AI Video Generator Market Size, Share & Industry Analysis, By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Sources (Text to Video, PowerPoint to Video, and Documents to Video (PDF, Spreadsheet, etc.)), By Application (Training & Education, Marketing & Advertising, Social Media, and Others (Presentation, etc.)), By Industry (IT & Telecom, Retail & E-commerce, Education, Healthcare, Real Estate, Media & Entertainment, and Others (Manufacturing, etc.)), and Regional Forecast, 2026-2034

AI VIDEO GENERATOR MARKET SIZE AND FUTURE OUTLOOK

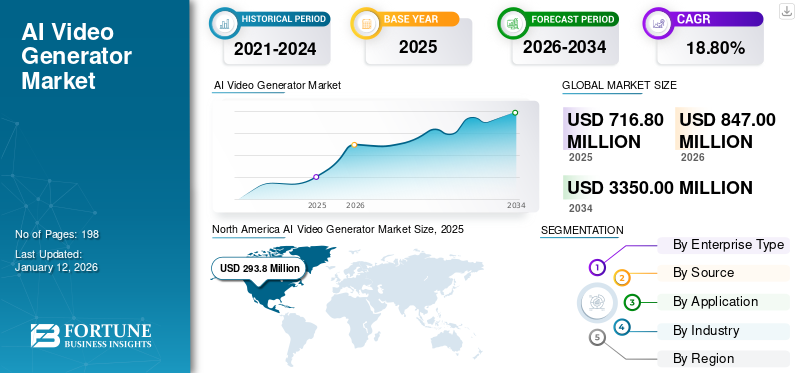

The global AI video generator market size was valued at USD 716.8 million in 2025. The market is projected to grow from USD 847 million in 2026 to USD 3,350.00 million by 2034, exhibiting a CAGR of 18.80% during the forecast period. North America dominated the global AI video generator market with a share of 41.00% in 2025.

An AI video generator is a software-based solution that employs artificial intelligence (AI), such as deep learning and natural language processing, to facilitate the automated generation of video content from a variety of inputs including text, images, or audio, with little or no human involvement.

The market is expected to grow as a result of increasing demand for scalable and economical video production, and the rapid adoption by marketing, education, and social media industries. In addition, advances in neural networks and cloud platforms are also boosting market growth. Growth of the market is further fostered by the ongoing rise in utilization of personalized and interactive video content and heavy investments in AI and cloud technologies, especially in the Asia Pacific and North America regions.

The main participants in the market include Veed Limited, Synthesia Limited., Colossyan Inc., Canva, and Steve AI.

Download Free sample to learn more about this report.

IMPACT OF GEN AI

Generative AI Speeds Up Video Production, Expanding Global Access and Adoption

Generative AI is revolutionizing the video production landscape by enabling the creation of high quality, scalable and cost effective content in about half the time. These AI powered video tools automatically perform the editing, writing and visual creation tasks reducing reliance on traditional video teams. They allow creators or businesses to produce professional quality videos for marketing, education or entertainment all in real-time. They also improve creative workflows by offering customization and language assistance. AI is making video creation accessible to everyone, which is likely to speed up the worldwide use of these tools.

MARKET DYNAMICS

Market Drivers

Explosive Growth of Video Content Consumption to Propel the Market Demand

The surge in the video consumption globally in the AI video generator space, largely propels the market demand. Digital platforms and social media increasingly making videos the centerpiece of their content strategies has created the necessity for video creation tools to scale quickly and with less cost. AI video creation tools automatically make personalized and engaging videos from basic text or data, enabling businesses to capitalize on the demand for videos more efficiently.

According to the U.S. National Telecommunications and Information Administration (NTIA), videos are reported to be accounted for more than 65% of global mobile internet traffic, indicating how fast video consumption is increasing and highlighting the trending dynamic that is expected to drive the AI video generator market growth.

This increase in video consumption acts as a catalyst, facilitating industries such as marketing, education, and entertainment to adopt AI-based video tools for scale, creativity, and compelling video content production, which is again, facilitating growth in the AI video generator market globally.

Market Restraints

Regulatory and Legal Uncertainty Poses Significant Challenges to Market Growth

The AI video generator market is growing but is facing many obstacles in the regulatory and legal landscape. Concerns about copyright violations, authenticity of content, and misuse of AI or synthetic content are all serious risks to brands and creators. Governments and regulatory bodies are still developing frameworks to govern the creation, distribution, and labeling of synthetic content. The absence of clear laws on ownership and data use makes adoption harder. These concerns may slow growth, especially in areas with strict content rules. Companies need to follow changing compliance requirements closely to stay transparent and protect their reputation.

