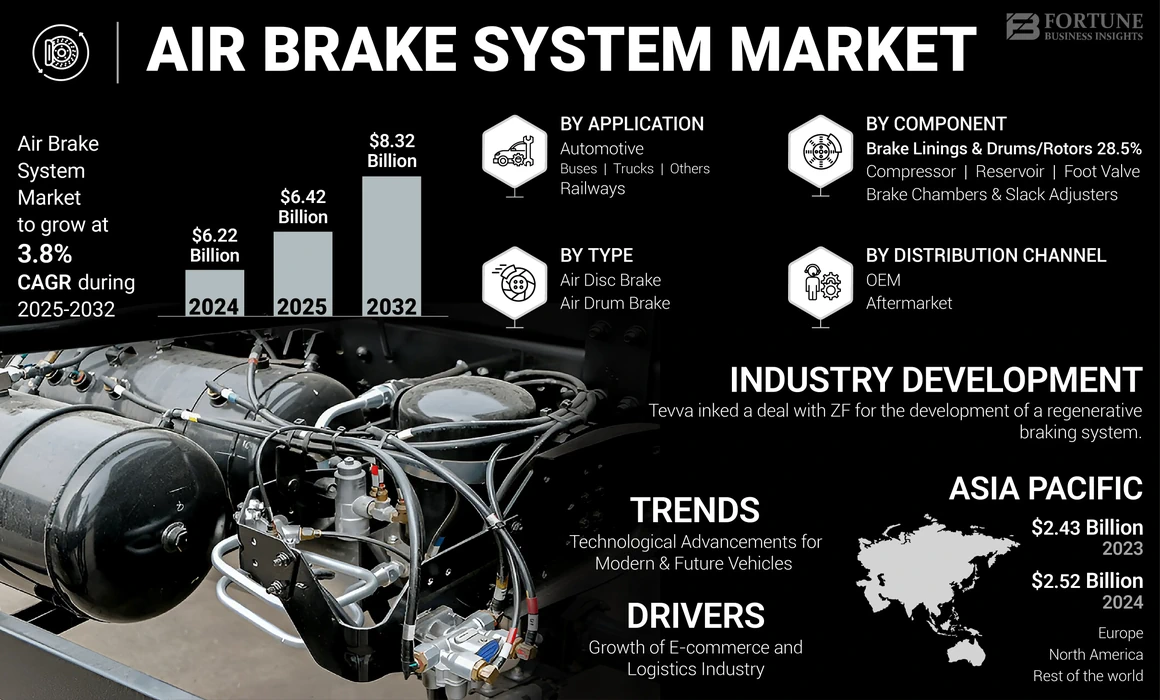

Air Brake System Market Size, Share & Industry Analysis, By Application (Automotive (Buses, Trucks, and Others) and Railways), By Type (Air Disk Brake and Air Drum Brake), By Component (Compressor, Reservoir, Foot Valve, Brake Chambers & Slack Adjusters, and Brake Linings & Drums/Rotors), By Distribution Channel (OEM and Aftermarket), and Regional Forecast, 2025– 2032

KEY MARKET INSIGHTS

The global air brake system market size was valued at USD 6.22 billion in 2024. The market is projected to grow from USD 6.42 billion in 2025 to USD 8.32 billion by 2032, exhibiting a CAGR of 3.8% during the forecast period. Asia Pacific dominated the global market with a share of 40.51% in 2024.

The air brake system, also known as compressed air brake, is a friction-causing component in vehicles. In this system, the piston is pushed by the compressed air, which smears pressure to brake pad and brake shoe, which helps in stopping the vehicle. An air brake is generally used in commercial vehicles such as buses, trucks, and railways. The system’s operating pressure is approximately 100–120 psi (690–830 kPa or 6.9–8.3 bar).

The air brake system market growth is driven by the development of air brake system technology to reduce weight and make it compatible with fast passenger trains. Alongside, the surging demand for commercial vehicles due to rising growth in the logistics sector is also expected to propel the market expansion over the forecast period. The advancement in technology, such as electronic brake systems and air disk brakes for commercial vehicles and rail vehicles, is further expected to drive the market growth during the forecast period.

