AI Inference Market Size, Share & Industry Analysis, By Hardware (GPU, ASIC, CPU, FPGA, and Others), By Deployment (Edge Inference, Cloud Inference, and Others), By Application (Robotics, Computer Vision, NLP, Generative AI, and Others), By End-user (Healthcare, Automotive, Retail & E-commerce, BFSI, Manufacturing, IT & Telecom, Aerospace & Defense, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

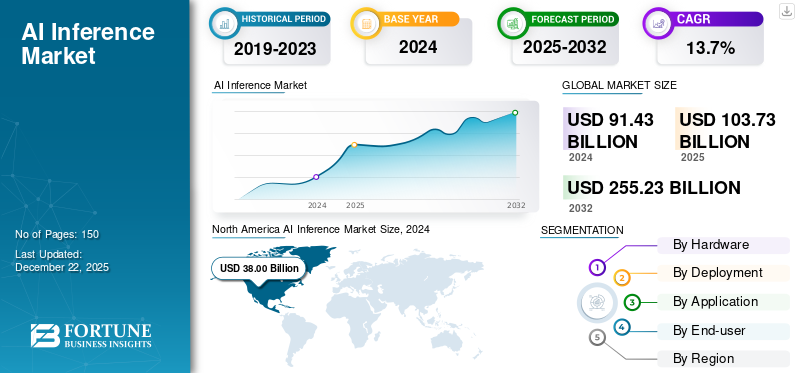

The global AI inference market size was valued at USD 103.73 billion in 2025 and is projected to grow from USD 117.80 billion in 2026 to USD 312.64 billion by 2034, exhibiting a CAGR of 12.98% during the forecast period. North America dominated the AI inference market with a market share of 41.78% in 2025.

The market is the sector that deploys and executes trained artificial intelligence and machine learning models to generate real-time predictions and insights from new data. This market comprises solutions that enable efficient processing of artificial intelligence (AI) workloads across various environments, including edge, cloud, and on-premises systems. Increasing adoption of AI-powered applications across industries, growing need for real-time data processing, advancements in specialized hardware for efficient AI computation, and the expansion of edge computing infrastructure are the driving factors of the market.

The COVID-19 pandemic accelerated the adoption of these technologies across various industries. This adoption has increased the demand for AI solutions to support diagnostics, supply chain management, and operational efficiency. For instance,

- According to Appen's State of AI 2020 Report, 41% of companies reported an acceleration in their AI strategies during the COVID-19 pandemic. This indicates a significant shift in organizational priorities toward leveraging AI amidst the global crisis.

Furthermore, key players in the market include Advanced Micro Devices, Inc., NVIDIA Corporation, Intel Corporation, Google LLC, Qualcomm Incorporated, Amazon Web Services, Inc., Cerebras Systems Inc., Groq Inc., Huawei Technologies Co., Ltd., and Mythic Inc.

Download Free sample to learn more about this report.

IMPACT OF RECIPROCAL TARIFFS

The imposition of reciprocal tariffs has introduced challenges to the market, affecting hardware and operational costs. Tariffs on components such as SPU, ASIC, CPU, FPGA, and others have increased prices, disrupting global supply chains and delaying infrastructure deployments. These cost booms have stressed AI companies, possibly hindering innovation and adoption of AI technologies. For instance,

- The imposition of a 25% tariff on semiconductors by the U.S. is projected to have a significant influence on the global semiconductor industry.

Companies re-evaluate their procurement strategies and consider alternative sourcing options in response to these challenges. These companies are investing in domestic manufacturing capabilities to ease the impact of tariffs. Furthermore, major cloud service providers are also increasingly developing in-house AI chips to reduce reliance on external suppliers and gain greater control over cost and performance.

IMPACT OF GENERATIVE AI

Demand for Advanced Solutions Drives the Gen AI Applications

Generative AI influences the market by driving demand for advanced and efficient solutions. The proliferation of generative models has significantly increased inference workloads, necessitating specialized hardware and software optimizations. Companies such as NVIDIA and AMD are developing GPUs and accelerators for these tasks to meet the computational demands of generative AI applications.

- For instance, in February 2025, AMD launched the Radeon RX 9070 XT and RX 9070 graphics cards, marking the debut of the RDNA 4 architecture within the RX 9000 Series. These graphics cards feature 16GB of memory, enhanced ray tracing, and AI accelerators to support advanced gaming capabilities.

This surge in generative AI applications is also reshaping market dynamics, with a growing emphasis on real-time, low-latency processing capabilities. The need for efficient inference solutions is encouraging investments in edge computing and specialized processors to manage the increased workload. As generative AI continues to expand across various sectors, the market is experiencing rapid growth.

AI INFERENCE MARKET TRENDS

Integration of Generative AI Models Drives Adoption

The increasing integration of generative AI models is a major trend fueling the AI inference market growth. The widespread adoption of generative technologies drives this integration. These models require substantial computational resources for real-time inference, stimulating demand for specialized hardware and optimized software solutions. The need for efficient and scalable inference capabilities intensifies as organizations deploy generative AI across various sectors.

