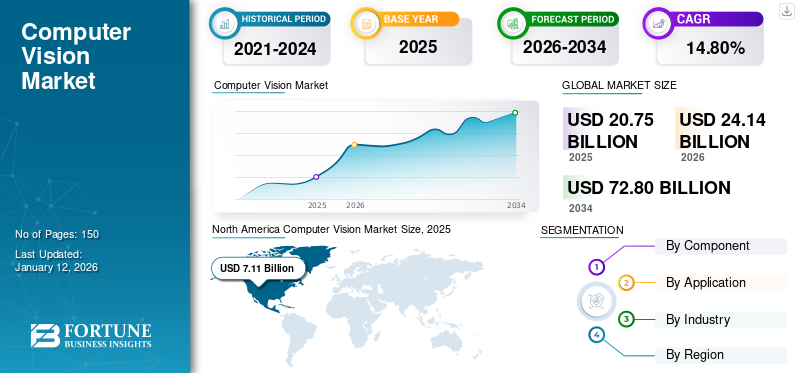

Computer Vision Market Size, Share & Industry Analysis By Component (Hardware and Software & Services), By Application (Facial Recognition, Image Classification, Object Detection, Object Tracking, and Others), By Industry (Automotive, Manufacturing, Healthcare, Retail, Agriculture, Logistics, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global computer vision market size was valued at USD 20.75 billion in 2025. The market is projected to grow from USD 24.14 billion in 2026 to USD 72.80 billion by 2034, exhibiting a CAGR of 14.80% during the forecast period. North America dominated the market with a share of 34.30% in 2025.

Computer vision (CV) is an area of artificial intelligence (AI) that enables computers to classify and understand objects and people in videos and images. Similar to human visual perception, the technology's objective is to replicate how humans see and understand visual information. This field is dedicated to automating and integrating the various processes and representations involved in visual Recognition. It includes many methods, such as image processing (encoding, transforming, and transmitting images) and statistical pattern classification (statistical decision theory applied to visual or other common patterns).

The current trends in 3D imaging and automation across major industries indicate a significant growth potential for the market, including the AI vision market. Therefore, the main goal of the technology is to enable computing devices to accurately identify objects and people in digital images and take appropriate actions.

As COVID-19 spread across the globe, businesses of all sizes and industries struggled to keep their resources safe and productive during the pandemic. However, this pandemic opened opportunities for these systems, with high-tech startups and major corporations working diligently to prevent and contain the virus. Additionally, this technology gained significant attention as an effective infection prevention and control (IPC) strategy, finding its applications in bacterial screening, masked facial recognition, pandemic drones, and thermography. AI vision proved to be a promising tool in treating patients with coronavirus disease (COVID-19). Large commercial spaces and public infrastructure such as airports, shopping centers, and public health facilities increased the demand for these systems during the pandemic. Therefore, the pandemic had a positive impact on the market.

IMPACT OF GENERATIVE AI

Integration of Generative AI in Computer Vision to Enhance Operations and Create Market Opportunities

The adoption of generative artificial intelligence (AI) has had a profound impact on computer vision by enabling the creation of realistic images, enhancing image generation tasks, and aiding in data augmentation. Techniques such as generative adversarial networks have revolutionized the field by generating synthetic data, improving image synthesis, super-resolution, inpainting, style transfer, and more. In addition, generative models facilitate domain adoption, where models trained on one dataset can be adapted to perform well on a different dataset, thus improving the robustness and generalization of these systems. Furthermore, advancements in deep learning and neural networks empower generative AI models to create incredibly realistic images and videos, opening up new possibilities in diverse applications. Moreover, the potential of generative AI in this technology is undeniable as the technology matures and becomes more widespread adoption and revolutionary applications across various industries. Thus, this factor boosts the global computer vision market growth.

Hence, various enterprises are developing and integrating generative AI capabilities to expand their product offerings and deliver a better customer experience. For instance,

- In October 2024, Clarifai joined the partner program of Hewlett-Packard Enterprise (HPE) to aid artificial intelligence and computer vision solutions. By joining the program, Clarifai delivers AI development, generative AI, and CV solutions over HPE hardware to support customers in positioning robust AI models at scale.

Impact of Reciprocal Tariffs

Reciprocal tariffs, where countries impose equal or retaliatory import duties on each other’s goods—can significantly impact the global market, particularly as it relies heavily on an international supply chain for hardware components (e.g., image sensors, GPUs, embedded systems) and software development talent.

Computer vision systems rely heavily on advanced hardware components such as high-resolution cameras, GPUs, and AI accelerators. When reciprocal tariffs are imposed—such as the U.S. placing duties on Chinese camera modules or China targeting U.S. semiconductors—it leads to a direct increase in system costs. This price hike affects integrators and developers across industries, particularly in cost-sensitive sectors such as manufacturing, logistics, and retail surveillance.