The early stages of the COVID-19 pandemic affected the market, resulting in the halt of the rail vehicle and commercial vehicle operations. This reduction in demand affected the sales and production of air brake components. For instance, according to OICA (International Organization of Motor Vehicle Manufacturers), in 2020, the production of buses and coaches witnessed a decline of 37% compared to 2019. This was followed by another 10% drop in 2021 compared to 2020.

Air Brake System Market Trends

Development in Technologies for Modern and Future Vehicles is the Major Trend

The growing trend toward the electrification and hybridization of vehicles, including focus on electric trucks and buses, has led companies to develop braking systems that work in synergy with these types of vehicles. The introduction of ADAS with an automated emergency braking system also relies on air brake components for effective operation in commercial vehicles.

The focus of major companies on developing electronic brake systems for increasing safety in vehicles is expected to drive the market growth. Companies are also developing technologies to reduce the weight of the air braking system without compromising safety and performance, fueling the market growth. In January 2023, Brakes India, a part of TSF Group, launched 25 components of the air brake system, which the company focused on developing over the past few years. With the help of this, the company aimed to widen its market share, providing innovative and developed products and catering for the growing market of electric vehicles. In 2023, the company recorded an export book order worth USD 16.26 billion. Thus, the major players in the market focusing on the development of innovative technologies fuel the growth of the air brake system market during the forecast period.

Download Free sample to learn more about this report.

Air Brake System Market Growth Factors

Expansion of E-commerce and Logistics Industry to Boost Market Growth

E-commerce and logistics companies rely heavily on a vast fleet of delivery vehicles, including trucks and vans. As these companies expand their operation to meet growing consumer demand for online shopping and fast deliveries, they need to procure and maintain more vehicles. This increases the demand for the product, as air brakes are essential for ensuring the safety and reliable operation of commercial vehicles.

Moreover, delivery vehicles in the e-commerce and logistics sector are often subjected to heavy usage and frequent stop-and-go driving in urban environments. This puts significant stress on their braking systems. This also generates the demand for high-quality braking systems, which fuels market growth. According to the American Trucking Association, in 2022, trucks transported nearly 61.9% of the value of surface trade between the U.S. and Canada. Around 11.46 billion tons of freight was conveyed by trucks, representing 72.6% of the total domestic cargo shipping.

RESTRAINING FACTORS

High Replacement Cost of Air Brake Components May Hinder the Market Growth

Commercial vehicle operators, such as trucking companies and fleet owners, often face tight budgets and cost pressures. High replacement costs of components, such as brake pads, drums, or valves, can strain their financial resources. For instance, the replacement cost of a caliper is considered around USD 130 and rotor replacement costs around USD 170 to USD 300. In addition, the replacement of front and rear brake pads costs nearly USD 240 to USD 700. This can lead to delayed or deferred maintenance, reducing the overall demand for air brake components. Thus, the high cost of air brake components replacement results in increased operating costs of vehicles, which hinders market growth.

Air Brake System Market Segmentation Analysis

By Application Analysis

Rise in Adoption of High-Speed Rails and Metros to Fuel the Railways Segment Growth

Based on application, the market is divided into automotive and railways.

The railways segment holds the major share in the market due to the wide application of air brakes in rolling stock, including locomotives as well as freight and passenger rail cars. Moreover, the increasing adoption of high-speed trains and railways are creating a demand for efficient and high-quality air braking systems. This is expected to drive the segment growth in the coming years. For instance, in August 2023, the California High-Speed Rail Authority approved the release of a Request for Qualifications (RFQ) for the adoption of 220 mph electrified high-speed trainsets.

The automotive segment is expected to expand with the highest growth rate during the forecast period. The automotive segment includes vehicles such as buses, trucks, rigid-body trucks, heavy-duty, and other specialized vehicles that require air brakes. The high growth in the logistics industry is driving the demand for commercial vehicles, including air brakes, thus boosting the segment growth during the forecast period.

By Type Analysis

Widespread Adoption of Air Drum Brakes in Commercial Vehicles to Drive Segment Growth

Based on type, the market is segmented into air disk brake and air drum brake.

The air drum brake segment dominated the market in 2024. Air drum brakes are commonly used in commercial vehicles due to their low cost compared to air disk brakes. This, provides the adoption of vehicles with the air drum brakes to be economical. Thus, the factor of cost and affordability in the segment, drives the demand of the market.

