Aminoglycosides Market Size, Share & Industry Analysis, By Generation (First Generation, Second Generation, Third Generation, and Others), By Application (Urinary Tract Infections, Respiratory Tract Infection, Skin Infections, Ophthalmic Infections, and Others), By Route of Administration (Oral, Parenteral, Topical, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

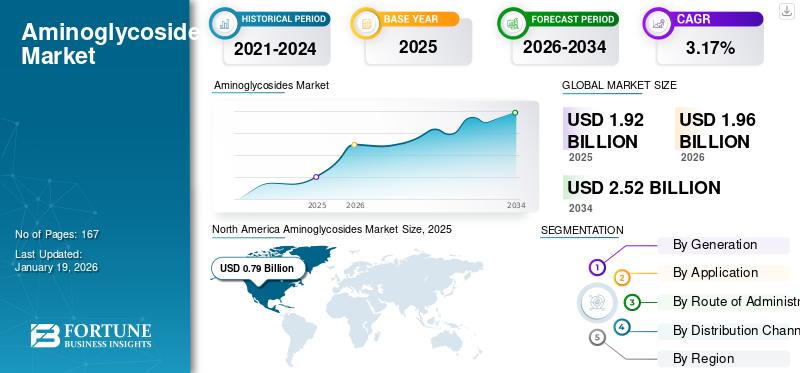

The global aminoglycosides market size was valued at USD 1.92 billion in 2025. The market is projected to grow from USD 1.96 billion in 2026 to USD 2.52 billion by 2034, exhibiting a CAGR of 3.17% during the forecast period. North America dominated the aminoglycosides market with a market share of 41.31% in 2025.

Aminoglycosides are a major class of bactericidal antibiotics having strong activity against many bacteria. They are extensively employed in treating complicated urinary tract infections, sepsis, nosocomial pneumonia, and respiratory conditions such as cystic fibrosis. Some of the known aminoglycosides are neomycin, tobramycin, gentamicin, amikacin, paromomycin streptomycin. Aminoglycosides differ from the rest of the antibiotics as they interfere with protein synthesis by binding to the bacterial 30S ribosomal subunit of RNA, causing the misreading of mRNA. This mechanism stops bacterial growth and kills the pathogen actively.

They are rated as better for use in critical care settings due to their ability to work synergistically with β-lactam antibiotics, providing greater and stronger coverage against multidrug-resistant organisms. Advances in technologies, such as inhaled forms and semi-synthetic derivatives, have enhanced their safety and delivery. Additionally, the market is expected to grow due to ongoing research and development.

- For instance, in 2022, Stanford University, U.S., received a Discovery Research Grant in partnership with the Cystic Fibrosis Trust to develop new aminoglycoside antibiotics for preventing hearing loss. Such developments are expected to propel the growth of the market.

The market encompasses several major players, with Hikma Pharmaceuticals PLC, Pfizer Inc., and Cipla at the forefront. A broad portfolio, continuous innovative product launches, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Urinary Tract Infections to Augment Demand and Support Market Growth

One of the most common applications of aminoglycosides is for the treatment of urinary tract infections. The rising burden of these infections has resulted in increasing antibiotic prescriptions. These infections are on the rise due to several factors, such as increasing geriatric populations, higher incidence of diabetes and poor hygiene in developing regions, and hospital-acquired UTIs.

In response, key operating companies are streaming their resources toward research and development, along with new product launches, to cater to the need for cost-effective antibiotics for treatment.

- For instance, in February 2024, Cipla Limited received approval from the Central Drugs Standard Control Organization (CDSCO) to market the novel antibiotic Plazomicin in India. Plazomicin is a new intravenous (IV) aminoglycoside indicated for the treatment of complicated urinary tract infections (cUTI), including pyelonephritis.

MARKET RESTRAINTS

Risk Associated with AMR to Hamper Market Growth

The aminoglycosides bactericidal class of antibiotics, pose a severe risk of development of antimicrobial resistance, hampering their effectiveness against bacterial infections. AMR has led to the emergence of aminoglycoside-resistant strains of Escherichia coli, Klebsiella pneumoniae, and Pseudomonas aeruginosa, which are among the most common causes of urinary tract, respiratory, and bloodstream infections.

- For example, in July 2023, the U.S. Centers for Disease Control and Prevention (CDC) reported a sharp rise in carbapenem-resistant Enterobacteriaceae (CRE) and aminoglycoside-resistant gram negative bacteria across hospitals. The CDC warned that multidrug-resistant infections are becoming increasingly difficult to treat and often require last-resort antibiotics.

- Similarly, in March 2024, the European Centre for Disease Prevention and Control (ECDC) noted that resistance to aminoglycosides in K. pneumoniae bloodstream infections surpassed 25.0% in several EU countries, reflecting a growing treatment gap.

