Automotive Brake Pads Market Size, Share & Industry Analysis, By Material (Non-Asbestos Organic (NAO), Semi-Metallic, Ceramic, and Carbon Composite), By Vehicle Type (Two Wheeler, Passenger Cars, and Commercial Vehicles), By Distribution Channel (Retail and Authorized Service Centers) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

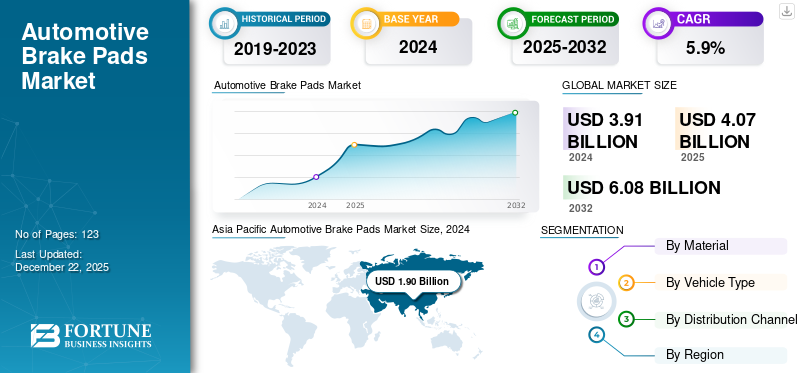

The global automotive brake pads market size was valued at USD 4.07 billion in 2025 and is projected to grow from USD 4.28 billion in 2026 to USD 6.67 billion by 2034, exhibiting a CAGR of 5.7% during the forecast period. Asia Pacific dominated the market with a valuation of USD 1.97 billion in 2025 and USD 2.06 billion in 2026.

Automotive brake pads are engineered friction components installed within a vehicle’s braking system. When the brake pedal is pressed, hydraulic force presses the brake pads against spinning rotors or drums, generating friction to slow or stop the vehicle. The pads are constructed from composite materials such as semi‑metallic, ceramic, or Non‑Asbestos Organic (NAO). They are designed to optimize braking performance, reduce noise and wear, manage heat dissipation, and minimize environmental and health hazards related to materials such as asbestos.

The market is highly competitive, consisting of global conglomerates and regional specialists. Key leaders include Robert Bosch GmbH, Brembo S.p.A., Akebono Brake Industry, ADVICS, Tenneco, ITT Inc., Delphi/BorgWarner, EBC Brakes, Nisshinbo, and ZF Friedrichshafen AG. These companies invest heavily in research, expanding production, forging strategic partnerships, and developing eco‑friendly, low‑copper or copper‑free, and EV‑compatible friction materials.

The COVID‑19 pandemic drastically affected the market by having a mix impact. Negative impact was due to supply chain disruptions, plant shutdowns, and sharp vehicle production and demand declines. OEM production slowed and aftermarket services diminished, as lockdowns reduced driving and service activity globally. At the same time, OEMs and brake pad suppliers responded to bottlenecks in raw materials and logistics by diversifying supply chains and accelerating facility reopenings, particularly in regions such as China and India, where resumption efforts began in mid‑2022 and 2023.

Emerging demand rebounded in late 2022 as automotive production resumed, supported by pent-up demand and economic stimulus. The crisis also sped up trends such as electrification and sustainable materials, prompting companies to fast‑track the development of EV‑specific, low‑dust, and eco‑friendly brake pads tailored to new vehicle brake architectures.

Automotive Brake Pads Market Trends

Increasing Demand for Eco-Friendly and High-Performance Brake Pads is a Key Market Trend

One major trend currently reshaping the global market is the accelerated movement toward low‑emission, copper‑free, and eco‑friendly friction materials, motivated by stringent regulatory mandates and proactive industry innovation. Regulatory bodies worldwide impose new limits on brake particulate emissions and heavy-metal content. In particular, the European Union’s Euro 7 standard, formally approved in early 2024 and set to take effect for new light vehicles in November 2026, marks the first time brake dust is regulated—limiting PM10 emissions to 3 mg/km for electric vehicles and 7 mg/km for hybrids and combustion models. The regulation also includes non‑exhaust particle thresholds and lifetime durability targets for the first time.

