Adults Vaccines Market Size, Share & Industry Analysis, By Type (Recombinant/Conjugate/Subunit, Inactivated, mRNA, Viral Vector, Live Attenuated, Toxoid, and Others), By Route of Administration (Parenteral and Oral), By Disease Indication (Viral Diseases {Hepatitis, Influenza, Human Papillomavirus, Herpes Zoster, and Others} and Bacterial Diseases {Meningococcal Disease, Pneumococcal Disease, Diphtheria/Tetanus/Pertussis, and Others}), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

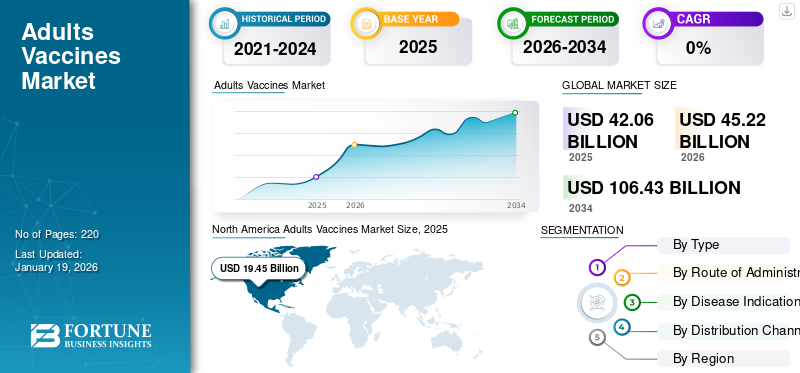

The global adults vaccines market size was valued at USD 42.06 billion in 2025. The market is projected to grow from USD 45.22 billion in 2026 to USD 106.43 billion by 2034, exhibiting a CAGR of 11.29% during the forecast period. North America dominated the adult vaccines market with a market share of 48.16% in 2025.

Adult vaccination protects individual and community health by preventing serious, sometimes life-threatening, diseases. As the population ages, their immune systems may weaken, making them more susceptible to infections that childhood vaccines might not fully protect against or diseases they may encounter for the first time. The market is primarily driven by the rise in the incidence of infectious diseases in adults and the increase in the geriatric population. Additionally, a rise in awareness about adult immunization and technological advancements supports the market growth during the forecast period. The rise in new product launches, approvals, and government initiatives, such as public health initiatives promoting adult immunization, also contributed to market growth.

- For instance, in May 2025, Moderna, Inc. received the U.S. FDA approval for mNEXSPIKE, a COVID-19 vaccine to treat individuals in the age group of 12-64 years.

The market is expected to show prominent growth in the future due to the high R&D investment and robust pipeline products of major players, such as GSK plc., Merck & Co., Inc., and Serum Institute of India Pvt. Ltd.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Incidence of Infectious Diseases in Adults Drives Market Growth

The growth of the market is driven by the rise in the incidence of infectious diseases in adults. Infectious disease cases are rising due to several factors, such as lack of awareness, lifestyle changes, and antimicrobial resistance. Additionally, adult populations’ density and aging, chronic conditions, and weakened immune systems also play a crucial role in the rising cases of infectious diseases. This surge increases the adoption rate of preventive and therapeutic vaccines, leading to a boost in the market growth for adults vaccines in the upcoming years.

- For instance, according to the data published by the Centers for Disease Control and Prevention in August 2024, in the U.S., influenza affects more than 8.8% of adults aged between 18-64 per year.

MARKET RESTRAINTS

Vaccine Hesitancy and Misinformation May Lower Market Growth

The vaccine hesitancy and misinformation about vaccines may hinder the market growth during the forecast period. The misleading information about vaccines, often spread through social media and other online platforms, may hamper public trust in vaccines. Additionally, religious and cultural beliefs also play a crucial role in vaccine hesitancy, with some individuals choosing not to vaccinate based on their personal beliefs, especially in conservative societies. These factors show a negative impact on market growth, resulting in a lowering of the adoption rate of vaccines.

- For instance, according to the data published in the medical journal Vaccine, in November 2024, 38.4% of adults expressed hesitancy related to COVID-19 vaccination.

- For instance, according to the data published by Ecancer Medical Science in August 2024, the HPV vaccine adoption rate is low due to myths and misconceptions surrounding it. One of which is infertility in girls.