The air disk brake segment is expected to expand at the fastest-growing CAGR over the forecast period. The growth of the segment can be attributed to the increasing technological development in vehicle safety. Air disk brakes are more efficient than air drum brakes, which enhance the efficiency of the vehicle. This, in turn, is expected to boost the segment growth during the forecast period. Moreover, companies are also focusing on providing the parts of the air brake system to cater to the increasing demand in the market. For instance, in July 2023, Dura Brake unveiled the availability of the parts for the air-disk brake systems of Hendrickson and WABCO. The company made the rotors and callipers for the MAXX22T system available. These factors fuel the segment growth over the forecast period.

By Component Analysis

Technological Advancement in Air Brake System to Bolster the Segment Growth for Brake Linings & Drums/Rotors

Based on component, the market is categorized into compressor, reservoir, foot valve, brake chambers & slack adjusters, and brake linings & drums/rotors.

The brake linings & drums/rotors segment held the largest market share in 2024. The growth can be attributed to the development of technology by the major players in the market. For instance, in January 2023, Brakes India developed Motor on Drum brakes, iron castings, and others for commercial vehicles. This factor is fueling the segment growth.

The compressor segment is expected to grow with the highest CAGR during the forecast period. Major companies in the market are focused on reducing the weight and size of air braking systems. Companies are remanufacturing air compressors to provide their beneficial use in the vehicle system and meet the latest technological requirements. For instance, in June 2021, Wabco started the remanufacturing of compressors to upgrade them to the latest technology.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Growth in Demand for Commercial Vehicles and Adoption of High-speed Trains to Propel the OEM Segment Growth

Based on distribution channel, the market is divided into OEM and aftermarket.

The OEM segment dominated the market in 2024. Major automotive players in the market are collaborating with vehicle parts and component suppliers or manufacturers to develop effective braking systems suitable for their vehicles. In December 2023, Tevva, an electric vehicle manufacturer based in the U.K., partnered with ZF to develop a regenerative braking system for a 7.5-ton battery-electric truck manufactured by Tevva. The electronic brake system (EBS) comprises regenerative and compressed-air brakes. Thus, the collaboration between companies to develop air brake systems for OEMs drives the segment growth over the forecast period.

The aftermarket segment is expected to grow at the highest CAGR during the forecast period. As the demand for commercial vehicles and rail vehicles is rising, the maintenance of their braking system for efficient operation also will be accountable. Governments are initiating metro rail projects and expanding the existing rail operations. Thus, the increasing operation of commercial vehicles and railways generates the demand for aftermarket braking systems.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, the Asia Pacific, and the rest of the world.

Asia Pacific Air Brake System Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Presence of Key Players in the Asia Pacific to Fuel the Market Growth

The Asia Pacific market for air brake system held the largest share in 2024 and is anticipated to grow with the highest CAGR during the forecast period. The region caters to the aftermarket production and also has the presence of major automotive players, major rail operations, which fuels the demand for OEM products as well as aftermarket. Moreover, companies tapping into the developed and emerging economies to enhance their market presence and position also elevates the market growth in the region. For instance, in September 2023, TMT was rewarded as the Supplier of the Year 2023 in Asia Pacific at the Shanghai-based Asia Pacific Supplier Conference held by Westinghouse Air Brake Tech Corp. This resulted in the progress of the company to achieve a leading market position in the region, fueling the market growth.

North America held a significant air brake system market share in 2024. The market for commercial vehicles in North America is saturated due to the high adoption rate of commercial vehicles in the region. Thus, the high utility of commercial vehicles in the region fuels the market growth in the North America region. The demand for air brake systems is highly correlated with the freight transportation industry. As e-commerce and global trade continue to grow, there is a greater need for long-haul and heavy-duty trucks, which rely on air brake systems for safe and effective braking.

The Europe market for air brake system held a considerable share in 2024. Several countries in the European region are inclined toward the adoption of environmentally friendly vehicles, contributing to a sustainable future. Thus, major automotive players in the market, such as Volvo, Daimler, and others, are focused on developing electric commercial vehicles. This generated the demand for electric brake systems comprising air brake systems and regenerative technology, which fuels the market development in the region.