In response, manufacturers are developing low‑particulate brake solutions that can meet these stricter requirements. Brands such as Tenneco launched low-emission brake technologies, designed to comply with Euro 7 and upcoming China 7 standards. It leverages renewable and recycled raw materials in novel friction formulations and disc coatings to reduce CO₂ emissions during production, reporting reductions around 20% to 30 % in manufacturing-related greenhouse gases. Meanwhile, Ferodo (part of Tenneco) expanded its zero‑copper brake pad offering into the commercial vehicle segment, with pads containing under 0.5 % copper, matching expected legislative limits well in advance.

North American regulations reinforce this shift. California law mandates brake pads should contain no more than 0.5% copper from 2025 onward, and similar bans are already in place in several U.S. states. As of 2021, over 60 percent of brake pads sold in California were already effectively copper‑free, resulting in an estimated 28 percent reduction in copper entering urban runoff. Regionally, the adoption rate of eco‑friendly ceramic or NAO (non‑asbestos organic) brake pads is surging. Moreover, ceramic pads now account for roughly 42 % of the EU market, up from 28 % in 2020, largely due to their significantly reduced emissions relative to semi‑metallic alternatives.

This trend reflects a broader transformation: environmental compliance and sustainability are central factors shaping innovation in brake pad design. Manufacturers are investing heavily in material science and testing infrastructures to deliver high‑performance products that satisfy new emissions rules while maintaining durability, noise control, and regenerative‑braking compatibility, signaling a strategic pivot toward cleaner, greener braking systems.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rise of Stringent Environmental and Emission Regulations Drives Market Growth

Regulatory developments demand reduced brake wear particulate matter, a focus for the first time under the upcoming EURO 7 standard, expected to take effect around late 2026. This will enforce PM10 emission limits between 3 mg/km (electric vehicles) and up to 11 mg/km (for heavy vans), depending on vehicle class. China's impending China 7 regulation will similarly restrict brake emissions starting in 2026–2027. These rules drive suppliers to overhaul material science and production engineering to meet and anticipate these thresholds. In response, a leading supplier recently introduced Low Emission Brake technology, designed to comply with Euro 7 and China 7, combining renewable, recycled raw materials, and advanced disc coatings that lower manufacturing-related CO₂ emissions.

Brake manufacturers actively participating in international measurement standard groups have been accelerating the development of dust‑limiting friction formulations in concert with automakers to match stringent Euro 7 limits. Meanwhile, firms are pushing copper out of brake materials. For instance, a major state-level mandate in California reduces allowable copper content to 0.5 percent by weight as of 2025. Leading industry players are responding with zero-copper or ultra-low-copper pad lines that comply ahead of deadlines.

Multiple companies have unveiled next-generation friction materials. Some suppliers launched enhanced ceramic pads that cut brake dust by up to 35% compared to conventional metallic brake pads. Yet another integrated wear‑sensor-enabled smart pad is improving maintenance efficiency by over 20 % in luxury vehicle segments. These regulatory pressures foster fundamental market transformation: manufacturers prioritize investment into alternative eco‑materials, sensor integration, and cleaner production. They engage OEMs in collaborative development, re-engineering friction formulations, and aligning supply chains with compliance timetables. As a result, regulatory mandates are no longer peripheral; they now directly drive innovation, product development, and competitive differentiation in the global brake pad market.

Market Restraints

Increasing Complexity, Supply Chain Disruptions, and Raw Material Volatility Impedes Market Growth

Worldwide regulators are tightening certification standards for brake friction materials, demanding rigorous testing across environmental, performance, and durability parameters. In Europe, new rules require brake pads to contain less than 0.5% copper by weight by mid‑2025, a steep drop from previous thresholds. In 2023, 23% of aftermarket pads failed copper content tests, risking substantial penalties. Certification for low‑emission materials now requires real‑world durability testing, batch-level inspections, and recycled content validation. This has resulted in EU type‑approval timelines stretching from an average of eight months in 2019 to around fourteen months in 2024. This elongation translates into delayed product rollouts and elevated compliance spending.

