Microsurgery Market Size, Share & Industry Analysis, By Product Type (Microsurgical Instruments {Microscissors & Microforceps, Microsutures, and Others}, Operating Microscopes, and Microsurgery Robots), By Application (Plastic Surgery, Ophthalmology Surgery, Neuro & Spine Surgery, Otolaryngology Surgery, Lymphatic Procedures, Vascular Surgery, Cardiovascular Surgery, and Others), By End-user (Hospital and ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

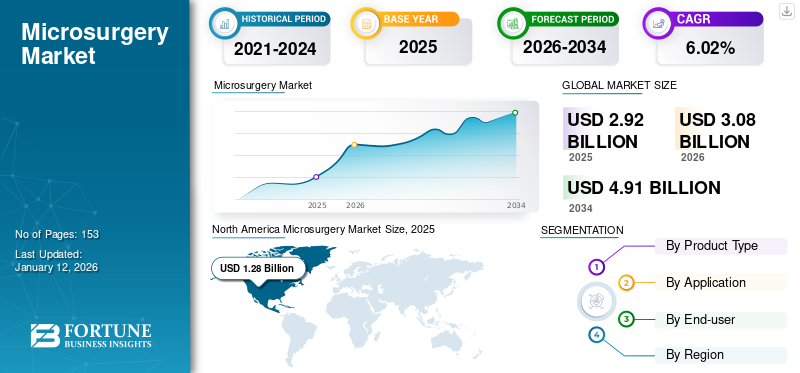

The global microsurgery market size was valued at USD 2.92 billion in 2025. The market is projected to grow from USD 3.08 billion in 2026 to USD 4.91 billion by 2034, exhibiting a CAGR of 6.02% during the forecast period. North America dominated the microsurgery market with a market share of 43.80% in 2025.

Microsurgery is a specialized surgical technique that uses microscopes and micro instruments to perform procedures, such as neurosurgeries, plastic surgeries, ENT & reconstructive surgeries, and dental surgeries. The increasing number of such procedures in hospitals and specialty clinics and rising demand for reconstructive and tissue transplant procedures among the young population are expected to boost the demand for microsurgeries.

- According to an article published by the Aesthetic Plastic Surgery National Databank in April 2022, the number of cosmetic surgeries went up by 54% in 2021 as compared to 2020.

Moreover, the increasing investments in research and development activities by market players to develop novel and effective tools and microscopes is expected to spur the global microsurgery market growth.

- For instance, Microsure secured USD 40 million funding for the development of a microsurgical robot called Musa-3 to offer surgeons precision and stability during procedures.

In 2020, the microsurgery market witnessed negative growth during the initial phase of the COVID-19 pandemic due to the decreased number of surgeries and demand for microsurgical instruments. However, the lifting of lockdown restrictions and rising number of patients visiting clinics and hospitals significantly accelerated the market’s growth in 2021, reaching pre-pandemic levels.

Global Microsurgery Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.92 billion

- 2026 Market Size: USD 3.08 billion

- 2034 Forecast Market Size: USD 4.91 billion

- CAGR: 6.02% from 2026–2034

Market Share:

- Region: North America dominated the market with a 43.80% share in 2025. This is due to the high volume of surgical procedures such as nerve repair and free tissue transfers, high adoption rates of microsurgical instruments, and a strong focus on gaining regulatory approvals for advanced surgical microscopes.

- By Product Type: Microsurgical instruments held the largest market share. The segment's dominance is driven by the significant benefits these instruments offer, including the ability to make force-free incisions, cause minimal tissue trauma, and achieve better overall surgical outcomes.

Key Country Highlights:

- Japan: The market is driven by an increasing adoption of microsurgical devices in hospitals and a rising geriatric population that is more prone to developing chronic conditions requiring surgical intervention.

- United States: Growth is fueled by a high number of accident-related injuries requiring microsurgery, particularly for hand and finger trauma. The market is also propelled by consistent FDA approvals for advanced new devices, such as specialized surgical microscopes.

- China: The market is expanding due to a rising number of patient visits to hospitals and specialty clinics for various microsurgical procedures and a growing adoption rate of advanced microsurgical devices in these healthcare settings.

- Europe: The market is driven by a rising demand for minimally invasive surgical techniques and strong efforts by regional players to expand their geographical footprint. The launch of new and innovative instruments by companies in the U.K. and Germany further supports growth.

