AI in Robot-Assisted Surgery Market Size, Share & Industry Analysis, By Product & Services (Systems, Software, and Services), By Specialty (Orthopedics, Neurology, Urology, Gynecology, Cardiology, and Others), By End User (Hospitals & Ambulatory Surgical Centers (ASCs), Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

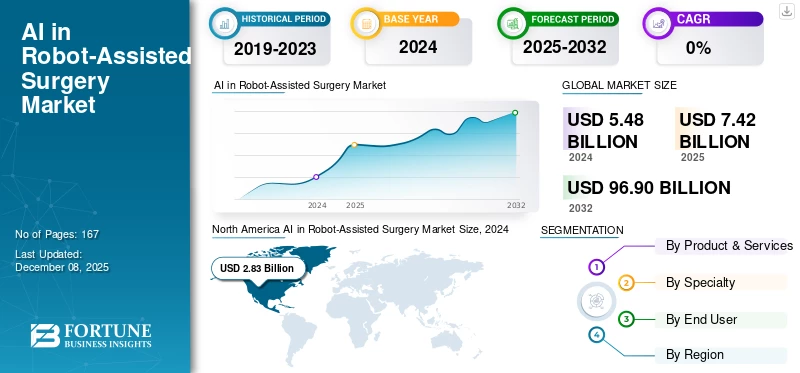

The global AI in robot-assisted surgery market size was valued at USD 7.42 billion in 2025 and market is projected to grow from USD 10.60 billion in 2026 to USD 207.56 billion by 2034, exhibiting a CAGR of 45.04% during the forecast period. North America dominated the AI in robot-assisted surgery market with a market share of 51.04% in 2025.

Increasing adoption of AI-based surgical procedures is resulting in more precise, efficient, and safe surgeries. They are used to analyze CT and MRI scans to create patient-specific 3D models, plan incision sites, optimize implant positioning, and determine surgical pathways. It also provides real-time guidance by segmenting anatomical structures on the screen, overlaying digital markers, and issuing alerts if instruments come close to critical areas. Additionally, AI stabilizes robotic arms, cancels out hand tremors, and can automate repetitive tasks such as suturing or bone preparation, which reduces surgeon fatigue and improves consistency. The wide application of AI in robot-assisted surgeries results in shorter surgery times, reduced complications, and speedy recovery.

Adjourning to the various advantages of AI assistance in robotic surgeries, many established players are focusing on new product launches, driving the AI in robot-assisted surgery market growth on an upward trajectory.

- For instance, in September 2024, ZEISS Group launched a Robotic Visualisation System for neurosurgery, ZEISS KINEVO 900 S.

The market encompasses several major players with Intuitive Surgical, Inc., Medtronic plc, Zimmer Biomet Holdings, Inc., and Globus Medical, Inc. at the forefront. A Broad portfolio, innovative product launches, and strong geographic expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing AI Capabilities in Offering Efficient Adaptability and Surgical Precision to Drive Market Growth

One of the key drivers for the growth of AI in robot-assisted surgery is the advancement of AI capabilities and its adaptability, combining surgical precision with real-world adaptability. AI integration enables robots to process vast surgical datasets, learn from patterns, and adjust dynamically during procedures. This adaptability reduces risks associated with unexpected complications and enhances the surgeon's confidence. These capabilities showcase AI’s role in making surgical robot systems smarter, safer, and more efficient.

- For example, in July 2025, researchers at Johns Hopkins University, leading a federally funded project, reported that a surgical robot trained on real procedure videos performed a critical phase of gallbladder removal autonomously, adapting to unexpected situations and responding to voice commands. This breakthrough shows how artificial intelligence can combine enhanced precision with the flexibility needed for real-world medicine.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

High Cost, Extensive Setup to Limit Patient Access and Hamper Market Growth

Although the integration of AI in robot-assisted surgeries offers wide-ranging applications, the high capital and operating costs are currently major factors restraining market growth. The high setup costs discourage smaller hospitals, especially in emerging economies, and can limit the growth potential of the market.

- For example, in June 2023, the International Journal of Abdominal Wall Surgery and Hernia Surgery published an article that reported that the acquisition costs of a da Vinci range between USD 0.5 million and USD 2.5 million, depending on model, configuration, and location. Additional costs, such as the annual service fee of up to USD 190,000 and the recurring costs for instruments and accessories ranging from USD 600 to USD 3,500 per surgical procedure, further limit adoption.

MARKET OPPORTUNITIES

Rising Investment for the Integration of AI in Robot-Assisted Surgery to Drive Innovation and Support Market Growth

Traditional robotic surgeries have relied heavily on the expertise of the surgeon, often leading to variability in surgical outcomes. The integration of AI in robot-assisted surgeries offers an opportunity to ease the process of conducting these surgeries by providing advanced visualization and agility. Built-in AI intelligence can guide, assess, or support the real-time decision-making for surgeons, improving surgical outcomes and speeding patient recovery. Increasing investment aimed at driving innovation and overcoming current challenges is expected to further drive market growth.