In China, GB 5763‑2018 standards require brake pads to be tested for performance up to 350 °C and through real‑road mountain descent tests and shear strength thresholds. A 2023 audit found that 34% of local manufacturers failed critical benchmarks, leading to recalls that affected 12 million vehicles. Certification under these conditions can increase costs by 15–20% for foreign suppliers. In the U.S., EV-focused updates to FMVSS now mandate effectiveness after 10,000 regenerative braking cycles plus salt‑spray testing equivalent to 10 Michigan winters—these measures are responses to early corrosion and wear issues in EV models. Warranty claims tied to brake failures have risen by 41% since 2020, prompting regulators to harden performance requirements and forcing suppliers to adopt stainless‑steel shims and hydrophobic coatings.

These regulatory burdens force companies to allocate heavy resources to compliance. A 2024 industry survey found that 68% of brake material manufacturers dedicate over 15% of their R&D budgets solely to certification activities. Laser‑brazed pad designs and blockchain traceability systems are deployed to meet ISO thermal and material traceability requirements, adding further cost. Meanwhile, counterfeit and substandard aftermarket products remain pervasive, particularly in emerging markets, eroding brand trust and complicating enforcement.

Persistent challenge of fluctuating raw material prices and the escalating cost of key components are some of the factors hampering the product adoption. Brake pads rely on diverse materials, including friction materials (such as aramid fibers, steel fibers, and ceramic compounds), metals (such as copper, steel, and aluminum), resins, abrasives, graphite, and various fillers. The price volatility of these commodities, driven by factors such as global market fluctuations, supply chain disruptions, and geopolitical tensions, directly impacts the production costs for manufacturers.

For example, the cost of lithium, crucial for EV batteries, experienced a 300% surge in two years ending in February 2025, indirectly affecting the cost structure and production strategies within the broader automotive and component industries, including brake pads. This upward pressure on raw material costs compresses profit margins for brake pad manufacturers, potentially leading to higher prices for consumers, which could deter or delay necessary replacements, consequently hindering overall automotive brake pads market growth.

These escalating certification demands foster market consolidation as smaller players struggle to absorb certification costs. Such structural restraints curtail innovation, slow the introduction of eco‑friendly materials, and limit competitive diversity, particularly in rapidly evolving EV and ADAS segments that require rapid iteration.

Market Opportunities

Aftermarket Expansion Driven by Vehicle Parc Growth and Demand for Upgrades is a Transformative Market Opportunity

A significant opportunity for the global automotive brake pads market forecast lies in the continuous expansion of the automotive aftermarket. This growth is primarily fueled by the rising vehicle parc and increasing consumer demand for replacements and upgrades. As the number of vehicles on the road rises worldwide, particularly in developing economies, and the average age of vehicles in developed nations increases, the demand for brake pads replacements is experiencing sustained growth. In 2024, the total global vehicle parc was estimated at approximately 1.4 billion units.

This large and aging fleet translates into a consistent need for maintenance, including regular brake pad changes, creating a robust replacement market for manufacturers and aftermarket suppliers. In March 2023, Brakes India Private Limited, a prominent manufacturer, announced the launch of platinum brake pads tailored for luxury cars, signifying an expansion targeting specific aftermarket segments for high-end vehicles.

Beyond basic replacements, a growing trend toward customization and performance upgrades among vehicle owners also presents a significant opportunity within the aftermarket. Consumers are increasingly opting for higher-performance brake pads that offer enhanced stopping power, reduced brake fade, and improved durability, leading to a surge in demand for premium brake pad formulations, including ceramic and low-metallic options. This trend is particularly evident in developed markets such as North America and Europe, where there is a higher demand for premium brake pads that provide better lifespan and performance.

In February 2024, Webb unveiled a new Ultra Grip air disc brake pads line, including a severe-duty option for demanding applications, addressing the need for specialized performance in the aftermarket. Furthermore, advancements in brake pad technology, including the development of quieter and more efficient pads tailored for Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), are creating new segments within the aftermarket. For instance, in April 2023, ZF Aftermarket expanded its product portfolio, including TRW brake pads, for the Indian passenger car market, indicating an effort to cater to diverse and evolving demands. Developing specialized brake pads compatible with regenerative braking systems in EVs and requiring improved performance for ADAS integration further drives this opportunity. Manufacturers are strategically investing in research and development to cater to these evolving demands, ensuring the aftermarket remains a vital and growing segment for the market.