Microsurgery Market Trends

Technological Advancements in Microsurgeries to Boost Market Growth

The adoption of microsurgical procedures is rising due to the advantages offered, such as better stereoscopic vision during miniature surgeries, minimum loss of blood, increased physical comfort, and surgeons’ minimized efforts & time. These are the significant factors contributing to the increasing number of microsurgeries.

Furthermore, technological advancements, such as real-time holographic navigation and surgical Artificial Intelligence (AI) are increasingly being adopted by surgeons. These technologies collect patients’ imaging data to create 3D models of organs, which will be used in surgical decision-making. In addition, the incorporation of AI tools helps prevent surgical errors during the procedure.

Similarly, the increased focus of key players on developing novel microsurgical instruments for digitized and robotic microsurgical procedures is a significant factor boosting surgeons’ preference for advanced microsurgical tools and microscopes.

- In May 2022, MMI announced the launch of its Symani Surgical System Simulator, developed by VirtaMed. The simulator will help improve, expand, and digitize the pathways for training offered by Symani as surgeons prepare to enhance their microsurgery skills by using robotics.

Download Free sample to learn more about this report.

Microsurgery Market Growth Factors

Rising Cases of Accident-Related Injuries to Drive Demand for Microsurgical Devices

The growing number of accident cases and other fatal injuries is one of the leading causes for the rising patient population across the world. For instance, in June 2022, according to the World Health Organization (WHO), 20 to 50 million people suffered non-fatal injuries during accidents, with many incurring a disability due to the injury.

Injuries to soft tissues of the hand and upper extremities that require reconstructive microsurgery for treatment are major factors contributing to the rise in demand for microsurgical devices globally. The damage to tissues and nerves requires extremely precise surgical devices, such as microsurgical scissors, needles, and forceps to conduct intricate procedures with great accuracy.

- According to a research article published by the National Center for Biotechnology Information (NCBI) in February 2020, traumatic hand injury is common, accounting for 6.6-28.6% of accident and emergency care visits. According to the same article, in the U.S., an analysis of the National Electronic Injury Surveillance System (NEISS) database showed a higher rate of finger injuries than those of the wrist or shoulder.

The rising incidence of such accidents has led to a surge in the number of patients undergoing microsurgical procedures.

- According to an article published by the American Society of Plastic Surgeons in October 2021, an estimated 23.9% of the injuries were work-related, 43.8% of the total patients were admitted to a hospital, and 58.2% of the total patients underwent a surgical procedure.

Therefore, these factors are anticipated to boost the demand for microsurgical tools and devices, leading to the growth of this market during the forecast period.

Innovative Product Launches to Propel Demand for Microsurgical Devices

The rising number of major injuries globally is one of the key factors contributing to the growing demand for microsurgeries. The rising demand for microsurgical devices by healthcare providers has increased the focus of market players on developing innovative microsurgical instruments and operating microscopes to treat such conditions through surgeries.

- In September 2022, Medical Microinstruments Inc. announced the launch of new Supermicro NanoWrist Instruments to be used with the Symani Surgical System. The product was developed specifically to address the challenges of microsurgery.

Moreover, the rising partnerships and collaborations among prominent market players and research organizations to launch innovative devices for microsurgeries is expected to support the adoption of novel treatments among healthcare providers.

- For instance, in April 2022, Carl Zeiss Meditec AG announced the acquisition of two manufacturers of surgical instruments, Kogent Surgical, LLC and Katalyst Surgical, LLC to further to strengthen its position as a medical instrument solution provider.

The increasing number of surgeons adopting microsurgery techniques for various procedures and several initiatives to launch innovative microsurgical instruments are expected to spur the growth of the market during the forecast period.

RESTRAINING FACTORS

High Surgery Costs and Lack of Reimbursement to Challenge Market Growth

There are several clinical benefits of microsurgeries, such as higher effectiveness, greater safety, lower risk of infections, and others. However, limitations, such as higher cost and greater out-of-pocket spending are anticipated to restrict the growth of the market. Microsurgeries often require specialized equipment and highly skilled surgeons, leading to significant expenses for both the patients and healthcare facilities. High cost of operating microscopes limits their adoption in the healthcare facilities, especially in emerging countries.

Furthermore, the healthcare system of emerging countries, such as Brazil, Mexico, and Africa suffers from lower awareness and diagnosis rate of various health conditions, thereby decreasing the volume of treatments and surgeries. The lack of reimbursement policies also hinders the patients' adoption of high-cost surgical procedures. Therefore, the increasing gap between the patients and microsurgery, and higher out-of-pocket expenditure are expected to lower the adoption of microsurgeries worldwide.

