraining factors in market expansion as they necessitate costly mitigation systems, stricter regulatory compliance, and operational risks across production, transportation, and end-use environments.

MARKET OPPORTUNITIES

Growing Demand for Hygiene Products Creates an Opportunity For Market Development

The growing demand for hygiene products, including baby diapers, adult incontinence items, and sanitary napkins, is one of the strongest opportunities for the market. This is because acrylic acid produces superabsorbent polymers (SAPs), which are the key component enabling these products’ fluid absorption properties.

The product is a critical raw material in producing SAPs through polymerization reactions with sodium hydroxide, forming polyacrylic acid gels with exceptional water-absorption capacity (up to several hundred times their own weight). These polymers are used in baby diapers, feminine hygiene products, and adult incontinence pads, offering softness, dryness, and odor control that enhance user comfort and hygiene.

MARKET CHALLENGES

Price Volatility of Raw Materials Acts as a Hinderance to the Market Expansion

Acrylic products are recognized as hazardous chemicals due to their corrosive nature, respiratory irritation risks, and aquatic toxicity. This leads to stringent safety and environmental regulations imposed by agencies, including the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), as well as other regional bodies, making compliance costly and operationally complex.

Feedstock price volatility is exacerbated by regulatory uncertainty, which in turn affects production planning and profitability. Regulatory mandates for low-VOC formulations and biodegradable materials further drive R&D but raise entry barriers for smaller players.

Regulatory Compliance May Hurdle the Market

Regulatory compliance poses a major hurdle for the market due to the chemical's hazardous nature and stringent environmental and occupational safety standards. The product is highly corrosive, volatile, and toxic to both human health and aquatic ecosystems, resulting in stringent regulations from agencies such as the U.S. EPA, European Chemicals Agency, and others. These regulations require producers to invest heavily in emission controls, containment, and safety training programs, which raises operational costs and complicates plant expansions, especially in densely populated or environmentally sensitive areas.

IMPACT OF COVID-19

Supply Chain and Production Disruptions Due to the Pandemic Hampered Market Growth

The COVID-19 pandemic had a mixed yet notable impact on the market between 2020 and 2025. Initially, the market experienced supply chain disruptions and reduced demand in key sectors such as construction and automotive, which slowed growth. However, the demand for hygiene products containing superabsorbent polymers (SAPs), which rely heavily on market products, surged significantly during national lockdowns, particularly in Europe and North America. Consumers stocked up on diapers, adult incontinence products, and sanitary napkins, causing short-term spikes and temporary tightness in the supply chain.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism and geopolitical factors have significantly impacted the market, primarily through supply chain disruptions and fluctuations in feedstock prices. Acrylic acid production heavily relies on petrochemical feed stocks, including propylene, which are vulnerable to geopolitical tensions, conflicts, and trade restrictions that affect oil and chemical supply flows.

Trade protectionism, including tariffs and export/import restrictions, particularly in the Asia-Pacific and between major chemical producers, compounds regional supply imbalances. Countries, including China and India, fast-growing product consumers and producers, experience both opportunities from increasing capacity expansions and challenges due to import dependence and regional trade policies. This causes regional price disparities and competitive uncertainty for manufacturers and end-users in coatings, adhesives, and superabsorbent polymers end markets.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Research and Development (R&D) in the market is strongly focused on sustainability, performance enhancement, and production efficiency to meet evolving regulatory and consumer demands. A key trend is the rising shift toward bio-based products produced from renewable feed stocks such as glycerol and sugars, driven by regulatory pressure to reduce fossil fuel dependence and lower carbon footprints. Major chemical companies, including BASF and Arkema, are leading R&D collaborations to scale bio-based production through fermentation and catalytic processes, aiming to bridge cost and performance gaps with traditional petrochemical routes.

SEGMENTATION ANALYSIS

By Derivative

Acrylic Esters Became a Popular Derivative Due to Their Versatility and Widespread Use

Based on derivative, the market is segmented into acrylic esters, acrylic polymers, and others.

The acrylic esters segment held the largest acrylic acid market with a share of 47.39% in 2026. The product is dominant due to its versatility and widespread use in surface coatings, adhesives, and sealants. Esters such as butyl acrylate, methyl acrylate, ethyl acrylate, and 2-ethylhexyl acrylate are major contributors. Butyl acrylate, for example, is widely used due to its balance of flexibility, weather resistance, and cost efficiency, making it a preferred ingredient in the construction and packaging industries. Acrylic esters improve gloss, adhesion, and durability in paints and coatings, driving strong demand.

The acrylic polymers segment held a notable share of the market. Acrylic polymers, including polyacrylic acid and related polymers, are significant for applications in superabsorbent polymers (SAPs) used in hygiene products such as diapers and sanitary napkins. They also find uses in adhesives, plastics, and textile treatments for enhanced water repellency and durability. The polymers segment is growing steadily due to strong hygiene product demand and expanding industrial uses.

The other segment includes derivatives such as acrylamide, acrylonitrile, and butadiene-based polymers, which serve in niche applications, namely as water treatment chemicals, synthetic rubbers, and specialty plastics. Though smaller in volume, these derivatives contribute to market diversity and technological advancements.

By Application

To know how our report can help streamline your business, Speak to Analyst

Paints & Coatings Segment Increasingly Demanded Due to Its Excellent Adhesive Properties.

Based on application, the market is segmented into paints & coatings, adhesives & sealants, textiles, personal care products, water treatment, and other.