Thus, reciprocal tariffs can significantly hinder the growth and innovation in the market.

COMPUTER VISION MARKET TRENDS

Integration of Artificial Intelligence into CV to Propel Market Growth

The integration of artificial intelligence (AI) into CV has profoundly transformed the field, which enables machines to interpret and analyze visual data with unprecedented accuracy and efficiency. For instance,

- In August 2024, Ryder and Terminal Industries piloted AI computer vision to automate yard operations, which achieved 99% accuracy in truck and trailer identification. The tech boosts efficiency, cuts manual work, and is now expanding across other Ryder sites.

These AI-driven models allow for real-time processing and decision-making, which is crucial in applications including autonomous vehicles, healthcare diagnostics, and retail behavioral detection. For instance,

- In December 2023, Centific and Telaid have partnered to deploy Centific's Pitaya.AI computer vision platform across retail and QSR locations in North America. The solution turns existing hardware including CCTV cameras into AI-powered systems that detect anomalies, improve safety, and boost efficiency.

MARKET DYNAMICS

Market Drivers

Surging Use of Efficient Quality Control in Manufacturing to Drive Market Growth

The growing demand for automation and efficacy is one of the main drivers of AI growth in the market. Automation and efficacy enable businesses to save time and resources while improving the accuracy of their decision-making processes. For this reason, several industries are now implementing AI CV technology to automate processes and enhance efficiency. For instance, in manufacturing, these systems can be used in factories to inspect products and detect defects. This allows for the identification and resolution of production issues more quickly and effectively, thereby increasing efficiency and reducing waste. Therefore, this factor drives the market growth.

Market Restraints

Higher Cost of Acquiring and Implementation Among Organizations May Hinder the Market Growth

The high cost of acquiring and implementing CV solutions is one of the biggest challenges to market growth. Evolving and deploying these AI systems can be expensive and often requires specialized software, hardware, and technical expertise. For companies new to AI computer vision, acquiring and deploying these systems can be a significant undertaking, including costs such as software licenses, hardware, and technical support. Additionally, companies may need to participate in training and development programs to increase their technical expertise with these systems. Therefore, these factors slow down the market growth.

Market Opportunities

Multiple Applications of CV in Healthcare to Create New Market Opportunities

In healthcare, the technology is transforming medical imaging, diagnostics, and surgery by enhancing the speed, accuracy, and efficiency of care. AI-powered systems can analyze X-rays, MRIs, CT scans, and ultrasounds with precision, detecting early signs of diseases such as cancer, heart conditions, and neurological disorders, often more accurately than human experts. For instance,

- In December 2024, PlacentaVision, an AI-based CV tool, was developed by researchers at Northwestern Medicine and Penn State. It analyses photos of placentas to detect abnormalities related to infection and neonatal sepsis.

Additionally, recent fundraising round by dental startups in order to advance their products also supports this trend. For instance,

- In July 2024, Pearl, an AI startup in dental care, raised USD 58 million in Series B funding to expand its AI-powered dental products. Pearl's AI tools, using machine learning and computer vision, help dentists improve diagnostic accuracy by analyzing X-rays for pathologies.

SEGMENTATION ANALYSIS

By Component

Rising Demand for Cloud-based and Automation Technologies to Aid Software & Services’ Progress in the Market

On the basis of component, the market is categorized into hardware and software & services.

The software & services segment holds the maximum market share 57.65% in 2026 for the year 2026 and are projected to grow with a leading CAGR. This is due to increasing demand for cloud-based computer vision solutions, advancements in augmented reality and virtual reality, deep learning, automation ML, and low-code platforms, and many other technologies. For instance,

- In January 2025, Blaize and alwaysAI collaborated to transform real-time insights with computer vision and AI edge computing applications. The partnership incorporates alwaysAI's CV technology and remote deployment abilities with Blaize's chipsets and edge devices, making unified edge deployments more reachable for enterprises.

Hardware is also projected to grow significantly during the study period due to the growing requisite for high-resolution cameras, 3D cameras, backlighting, dark field lighting, frame grabbers, processors, etc., for numerous applications.

By Application

Facial Recognition Segment Dominates Owing to Rising Security & Surveillance Applications

On the basis of the application, the market is categorized into facial recognition, image classification, object detection, object tracking, and others.

The facial recognition segment dominates the market with the maximum market share. It is used to identify individuals with high accuracy, making it a valuable tool for security and surveillance applications. Furthermore, it can be used to match faces in video footage with databases of known criminals or missing persons, helping to apprehend suspects and locate missing individuals.

