Geochemical Services Market Size, Share & Industry Analysis, By Type (Laboratory Based and Infield Based), By Service Type (Sample Preparation, Mixed Acid Digest, Hydrogeochemistry, Fire Assay, X-ray Fluorescence, Aqua Regia Digest, and Others), By End-User (Mineral and Mining, Oil and Gas, Archaeological Survey, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

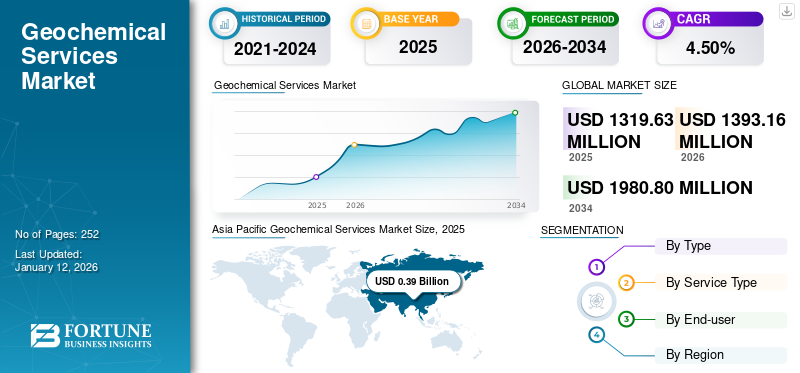

The global geochemical services market size was valued at USD 1.32 billion in 2025. It is projected to be worth USD 1.34 billion in 2026 and reach USD 1.98 billion by 2032, exhibiting a CAGR of 4.5% during the forecast period. The Asia Pacific dominated the geochemical services market with a share of 29.95% in 2025.

Geochemical services involve the study and analysis of the origin, evolution, and distribution of chemical elements in deposits and minerals. These services encompass a diverse set of tests to analyze the geographical characteristics of a given location, including the evaluation of soil, water, and rock samples. These services are used by industries such as mining, oil and gas, and environmental monitoring to identify contaminants, evaluate resource quality, and support exploration activities.

The market share is rising, especially in the mining industry, as companies aim to locate and measure mineral resources more effectively. These services offer essential information that improves exploration techniques and operational choices in resource extraction.

SGS SA is a global leader in geochemical services, offering a wide range of analytical solutions for mining, oil & gas, and environmental industries. With an extensive network of laboratories worldwide, the company provides geochemical analysis for elements such as base metals, rare-earth elements, and bulk commodities.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand from the Mining Sector to Drive Growth in the Market

The mining sector is witnessing an increase in the need for different minerals and metals, which requires accurate geochemical evaluations to effectively locate and obtain these resources. The expansion of mining operations and the requirement for precise mineral and resource evaluations are propelling the need for geochemical services. This trend applies to both new mining initiatives and the expansion of existing ones. Moreover, improvements in geochemical analysis technologies have enhanced the efficiency and precision of mining operations. This encompasses the creation of on-site laboratories that minimize the turnaround time between data gathering and result evaluation.

In February 2025, Probe Gold Inc. reported promising outcomes from geochemical characterization studies conducted at its Novador mine project in Val-d’Or, Quebec. These environmental geochemistry programs evaluated a range of mining materials, such as waste rock, mineralized rock, and tailings from metallurgical testing, to assess their potential for acid generation and metal leaching. These factors are driving the geochemical services market growth in the recent years.

Rising Investment in the Oil and Gas Exploration to Drive Market Development

The resurgence of worldwide investment in oil and gas exploration is generating a significant need for geochemical services. These services are essential for locating possible extraction locations, evaluating reservoir quality, and guaranteeing environmental compliance. The growing investment in oil and gas exploration boosts the need for these services, which are crucial for enhancing exploration initiatives and ensuring adherence to environmental regulations.

As per the IEA data, the Upstream oil and gas investment is projected to grow by 7% in 2024, reaching USD 570 billion, after a 9% increase in 2023. This growth is spearheaded by NOCs (National Oil Companies) in the Middle East and Asia, which have raised their investments in oil and gas by more than 50% since 2017, accounting for nearly the complete increase in expenditures for 2023-2024. The market is anticipated to expand considerably, fueled by heightened activities in oil and gas exploration. As energy firms continue their search for new reserves to fulfill global energy requirements, the demand for geochemical services is predicted to increase.

