Airport Services Market Size, Share & Industry Analysis, By Airport Type (International and Domestic), By Application (Aeronautical Services and Non-Aeronautical Services), By Infrastructure Type (Greenfield Airport and Brownfield Airport), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

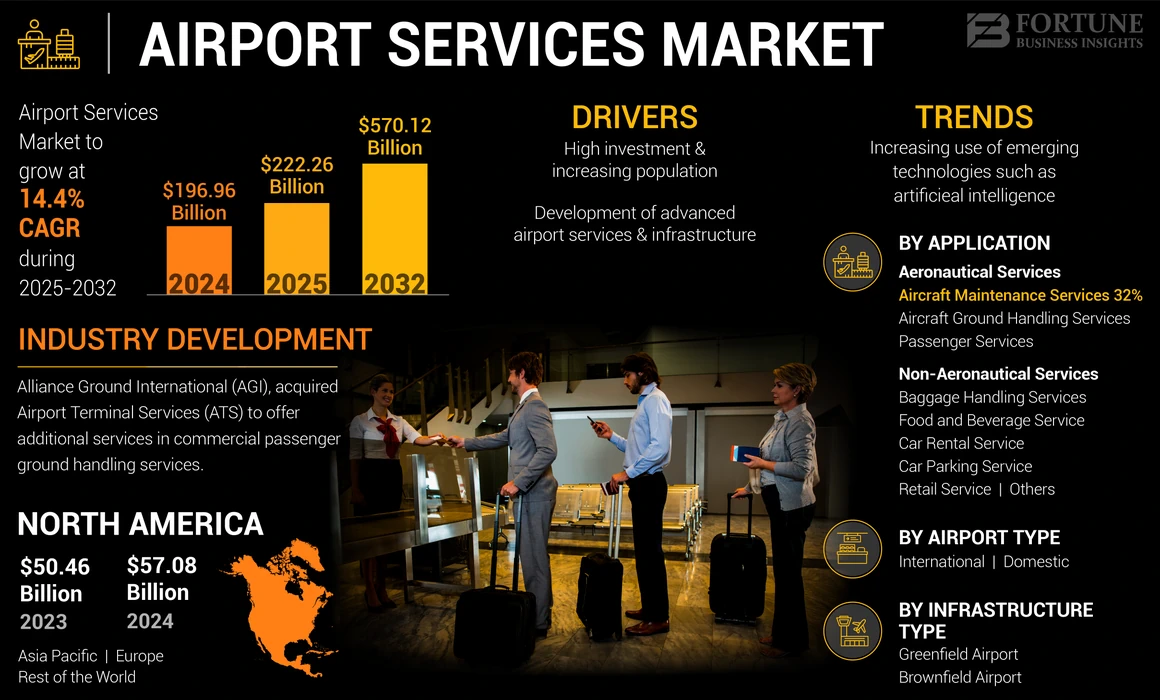

The global airport services market size was valued at USD 196.96 billion in 2024. The market is projected to grow from USD 222.26 billion in 2025 to USD 570.12 billion by 2032, exhibiting a CAGR of 14.4% during the forecast period. North America dominated the airport services market with a market share of 28.98% in 2024. Moreover, the airport services market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 130.37 billion by 2032, driven by increase in air & passenger traffic and cargo transportation to drive market size & growth.

Growth in the aviation industry has had a major effect on the market. These business opportunities include floor management (cargo and cargo/ delivery, flight control, and others) and passenger handling (customer service functions). Increased infrastructure development, passenger traffic, and congestion in developing countries are expected to witness significant airport services market growth. A significant rise in the refurbishment of existing airport infrastructure and the number of airports is also anticipated to lead to further development of the market.

The airport usually facilitates repair facilities and paved runways and provides a passenger and cargo depot. Service providers are presently seeking higher and long-term business and trade associates to benefit for a long time such as the modernization of airport infrastructure. Furthermore, countries worldwide are investing to make their airport infrastructure user-friendly and advanced. For instance, in October 2023, AAI (Airports Authority of India) awarded a contract of USD 18.1 million for the terminal expansion of Prayagraj Airport. Airport services experienced a drastic decline in demand as soon as lockdowns were imposed following the spread of the COVID-19 pandemic. One million jobs were lost, with industrial aviation losses reaching USD 126 billion. Furthermore, air connections decreased by over 50% in 2020, with passenger footfall reducing by more than 1.7 billion. There was also a decline of 60.2% in flights than in 2019.

