Canada Geotechnical Services Market Size, Share & COVID-19 Impact Analysis, By Type (Underground City Space, Slope and Excavation, and Ground and Foundation), By End-User (Municipal, Bridge and Tunnel, Oil & Gas, Mining, Marine, Building Construction, and Others), and Forecast, 2025-2032

Canada Geotechnical Services Market Size

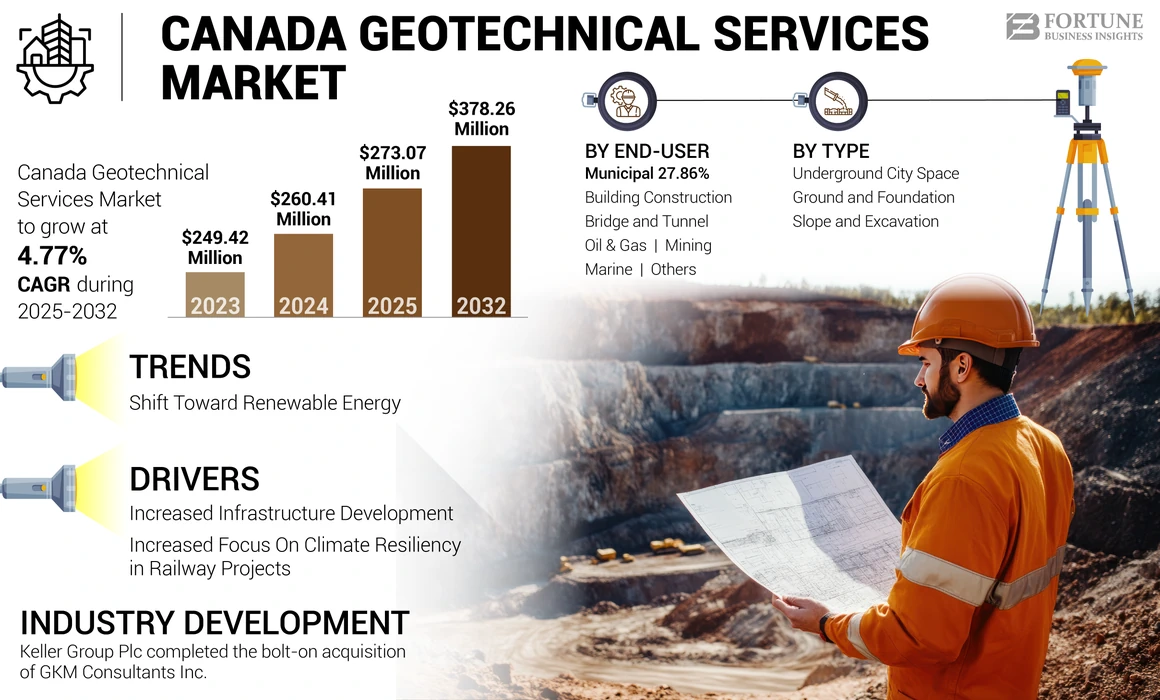

The Canada geotechnical services market size was worth USD 260.41 million in 2024. The market is projected to grow from USD 273.07 million in 2025 to USD 378.26 million by 2032, exhibiting a CAGR of 4.77% during the forecast period.

Geotechnical services involve studying the behaviour of soil, rock, and groundwater to understand their impact on construction, infrastructure, and environmental projects. These services provide valuable information for designing safe and stable structures, including buildings, bridges, and dams and assessing the potential risks such as landslides or soil erosion. Moreover, geotechnical engineers analyze subsurface conditions, conduct soil testing, and provide recommendations to ensure the success and safety of various projects.

COVID-19 IMPACT

Disruptions in End-User’s Activities Had a Negative Impact on the Market Growth

The impact of the COVID-19 pandemic on the Canadian market was negative. Many construction activities were delayed or cancelled due to lockdowns, supply chain disruptions, and economic uncertainty. This directly affected the demand for geotechnical services, as fewer new projects were initiated. Moreover, geotechnical investigations often require site visits and fieldwork. COVID-19 restrictions and safety concerns led to limitations on travel and field activities, slowing down data collection and analysis. Many businesses, including those in the construction and infrastructure sectors, faced financial challenges during the pandemic. In addition, clients' budget constraints affected their ability to invest in geotechnical studies and services. Furthermore, the mining sector also witnessed fewer mineral exploration investments in 2020. This was attributed to the slowdown of overall manufacturing activities, resulting in uncertainty in demand for minerals, consequently hampering the market growth.