This trend boosts vendors' development of advanced AI accelerators and inference platforms tailored to the unique demands of generative models.

- For instance, in August 2024, Cerebras Systems introduced Cerebras Inference, an AI inference solution that delivers up to 20 times faster than GPU-based alternatives. The offering is priced at USD 0.10 per million tokens, providing significantly improved price-performance for AI workloads.

Enhanced performance and cost-efficiency in inference enable broader application of generative AI, from content creation to personalized recommendations. Therefore, the integration of generative AI is expected to increase the market share.

MARKET DYNAMICS

Market Drivers

Rising Demand for Real-time Data Processing Fuels Market Expansion

Businesses across sectors require immediate insights to enhance decision-making and operational efficiency, increasing the demand for real-time data processing. Applications such as autonomous vehicles, healthcare diagnostics, and industrial automation depend heavily on low-latency solution to function effectively. This demand fuels investments in optimized solutions that deliver rapid and accurate inference results.

Furthermore, the proliferation of IoT devices and the exponential growth of data generated at the edge intensify the need for real-time AI processing. Real-time inference reduces the reliance on centralized cloud computing, minimizing latency and bandwidth consumption. As organizations prioritize faster response times and improved user experiences, adopting these technologies is expected to accelerate significantly across industries.

- For instance, in March 2025, Cerebras Systems established six AI inference datacenters equipped with CS-3 systems, increasing capacity by 20 times to process over 40 million Llama 70B tokens per second.

Market Restraints

High Hardware Costs and Integration Challenges Limit the Adoption

The market faces several restraints that could hinder its growth. It requires specialized processors such as GPUs, ASICs, CPUs, FPGAs, and others that can be expensive to develop, manufacture, and deploy. These costs may limit adoption, particularly among small and medium-sized enterprises with limited budgets.

Additionally, the complexity of integrating these solutions into existing IT infrastructure poses substantial barriers. Organizations require skilled personnel to manage and optimize AI workloads, creating a talent shortage that slows implementation. Moreover, the privacy and security concerns related to data processing further complicate deployment, potentially delaying market expansion.

Market Opportunities

Energy-efficient Inference Hardware to Open New Market Opportunities

Developing and deploying energy-efficient inference hardware and infrastructure presents a significant opportunity for the market. The growth of AI workloads drives demand for solutions that optimize inference performance while minimizing power consumption. Emerging technologies are designed to deliver high-speed, low-power AI inference, particularly suited for mobile, IoT, and embedded systems.

This focus on energy efficiency addresses environmental and sustainability concerns, and reduces operational costs for businesses deploying AI. Companies are investing in specialized hardware that balances performance with power savings, enabling real-time AI processing in edge environments.

- For Instance, In April 2025, VSORA, Europe’s sole provider of ultra-high-performance AI inference chips, completed a USD 46 million funding round.

Thus, energy-efficient solutions are expected to drive innovation and market expansion across various industries requiring scalable and sustainable AI capabilities.

SEGMENTATION ANALYSIS

By Hardware

GPU Segment Leads the Market with Superior Parallel Processing Capabilities

Based on hardware, the market is divided into GPU, ASIC, CPU, FPGA, and others.

Graphics Processing Units (GPUs) segment is projected to dominate the AI inference market with a 35.32% share in 2026 due to their high parallel processing capabilities, which make them well-suited for handling complex AI workloads and deep learning models. Their broad adoption across enterprises and support from major AI frameworks further reinforce their market leadership.

Application-Specific Integrated Circuits (ASICs) are expected to grow at the highest CAGR due to their customized architecture, which offers superior performance and energy efficiency for these tasks. Their rising use in large-scale data centers and edge devices drives rapid adoption.

By Deployment

Edge Inference Dominates Market Due to Rising Demand for Real-time Processing

Based on deployment, the market is divided into edge inference, cloud inference, and others.

The edge inference segment is expected to lead the market, contributing 70.76% globally in 2026. Edge inference leads the market and is projected to grow at the highest CAGR due to increasing demand for real-time, low-latency AI processing near data sources, particularly in IoT, automotive, and industrial applications. Its ability to reduce reliance on cloud infrastructure while improving data privacy and bandwidth efficiency fuels its rapid expansion.

Cloud inference holds the second-largest AI inference market share due to its scalability, flexibility, and integration with large AI models. It remains a preferred choice for enterprises requiring centralized management of complex AI workloads.

By Application

Robotics Holds the Largest Share in the Market, Driven by Real-time Decision-Making Needs

Based on application, the market is classified into robotics, computer vision, NLP, generative AI, and others.

Robotics segment will account for 27.62% market share in 2026 as it heavily relies on real-time decision-making, computer vision, and sensor data interpretation, all of which require robust inference capabilities. The proliferation of automation in industrial and service sectors supports this dominance.

Natural Language Processing (NLP) is expected to witness the highest CAGR due to surging demand for voice assistants, chatbots, and language translation tools. The rise of generative AI and large language models accelerates investment in NLP inference capabilities.