GLOBAL AIRPORT SERVICES MARKET OVERVIEW

Market Size & Forecast

- 2024 Market Size: USD 196.96 billion

- 2025 Market Size: USD 222.26 billion

- 2032 Forecast Market Size: USD 570.12 billion

- CAGR: 14.4% from 2025–2032

Market Share

- North America dominated the airport services market with a 28.98% share in 2024, valued at USD 57.08 billion, driven by major players such as S.A.S. Services Group, Inc. and Air General Inc.

- By airport type, the domestic segment is expected to lead the market due to increasing domestic passenger traffic, especially in countries like India and China.

Key Country Highlights

- United States: The U.S. airport services market is projected to reach USD 130.37 billion by 2032, fueled by rising passenger traffic, cargo transportation, and long-term modernization contracts.

- India: Rapid growth in domestic aviation, low-cost carriers, and infrastructure investments position India as the world’s third-largest aviation market.

- China: Expected to surpass the U.S. in air passenger traffic by 2024, China is investing heavily in airport development and modernization.

- Germany, France, U.K.: Europe’s airport market is supported by strong service providers such as Fraport AG, LHR Airports Ltd., and Worldwide Flight Services.

- Japan: Tokyo Haneda International Airport reopened its Terminal 2 after a three-year pandemic closure, signaling renewed growth in passenger services.

Airport Services Market Trends

Development of Smart Airports Creates Growth Opportunities for Market

Due to the rapid progress of urbanization, increase in disposable income, and rapid expansion of the aviation industry in recent years, passenger transportation has increased significantly, especially in the Asia Pacific region. As the development of smart airports progresses, the passenger experience at the airport will improve. The efficiency of these airports will also improve by providing automated service delivery, mobile-ready operations, real-time operational planning, shared services, and more. For instance,

- In June 2023, Amandeus IT Group, a Spanish multinational technology company, entered a strategic partnership with Pristina International Airport. The airport is expected to introduce Amadeus’ Airport Management Suite (AMS) for information management and flight schedules a year in advance. It will provide all airport stakeholders with a long-range operational view to increase efficiency.

Download Free sample to learn more about this report.

Airport Services Market Growth Factors

Increase in Air & Passenger Traffic and Cargo Transportation to Drive Market Growth

An increase in the overall air traffic and cargo transportation has contributed to the growth of the airport services market. Adoption of advanced ground support equipment and electronic components by airports will drive the global market growth. According to the International Air Transport Association (IATA), 52.2 million metric tons of cargo was transported in 2015 and recorded a CAGR of 4.1% till 2021. IATA’s 20-year air passenger forecast shows that the number of air travelers could double to 8.2 billion by the end of 2037. This factor is expected to drive the growth of the market.

Asia Pacific will show significant growth with 2.35 billion additional passengers from 2017 to 2037. Thus, there will be a total of 3.9 billion air travelers from Asia Pacific in 2037. North America will grow by 2.4% annually and will carry 1.4 billion passengers by 2037.

Latin American air travelers will reach to a total of 731 million, an additional 371 million passengers annually with a CAGR of 3.6%. The total market size of the Middle East & Africa will be 501 million passengers till 2037. The region is expected to add an extra 290 million passengers with a CAGR of 4.4%. By 2037, Africa will witness an addition of 199 million passengers to reach a total market of 334 million passengers.

Additionally, a growth in the number of aircraft deliveries worldwide is anticipated to fuel the market’s growth. Therefore, as the forecast by IATA suggests, the market is expected to gain traction due to increased post-pandemic passenger traffic, cargo transportation, and aircraft deliveries worldwide.

Development of Advanced Airport Services and Infrastructure to Bolster Growth

There is a rising need to develop airport infrastructure in smaller cities. Hence, airports are under constant progression to accentuate their infrastructure and improve customer experience. New construction projects around the world are developing exponentially. According to a study from Business Wire, the number of projects in the implementation phase reached USD 377.6 billion, while the ones in the planning phase cost USD 215.8 billion. An instance of the same could be, in December 2021, Heathrow – Europe’s busiest airport in the U.K., announced that it aims to have a third runway ready by 2026. The airport is predicted to introduce a new pilot component tracking system to enable attaining this goal on schedule. Siemens Digital Logistics will develop the technology. The system will track millions of vital construction components destined for the new runway site in real-time.