Among these, the paints & coatings segment registers a dominating acrylic acid market with a share of 31.96% in 2026. The growth is driven by acrylic esters’ excellent adhesion, durability, and weather resistance. These properties make acrylic product derivatives essential in automotive, construction, and consumer goods coatings, providing gloss, color retention, and corrosion protection.

The personal care segment leverages superabsorbent polymers produced from the product market in products including diapers, sanitary napkins, and adult incontinence products, reflecting growing hygiene awareness and demographic trends.

Adhesives & sealants have significant growth due to strong demand from the packaging, automotive, and construction industries. Acrylic product-based pressure-sensitive adhesives offer superior bonding, flexibility, and durability, making them pivotal in high-performance bonding solutions.

Acrylic derivatives are used for textile finishes to enhance water repellency, durability, and anti-soiling features that withstand multiple washes. This application contributes to functional and performance textiles in apparel and industrial uses.

Acrylic product polymers are utilized in water treatment chemicals to improve flocculation, sedimentation, and contaminant removal processes. This sector benefits from increasing investments in industrial and municipal water infrastructure.

The other segment includes diverse applications such as paper coatings, plastic additives, surfactants, agricultural chemicals, and specialty products, highlighting the broad utility of acrylic product derivatives.

ACRYLIC ACID MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Acrylic Acid Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the leading acrylic acid market with a size of USD 3.84 billion in 2026. The region benefits from rapid industrialization, urbanization, and rising hygiene awareness, especially in China and India. Large-scale production facilities, government support, and proximity to feedstock sources enable the Asia Pacific to lead in both production and consumption. China is particularly important as a manufacturing hub, with key companies expanding production capacity to meet domestic and export demand. The Japan market is projected to reach USD 0.46 billion by 2026, the China market is projected to reach USD 2.06 billion by 2026, and the India market is projected to reach USD 0.56 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America holds a significant share with resilient supply chains anchored by integrated petrochemical complexes, particularly in the U.S. Gulf Coast. Growth is fueled by advances in bio-based acrylic production, shale gas-enabled cost advantages, and demand from automotive, construction, and personal care industries. The region is expected to register the fastest growth rate due to robust infrastructure and strong investments in innovation and sustainability. The U.S. market is projected to reach USD 2.29 billion by 2026.

Europe

Europe's market focuses on sustainability and regulatory compliance, with strong investments in carbon footprint reduction and circular economy initiatives. Major countries such as Germany, France, and the UK have well-developed chemical industries supporting steady market growth driven by coatings, adhesives, and hygiene applications. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.62 billion by 2026.

Middle East & Africa, and Latin America

The Middle East & Africa and Latin America regions hold smaller market shares but are experiencing growing demand due to increasing industrial activities and infrastructure development. Investments and exports in chemicals are aiding gradual market expansion. The Middle East leverages its petrochemical resources to expand acrylic production and integrate derivatives manufacturing.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Rising Production of Textiles for Sustainability and Performance by Key Players Fuels Industry Growth

BASF SE (Germany), NIPPON SHOKUBAI CO., LTD. (Japan), Arkema S.A. (France), LG Chem Ltd. (South Korea), and Shanghai Huayi Acrylic Acid Co., Ltd. (China) are the key players in the market. Major investments by companies in developing Textiles that address evolving demands for sustainability and performance.

LIST OF KEY ACRYLIC ACID COMPANIES PROFILED IN THE REPORT

- BASF SE (Germany)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- Arkema S.A. (France)

- LG Chem Ltd. (South Korea)

- Mitsubishi Chemical Group Corporation (Japan)

- Dow Inc. (U.S.)

- Sasol Limited (South Africa)

- Shanghai Huayi Acrylic Acid Co., Ltd. (China)

- Hexion Inc. (U.S.)

- Wanhua Chemical Group Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- August 2024 – BASF announced it will switch its Ethyl Acrylate (EA) production entirely to bio-based EA from Q4 2024, offering approximate 40 % ^14C traceable bio content and 30 % reduced carbon footprint.

- July 2022 – LG Chem and GS Caltex initiated construction of a 3-Hydroxypropionic acid (3HP) pilot plant, aiming to build an eco-friendly “white bio” raw material ecosystem. This move supports LG Chem’s efforts to integrate bio-based feedstocks into acrylic acid / acrylic monomer value chains. It signals strategic intent to reduce reliance on fossil-based propylene and respond to sustainability demands.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, derivatives, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion), Volume (Kilo Ton) |

|

Growth Rate |

CAGR of 4.0% from 2026 to 2034 |

|

Segmentation |

By Derivative, By Application, By Region |

|

By Derivative |

· Acrylic Esters · Acrylic Polymers · Others |

|

By Application |

· Paints & Coatings · Adhesives & Sealants · Textiles · Personal Care Products · Water Treatment · Others |

|

By Region |

· North America (By Derivative, By Application, By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Derivative, By Application, By Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Derivative, By Application, By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Derivative, By Application, By Country) o Mexico (By Application) o Brazil (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Derivative, By Application, By Country) o GCC (By Application) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 9.98 billion in 2026 and is projected to reach USD 13.71 billion by 2034.

Recording a CAGR of 4.0%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

The Paints & Coatings application segment led in 2026.

Asia Pacific held the highest market share in 2025.

Expanding demand from the coatings, adhesives & sealants, and textiles industry drives the acrylic acid market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us