MARKET OPPORTUNITIES

Peptide-Linked Aminoglycoside Adjuvants for Combating MDR Infections to Create Lucrative Growth Opportunities

To combat the pressing issue of AMR, the development of multidrug-resistant aminoglycoside antibiotics provides a lucrative growth opportunity. Resistance to aminoglycosides is often derived from bacterial enzymes that modify and inactivate the drugs. Thus, the development of peptide-linked aminoglycoside conjugates could overcome this obstacle. This approach provides an adaptable pathway to restore the effectiveness of existing aminoglycosides against multidrug-resistant (MDR) pathogens.

- For instance, in August 2025, Frontiers in Microbiology published an article titled ‘Synergistic action between peptide-neomycin conjugates and polymyxin B against multidrug-resistant gram-negative pathogens. The study reported that peptide modifications provide promising new tools to mitigate the growth of antibiotic-resistant pathogens using peptide-linked aminoglycosides.

AMINOGLYCOSIDES MARKET TRENDS

Growing Adoption of Combination Therapy with Aminoglycosides is One of the Significant Market Trends

Aminoglycosides are increasingly being integrated into multidrug combination regimens rather than used as standalone therapies. In complex infections such as NTM lung disease caused by MAC, single-drug approaches have shown limited success. At the same time, combination therapy improves patient outcomes, slows resistance development, and extends the therapeutic life of existing antibiotics. This trend is reshaping the aminoglycoside market by shifting its use away from commodity applications toward specialized, value-driven roles within combination treatment strategies.

- For instance, in March 2021, Insmed Incorporated received approval from Japan’s Ministry of Health, Labour and Welfare (MHLW) for ARIKAYCE (amikacin liposome inhalation suspension). It is indicated for the treatment of patients with nontuberculous mycobacterial (NTM) lung disease caused by Mycobacterium avium complex (MAC) who did not respond sufficiently to prior treatment with a multidrug regimen (MDR).

MARKET CHALLENGES

Risk of Toxicity Poses a Challenge and Hampers Market Growth

A key challenge facing the aminoglycoside market is the heightened risk of ototoxicity in patients with rare mitochondrial mutations. Despite drug levels remaining within the recommended therapeutic range, patients with mitochondrial mutations may still develop irreversible hearing loss. This creates a layer of clinical uncertainty, as the mutations are uncommon and their real-world impact remains difficult to predict. While genetic testing can help reduce risk, it is not always feasible in urgent care situations and may not be practical for all patient populations.

- For instance, in January 2021, the Government U.K. reported the narrow therapeutic window for aminoglycosides and their application might result in toxicity, including nephrotoxicity and ototoxicity, which can result in permanent hearing loss. Such factors pose a risk for the adoption of the product and hamper the aminoglycosides market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Generation

Growing Occurrence of Bacterial Infections to Boost Third-Generation Segment Growth

On the basis of generation, the market is classified into first generation, second generation, third generation, and others.

The third generation segment is estimated to hold the leading share in the market. The high share is attributed to the third generation due to the increasing incidence of bacterial infections and the promising effectiveness showcased by third-generation aminoglycosides. Additionally, undermining the growing demand, many key operational entities are focusing on strategic collaboration and partnership to expand access to these medications.

- For instance, in June 2022, Sihuan Pharmaceutical Holdings Group Ltd. announced an exclusive licensing agreement with Shanghai SPH New Asia Pharmaceutical Co., Ltd. The collaboration focused on the formulation of two new anti-infection drugs of Xuanzhu Biopharm, Benapenem and Plazomicin, third-generation aminoglycosides, in the Greater China Territory.

By Application

Respiratory Tract Infections Segment Dominated due to Rising Emphasis on Research and Development

In terms of application, the market is categorized into urinary tract infections, respiratory tract infections, skin infections, ophthalmic infections, and others.

The respiratory tract infection segment captured the largest aminoglycosides market share in 2024. Aminoglycosides play an important role in the treatment of respiratory tract infections, particularly caused by Pseudomonas aeruginosa, which is a common cause of hospital-acquired infections. These products show effectiveness against these multidrug-resistant bacteria and are used to treat cystic fibrosis. Due to such wide application, many key companies are focusing on research and development of new products to drive segment growth in the forecast period.

- For instance, in May 2024, the Centers for Disease Control and Prevention reported that Cystic fibrosis (CF), a genetic disorder that causes problems with breathing and digestion, affects about 35,000 people in the U.S. Such a high prevalence of respiratory diseases boosts the demand for aminoglycosides.

By Route of Administration

New Product Launches Boosted the Topical Segment Growth

Based on route of administration, the market is segmented into oral, parenteral, topical, and others.

The topical segment held the dominant market share in 2024. The topical route of administration provides various benefits such as minimal systemic absorption, rapid effectiveness against infections, and lower dosing requirements. Furthermore, novel product launches are expected to drive growth in the segment.

- For instance, in October 2024, Appili Therapeutics Inc. received positive feedback from the U.S. FDA regarding the development strategy for ATI-1801. ATI-1801, a novel topical formulation of paromomycin (15% w/w), is under advanced clinical development for the treatment of cutaneous leishmaniasis, a disfiguring skin infection.

