AI-enabled Testing Market Size, Share & COVID-19 Impact Analysis, By Deployment (Cloud and On-premise), By Application (Web-based and Mobile-based), By Technology (Machine Learning, NLP (Natural Language Processing), Computer Vision, MBTA (Model-based Test Automation), and Others), By Industry (IT & Telecom, BFSI, Healthcare, Energy & Utilities, and Others), and Regional Forecast, 2026–2034

AI-enabled Testing Market Size

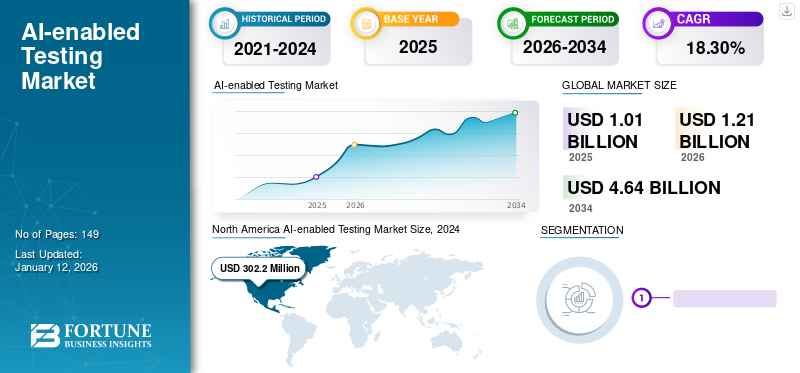

The global AI-enabled testing market size was valued at USD 1.01 billion in 2025 and is projected to grow from USD 1.21 billion in 2026 to USD 4.64 billion by 2034, exhibiting a CAGR of 18.30% during the forecast period. North America dominated the global AI-enabled testing market with a share of 34.60% in 2025.

AI-based software testing refers to the usage of technologies, such as Machine Learning (ML), Artificial Intelligence (AI), and other related mechanisms for testing software applications to certify that they are working and performing accurately to offer a better user experience. These solutions help testers save their efforts in testing, have the capability to generate enhanced quality test cases, faster test executions, and accomplish higher test coverage.

AI features proficiently evaluate the fundamentals and their usability and recognize reusable components that can be used instead of creating identical test cases. Hence, the usage of AI in software testing enhances the capability to develop enhanced-quality self-curative test cases. Thus, various key players are enhancing their offerings with new emerging technologies, such as AI, machine learning, RPA, computer vision, and many others. For instance,

- In June 2023, InfoVision, in collaboration with Tricentis, announced an AI-driven continuous testing solution to accelerate its software testing speed. The solution is an end-to-end AI-driven continuous testing and AI-powered autonomous solution. It is based on the Tricentis AI-powered, no-code, script-less automation platform for enterprise applications and infrastructure testing facilities with the usage of predictive modeling and prearranged automation for re-usability.

COVID-19 IMPACT

Increase in Introduction of AI-enabled Testing Solutions with Advanced Technologies During Pandemic Favored Market Growth

As the COVID-19 pandemic affected intra-national and cross-border mobility, enterprises relied on online channels for handling operations, empowering sales, receiving payments, and reaching customers. Software failures prompted by internal bugs inflicted havoc on dealings, resulting in multi-dollar losses, identity theft, and data leakage.

AI-enabled testing helps to enhance the efficiency of testing teams. AI-enabled automation structures certify quick bug fixes, minimize QA costs, and sooner time-to-market with advanced features including quick test data generation, visual testing, smarter and faster test creation, and many more. Such features propelled the progress of AI-enabled testing market share across various industries. Hence, various key players introduced new solutions with advanced technologies during times of pandemic with new collaborations and alliances across different regions.

- In September 2020, Appvance, in partnership with PwC Australia, introduced Appvance IQ (AIQ) in Australia and built an AI-powered testing practice over AIQ. AIQ is the AI-enabled combined test automation system with machine learning mechanisms that revolutionizes software QA procedures.

Hence, such advances and modernizations fueled market growth during the pandemic.

AI-enabled Testing Market Trends

Implementation of AI-driven Security Testing for Better Security to Propel Market Progress

Artificial intelligence helps in recognizing security risks and vulnerabilities more efficiently while making AI-driven testing applications safer and more reliable. AI-powered security testing aids users in weaving application security testing professionally into each phase of development.