MARKET OPPORTUNITIES

Rise in Technological Advancements May Drive Market Growth in the Future

In recent years, technological advancements in vaccines have led to the development of mRNA platforms and new formulations, especially for adults. These new vaccine formulations are designed to address prevalent diseases such as influenza and pneumonia with high efficacy and low side effects. These high-efficacy vaccines increase convenience, which is expected to raise the vaccination rate among adults. This high vaccination rate lowers the burden of infectious diseases and supports the adults vaccines market share.

- For instance, in May 2025, Moderna’s mRNA platform could now develop vaccines for infectious diseases, such as immuno-oncology, rare diseases, and autoimmune diseases.

MARKET CHALLENGES

Lack of Awareness May Hamper Market Growth

Lack of vaccine awareness among adults is a significant challenge, hampering the market growth. The lack of awareness is attributed to insufficient knowledge about vaccine benefits, efficacy, and safety, and a limited understanding of the need for specific vaccines. This leads to delayed or missed vaccinations, which lowers the vaccine uptake rate and hampers the market growth.

- For instance, in February 2025, GSK plc., conducted a survey, which showed that more than 56.6% of Indian participants aged 50 and above are unaware of shingles disease. This lack of awareness may lower the product adoption rate, resulting in slow adults vaccines market growth.

Other Challenges

High R&D and Manufacturing Costs

The high vaccine manufacturing and R&D cost is a significant factor impacting the growth of the market. The high cost is due to adults vaccines requiring large-scale trials and long-term monitoring for safety and efficacy.

ADULTS VACCINES MARKET TRENDS

Rising Development of Combination Vaccines, a Prominent Market Trend

Combination vaccines is a major trend in the adult vaccine market. Combination vaccines refer to a combination of multiple vaccines in a single injection. This growing trend is attributed to its convenience and potential to improve vaccination rates. It helps to reduce the burden of prioritization and increase vaccine uptake. Additionally, factors such as the rise in the incidence of infectious diseases and the increase in the global pediatric population have resulted in a growing demand for effective preventive vaccines. Various combination vaccines are anticipated to be developed in the future, such as influenza + COVID combination, influenza + RSV combination, and others.

- For instance, according to the data published in the National Center for Biotechnology Information in February 2024, currently, only one combination vaccine has been developed for adults, Tdap, a combination vaccine for tetanus, diphtheria, and pertussis.

Other Trends

Life-Course Immunization and Value-driven Immunization

The governments are aligning with the World Health Organization (WHO) recommendations to expand the adult vaccine schedules. This type of initiative raises the product adoption rate and supports the market growth.

- For instance, in May 2025, the Centers for Disease Control and Prevention published the adult immunization schedule for ages 19 years and older.

Furthermore, the study by the Office of Health Economics and funded by IFPMA announced that adult vaccination programs may deliver up to 19% return on investment in societal and healthcare savings.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Efficacy and Availability Drive Growth of Recombinant/Conjugate/Subunit Segment

On the basis of type, the market is segmented into mRNA, viral vector, inactivated, toxoid, live attenuated, recombinant/conjugate/subunit, and others.

The recombinant/conjugate/subunit segment dominated the market with the highest share in 2024. The growth of the segment is attributed to the ability of such vaccines to elicit a precise immune response for long-term protection. Moreover, the use of recombinant DNA technology has simplified the production of subunit vaccines. This stimulates the prominent players to increase focus on receiving approval for such vaccines, which is expected to boost the segment growth.

- For instance, in March 2025, Merck received European Commission (EC) approval for CAPVAXIVE, a conjugate vaccine used for the prevention of invasive pneumococcal disease and pneumococcal pneumonia in adults.

The inactivated segment held a significant share of the market in 2024. This can be attributed to the factors such as its effectiveness against a wide range of diseases, such as influenza, polio, hepatitis A, and others. Inactivated vaccines are generally easier to administer and less expensive to manufacture as compared to other types of vaccines, leading to an increase in their preference among manufacturers and healthcare professionals.

By Route of Administration

New Product Launches Drive Growth of Parenteral Route of Administration

On the basis of route of administration, the market is classified into oral and parenteral.