For instance, according to Canada's (Department of the Government of Canada, accountable for minerals and metals, energy, earth sciences, mapping, and others) Natural Resources Minerals and Mining Publications, mineral spending is expected to decline in most territories and provinces in 2023. The largest declines are anticipated for Nunavut (-28%) and British Columbia (-33%), owing to a few large projects transitioning from deposit appraisal and exploration to construction.

Canada Geotechnical Services Market Trends

Shift Toward Renewable Energy is one of the Key Trends in the Market

The shift toward renewable energy is one of the key trends in the Canada geotechnical services market share. These services are essential for assessing the suitability of sites for renewable energy projects, such as wind farms, solar installations, and hydropower plants. Detailed geotechnical studies help identify soil stability, foundation design, and terrain suitability. So, a shift toward renewable energy is expected to propel the market growth.

For instance, in August 2023, Vestas secured an order for a 148 MW Canadian wind project. The order includes supply, delivery, and commissioning of the turbines, as well as a 10-year service agreement to ensure the optimized performance of the asset.

Download Free sample to learn more about this report.

Canada Geotechnical Services Market Growth Factors

Increased Infrastructure Development to Drive the Market Growth

Geotechnical services play a critical role in infrastructure development by providing essential information about the ground conditions at construction sites. As countries invest in upgrading and expanding their infrastructure, including roads, bridges, tunnels, airports, and public transportation systems, the demand for geotechnical services rises. These services help ensure the stability and durability of structures, preventing issues such as foundation failures or structural collapse. Before any construction project begins, geotechnical engineers assess the suitability of the land for the intended infrastructure. Due to the increase in infrastructure, the land investigation services and other services keep increasing.

For instance, a federal investment of USD 21.1 million will allow the Pays de la Sagouine, one of New Brunswick's premier tourist and cultural attractions, to transform the visitor experience through the construction of new buildings, a new pedestrian bridge, a multi-use trail and a boardwalk with a viewpoint to be improved and a terrace with kiosks.

Increased Focus On Climate Resiliency in Railway Projects to Bolster the Market Growth

An increased focus on climate resiliency in railway projects is one of the factors driving Canada geotechnical services market growth. Climate change leads to increased extreme weather events, such as heavy rainfall, flooding, and landslides. Geotechnical services play a crucial role in assessing the suitability of railway construction sites in vulnerable areas and designing infrastructure that can withstand these challenges.

For instance, the Great Sandhills Rail, Southern Saskatchewan Climate Resiliency Project, Saskatchewan will receive USD 221,292 to conduct geotechnical surveys and excavations and to install cutting-edge geotextile technologies to stabilize and enhance roadbed drainage along sections of track highly exposed to the impact of climate change, as per Transport Canada.

RESTRAINING FACTORS

High Cost of Offshore Geotechnical Services May Hinder the Market Growth

The high cost of geotechnical services is hampering the growth of this market. The solution has multiple services, such as geotechnical design, offshore site investigations, foundation design and installation analysis, cable route analysis and planning, and others and each has its initial cost, and involve complex activities, procedures, and surveys that have high cost per location. Due to the complex tools and technique procedures, the cost of offshore equipment and machinery is high. In addition, the cost of advanced technology used in geotechnical monitoring and instrumentation solutions is a major market restraint.

Moreover, the budget and cost of services may vary depending on the offshore location and the complexity of the tools, which also negatively impacts the market growth.

Canada Geotechnical Services Market Segmentation Landscape

By Type Analysis

Underground City Space Segment Holds the Largest Share due to Environmental Aspects and Urbanization in Canada

Based on type, the market is segmented into underground city space, slope and excavation, and ground and foundation.

The underground city space segment has the dominating market share. Due to urban management environmental aspects, industry trends are growing. The underground city space segment within this market pertains to the planning, designing, and developing subterranean spaces within urban environments. This could include underground facilities such as tunnels, basements, parking structures, utility tunnels, and underground urban areas. The demand for underground spaces arises from the need to accommodate urban population growth, optimize land usage, and address challenges such as congestion and limited surface area.

Ground and foundation types are also one of the major segments in the market. Geotechnical engineers often evaluate ground and foundation types to decide the most appropriate solutions for construction projects. The geotechnical services demand associated with ground and foundation types is expected to grow as infrastructure development and urban expansion persist.