By Distribution Channel

Retail Pharmacy Segment Led due to Easy Access to Medication

Based on distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

In 2024, the global market was dominated by retail pharmacies in terms of distribution channels. Retail pharmacies provide easy access to medication and retain higher engagement and trust among patients, contributing to growth in the segment. Underlying these benefits, many retail pharmacies are focusing on expanding their distribution network to better serve patient needs.

- For instance, in September 2024, Pharmaprix, a pharmacy chain in Quebec, announced the expansion of its care clinic network. These innovative clinics offer a range of primary care services, including treatment for hormonal contraception, shingles, acne, urinary tract infections, and allergic rhinitis. Such advancements in these channels are expected to boost the segment's growth in the market.

Aminoglycosides Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Aminoglycosides Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2023, valued at USD 0.76 billion, and continues to lead in 2024, with a valuation of USD 0.77 billion. The dominance of the region is supported by strategic collaboration among key operational entities, new product launches, and research and development activities.

Furthermore, the U.S. dominated the North America region due to a robust healthcare ecosystem, along with strong purchasing capacity, strategic collaboration among key companies, and reimbursement mechanisms for critical antibiotics in the country.

- For instance, in May 2023, Tanner Pharma Group collaborated with Cipla Therapeutics to launch an innovative Named Patient Program (NPP) for Zemdri (plazomicin) Injection. The program expanded access to Zemdri on a Named Patient basis in countries and regions where the drug is not yet commercially accessible. Such developments are expected to drive regional growth.

Other regions, such as Europe and the Asia Pacific, are also anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 2.80%, making it the second-highest region, with an estimated valuation of USD 0.49 billion in 2025. This growth is primarily due to the strong healthcare infrastructure and increasing antimicrobial stewardship, coupled with stringent safety regulations. After Europe, the market in the Asia Pacific is estimated to reach USD 0.32 billion in 2025, securing the position of the third-largest region in the market.

The Latin America and Middle East & Africa regions would witness a moderate growth over the forecast period. In 2025, the Latin America market is set to reach a valuation of USD 0.20 billion, driven by rising healthcare expenditure.

COMPETITIVE LANDSCAPE

Key Industry Players

Industry Participants Focus on Geographic Expansion to Reinforce their Market Presence

The global market shows a semi-concentrated structure with numerous small- to mid-size companies actively operating across the globe. These players focus on product innovation, strategic partnerships, and geographic expansion to strengthen their market presence.

Amneal Pharmaceuticals, Inc., Hikma Pharmaceuticals PLC, and Cipla are some of the key players in the market. They offer a comprehensive range of aminoglycosides globally through a strong distribution network, and strategic collaborations with other operational entities further support their dominance.

Apart from this, other prominent players in the market include Insmed Incorporated, Lupin, Sun Pharmaceutical Industries Ltd, Nordic Group B.V., and others. These companies are undertaking various strategic initiatives, such as investments in R&D and partnerships with pharmaceutical companies to enhance their market presence.

LIST OF KEY AMINOGLYCOSIDE COMPANIES PROFILED

- Amneal Pharmaceuticals, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Insmed Incorporated (U.S.)

- Pfizer Inc. (U.S.)

- Cipla (India)

- Nordic Group B.V. (Netherlands)

- Lupin (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Nordic Pharma, Inc., a subsidiary of Nordic Group B.V., launched and authorized the generic launch of Maxitrol (Neomycin and Polymyxin B Sulfates and Dexamethasone Ophthalmic Suspension) for the treatment of eye infections.

- August 2021: Xellia Pharmaceuticals expanded its manufacturing capacity by opening a new site in Cleveland, Ohio. The facility released the first anti-infectives to be distributed for use by U.S. hospitals.

- December 2020: GSK plc collaborated with Uppsala University for the ENABLE project. The project brought together over 50 European partners from academia and industry to co-develop novel antibiotics. The Swiss start-up Juvabis advanced its antibiotic (1003 (apramycin) in clinical trials, showcasing positive results.

- June 2018: Lupin launched Tobramycin Inhalation Solution USP, following the approval by the U.S. FDA. The generic aminoglycoside is indicated for the management of cystic fibrosis patients with P. aeruginosa.

- July 2021: Amneal Pharmaceuticals, Inc. received Abbreviated New Drug Application (ANDA) approval from the U.S. FDA for the generic version of TobraDex, adding another complex ophthalmic product to its generics portfolio.

REPORT COVERAGE

The global aminoglycosides market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.17% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Generation

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.92 billion in 2025 and is projected to reach USD 2.52 billion by 2034.

In 2025, the market value stood at USD 0.79 billion.

The market is expected to exhibit a CAGR of 3.17% during the forecast period (2026-2034).

By generation, the third generation segment led the market.

The key factors driving the market are the rising focus on research and development activities.

Pfizer Inc., Cipla, and Insmed Incorporated are some of the prominent players in the market.

North America dominated the market with a share of 41.31% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us