The parenteral segment dominated the market with the largest share in 2024 owing to new product launches and the availability of a broad range of products based on the parenteral route of administration. This route has high efficacy and bioavailability as compared to the oral route. In emergency cases, parenteral is the most useful as it showcases a quick onset of action. Additionally, in this route of administration, drugs get easily absorbed into the body as the drugs bypass the liver's first-pass metabolism, increasing the product adoption rate. New parenteral vaccine launches also drive the market growth.

- For instance, in January 2022, Moderna, Inc. received approval from the U.S. FDA for its Biologics License Application (BLA) for SPIKEVAX (COVID-19 Vaccines, mRNA) to treat individuals 18 years of age and older.

The oral segment held a significant share of the global market in 2024. The segment growth is attributed to a shift of focus on launching oral vaccines due to easy administration, cheaper rate, better safety, and other advantages.

By Disease Indication

Increasing Number of Viral Disease Cases to Drive Segmental Growth

Based on disease indication, the market is segmented into viral diseases and bacterial diseases.

The viral diseases segment dominated the market in 2024. The viral diseases are further sub-segmented into hepatitis, influenza, human papillomavirus, herpes zoster, and others. The segment’s growth is primarily attributed to the rise in prevalence of viral diseases, such as influenza. This high number of cases associated with the influenza virus is expected to increase the demand for vaccines to prevent and avoid further complications, which will drive the segment’s growth during the forecast period.

- For instance, according to the data published by the Centers for Disease Control and Prevention (CDC) in 2023, in the U.S., more than 48.0% of adults age 18 and older received an influenza vaccine.

The bacterial diseases segment held a significant market share in 2024 owing to the global rise in antimicrobial resistance (AMR) concern. Bacterial vaccines are an effective solution for controlling antimicrobial resistance (AMR) in humans. Additionally, the rise in the incidence of bacterial infections due to the aging population and weak immune systems further increases the demand for bacterial vaccines, which is expected to support the segment's growth during the forecast period.

- For instance, according to the data published by the Open Forum Infectious Diseases in April 2023, in the U.S., the risk of pneumococcal disease was higher in adults and older adults, especially with immunocompromising conditions.

By Distribution Channel

Government Suppliers’ Focus on Achieving Sustainable Supply of Vaccine Supports Segment Growth

Based on distribution channel, the market is segmented into hospital & retail pharmacies, government suppliers, and others.

The government suppliers segment dominated the market share in 2024. This dominance is due to the rise in focus of government suppliers, such as the Pan American Health Organization (PAHO), to achieve a sustainable supply of vaccines across the globe. Additionally, government initiatives, such as awareness drives and vaccination campaigns, also support the market growth during the forecast period.

- For instance, in February 2024, Takeda Pharmaceutical Company Limited and Biological E. Limited, in partnership, announced that the QDENGA, a tetravalent dengue vaccine for children and adults, will be made available for procurement by governments in endemic countries by 2030 to support the National Immunization Programs.

The hospital & retail pharmacies segment is expected to grow significantly in the upcoming years. The growth of the segment is attributed to the increasing number of hospitalizations and the rising cases of infectious diseases. The hospital and retail pharmacies ensure that vaccines are available enough to meet the demands of patients.

Adults Vaccines Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Adults Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 19.45 billion in 2025 and USD 20.92 billion in 2026. The large patient population associated with viral and bacterial diseases drives the growth of the market in this region. Additionally, favorable rules and regulations with robust infrastructure further support the market growth.

U.S.

The U.S. market dominated the North American region in 2024 owing to the robust usage of vaccines and the increasing number of vaccination plans to prevent viral and bacterial diseases in the region. The high prevalence of these diseases results in a rise in demand for effective preventive measures, supporting market growth. Additionally, fast regulatory approvals and a high adoption rate of new treatment options supplement the country’s market growth.

- For instance, in June 2025, Moderna, Inc. received approval from the U.S. Food and Drug Administration for the RSV vaccine, mRESVIA, in adults aged 18–59.

Europe

Europe held a significant share of the adults vaccines market with the rising R&D activities for the development of vaccines. Additionally, the rise in government expenditure for the prevention of infectious diseases in the region also supports the market growth. Europe has a mature market with universal healthcare systems, which enables wide access to vaccines.

- For instance, in May 2025, the Health Emergency Preparedness and Response Authority (HERA) of the European Commission, through the European Health and Digital Executive Agency (HaDEA), established the “European Vaccines Hub for Pandemic Readiness (EVH).” This center is established for the development of public-relevant vaccines.