Market Opportunities

Rise of Virtual Influencers and Synthetic Spokespersons Set to Fuel Industry Growth

The rise of virtual influencers and synthetic spokespersons opens up additional growth opportunities for the AI video generator market. Brands are shifting toward these digital avatars for advertising, customer engagement, and brand storytelling. Virtual influencers can interact across multiple platforms without geographic boundaries. Digital avatars provide 24/7 availability and ease of adaptability. Furthermore, AI-generated talent reduces expenses for production while allowing for the personalization of the business to consumers. This novel idea synchronizes with changing consumer behavior that desires immersive and interactive experiences, leading to increased adoption of AI video generation and technologies to tell brand stories and engage audiences in marketing or entertainment globally.

AI VIDEO GENERATOR MARKET TRENDS

Specialized Use Case of AI Video Generator to Create New Market Opportunities

The AI video generator market is advancing from a focus of general video creation to specialized use cases across different industries. Industries are using this technology for corporate training, educational modules, customized marketing videos, and product demonstrations. Businesses can take advantage of the automatic localization, real time customization, and the ability to leverage dynamic storytelling capabilities which all contribute to more efficiency and engagement. AI can enhance personalization - tailoring content for each individual viewer - keeping relevance to viewers and connecting them to brands. This growth for specialized video creation will create different market opportunities for software providers, content creators, and businesses to drive deeper integration of AI-powered video technology into the communication and business operations.

SEGMENTATION ANALYSIS

By Enterprise Type

Early Adoption of Advanced AI Video Tools Boosts Large Enterprises Segment Growth

Based on the enterprise type, the market is segmented into Small & Medium Enterprises (SMEs) and large enterprises.

In 2026, the Large Enterprises segment is projected to lead the market with a 50.86% share, due to greater resources and increased usage of AI-based tools to generate quality videos in minimum time. Similarly, the growing usage of AI-based video generation tools helps to automate the video generation process based on a large amount of user data. It also enables the creation of fast video content at a large scale to deliver a personalized user experience.

Small and Medium Enterprises (SMEs) are expected to grow at the highest CAGR of 21.1% in the market. This rapid growth is attributed to the increasing affordability and accessibility of AI-based video tools, enabling SMEs to adopt innovative technologies for content creation, marketing, and communication.

By Sources

Text to Video Segment Dominates Market as It Enables Fast and Scalable Content Creation

Based on sources, the market is divided into text to video, PowerPoint to video, and documents to video (PDF, spreadsheet, etc.)).

The text-to-video segment is expected to lead the market, contributing 46.25% globally in 2026, leads the market. This dominance arises from its capability to rapidly convert written scripts or articles into engaging video content, ensuring scalability, efficiency, and cost-effectiveness for creators, marketers, and enterprises seeking streamlined multimedia production through automated AI-driven solutions.

The PowerPoint to video segment is estimated to record the largest CAGR of 21.8% over the forecast period. This is because various businesses in different industry verticals rely on PowerPoint for presentations, training, product demos, and advertising. The increased usage of PowerPoint to video conversion tools among various enterprises helps convert PowerPoint training resources into innovative and captivating videos with voiceover to improve customer engagement and deliver better user experience over the forecast period.

By Application

High Demand for Personalized Promotional Videos Augments the Marketing & Advertising Segment Growth

Based on the application, the market is divided into training & education, marketing & advertising, social media, and others (presentation, etc.).

The Marketing & Advertising segment is expected to lead the market, contributing 33.88% globally in 2026, This is due to the rising usage of personalized AI video generators to optimize the quality of advertising and marketing content cost-efficiently.

The social media application segment is projected to record the highest CAGR of 23.5% in the market. This rapid growth is fueled by the surging demand for short-form, high-volume video output tailored for platforms such as TikTok and Instagram.

By Industry

Heavy Investment in AI for Content Production Augments the Media and Entertainment Segment Growth

Based on the industry, the market is divided into IT & telecom, retail & e-commerce, education, healthcare, real estate, media & entertainment, and others (manufacturing, etc.).

In 2026, the Media & Entertainment segment is projected to lead the market with a 23.87% share, leads the majority AI video generator market share due to its continuous investment in automation and creative technologies. This sector leverages AI to streamline video creation, enhance visual effects, and scale personalized content production, driving efficiency and innovation.

The retail and e-commerce industry, projected to grow at the highest CAGR of 22.8%, is rapidly adopting AI video generators to enhance customer engagement and conversion. Businesses in this sector utilize AI-driven video tools to craft dynamic product showcases and hyper-personalized shopping experiences.

To know how our report can help streamline your business, Speak to Analyst

Regional Insights

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America dominated the market with a valuation of USD 293.8 billion in 2025 and USD 349.7 billion in 2026, due to rapid technology adoption and strong infrastructure. The region benefits from the presence of major AI-focused companies and a well-established digital ecosystem. The U.S. market is projected to reach USD 182.8 billion by 2026, driven by rapid deployment of advanced AI solutions and widespread use across industries.