Segmentation Analysis

By Vehicle Type

Higher Volume and Increasing Demand for Personal Transportation Drives Passenger Cars Segment Growth

By vehicle type, the market is trifurcated into two wheelers, passenger cars, and commercial vehicles.

Passenger car segment is the dominant force in the global market with a share of 61.42% in 2026, holding a substantial automotive brake pads market share. This growth is fueled by the sheer volume of passenger vehicles worldwide, increasing demand for personal transportation, and stricter safety regulations necessitating high-performance braking systems. The average age of vehicles and the frequency of brake pad replacements in urban driving also contribute significantly to aftermarket demand. The integration of advanced features and the growth of EVs requiring specialized brake pads further solidifies its leading position.

Two-wheelers constitute a significant portion of the market, particularly in emerging economies where they serve as a primary mode of transport. The market is driven by high motorcycle and scooter adoption, increasing safety awareness, and advancements including the shift from drum to disc brakes. For example, Endurance Technologies Limited acquired Frenotecnica Srl in June 2022, broadening its reach in two-wheeler friction materials. The segment benefits from new vehicle sales and a robust aftermarket demand for replacements, further fueled by e-commerce penetration.

Commercial vehicle segment is experiencing significant growth in the brake pads market. This growth is primarily attributed to rapid industrialization, the booming e-commerce sector, and the expanding global demand for logistics and transportation services, which heavily rely on LCVs and HCVs. For instance, First Brands Group enhanced its Raybestos brake component line in February 2021, including greater coverage for commercial vehicles, indicating a focus on this growing market. The increasing need for reliable, durable brake pads in high-mileage fleets further fuels this segment's rapid expansion.

By Material Type

Semi‑Metallic Leads The Market Due To Their Wide Usage In Passenger And Commercial Applications

By material type, the market is classified into Non-Asbestos Organic (NAO), semi-metallic, ceramic, and carbon composite.

Semi‑metallic remains the dominant material segment with market share of 39.55% in 2026. These pads contain 30% to 60% metals, such as steel or copper blends, making them favored for their robust heat dissipation, exceptional durability, and proven performance under varied wet/dry operating conditions. They continue to be widely used in both passenger vehicles and commercial segments. While newer low‑particulate formulations challenge them, their reliability and established supply chains keep semi‑metallic as the market bedrock, especially in heavy loads and performance driving contexts.

Ceramic brake pads are gaining fastest growth prominence, particularly in the premium vehicle segment and Electric Vehicles (EVs). They are favored for their silent operation, minimal dust production, and superior stability across a range of temperatures. Brakes India Private Limited recently launched ZAP brake pads, specifically designed for EVs, boasting enhanced corrosion protection, low brake dust, and quiet performance, indicating this trend in the EV sector. While offering excellent performance and durability, their higher manufacturing cost has traditionally limited their adoption in the broader market.

Carbon composite brake pads occupy a niche in the market, primarily used in high-performance and racing applications due to their exceptional braking power and high-temperature resistance. Brembo unveiled the DYATOM carbon ceramic brake disc in March 2020. Additionally, Surface Transforms PLC partnered with Koenigsegg in June 2020 to supply carbon ceramic brake discs for their new hypercar, showcasing their role in luxury and demanding environments. While offering unparalleled performance and lighter weight, their significantly higher cost remains a major barrier to widespread adoption.

NAO segment is also expanding due to rising regulatory pressure to eliminate asbestos and reduce brake dust. Ultra‑quiet NAO pads optimized for EVs offer 30–40 percent less particulate emissions, and manufacturers report adoption in over 19% of EV aftermarket installations across major markets. Their advantages, quiet braking, low dust, eco‑credentials, and cost‑effectiveness, make them popular in urban commuters and light vehicle platforms, especially where particulate standards such as Euro 7 and California’s copper limits drive material innovation.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Retail Channel Segment Grows at Fastest Rate Due to Consistent Replacements

By distribution channel, the market is bifurcated into retail and authorized service centers.

The retail channel is the fastest‑growing segment with a market share of 64.74% in 2026. This growth is propelled by expanding vehicle fleets, aging cars requiring replacements, and consumer preference for premium ceramic or eco‑friendly upgrades. Online platforms and independent parts stores are accelerating the trend, especially as city dwellers seek quieter, low-dust options post-purchase. Retail also sells innovative products such as smart wear‑sensor ceramic pads marketed directly to consumers.