Asia Pacific

Asia Pacific held a substantial share of the market in 2024 and is the fastest-growing region of the global market. The demand for preventive vaccines increases due to the high prevalence of infectious diseases. Additionally, an increase in R&D activities and government initiatives also drives market growth for adults vaccines in this region.

- For instance, in December 2022, the Central Drugs Standard Control Organisation (CDSCO) approved the world’s first intra-nasal vaccine developed by India for COVID-19 for restricted use in emergencies for adults.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa held comparatively lower shares but are expected to grow during the forecast period. The rise in awareness about vaccination, with the rise in demand for advanced vaccines, supports regional growth.

- For instance, as per the article published by the National Center for Biotechnology Information (NCBI) in August 2022, in the past decade, the emergence of chikungunya and Zika and the endemic circulation of all four dengue serotypes have increased the burden of arbovirus diseases in Brazil.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Development and Launches by Key Companies Resulted in their Dominating Position

The global adults vaccines market is concentrated with companies such as GSK plc., Sanofi, and Serum Institute of India Pvt. Ltd., accounting for a significant market share.

The GSK plc. held a significant share of the global adults vaccines market. GSK plc., consistently ranks among the top companies in revenue and market share. The dominance of the company is due to its vaccine portfolio, which focuses on targeting a wide range of infectious diseases in adults. The company’s key vaccines, such as Shingrix (for shingles), Infanrix Hexa, and Synflorix, are widely adopted products. Additionally, GSK plc., has a strong global presence and collaboration with other global organizations, leading to the growth of the company in the market.

- For instance, in January 2021, GSK plc., PATH, and Bharat Biotech entered into a product transfer agreement aimed at ensuring the long-term supply of malaria vaccine.

Sanofi accounted for a notable share in 2024 due to its robust global presence and broad portfolio of vaccines. Additionally, pipeline vaccine products and clinical success further drive the growth of the company in the adults vaccines market.

Furthermore, Merck & Co., Inc., Bavarian Nordic, EMERGENT, and AstraZeneca are among the other key players in the market. These players are focusing on the development of therapeutic and preventive vaccines and have significant investments in the research & development of innovative products that have supported the companies’ share of the market.

LIST OF KEY ADULTS VACCINES COMPANIES PROFILED

- Bavarian Nordic (Denmark)

- GSK plc (U.K.)

- EMERGENT (U.S.)

- Merck & Co., Inc. (U.S.)

- Inovio Pharmaceuticals, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- CSL (Australia)

- AstraZeneca (U.K.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Merck initiated MOBILIZE-1 Phase 3 clinical trial study evaluating the efficacy, safety, and immunogenicity of V181, a single dose of dengue vaccine candidate for adults aged 18 years and above.

- August 2024: Walvax Biotechnology Co., Ltd. announced that the World Health Organization (WHO) accepted pre-qualification for Walrinvax, an HPV vaccine used in the treatment of HPV infection in females 9 through 30 years of age.

- July 2023: Emergent BioSolutions received approval from the sU.S. FDA for its anthrax vaccine, which is used in adults aged 18 through 65.

- June 2023: GSK plc received approval for Shingrix, for the prevention of shingles in adults aged 18 and over, from the Japanese Ministry of Health, Labour and Welfare (MHLW), expanding the company’s product range in Japan.

- June 2022: Japan’s MHLW accepted a regulatory submission for GSK’s Shingrix vaccine to prevent shingles (herpes zoster) in adults aged 18 years and older.

REPORT COVERAGE

The global adults vaccines market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on the prevalence of infectious diseases in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.29% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Route of Administration

|

|

|

By Disease Indication

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 42.06 billion in 2025 and is projected to reach USD 106.43 billion by 2034.

In 2025, the market value stood at USD 19.45 billion.

The market is expected to exhibit a CAGR of 11.29% during the forecast period of 2026-2034.

The recombinant/conjugate/subunit segment led the market by type.

The key factors driving the market are the rise in the prevalence of infectious diseases and the rise in demand for advanced treatment options.

GSK plc., Sanofi, and Merck & Co., Inc., are the top players in the market.

Increased awareness about the benefits of vaccinations, robust pipeline of products, and a surge in the demand for vaccines in developing markets are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us