Microsurgery Market Segmentation Analysis

By Product Type Analysis

Microsurgical Instrument Leads the Market Owing to Number of Benefits Offered

By product type, the market is segmented into microsurgical instruments and operating microscopes. The microsurgical instruments segment is further divided into microscissors & microforceps, microsutures, and others.

The microsurgical instrument segment dominates the market with a share of 62.06% in 2026 and is expected to register a significant CAGR during the forecast period. The benefits of these surgical instruments, such as force-free incisions, minimal tissue trauma, and better surgical outcomes are predicted to increase the demand for surgical microscopes.

The operating microscopes segment held a significant market share in 2024 and is expected to register the highest CAGR due to the increasing number of surgeons conducting microsurgeries using microscopes for better and more effective visualization. Moreover, the rising number of regulatory approvals and novel product launches by major companies will contribute to the segment's growth.

- For example, in November 2020, Leica Microsystems announced the launch of its next-generation EnFocus intraoperative Optical Coherence Tomography (OCT) solution, which was built into the Proveo 8 ophthalmic microscope. The new invention was developed to support the surgical workflow and help ophthalmic surgeons conduct focused surgeries.

By Application Analysis

Increasing Awareness about Microsurgeries in Ophthalmology Drove Market Growth

Based on application, the market is segmented into neuro & spine surgery, plastic surgery, otolaryngology surgery, ophthalmology surgery, and others.

The ophthalmology surgery segment held the highest global microsurgery market share due to the increasing demand for microsurgical instruments for eye surgeries and higher requirement of microscopic images in such miniature procedures.

Furthermore, the rising focus of major market players on developing new and technologically advanced microsurgical devices and instruments in ophthalmic procedures is expected to drive the segment growth during the forecast period.

- For instance, in April 2019, Carl Zeiss Meditech AG unveiled the Artevo 800, the first digital microscope for ophthalmic surgery. The device claimed to offer better accuracy while conducting the procedure by providing the best resolution, comfort, and workflow in the operating room.

The neuro & spine surgery segment is expected to record the highest CAGR during the forecast period owing to factors, such as the high requirement of operating microscopes in such miniature surgeries and increasing number of neurosurgeries worldwide.

- According to an article published by the NCBI in October 2021, an estimated 22.6 million patients suffer from neurological disorders or injuries that further need a neurosurgeon's expertise, of which 13.8 million require surgery.

Additionally, the rising focus of key players on developing and launching new microsurgery devices for use in spine and neurosurgeries for better visualization and smoother surgical procedures is fueling the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Specialty Clinics to Register Highest CAGR Owing to Increased Adoption of Microsurgical Instruments

Based on end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The specialty clinics segment is expected to register the highest CAGR owing to the increased focus on using microscopes in surgeries. This factor is leading to a notable rise in the adoption of surgical microscopes in specialty clinics, which is anticipated to propel the segment’s growth.

The hospitals & ASCs segment dominated the market with a share of 65.20% in 2026 and is anticipated to witness a significant CAGR during the forecast period. The rising frequency of patient visits to hospitals, Ambulatory Surgical Centers (ASCs), and specialty clinics for various microsurgeries is one of the major reasons responsible for the segment’s growth. The increasing adoption of microsurgical devices and instruments in hospitals across developed and emerging countries, such as China and Japan is an important factor contributing to the segment's growth.

- For instance, in February 2022, K.J. Somaiya Hospital purchased a new Leica-F50 microscope to assist doctors in carrying out different types of surgeries. These include otolaryngology surgery, neurosurgery, microsurgery, and plastic surgery with a high level of precision.

REGIONAL INSIGHTS

Based on the geography, the market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Microsurgery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest market share and generated a revenue of USD 1.28 billion in 2025. The region is expected to dominate the market in the coming years as well owing to the rising number of surgical procedures including nerve repair, nerve grafting, blood vessel repair, and free tissue transfers and higher rate of surgeries through microsurgical instruments. Moreover, increased focus on getting approval from regulatory bodies for the use of surgical microscopes by surgeons is also responsible for driving the market’s growth in the region. The U.S. market is projected to reach USD 1.23 billion by 2026.

- For instance, in April 2019, Leica Microsystems received the DeNovo Clearance from the U.S. FDA to commercialize its FL400 surgical microscope. The microscope is specially built for differentiating malignant glioma tissue from normal brain tissue.