North America AI Video Generator Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe

The European market is substantially growing and is likely to contribute to a revenue share of USD 165.8 million in 2025. This growth is due to growing adoption of advanced AI-driven content creation tools. The UK market is projected to reach USD 30.1 billion by 2026, while the Germany market is projected to reach USD 41.3 billion by 2026. The France market is projected to reach USD 30.2 billion by 2025.

Asia Pacific

The Asia Pacific AI video generator market is anticipated to reach USD 150.2 million by 2025, registering the highest CAGR of 23.8% among all regions. This strong growth is attributed to rapid digitalization, the surge in social media engagement, and the expansion of dynamic startup ecosystems across emerging economies. China, valued at USD 49 million in 2026, leads the region due to strong AI development and tech infrastructure, while India, at USD 34.7 million in 2026, shows accelerating adoption driven by content creators and growing digital-first businesses. The Japan market is projected to reach USD 37.2 billion by 2026.

South America and Middle East & Africa

The Middle East & Africa are estimated to record the growth rate of USD 77.8 million in 2025 due to the increasing adoption of artificial intelligence and machine learning technologies in academic institutions and IT firms for marketing and learning purposes. The GCC countries is estimated to value at USD 28.8 million.

South America, expected to be valued at USD 29.4 million in 2025, is in a deployment phase due to the increasing penetration of advanced digital technologies across the IT infrastructure of different industry verticals. These technologies are being used to advance marketing and advertising processes in Brazil and Argentina, boosting the adoption of AI video generator platforms over the forecast period.

COMPETITIVE LANDSCAPE

Key Industry Players

Technological Developments by Leading Companies to Aid in Market Proliferation

Companies operating in the market mainly include DeepBrain AI Ltd., Moovly, D-ID (De-Identification Ltd.), GoAnimate, Inc., HeyGen, Runway AI, Inc., Alphabet Inc., Elai.io, and others. These companies are focusing on bringing developments in enhancing the features of AI video generator software. To enhance their operations throughout the world, the key players are using various strategic methods, such as introduction of new products and partnering with other firms.

LIST OF KEY AI VIDEO GENERATOR COMPANIES PROFILED:

- Veed Limited (U.K.)

- Synthesia Limited (U.K.)

- Colossyan Inc. (U.K.)

- Canva (Australia)

- Steve AI (U.S.)

- DeepBrain AI Ltd. (U.S.)

- Moovly (Canada)

- D-ID AI Video (De-Identification Ltd.) (Israel)

- GoAnimate, Inc. (VYOND) (U.S.)

- HeyGen (U.S.)

- Runway AI, Inc. (U.S.)

- Alphabet, Inc. (U.S.)

- Elai.io (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2025- OpenAI has unveiled its latest advancement in artificial intelligence with the launch of Sora 2, an upgraded video generation model that integrates hyperrealistic video creation with social media functionalities. This move positions the company to challenge established platforms such as TikTok by blending AI-driven content creation with user-generated sharing.

- September 2025- Universal Ads, which enables brands of any size to create, buy, and measure ads across premium video, launched a new in-platform ad creation tool that lets advertisers build commercials using generative AI in just minutes. With no need for pre-existing video assets, businesses of any size can now tap into the premium world of television and create ready-to-air campaigns.

- July 2025- Baidu launched a new AI-powered image-to-video generator called MuseSteamer, alongside a major upgrade to its core search engine. The move comes as part of the company’s broader strategy to strengthen its enterprise AI offerings. This generator is designed to turn static images into short AI-generated videos, up to 10 seconds in length.

- April 2025- Chinese short video giant Kuaishou Technology unveiled an upgraded version of its Kling video generation artificial intelligence (AI) model, touting it as “the world’s most powerful” as competition intensifies in the race to develop video-generating models.

- January 2024- AI-powered enterprise video solutions provider AiVANTA and AI-led content automation and avatar technology provider UnScript have signed a partnership deal to offer AI-driven video solutions for enterprises. UnScript’s AI technology allows organisations to make professional-quality videos tailored to meet their social media, marketing, and advertising needs without carrying out video shoots, thus, slashing down the production costs and time. AiVANTA will use UnScript’s technology to deliver personalised video solutions to its enterprise-class clients.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the AI video generator market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.80% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Enterprise Type

By Source

By Application

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 716.8 million in 2025 and is projected to reach USD 3,350.00 million by 2034.

The market is expected to exhibit steady growth at a CAGR of 18.80% during the forecast period.

The rapid rise in video content consumption on digital platforms is speeding up the market growth.

Veed Limited, Synthesia Limited., Colossyan Inc., Canva, and Steve AI are some of the top players in the market

The North America region held the largest market share.

North America held the largest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us