Furthermore, object detection is expected to grow at the highest CAGR during the forecast period. It plays a crucial role in security systems, which enables real-time identification of intruders, suspicious objects, and potential hazards.

In addition, imagine surveillance cameras that automatically alert authorities upon detecting unauthorized personnel in restricted areas or self-driving cars that instantly recognize and avoid obstacles on the road. Therefore, these factors play a vital role in driving the market growth.

To know how our report can help streamline your business, Speak to Analyst

By Industry

Manufacturing Segment Led Due to Growing Computer-based Applications Among Manufacturing Sector

On the basis of the industry, the market is categorized into automotive, manufacturing, healthcare, retail, agriculture, logistics, and others.

The manufacturing segment held the largest market share in 2024. The market is experiencing a boom in the manufacturing industry, transforming various processes, and bringing significant benefits. In manufacturing, these systems inspect products with precision to detect defects such as scratches, cracks, or incorrect assembly parts. These applications analyze images of machinery to detect anomalies and predict potential failures, preventing downtime and costly repairs.

Moreover, automotive is expected to grow at the highest CAGR during the forecast period. The technology helps in assembly automation, autonomous driving, accident prevention, and improving behavior analysis. Several benefits of CV applications across automotive include immediate diagnostic feedback, localization and service vendor incorporation, multi-language aid, active maintenance commendations, and several other benefits.

COMPUTER VISION MARKET REGIONAL OUTLOOK

North America

North America Computer Vision Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 7.11 billion in 2025 and USD 8.17 billion in 2026. North America holds the largest share of the market. The high market share is due to the numerous Internet of Things (IoT) deployments in the region. Furthermore, robust IT and telecom infrastructure throughout the region and the number of cloud and edge deployments are some features supporting the technology adoption. Moreover, applications of the technology are expanding across various sectors, such as healthcare, retail, manufacturing, and security, which is driving market growth. The growing volume of image and video data provides valuable training material for these models, further enhancing their capabilities. Thus, these factors promote the market growth in the region.

Download Free sample to learn more about this report.

The U.S. dominates the computer vision market share in North America. Increasing demand for autonomous systems such as robots, vehicles, and drones that rely on navigation on this technology for navigation that drives the market growth. Also, heavy investments in automation across manufacturing and healthcare fuel the market progress in the country. The U.S. market is projected to reach USD 4.91 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific region is anticipated to witness the highest growth in terms of CAGR during the forecast period. This growth is attributed to the increasing number of use cases across various industries, which is expected to be the major factor driving demand in the regional market. The adoption of the technology in the automotive, electronics, and manufacturing industries to improve safety and automate various workflows, such as assembly lines, quality inspection, and inventory management, is driving the demand in Asia Pacific. These industries continue to invest in product research and development, and the demand for such systems is expected to increase in the future. The Japan market is projected to reach USD 1.35 billion by 2026, the China market is projected to reach USD 1.37 billion by 2026, and the India market is projected to reach USD 0.70 billion by 2026. For instance,

- In July 2024, Fitterfly, an Indian digital therapeutics firm in partnership with Google Cloud, launched Fitterfly Klik, a meal-tracking application by leverages CV technology. The app enables individuals with diabetes to analyze their meals with the help of a picture and AI that inspects calorie count, portion size, macronutrients, and micronutrients.

Europe

Europe region is anticipated to exhibit steady growth over the forecast period. This region is also known for its strong industrial base. Europe’s robust manufacturing and automotive industries are early adopters of this technology for automation and quality control. Germany and the U.K. are the leading markets due to government investments, strong technology development, and established industrial sectors. Thus, this factor boosts the market growth. The U.K. market is projected to reach USD 1.52 billion by 2026, while the Germany market is projected to reach USD 2.15 billion by 2026.

South America

Similarly, South America is showing substantial growth in this market due to the increasing adoption of AI and deep learning, making these solutions more accessible and affordable. Moreover, governments in the region are actively promoting AI and digital transformation strategies, investing in infrastructure, expanding their offerings, and developing tools to simplify the technology applications for businesses.

Middle East & Africa

Moreover, the Middle East & Africa market is expected to witness prominent growth in the coming years due to increased investment and government funding for digitization. Various applications of the technology, such as image classification, object detection, and facial Recognition, are projected to grow at a substantial rate owing to various new applications and implementations across different countries of the Middle East and Africa. For instance,

- In May 2025, DXB announced its plan to invest more in facial Recognition and AI to make the passenger experience more seamless and extend capacity. As per the Dubai Airport CEO, Paul Griffiths, all setups can be shifted to the new planned passenger terminal at Al Maktoum International Airport (DWC).