Europe accounted for a substantial share of this market. Rising demand for minimally invasive surgical techniques, high adoption of sanitary surgical procedures by surgeons, and rising efforts by key players operating in the market to expand their geographical footprint are expected to drive the market’s expansion in the region. The regional players are focusing on strengthening their portfolio of microsurgical tools, which is expected to propel the regional market growth over the forecast period. The UK market is projected to reach USD 0.13 billion by 2026, while the Germany market is projected to reach USD 0.2 billion by 2026.

- For instance, in November 2023, Surtex Instruments Limited launched the Infinex instrument series that consists of micro scissors, forceps, and needle holders for microsurgeries.

Asia Pacific is expected to record a significant CAGR during the forecast period owing to a rise in the percentage of the geriatric population which are prone to developing various chronic conditions, which further requires surgeries for treatment. Growing strategic and planned initiatives by companies across the region, rising awareness among the patient population regarding new microsurgical treatments, and comparatively lower treatment & surgery costs are factors supporting the regional market’s growth. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.19 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

However, the rest of the world accounted for a comparatively lower market share due to the rising awareness programs initiated by government bodies and other private organizations, which increased the number of microsurgeries across the regions.

KEY INDUSTRY PLAYERS

Introduction of Advanced Microsopes by Carl Zeiss Meditech AG and Baxter to Spur Market Growth

Carl Zeiss Meditech AG and Baxter are among the top players in the market with a strong brand presence and vast geographical footprint. The companies are increasing their investments in research and development activities to launch effective and highly advanced microscopes. Furthermore, a strong focus on strategic mergers with other companies and research organizations to develop effective devices is anticipated to support the expansion of these market players during the forecast period.

Other players involved in the market include Leica Microsystems, Santen Pharmaceutical Co. Ltd., Stryker, and other mid-sized, local companies. These firms are focusing on business expansion through strategic acquisitions and collaborations with other market players to upscale their R&D activities.

List of Top Microsurgery Companies:

- Carl Zeiss Meditech AG (Germany)

- Leica Microsystems (Danaher) (Germany)

- Baxter (U.S.)

- Halma plc (U.K.)

- Stryker (U.S.)

- Alcon Inc.(Switzerland)

- Olympus Corporation (Japan)

- Integra LifeSciences Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medical Microinstruments, Inc. (U.S.)

- Microsure (Netherlands)

- Sony Group Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- October 2023 – Medical Microinstruments, Inc, collaborated with Device Technologies to distribute Symani system across the Philippines, Hong Kong, Singapore, Thailand, Vietnam, Malaysia, Indonesia, Macau, and New Zealand.

- October 2022 – A segment of Zeiss Group, which is the parent company of Carl Zeiss Meditech AG, announced a new microsite featuring nine researchers and 24 areas of study. This announcement was made to celebrate the breakthrough achieved by Zeiss instruments.

- July 2022 – Medical Microinstruments, Inc., secured USD 75 million to expand the commercialization of its Symani microsurgery system in the U.S.

- October 2021 – Leica Microsystems announced the launch of a new generation of its M320 dental microscope, which offers ultra-high-resolution imaging with an integrated camera. The product was expected to enhance the outcome of dental treatments and increase a dentist’s comfort while working.

- September 2020 – True Digital Surgery and Aesculap, Inc. announced that the Aesculap Aeos Robotic Digital Microscope was available in the U.S. The product enabled surgeons to execute high-precision movements during certain surgical procedures, such as neurosurgery, spine, ear, nose, and throat surgeries.

- August 2020 – Surtex Instruments Limited announced the launch of its new website designed to serve as a tool for searching instruments for surgical and dental procedures with high-definition images and detailed product descriptions.

REPORT COVERAGE

The report provides detailed information about the market’s competitive landscape. It includes statistics, such as prevalence of chronic diseases and number of accidents. Additionally, it focuses on key points, such as technological advancements, new product launches, and key industry developments, such as partnerships, mergers, and acquisitions. Furthermore, the report offers a regional analysis of different segments, profiles of key market players, trends, and the impact of COVID-19 on the market. The report comprises quantitative and qualitative insights contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.02% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood atUSD 3.08 billion in 2026 and is projected to reach USD 4.91 billion by 2034.

The market will exhibit steady growth at a CAGR of 6.02% during the forecast period.

The ophthalmology segment led the application segment.

Rising number of plastic & reconstructive surgeries, increasing advancements in microsurgical procedures, rising research & development activities by major market players, growing number of regulatory approvals, and launches of medical devices, such as needle holders are the key drivers of the market.

Carl Zeiss Meditech AG, Koninklijke Philips N.V., and Baxter are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us