It enables users and enterprises to boost their cybersecurity, speed up remediation procedures, meet the expected regulations, streamline security testing, eliminate security hurdles, and develop trust across all stages of SDLC (Software Development Life Cycle). It uses machine learning algorithms, actual-time threat intelligence tools, and automation to deliver extra security and benefits.

By leveraging the power of AI, organizations can significantly enhance their security posture, stay ahead of upcoming threats, and develop a more resistant defense against cybersecurity. Hence, key market vendors are introducing new security-based AI testing to cater to customers' demands. For instance,

- In November 2023, GitHub announced the launch of AI-driven application security testing to help users secure their code more proficiently and securely. The new advanced solutions comprise three major features with robust enhancements for security capabilities. These include faster fixing of issues with code scanning autofix, identification of leaked passwords with secret scanning, and reducing time with consistent expression generators for customized patterns.

Such advancements with new technologies are enhancing the AI-enabled testing market growth across various industries.

Download Free sample to learn more about this report.

AI-enabled Testing Market Growth Factors

Rising Demand for No-code or Codeless Testing Solutions to Drive Market Development

Low-code or codeless platforms offer an instinctive graphical interface, allowing testers to build AI-enabled designs and implement automatic test cases with nominal coding. This streamlines test automation, making it available to a broader audience, including those users with partial coding expertise. Hence, low-code test automation is gaining significant popularity with its capability to accelerate and streamline the test automation procedure. For instance,

- According to industry experts, by the year 2025, nearly 70% of freshly developed enterprise solutions will be created with the help of low-code or no-code technologies.

With the simple-to-use interface of AI-driven no-code testing tools, stakeholders and project managers can cooperate without any widespread technical knowledge. Users are required to have an elementary knowledge of CSS and HTML to run, maintain, and edit test cases.

- In April 2023, Sofy introduced SofySense, a generative AI-powered no-code mobile application testing solution. The new innovative testing solution combines AI and no-code/codeless automation. The solution augments Sofy’s pre-existing platform and integrates GPT-unified, intelligent software-testing AI systems to offer QA (quality assurance) assistance.

All these factors, such as the rising need for no-code AI-based testing and innovations, are driving the growth of these solutions in the market.

RESTRAINING FACTORS

Higher Data Dependency on AI-based Testing Applications Can Impede Market Progress

AI models study historical data, and if this data comprises biases, the subsequent models can propagate those biases. AI-based models and solutions are highly dependent on the availability of data in that particular industry. Biased and insufficient data can lead to unfair or inaccurate testing outcomes.

In the framework of software testing, partial training data can cause inadequate testing reporting or discriminating treatment of specific user groups. Hence, it is necessary to be aware of such biases and to initiate steps to diminish them by safeguarding the diversity and representativeness of these datasets.

Hence, developers need to prioritize the addition of data sets to avoid discrimination and bias in evolving technologies and do extensive testing on the same. Also, the limited data would lead AI to have a limited understanding of the nuances and complexities of the software. Thus potentially missing the hidden defects or critical edge cases.

AI-enabled Testing Market Segmentation Analysis

By Deployment Analysis

Cloud-based AI-enabled Testing Solutions Growth Enhanced by Cost Efficiency and Faster Testing Cycles

Based on deployment, the market is categorized into cloud and on-premise.

The cloud segment accounts for the highest market revenue with a share of 62.80% in 2026 and is predicted to grow with a leading CAGR during the forecast period. As the cloud-driven infrastructure aids accessible testing across the globe while offering actionable insights as per the testing requirements and fluctuating workloads, it holds the highest share. It also provides better accessibility and cost efficiency with pay-as-you-go models, rapid testing cycles, enhanced collaboration of real-time insights and testing environment, and many such benefits.

The on-premise deployments account for a substantial market share during the forecast period. On-premise deployment offers better privacy and security as the testing environment is completely under the control of the enterprise. It also enables organizations to customize the testing environment as per their requirements.

By Application Analysis

Web-based AI-enabled Applications to Upsurge Segment Growth Owing to Ease of Use and Scalability

By application, the market is bifurcated into web-based and mobile-based.