- For instance, in June 2025, ForSight Robotics received USD 125.0 million Series B funding led by Eclipse. The investment accelerated the development of the ORYOM Platform, a robotic surgery platform for cataract and other eye diseases. The platform utilizes AI-based algorithms, advanced computer vision, and micromechanics to enhance surgical precision, increase patient access to high-quality treatment, and decrease the physical burden on surgeons.

AI IN ROBOT-ASSISTED SURGERY MARKET TRENDS

Integration of Cloud-Based Data and Machine Learning Models to Standardize Surgical Training

One of the prominent global trends in the AI in robot-assisted surgery market is the integration of cloud-based surgical training using centralized data collection and machine learning analytics. These tools help reduce variability in surgical education and performance. Machine learning models deliver personalized feedback, highlight best practices, and identify areas for improvement, creating standardized, scalable training across diverse settings. This accelerates skill development and elevates overall surgical quality.

- In February 2023, Asensus Surgical, Inc. collaborated with Google Cloud to enhance its Performance-Guided Surgery (PGS) framework. This initiative integrated the company’s Intelligent Surgical Unit (ISU) with Google Cloud’s ML technologies and secure cloud infrastructure, enabling the aggregation, analysis, and visualization of surgical performance data across multiple sites.

Additionally, the increasing use of AI for automating micro tasks such as suturing, stapling, or tissue segmentation, while still keeping surgeons in control, is another major trend driving the market.

MARKET CHALLENGES

Stringent Regulatory Landscape Governing Medical Devices and Surgical Robotics to Pose a Significant Challenge

One of the key restraints for the AI-assisted robotic surgery market is the stringent regulatory landscape governing medical devices and surgical robotics. Compliance with quality systems, device reporting, and safety validation requires a significant investment of resources, which can slow down product approvals and market entry. Any gaps in meeting these standards can lead to warnings, recalls, or delays, directly impacting the company's reputation.

- For instance, in August 2024, the U.S. FDA warned Globus Medical for failing to follow quality systems regulation (QSR) and medical device reporting (MDR) requirements.

Segmentation Analysis

By Product & Services

Systems Segment Dominated the Market due to its Accuracy and Safety

On the basis of products & services, the market in AI in robot-assisted surgery is classified into systems, software, and services.

The systems held the leading share of the market during the forecast period due to enhanced surgical precision and consistency, minimizing human error and improving overall safety in complex procedures. These systems also support surgeons with real-time imaging, data analytics, and automated insights, which reduces cognitive load and improves decision-making during operations.

- For instance, in August 2024, PROCEPT BioRobotics received the U.S. FDA 510(k) clearance of its next-generation platform, the HYDROS Robotic System. The system features FirstAssist AI treatment for surgical planning, advanced image guidance, robotic resection, and a streamlined workflow.

By Specialty

Orthopedics Segment Dominated due to Rising Incidence of Musculoskeletal Disorders

Based on specialty, the market is segmented into orthopedics, neurology, urology, gynecology, cardiology, and others.

The orthopedics segment held the dominating position in 2024. The growth of the segment is fueled by the rising prevalence of musculoskeletal disorders such as osteoarthritis, spinal conditions, and fractures, particularly among the aging population, and by the increasing global demand for AI in robot-assisted surgery for minimally invasive joint replacement and spinal procedures.

- For instance, in February 2024, Smith+Nephew launched its CORI Surgical System, a robotic-assisted surgical solution designed to personalize surgery, advance efficiencies, and optimize performance across the company’s orthopedic reconstruction portfolio.

The neurology segment is set to experience a considerable growth rate during the forecast period.

By End User

Adoption of Surgical Systems by Hospitals & Ambulatory Surgical Centers Boosted the Segment’s Growth

Based on end user, the market is segmented into hospitals & ambulatory surgical centers (ASCs), specialty clinics, and others.

In 2024, the hospitals & ambulatory surgical centers segment held the dominant AI in robot-assisted surgery market share. Hospitals & ambulatory surgical centers are the preferred choice for minimally invasive surgical procedures, as they provide specialized expertise and comprehensive post-operative care. Additionally, the high adoption of surgical systems by hospitals and ambulatory surgical centers reinforces the dominance of the segment.

- For instance, in April 2024, Asensus Surgical, Inc. collaborated with Sendai Tokushukai Hospital in Japan to utilize a Senhance Surgical System. The system offered innovative features such as haptic feedback to enhance surgical capabilities and facilitate precise procedures. The collaboration aimed to improve patient outcomes, with adoption by hospitals & Ambulatory Surgical Centers (ASCs) driving the segment's growth.

In addition, the specialty clinics segment is projected to grow at the highest CAGR during the study period.

AI in Robot-Assisted Surgery Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America AI in Robot-Assisted Surgery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025, valued at USD 19.07 billion, and also continued its leadership in 2026, reaching USD 27.2 billion. The region is forecasted to grow steadily due to the strong demand for precision surgeries and the fast adoption of cutting-edge technologies. Additionally, high clinical spending, robust healthcare infrastructure, and active commercialization efforts are expected to further drive growth. In North America, the U.S. is expected to lead the market due to a high density of surgeon training, active technological advancement, accompanied by new product launches. Such developments are estimated to drive the growth in the region.