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Companies to Take Up Merger & Acquisition Strategies for Expanding Their Operations

Key players in the industry have been expanding their global presence by introducing solutions that are specialized in nature and are customized according to specific sectors. They have been engaging in partnerships and acquisitions of local businesses to establish a strong foothold in numerous regions. These companies are focusing on the creation of marketing strategies and developing new solutions for maintaining which are effective and growing their market share. Thus, the rising demand for CV solutions is expected to build profitable market opportunities for the market players.

Major Players in the Computer Vision Market

The market players, such as Omron Corporation, Intel Corporation, Ricoh, Cognex Corporation, and Basler AG, are prominent players with a market share of 42%. These players focus on new product innovations, upgrades, portfolio expansion into new geographical areas, and collaborations with other players to expand their business presence across different regions.

To know how our report can help streamline your business, Speak to Analyst

List of Key Computer Vision Companies Studied

- Microsoft Corporation, Inc. (U.S.)

- Ricoh (Japan)

- Basler AG (Germany)

- Cognex Corporation (U.S.)

- Omron Corporation (Japan)

- Intel Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- alwaysAI, Inc. (U.S.)

- Matroid Inc. (U.S.)

- Cogniac (U.S.)

- Clarifai, Inc. (U.S.)

- Huawei Technologies (China)

- Axis Communications (Sweden)

- TechSee (Israel)

- KEYENCE CORPORATION (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- Teledyne Vision Solutions (Canada)

- Allied Vision Technologies GmbH (Germany)

- Texas Instruments Incorporated (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Clarifai collaborated with Arrow Electronics to help businesses enhance the value derived from AI initiatives. As part of this partnership, Arrow was designated as Clarifai's official commercial distributor to expedite the adoption of AI across various industries by utilizing Arrow's vast global distribution network.

- October 2024: alwaysAI collaborated with Eagle Eye Networks to provide sophisticated computer vision solutions to businesses. By incorporating alwaysAI's CV technology into the Eagle Eye Cloud VMS (video management system), customers are enabled to utilize a variety of advanced CV applications.

- April 2024: Cognex Corporation combined 2D and 3D vision technologies with AI to tackle a range of inspection and measurement tasks and introduced it in their new In-Sight L38 3D Vision System.

- December 2023: AlwaysAI collaborated with professors at the University of California, San Diego, to advance computer vision technology. This collaboration enabled users to leverage San Diego's outstanding academic and technical talent to develop practical technology applications that deliver incredible value to customers.

- October 2023: Remark Holdings, Inc., an AI-powered video analytics provider, announced a partnership with Arrow Electronics and Intel. This partnership would expand more than 200,000 customers by providing Intel-based AI servers running Remark's reach Remark's Smart Safety Platform (SSP) is responsible for warehousing, sales, and logistics sales support.

- August 2023: TechSee announced integration with Amazon Web Services to support Amazon Connect. The integration with Amazon Connect provides better customer service at lower costs by incorporating artificial integration and an augmented reality platform.

- August 2023: Amazon announced the launch of a shelf monitoring solution for sellers to ensure high-quality fresh food. The launch of this solution allows sellers to meet consumer demand for high-quality fresh fruits and vegetables when shopping on Amazon Fresh.

- August 2023: NVIDIA announced the launch of the NVIDIA Omniverse platform, which provides new foundational services and applications for developers and industrial enterprises to improve and extend their 3D pipelines using the OpenUSD framework and generative AI. By adopting this platform, developers can improve their tools, and companies can create larger, more complex global simulations as digital testbeds for industrial applications.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key market players are planning to invest constantly in research and development. Investing in R&D to integrate advanced technologies with CV solutions aids enterprises in expanding business progress. Rising funding and investment across startups and small businesses in biometric authentication and facial recognition are driving the market progress in the region. For instance,

- In August 2024, 20Face, a Dutch-based startup, secured USD 1.44 million (EUR 1.3 million) to progress its privacy-resilient facial recognition mechanism. The investment comprises contributions from present shareholders such as Oost NL and Value Creation Capital, and new shareholder Twinning Participaties. 20Face makes use of CV and advanced AI for facial recognition.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Application

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 72.80 billion by 2034.

In 2025, the market was valued at USD 20.75 billion.

The market is projected to grow at a CAGR of 14.80% during the forecast period.

By industry, the manufacturing sector captured the largest share in 2025.

The surging requirement among various applications across the globe is the key factor driving market growth.

Intel Corporation, Amazon, Nvidia Corporation, Cogniac, Matroid Inc., Techsee, alwaysAI, Microsoft Corporation, Clarifai, and Omron Corporation are the top major players in the market.

North America holds the largest market share.

By application, the object detection segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us