The web-based segment held the maximum share of the market with a share of 70.24% in 2026 and is anticipated to grow with the highest CAGR over the forecast period. Web-based testing utilizes the power of artificial intelligence and the web to deliver user-friendly, accessible testing solutions to everyone, regardless of technical expertise. Hence, they are extensively used across web application testing, API testing, automated regression testing, and others, thereby accounting for the maximum share of the market.

Mobile-based AI-enabled testing provides users with the convenience and flexibility over a tablet or a smartphone. It helps enterprises to directly test the application’s functionality, user experience, and functionality with the guidance of AI.

By Technology Analysis

Machine Learning Segment to Propel Growth with its Enhanced Capabilities

By technology, the market is segmented into machine learning, NLP (Natural Language Processing), computer vision, MBTA (Model-based Test Automation), and others (RPA).

The machine learning segment held the largest market witha share of 37.48% in 2026. ML mechanisms optimize test sets by identifying unnecessary test cases and ensuring optimal test reporting through keyword analysis. Machine learning automates test sets by creating scripts that perform tasks or operations similar to those of manual testers. Compared to manual testers, machine learning requires significantly less time, making it a preferred technology for enterprises and testers. For instance,

- According to the Zappletech Test Automation Trends Report 2022, machine learning’s share in software testing is predicted to grow with a CAGR of more than 7% from 2021 to 2027.

The computer vision segment is estimated to grow with a leading CAGR during the forecast period. Computer vision enables businesses to reimagine their present way of functioning and resolving problems. The technology can be used across various testing solutions, such as mobile app testing, IoT device testing, marketing and advertising testing, automotive, and many more. For instance,

- In August 2023, Anyverse and Tech Mahindra collaborated on AI adoption in the automotive sector. The alliance would simplify the usage of synthetic data to test, train, and certify AI systems for customers globally in the automotive sector. Anyverse is a synthetic data generation solution that hastens the growth of computer vision-driven solutions for autonomous uses.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Higher Usage of AI-enabled Testing in IT and Telecom Sector to Upsurge Segment Expansion

Based on industry, the market is segmented into IT & telecom, BFSI, healthcare, energy and utilities, and others (government, education, and manufacturing).

The IT and telecom segment held the highest market with a share of 36.24% in 2026. AI-based testing solutions help IT and telecom enterprises analyze vast amounts of data from networks, servers, and applications and recognize performance bottlenecks, configuration errors, security vulnerabilities, and many more. Hence, various market players advance their solutions to satisfy the changing necessities of these organizations and enterprises. For instance,

- In March 2022, HeadSpin collaborated with Tricentis to bring together wide-ranging AI, device infrastructure, and global edge to significantly increase the quality of software experience. The alliance also permits HeadSpin to use the agile test management platform of Tricentis, qTest, to advance efficiency and safeguard collaboration for DevOps teams.

The healthcare segment is anticipated to grow with the highest CAGR during the forecast period. AI-driven testing solutions offer actual-time analysis and monitoring, predictive analysis for larger amounts of medical data to recognize patterns and other complications, identifying biases in healthcare algorithms, and so on. Hence, it can be used in various healthcare operations, and it is predicted to grow with a leading CAGR.

REGIONAL INSIGHTS

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America AI-enabled Testing Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest market with a size of 0.35 billion in 2025. The region has the maximum number of investors, with most investments in the U.S. The U.S. also has the major presence of prominent players aiding the progress of AI-enabled testing solutions in the market. The U.S. market is projected to reach USD 0.21 billion by 2026. Also, the region contributes the largest share of emerging technologies and their advancements, such as machine learning, robotic process automation, and NLP, among others. For instance,

- In September 2023, Copado announced the launch of Copado 1 Platform, the end-to-end turnkey DevOps solution for Salesforce. The solution combines the complete SDLC on Salesforce, comprising AI-enabled testing, into one platform.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

According to Fortune Business Insights, Asia Pacific is anticipated to grow with a leading CAGR over the forecast period. The development of emerging mechanisms, such as artificial intelligence, machine learning, and NLP, is growing in Japan, India, South Korea, and other countries. Thus contributing to the progress of AI-enabled solutions in the market. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026. Also, key players are investing in such countries with strategies such as collaborations, investments, and partnerships. For instance,

- In May 2023, Micron Technology announced it would invest over 500 billion yen (USD 3.6 billion) in Japan in the coming years. With support from the government of Japan, they enhance end-to-end technological innovation, such as emerging generative AI applications and others.