- For instance, in April 2024, Medtronic launched 14 new performance insights algorithms to boost AI analytics for a wide range of laparoscopic and robotic-assisted surgical procedures. These new launches widen the capabilities of Medtronic’s Touch Surgery Ecosystem, connecting technologies both inside and outside the operating theatre, simplifying surgical workflow, and deepening insights to improve performance.

Europe is anticipated to witness a notable growth in the coming years. During the forecast period, the region is projected to record a growth rate of 42.5%, which is the second highest amongst all the regions, and touch the valuation of USD 1.45 billion in 2025. This growth is primarily driven due to increasing R&D, strong clinician engagement with minimally invasive techniques.

The Asia Pacific market is expected to account for the second-largest market and is estimated to reach USD 1.68 billion in 2025. Furthermore, expansion of private healthcare and rising investment coupled with robust spending by government on modernization of healthcare is expected to drive the growth in Asia Pacific region.

Over the forecast period, the Latin America would witness a moderate growth in this market. The Latin America market in 2025 is set to record USD 0.32 billion as its valuation, with the increasing demand for minimally invasive procedures and the application of AI in robotic surgeries driving the growth in these regions. Similarly, the growing demand from urban patient base for advanced surgical care in the regions are some of the major factors driving market growth in the regions of Middle East & Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Launches and Strategic Collaboration among Key Players Resulting in their Leading Position in the Market

The global AI in robot-assisted surgery market shows a semi-concentrated structure with numerous small- to mid-size companies aggressively operating globally. These players are focusing on product innovation, research and development, strategic partnerships, and geographic expansion.

Intuitive Surgical, Inc., Medtronic plc, and Zimmer Biomet Holdings, Inc., are some of the dominating players in the market. A comprehensive range of Gene Therapies, global presence through a strong distribution network, and collaborations with research and academic institutes are a few characteristics of these players that support their dominance.

Apart from this, other prominent players in the market include Globus Medical, Inc., Siemens Healthineers AG, Asensus Surgical, Inc., and others. These companies are undertaking various strategic initiatives, such as investments in R&D and partnerships with pharmaceutical companies to enhance their market presence.

LIST OF KEY AI in Robot-Assisted SURGERY COMPANIES PROFILED

- Intuitive Surgical, Inc. (U.S.)

- Medtronic plc (Ireland)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Stryker Corporation (U.S.)

- Smith & Nephew plc (U.S.)

- Globus Medical, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Asensus Surgical, Inc. (U.S.)

- CMR Surgical Ltd. (U.S.)

- Virtuoso Surgical, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2025: CARE Hospitals, Hitech City, introduced the AI-powered Stryker Mako Robotic System in India to improve precision and personalization in joint replacement procedures to reduce recovery times.

- June 2025: Johnson & Johnson MedTech, in collaboration with NVIDIA and Amazon Web Services, launched the PolyphonicTM AI Fund for Surgery to help develop AI solutions that solve challenges before, during, and after surgery. The initiative aimed to build on the company’s work to advance AI that will help redefine modern surgical practices and improve patient outcomes.

- March 2025: Olympus Corp. partnered with Zoloft to launch its first AI-powered clinical decision tool. The application integrated advanced imaging analytics and machine learning, facilitating surgeons with preoperative planning.

- August 2025: Method AI raised USD 20.0 million in series A funding from JobsOhio and the Cleveland Clinic. The investment is expected to boost the development of the robotic assistance procedures product.

- June 2024: Globus Medical received the U.S. FDA 510(k) clearance for its ExcelsiusFlex orthopedic robot for spine surgeries and an imaging platform. The company acquired NuVasive and its Pulse spine surgery platform for USD 3.10 billion.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 45.03% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product & Services · Systems · Software · Services |

|

By Specialty · Orthopedics · Neurology · Urology · Gynecology · Cardiology · Others |

|

|

By End User · Hospitals & Ambulatory Surgical Centers (ASCs) · Specialty Clinics · Others |

|

|

By Geography · North America (By Product & Services, Specialty, End User, and Country) o U.S. o Canada · Europe (By Product & Services, Specialty, End User, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Product & Services, Specialty, End User, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product & Services, Specialty, End User, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product & Services, Specialty, End User, and Country/Sub-region) o GCC o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.32 billion in 2025 and is projected to reach USD 204.71 billion by 2034.

In 2025, the market value stood at USD 7.32 billion.

The market is expected to exhibit a CAGR of 45.03% during the forecast period (2026-2034).

The systems segment led the market by product & services.

The rising prevalence of chronic diseases is the key factor driving the market.

Intuitive Surgical, Inc., Medtronic plc, and Zimmer Biomet Holdings, Inc. are some of the prominent players in the market.

North America dominated the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us