The rest of the world held a significant market share of the market in 2024. The rest of the world region comprises the Latin America, the Middle East, and Africa sub-regions. The growth of the railway sector and transportation and logistics sector generates the demand for commercial vehicles, including trucks, buses, and rail vehicles. As these types of vehicles are equipped with air brake systems. The increasing demand for commercial vehicles and rail vehicles fuels the demand for the market in the region.

Key Industry Players

Companies Focus on Product Innovations to Gain a Competitive Edge

The market is considered fragmented, with the presence of several major global and local players. Companies are highly focused on the research and development for innovating and developing highly efficient, lightweight brake systems. Knorr-Bremse, Wabtec, and ZF, among others, are expected to dominate this industry. In June 2023, Knorr-Bremse, headquartered in Germany, developed smart and electrified braking systems for rail vehicles.

LIST OF TOP AIR BRAKE SYSTEM COMPANIES:

- Knorr-Bremse (Germany)

- Wabco (Belgium)

- Meritor (U.S.)

- SORL Auto Parts, Inc. (China)

- Wichita Clutch (U.S.)

- Bludot Manufacturing (U.S.)

- Continental AG (Germany)

- Maxcess (U.S.)

- Cojali S.L. (Spain)

- Haldex (Sweden)

- Federal-Mogul Holdings Corporation (U.S.)

- Airmaster Brake Systems (South Africa)

- Brakes India Limited (India)

- YUMAK Air Brake Systems (Turkey)

- ZF (Germany)

- Wabtec (U.S.)

- Nabtesco (Japan)

KEY INDUSTRY DEVELOPMENTS:

- October 2023- The Commercial Vehicle Safety Alliance (CVSA) released the results of the Brake Safety Week. Around 18,875 commercial vehicles were inspected, out of which 2,375 (12.6%) were removed from roadways due to inspectors discovered brake-related out-of-service violations.

June 2023 – Tevva, an electric vehicle manufacturer in the U.K., partnered with ZF to develop a regenerative braking system. The regenerative braking system involves the electronic brake system that is to be used in Tevva’s 7.5t battery-electric truck. - June 2023- The Commercial Vehicle Safety Alliance (CVSA) scheduled the Brake Safety Week between August 20 and 26. This is focused on the brake lining/pad violations.

- February 2023- New York Air Brake LLC (NYAB), a leading manufacturer of train control systems for the railroad industry, accommodated an additional disc brake production line to its Watertown, New York, headquarters. This helped the company cater for its increased product demand and create 20 additional assembly jobs.

- December 2022- The Association of American Railroads approved the DB-60 II with Brake Cylinder Maintaining (BCM) technology developed by New York Air Brake.

- February 2022 – Knorr Bremse celebrated 100 years of operation of its compressed air brake system. The technology was patented on February 14 1922 and the compressed air brake is still used in commercial vehicles.

- December 2021 – New York Air Brake Company, a subsidiary of Knorr Bremse, achieved TTX’s Excellent Supplier designation for the second consecutive year. The award was based on New York Air Brake Company’s OE brakes, Rail Services (repair centers), and Friction (ABS).

- April 2021 – Haldex signed a partnership with the Fast Group, a leading commercial vehicle component manufacturer in China. Haldex performed this partnership in order to expand its business in the China market. Both organizations formed a joint venture to manufacture and provide air disk brakes and aftersale support in China.

- January 2021 – ZF signed a contract with Navistar to provide its MAXXUS L2.0 air disc brakes. The MAXXUS L2.0 air disc brakes are fitted in 100 Navistar International trucks.

REPORT COVERAGE

The report provides a detailed analysis of the air brake system market trends and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides this, it offers insights into the key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Type

|

|

|

By Component

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was valued at USD 6.22 billion in 2024.

The market is anticipated to grow at a CAGR of 3.8% during the forecast period (2025-2032).

The market size in Asia Pacific stood at USD 2.52 billion in 2024.

The expansion of the e-commerce and logistics industry is expected to boost market growth during the forecast period.

Some of the top players in the market are Knorr Bremse, Wabtec, and ZF.

The Asia Pacific dominated the market in 2024.

The high replacement cost of air brake components may hinder the market growth during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us