Additionally, growing demand for amenities for longer routes, more modern air traffic control, and more gates is expected to accentuate market growth.

RESTRAINING FACTORS

Lack of Appropriate Infrastructure and Strict Government Restrictions to Limit Market Growth

Despite the booming aerospace industry and refurbishment of old airports, some regions in the world are still struggling with the lack of appropriate infrastructure to support highly equipped aircraft and support appropriate services. The government or the civil aviation ministry plays a major role in airport-related services and infrastructure. There are various relief and support initiatives for airport service providers. However, in some scenarios, strict rules and regulations by the government and airport authorities hinder airports and aviation-related growth. Airports worldwide have different and targeted governance systems. Thus, the industry's current crisis requires more cooperation to help the aviation industry recover.

Airport Services Market Segmentation Analysis

By Airport Type Analysis

Rise in Domestic Passenger Traffic to Boost the Domestic Segment

The market is classified into international and domestic based on airport type.The international segment is anticipated to be the fastest-growing after travel restrictions worldwide are lifted post-pandemic. Increased travel spending by middle-class customers in developing countries is a primary factor in the growth of domestic passengers. Domestic airline demand is growing due to increased development in business, tourism, and other sectors.

The domestic segment is predicted to lead the market in the forecast period due to the growth in domestic passenger traffic amid the pandemic. The increase in the population of domestic passengers in developing countries, such as China and India, is anticipated to enhance the growth of the market. Since India has the 3rd largest domestic market globally, increased spending on domestic airports and passenger traffic is expected to propel the segment's growth.

By Application Analysis

Growing Demand for Aircraft Maintenance Services Driven by Increased Active Aircraft Fleet Size to propel market growth

According to application, the market is segmented into aeronautical services and non-aeronautical services.

The aeronautical services segment accounted for the higher market share owing to the growing demand for advanced aeronautical services in the market. The segment is further classified into aircraft ground handling services, aircraft maintenance services, and passenger services.

Aircraft maintenance services mainly include fleet maintenance required to ensure the airworthiness of a part or the whole aircraft, including inspections, repairs periodically, which drives the growth of the market, supported by the rise in the active fleet size of aircraft by many operators.

Aircraft ground handling services comprise parking service, ramp service, lavatory cleaning and replenishment, and others. Passenger services include transit service, security service, and others.

Passenger services comprise services rendered to the passenger such as catering, buggies, strollage, help desks, and check-in services.

Non-aeronautical services include car rental, parking, food, beverage, retail, and baggage handling services. The non-aeronautical services segment is predicted to be the fastest-growing segment in the market. Non-aeronautical revenue gives additional aid to the airport service provider during a pandemic or economic depression.

To know how our report can help streamline your business, Speak to Analyst

By Infrastructure Type Analysis

Greenfield Airport is Predicted to Experience Substantial Growth Owing to New Investments from Emerging Markets

Based on infrastructure type, the market is bifurcated into Greenfield airport and brownfield airport.

With the sudden rise in air passenger traffic & travelers and increased airline fleet, airport operators are spending more and undergoing immense pressure concerning passenger handling. Greenfield airport is an expression used to refer to a new airport in a new location, built from the ground. Rise in the investments in the development of new airport projects around the world expected to witness significant market growth and is anticipated to hold the highest CAGR during the projection period. Moreover, due to the rising demand for internationally benchmarked airports, the brownfield airport segment is expected to rise during the forecast period due to development and modernization of airports.

REGIONAL INSIGHTS

By geography, the market is divided into North America, Europe, Asia Pacific, and the Rest of the World.

North America Airport Services Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2024 and was valued at USD 57.08 billion.The growth is attributed to major market players such as S.A.S. Services Group, Inc. and Air General Inc. The region held the largest passenger traffic in the base year after the pandemic hit. Thus, the region accounted for a significantly large market share and is predicted to grow at an increasing rate over the forecast period.

The Europe airport services market share is anticipated to witness substantial growth due to the growing airport infrastructure in the U.K., France, and Germany. Moreover, Germany is a primary hub for airport service providers, including Frankfurt Airport Services Worldwide, Fraport AG, LHR Airport, and Worldwide Flight Services. These are some major service providers in the region.