To know how our report can help streamline your business, Speak to Analyst

By End-user

IT & Telecom Sector Leads Market Growth with Early Adoption of AI Technologies

Based on end-user, the market is divided into healthcare, automotive, retail & e-commerce, BFSI, manufacturing, IT & telecom, aerospace & defense, and others.

The IT & telecom segment is expected to account for 25.62% of the market in 2026. The IT & telecom sector dominates the market owing to its early adoption of AI technologies for network optimization, predictive maintenance, and customer service enhancement. High data throughput and infrastructure readiness contribute to sustained leadership.

Manufacturing is projected to grow at the highest CAGR due to the increasing implementation of AI-powered quality control, predictive maintenance, and robotics on the factory floor.

AI INFERENCE MARKET REGIONAL OUTLOOK

North America

North America AI Inference Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America accounted for USD 43.34 billion in 2025. North America dominates the market due to its advanced technological infrastructure and early adoption of AI across industries. The presence of key market players, robust R&D investments, and widespread deployment of AI in industries, such as IT, healthcare, and automotive contribute to its leadership. Government initiatives and strong venture capital funding further accelerate innovation and commercialization in the region.

The U.S. is a major user of these solutions due to its advanced semiconductor industry, investments in AI research & development, and dominance of major cloud service providers such as Google, Amazon, and Microsoft, which drives the deployment of these technologies.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific AI inference market is expected to grow at the highest CAGR due to rapid digitalization, increasing adoption of smart devices, and expanding industrial automation. Countries such as China, Japan, South Korea, and India are heavily investing in AI-driven technologies, supported by favorable government policies and innovation ecosystems. The growing presence of local AI startups and tech giants further accelerates the deployment of inference solutions across various sectors. The Japan market reaching USD 6.06 billion by 2026, the China market reaching USD 7.56 billion by 2026, and the India market reaching USD 4.96 billion by 2026.

Europe

Europe market holds the second-largest market share, driven by strong regulatory support, digital transformation initiatives, and significant investment in AI research. The region benefits from established industries adopting AI inference for automation and process optimization in the manufacturing and automotive sectors. Collaboration between governments, academia, and private enterprises supports AI infrastructure development. The UK market reaching USD 7.81 billion by 2026 and the Germany market reaching USD 6.65 billion by 2026.

Middle East and Africa and South America

The Middle East & Africa and South America regions are projected to grow more slowly due to limited technological infrastructure and lower investment in AI research & development. Economic constraints, skills shortages, and slower digital transformation initiatives hinder widespread adoption of inference technologies. However, gradual improvements in connectivity and regional government strategies may support this growth in the coming years.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen their Market Positioning

Players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving Application.

Long List of Companies Studied (including but not limited to)

- NVIDIA Corporation (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- Intel Corporation (U.S.)

- Google LLC (U.S.)

- Qualcomm Incorporated (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Cerebras Systems Inc. (U.S.)

- Groq Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Mythic Inc. (U.S.)

- d-Matrix Corp. (U.S.)

- Untether AI Corporation (Canada)

- Esperanto Technologies Inc. (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Meta Platforms, Inc. (U.S.)

- SK Hynix (South Korea)

- And more...

KEY INDUSTRY DEVELOPMENTS

- In May 2025, Chalk secured USD 50 million in a Series A funding round led by Felicis, bringing the company to USD 500 million. The investment, with participation from Triatomic Capital, General Catalyst, Unusual Ventures, and Xfund, will support platform enhancement and expansion of operations in San Francisco and New York.

- In May 2025, Red Hat launched the AI Inference Server to advance generative AI deployment across hybrid cloud environments. The solution integrates Neural Magic technologies to enhance speed, accelerator efficiency, and cost-effectiveness for running AI models on diverse cloud platforms.

- In May 2025, Rafay Systems launched its Serverless Inference offering, an API for running open-source and custom large language models, now generally available. NVIDIA Cloud Providers and GPU Clouds have adopted the platform to deliver multi-tenant, self-service AI computing and application solutions.

- In April 2025, NTT developed an AI inference LSI capable of real-time processing of ultra-high-definition video on edge devices and terminals. The technology extends AI inference resolution capabilities to 4K, enabling low-power, real-time operation.

- In March 2025, Akamai launched Cloud Inference to support faster and more efficient deployment of large language models (LLMs) in real-world applications. The solution operates on the Akamai Cloud platform, addressing the limitations of centralized cloud infrastructure.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product/service types, and product applications. Besides, the report offers insights into the market trend analysis and highlights vital application developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 12.98% from 2026 to 2034 |

|

|

Segmentation |

By Hardware

By Deployment

By Application

By End-user

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 312.64 billion by 2034.

In 2025, the market size stood at USD 43.34 billion.

According to the report by Fortune Business Insights, the market is projected to grow at a CAGR of 12.98% during the forecast period.

Robotics is the leading application in the market.

Rising demand for real-time data processing fuels market expansion .

NVIDIA Corporation, Advanced Micro Devices, Inc., Intel Corporation, and Google LLC are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us