By End-User Analysis

Municipal Segment Dominates Due to Huge Investment in Municipalities

In terms of end-user, the market is segmented into municipal, bridge and tunnel, oil & gas, mining, marine, building construction, and others.

The municipal segment is dominating the market. The Budget 2022 invested USD 259.5 million in municipalities, comprising more than USD 141 million via special assistance, municipal operations, Canada community building, and community enhancement employment aid. In addition, USD 10 million was for projects under the municipal capital works program, and more than USD 73 million was for community infrastructure projects under the Investing in Canada infrastructure program.

The bridge and tunnel is also one of the major segments in the market. For instance, in January 2022, the Ontario government and its major delivery partners, Metrolinx and Infrastructure Ontario, gave a contract worth USD 729.2 million to West End Connectors.

The mining segment is market share is expected to decline during the forecast period. This is attributed to declining mineral exploration spending. According to Canada's (Department of the Government of Canada, accountable for minerals and metals, energy, earth sciences, mapping, and others) Natural Resources Minerals and Mining Publications, Mineral spending is expected to decline in most territories and provinces in 2023.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Keller Group plc is a Major Player as it offers Solutions to a Broad Range of Geotechnical Challenges Across the Entire Construction Spectrum

Keller Group Plc is one of the leaders in geotechnical engineering services that provides technical and advanced solutions and ground behaviour services to the construction industry.

- In May 2022, Keller Group Plc completed the bolt-on acquisition of GKM Consultants Inc., a small geo-structural measurements and monitoring business based in Quebec, Canada, for USD 6.2 million. GKM is integrating into its speciality services business and will help accelerate its growth in this specialist segment.

Its services are widely used in ground activities, including foundation support, ground retention, ground controls, environmental protection, and others, and deliver effective and efficient quality.

List of Top Canada Geotechnical Services Companies:

- Keller Group plc (U.K.)

- Fugro (Netherlands)

- WSP (Canada)

- AECOM (U.S.)

- Stantec (Canada)

- Tetra Tech (U.S.)

- SGS (Canada)

- Canadian Geo (Canada)

- Terrapex (Canada)

- Canada Engineering Services Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- November 2022- Marine Renewables Canada and Canada’s Ocean Supercluster formed a partnership to share knowledge and support marine renewable energy development in Canada. In their collaboration, both companies will work toward innovation, increasing awareness and investment, and developing and using marine renewables in Canada.

- May 2022 –Keller Group Plc completed the bolt-on acquisition of GKM Consultants Inc., a small geo-structural measurements and monitoring business based in Quebec, Canada, for USD 6.2 million. GKM is integrating into its speciality services business and will help accelerate its growth in this specialist segment.

- July 2021- Keller Group Plc announced that it has acquired RECON Services, a geotechnical and industrial services company headquartered in Texas, U.S. The acquisition of RECON by Keller Group is worth USD 23 million and the expected earn-out is USD 15 million.

- April 2021- Fugro was awarded a deepwater site survey contract for Equinor in eastern Canada. Equinor had selected Fugro to conduct a deep-sea site survey in Canada's Flemish Pass, 500km from St. John's, Newfoundland, and Labrador, in water depths of approximately 1200m. Fugro's field campaign ran from July to August, including a seabed, environmental, and soil survey.

- October 2020- WSP extended the business of Canadian tunnels with world-class experts. This expansion helped WSP grow the practice for tunnels and deliver timely solutions with innovative and cost-effective factors. The company also announced that it will deliver best-in-class projects with innovation, timely, and cost-effective solutions. It focuses on local needs and ground conditions and works extensively with leading-edge technology, including BIM, VDC, and ground/structure interactions.

REPORT COVERAGE

The report provides a detailed market analysis. It provides essential information on key products, leading segment information, key market developments, and leading product applications. Along with this information, it provides insights into the market trends. The above factor will reflect the market growth in the coming year.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.77% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type and By End-User |

|

Segmentation |

By Type

By End-User

|

Frequently Asked Questions

Fortune Business Insights says that the Canadian market for geotechnical services was worth USD 260.41 million in 2024.

The market is expected to exhibit a CAGR of 4.77% during the forecast period (2025-2032).

By type, the underground city space segment holds the largest share.

Keller Group plc, Fugro, AECOM, and WSP are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us