Authorized service centers remain the dominant distribution channel, accounting for over 60 percent of installations via OEM-backed maintenance and scheduled service networks. Customers rely on factory-approved pads for quality assurance, compliance with emissions standards, and coverage of warranty requirements. Though growth is steadier than retail, service centers increasingly feature upgraded eco‑ or ceramic pads aligned with automaker mandates—and remain a core channel tied to new vehicle sales.

Authorized service centers have consistent growth, accounting for over 60% of installations via OEM-backed maintenance and scheduled service networks. Customers rely on factory-approved pads for quality assurance, compliance with emissions standards, and coverage of warranty requirements. Though growth is steadier than retail, service centers increasingly feature upgraded eco‑ or ceramic pads aligned with automaker mandates—and remain a core channel tied to new vehicle sales.

AUTOMOTIVE BRAKE PADS MARKET REGIONAL OUTLOOK

Regionally, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Automotive Brake Pads Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region stands as the dominant region in the global market. Asia Pacific dominated the market with a valuation of USD 1.97 billion in 2025 and USD 2.06 billion in 2026. Soaring vehicle production, rapid urbanization, rising disposable incomes, and a booming aftermarket segment primarily fuel this growth. The region's major markets, including China, India, and Japan, drive demand with their burgeoning automotive sectors and growing consumer awareness about vehicle safety. China alone accounts for the maximum regional sales, propelled by massive OEM output and increasing vehicle ownership. In March 2023, Brakes India Private Limited launched ZAP brake pads for electric vehicles, highlighting the region's focus on innovative solutions for the growing EV market. Government initiatives promoting road safety and EV adoption are further accelerating market expansion in the region. The Japan market is projected to reach USD 0.20 billion by 2026, the China market is projected to reach USD 0.85 billion by 2026, and the India market is projected to reach USD 0.52 billion by 2026.

Europe

Europe represents the fastest-growing market for automotive brake pads, characterized by stringent vehicle safety norms and a robust automotive industry. The region is witnessing a rapid adoption of electric vehicles, driving demand for vehicles which require specialized braking with lower dust formation and longer lifecycles. European OEMs are heavily investing in research and development to integrate sustainability and high performance into their braking systems. For example, in June 2024, Valeo launched an extensive range of brake pads designed for electric and hybrid vehicles, covering 92% of EV/PHEV models in Europe. Countries such as Germany, France, and the U.K. are at the forefront of these innovations, contributing to the consistent growth of the automotive brake pads market. The UK market is projected to reach USD 0.11 billion by 2026, and the Germany market is projected to reach USD 0.21 billion by 2026.

North America

North America holds a significant share in the global market, fueled by factors such as high vehicle ownership per capita and stringent safety regulations. The region exhibits a strong preference for premium brake pads, offering extended lifespan and enhanced performance. The increasing adoption of Electric Vehicles (EVs) and hybrid vehicles is driving innovation in brake pad technology to meet the demands of regenerative braking systems. For instance, Bosch launched enhanced ceramic brake pads for hybrid and electric vehicles in 2023, reducing brake dust emission by up to 35% compared to traditional metallic pads. This focus on sustainable and efficient braking solutions contributes to the region's overall market stability and growth. The U.S. market is projected to reach USD 0.74 billion by 2026.

Ongoing innovation, stricter environmental standards, and evolving OEM strategies shape the U.S. automotive brake pads market. Manufacturers like FDP Virginia have introduced new premium products that comply with copper and material restrictions, ensuring regulatory compliance and improved sustainability. Brembo launched an aftermarket product line for heavy-duty vehicles, reflecting the need for robust solutions across vehicle categories. Gold Phoenix recently signed an OEM contract with Daimler, underlining the importance of global alliances. Investments by industry leaders like KB Autosys in U.S. manufacturing underscore a focus on domestic capacity and advanced materials. These developments are supported by a strong aftermarket segment, high vehicle usage rates, and consumer demand for both performance and eco-friendly brake pads.

Rest of the World

The rest of the world region, encompassing Latin America, the Middle East & Africa, is experiencing significant growth in the market. This growth is driven by expanding automotive industries, increasing vehicle penetration, and improved infrastructure development in these emerging economies.