Asia Pacific is expected to be the biggest emerging global region due to a recent surge in air passenger traffic. Air passenger traffic and growing low-cost carriers in India and China encourage the modernization and development of airport infrastructure and the expansion of new airport numbers in the region. According to the International Air Transport Association, China’s air passenger traffic will exceed the U.S. in 2024. Furthermore, India is anticipated to be the third-largest aviation market due to a rise in aircraft fleets and the increased trend of low-cost carriers during the forecast period.

The rest of the world is also predicted to witness high growth in the market due to modernization and advancements in the airports and an increase in the frequency of foreign tourists. Moreover, growing investment by the governments in advancing the public infrastructure to enhance tourism is predicted to drive market growth.

KEY INDUSTRY PLAYERS

Growing Acquisition Route Expansion and Modernization Strategies to Lead to Market Growth

LHR Airports Ltd. and Fraport AG Frankfurt Airport Services Worldwide are some of the largest airports in the world. These airport authorities provide various services at their airports. Airport service providers have used space expansion and collaboration strategies to compete in the market. Frankfurt International Airport has the most direct routes worldwide, serving over 300 destinations on five continents. Additionally, airports welcome new strategic alliances and partnerships and enter into long-term contracts with airlines to build long-term relationships with aircraft system OEMs, airlines, and Maintenance, Reports and Overhauls (MROs) to continue in the market.

List of Top Airport Services Companies:

- Beijing Capital International Airport Co. Ltd. (China)

- Fraport AG Frankfurt Airport Services Worldwide (Germany)

- Air General Inc. (U.S.)

- dnata (UAE)

- Worldwide Flight Services (France)

- S.A.S. Services Group, Inc. (U.S.)

- LHR Airports Limited (U.K.)

- Acciona (Spain)

- Signature Aviation plc (U.K.)

- Tokyo International Air Terminal Corporation (Japan)

- Çelebi Aviation (Turkey)

- Airports de Paris SA (France)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – Houston-based Hobby Airport unveiled the opening of 10 new restaurants in the airport. The opening is expected to bring forth around USD 74 million worth of revenue and at least 300 jobs.

- September 2023 – Lufthansa Airways unveiled the launch of new services for Minnesota by June 2024. With the launch, Lufthansa became the 18th airline opening at the Minneapolis-St. Paul International Airport (MSP), with the airlines headquartered in Germany.

- July 2023 – Tokyo Haneda International Airport reopened Terminal 2, which had been closed for more than three years during the pandemic. In a highly anticipated move, Japan Airport Terminal Co., Ltd. and Tokyo International Airport Corporation reopened the Terminal 2 (International Common Use Area) facilities from July 19, 2023.

- August 2023 – The U.S. donated a cutting-edge aviation security equipment to Guarulhos Airport. The donation was done as part of a partnership between the U.S. Transportation Security Administration (TSA) and Guarulhos Airport to deliver airport security equipment.

- May 2023 – Scotland's regional airline Loganair celebrated the launch of new flights to London. Dundee welcomed a new route with the launch of its first flight to the London Heathrow (LHR) airport in 40 years.

- October 2023 – Kuehne+Nagel, a world leader in transport and logistics, inaugurated its new center, located in the heart of Cargo City at the Paris Charles-de-Gaulle airport. The opening of the new aviation hub demonstrated Kuehne+Nagel's desire to increase its presence in France at one of the most important airports in Europe for air transport, with ambitions to double its output by 2026.

- November 2023 – Dnata announced that it had been awarded a multi-year contract by Juneyao Air at Milan Malpensa (MXP) Airport. Under the agreement, the company would provide a wide range of passenger, ramp, and baggage handling services.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on key aspects such as service types, major players in the market, and different applications of these services. Moreover, the report offers insights into market trends, competitive landscape, market competition, product pricing, market status, and key industry developments. In addition to the factors mentioned above, the report encompasses several direct and indirect factors that have contributed to the global market sizing in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.4% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Airport Type

|

|

By Application

|

|

|

By Infrastructure Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights states that the global market size was valued at USD 196.96 billion in 2024 and is projected to reach USD 570.12 billion by 2032.

Registering a CAGR of 14.4%, the market is predicted to grow rapidly during the forecast period of 2025-2032.

The Greenfield Airport Infrastructure segment will lead this market from 2025-2032.

Fraport AG Frankfurt Airport Services is the leading player in the market.

North America dominated the market in terms of share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us