Europe

AI-enabled testing is rapidly gaining traction in European countries, with various facilities and initiatives to aid in its adoption and development. Also, various government policies and investments in Germany, Spain, Italy, and France, are contributing to the region’s market growth. Hence, Europe is taking a preemptive approach to AI-enabled testing development and recognizing it to boost innovation and the economy. The UK market is projected to reach USD 0.1 billion by 2026, while the Germany market is projected to reach USD 0.07 billion by 2026. For instance,

- In March 2023, the Spanish government, with the Economic Affairs and Digital Transformation Ministry, signed an essential agreement with the inventive research center ADIA Lab, which has selected Spain as its headquarters in Europe for the progress of advanced computing and AI.

Middle East & Africa and South America

Various factors, such as the penetration of new industries and the development of the economy in the Middle East & Africa and South America, led to the development of AI-enabled testing market share in 2024. Furthermore, the relative spending on artificial intelligence, robotics, and machine learning in these regions contributes to market progress.

KEY INDUSTRY PLAYERS

Rising Emphasis on Global Expansion to Fortify Key Players’ Market Positions

Key players are proficient in incorporating new mechanisms across various sectors, such as BFSI, healthcare, IT, and telecom, among others. Upgrading solutions with innovative mechanisms is one of the substantial approaches players implement. Similarly, prominent players intentionally collaborate and form alliances for global expansion.

List of Top AI-enabled Testing Companies:

- Functionize, Inc. (U.S.)

- Sauce Labs Inc. (U.S.)

- Tricentis (U.S.)

- Diffblue Ltd. (U.K.)

- Applitools (Israel)

- Mabl Inc. (U.S.)

- UBS Hainer GmbH (Germany)

- Testim (U.S.)

- Perforce Software, Inc. (U.S.)

- Open Text (MicroFocus) (Canada)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Mabl announced an incorporation with advanced automated testing GitLab, the most all-inclusive AI-powered DevSecOps solution for software modernization. The integration allows development teams to effortlessly leverage the platforms for end-to-end testing response straight within CI/CD channels.

- September 2023: Perforce Software announced the addition of generative AI, BlazeMeter’s Test Data Pro, to test automation to improve coverage, precision, and shift left velocity. It is intended to enhance test data creation. It leverages pioneering AI mechanisms to democratize and streamline the usage of test data.

- October 2023: Katalon introduced TrueTest with three AI-based competencies that allow quality engineering teams to truly understand the application, unconventionally generate regression tests and automatically execute business regression tests.

- May 2023: UiPath introduced an end-to-end AI-driven business automation platform to fast-track digital transformation for SAP customers. It helps customers automate and centralize their testing with its UiPath Test Suite, unlock all-in-one test prioritizing with heatmap, and change influence exploration for SAP.

- May 2023: Applitools introduced Execution Cloud, an innovative cloud-driven testing platform that allows teams to function their present tests over an AI-empowered testing substructure. The new addition to the Ultrafast Test platform of Applitools is developed to offer teams that use open-source structures.

REPORT COVERAGE

The report provides a comprehensive analysis of the market and highlights vital aspects such as top companies, product kinds, and emerging new solution applications. Besides this, it delivers insights into recent market developments and provides insights on essential industry expansions. In addition to the aspects stated above, the report combines numerous dynamics that have contributed to the market development in recent years.

Report Scope & Segmentation

| ATTRIBUTE |

DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 18.30% from 2026 to 2034 |

| Unit | Value (USD Million) |

| Segmentation |

By Deployment

By Application

By Technology

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 4.64 billion by 2034.

In 2025, the market was valued at USD 1.01 billion.

The market is projected to grow at a CAGR of 18.30% during the forecast period.

Based on industry, the IT & telecom segment leads. The segment captured the highest share in terms of revenue in 2024.

Rising demand for no-code or codeless testing solutions to drive market development.

Applitools, UiPath, Sauce Labs Inc., Tricentis, and Functionize, Inc., among others, are the top players in the market.

North America dominated the global AI-enabled testing market with a share of 34.60% in 2025.

By technology, computer vision is expected to grow with a leading CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us