COMPETITIVE LANDSCAPE

Key Industry Players

Pioneering Innovation, Premium Quality Products with Multiple OEM Tie-ups Make Brembo S.P.A. a Leading Player.

Brembo S.p.A., an Italian multinational renowned for its advanced braking systems, is a major contributor to the global market share. Brembo’s leadership stems from its pioneering innovation, premium quality products, and deep integration with high-performance and luxury vehicle manufacturers worldwide. Their strong focus on R&D allows them to deliver cutting-edge materials such as carbon-ceramic composites and high-performance semi-metallic pads, which excel in thermal stability, braking precision, and durability.

Brembo’s product portfolio includes brake pads tailored for passenger cars, motorcycles, commercial vehicles, and motorsports, with specialized solutions such as low-dust ceramic pads, carbon-carbon composite pads for racing, and eco-friendly materials compliant with strict emission standards. Their global manufacturing footprint and robust OEM partnerships across Europe, Asia, and North America further reinforce their market dominance.

Federal-Mogul (now part of Tenneco Inc.), a global powerhouse with a broad product portfolio and extensive aftermarket reach. Federal-Mogul’s rise is driven by its diversified offering, extensive distribution network, and continuous innovation in friction materials—especially semi-metallic and NAO brake pads tailored for a wide spectrum of vehicles from economy to premium segments. Their product range encompasses conventional semi metallic pads, ceramic pads optimized for low noise and emissions, and advanced composite materials designed for electric vehicles and commercial trucks. Federal-Mogul’s ability to serve both OEMs and the aftermarket with reliable, performance-driven products, combined with aggressive expansion into emerging markets, secures its strong market presence globally.

LIST OF KEY AUTOMOTIVE BRAKE PADS COMPANIES PROFILED

- Brembo S.p.A. (Italy)

- Akebono Brake Industry Co., Ltd. (Japan)

- ADVICS Co., Ltd (Japan)

- Showa Corporation (Japan)

- TRW Automotive (U.S.)

- Continental AG (Germany)

- Bosch Automotive (Germany)

- Federal-Mogul Motorparts (U.S.)

- Zhejiang Guihang Automotive Components Co., Ltd. (China)

- Mando Corporation (South Korea)

- Delphi Technologies (U.S.)

- Valeo SA (France)

- Nisshinbo Holdings Inc. (Japan)

- Tenneco Inc. (U.S.)

- FMSI (Federated Motorcar Service Inc.) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, Bremskerl CV launched "Loaded" Air Disc Brake Calipers for fleets, simplifying maintenance with pre-installed pads, reducing downtime, offering custom options, and promoting cost savings while enhancing vehicle performance and safety.

- In May 2025, Friction One Brake Technology Co., Ltd. acquired the DRiV Juarez II brake pad manufacturing facility in Ciudad Juarez, Mexico. This move expands Friction One’s manufacturing capabilities and enhances its ability to serve customers in North America with friction products.

- In April 2025, Tenneco introduced Emission Brake Technology for light and commercial vehicles. innovative friction formulations, brake disc coatings helping vehicle OEMS and tier one suppliers meet euro 7 and china 7 emissions standards.

- In February 2025, ASIMCO officially launched its new fully automated OE brake pad manufacturing facility, showcasing its commitment to precision engineering, automation, and stringent quality control. This state-of-the-art plant is designed to produce high-performance brake pads that meet the demanding standards of today’s automotive industry.

- In September 2024, Tenneco introduced a next-generation, environmentally friendly organic disc brake pad that meets the complex requirements of modern regional trains. The Jurid 870 brake pad, featuring “Green Pad” technology, offers both the exceptional temperature resistance and mechanical strength needed for use in applications previously requiring sintered friction materials.

REPORT COVERAGE

The global automotive brake pads market report provides detailed analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology. Besides this, the report offers insights into the latest market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market’s growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

By Vehicle Type

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market will reach USD 6.67 billion in the brake pad market by 2034.

The market is expected to grow at a CAGR of 5.7% during the forecast period.

Increasing consumer and regulatory demand for sustainability and eco‑design

Asia Pacific led the market in 2025.

Asia Pacific market size share was USD 1.97 billion in 2025.

Bosch, Valeo, and Denso are a few of the major players operating in the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us