MARKET RESTRAINTS

Higher Cost of Geochemical Services to Hinder Market Expansion

Geochemical services encompass sophisticated analytical methods and specialized instruments, which lead to elevated operational expenses. These complexities necessitate a considerable investment in technology and qualified staff, leading to increased overall costs. As a result, the elevated expenses can limit market access, particularly for smaller clients or projects with constrained budgets, consequently reducing the potential growth of the market.

The complex nature of frameworks demands customized strategies, which require elevated levels of skill and more advanced technology. Geochemical services require highly skilled personnel to operate equipment, collect samples, and interpret data. The cost of maintaining this expertise is significant and adds to the overall pricing of these services.

The market for geochemical services is sensitive to economic changes, especially in industries such as mining and oil and gas. In times of economic decline, businesses cut back on their budgets for exploration and production, leading to a lower demand for geochemical analysis.

MARKET OPPORTUNITIES

Integration of AI and Machine Learning to Create Opportunity for Market Growth

AI and ML analyze extensive datasets more effectively and accurately than conventional methods. This ability facilitates an improved understanding of geochemical data, resulting in more accurate forecasts of mineral deposits and resource sites. By examining both historical and real-time data, AI and ML models forecast geological formations and mineral deposits with greater precision. This forecasting ability aids in enhancing exploration strategies, lowering expenses, and improving the likelihood of resource discovery.

Saiwa is a company specializing in Artificial Intelligence (AI) that delivers AI and machine learning services via a service-focused platform. In the field of mineral exploration, Saiwa provides services such as anomaly and defect detection. These offerings leverage AI to evaluate geological data, recognizing patterns and anomalies that conventional techniques could easily overlook. By integrating these AI-based methods, Saiwa enhances the precision and efficiency of mineral exploration, assisting in the identification and evaluation of valuable resources. Thus, the adoption of AI and ML within the market present chances for improved data analysis, predictive modeling, operational efficiency, real-time insights, and better environmental monitoring.

MARKET CHALLENGES

Sample Quality and Consistency Challenges to Restrain Market Growth

In the field, geochemical samples are often collected in remote, harsh, or logistically challenging environments, where issues such as contamination, improper labeling, poor preservation, or inconsistent sampling techniques can easily compromise the integrity of the data. Even minimal contamination from equipment, handling, or environmental exposure can alter the chemical signature of a sample, leading to inaccurate interpretations and potentially costly decision-making errors. Additionally, variations in how different field crews collect or process samples can introduce bias or inconsistency across datasets, making it difficult to compare results or build reliable geochemical models. To address these risks, strict protocols for sample collection, including chain of custody, storage, and transport, must be rigorously implemented and continuously monitored. Moreover, field personnel need specialized training to ensure that procedures are followed exactly, even under challenging conditions. The need for high-quality, reproducible samples is especially critical in industries such as mineral exploration and environmental remediation, where decisions based on faulty geochemical data can result in substantial financial losses, regulatory penalties, or missed resource opportunities.

Download Free sample to learn more about this report.

GEOCHEMICAL SERVICES MARKET TRENDS

Booming Exploration of Minerals to Drive Market Growth

As industries shift toward electrification, renewable energy, and advanced technologies, the demand for materials such as lithium, cobalt, nickel, copper, and rare earth elements has surged. The rapid expansion of electric vehicles, battery storage systems, wind turbines, and other clean energy technologies has triggered a race to discover and develop new mineral deposits worldwide. For instance, the surge in electric vehicle (EV) sales continues to drive strong growth in battery demand. In 2023, EV battery demand exceeded 750 GWh, a 40% increase over 2022, with electric cars responsible for the vast majority of this rise. Most of the growth stems from higher EV sales, with a smaller share due to larger average battery sizes. This trend is fueling demand for critical minerals: battery-related lithium demand reached around 140 kt in 2023, accounting for 85% of total lithium use, and grew by over 30% year-on-year. Cobalt demand from batteries rose by 15% to about 150 kt, making up 70% of total cobalt use. Nickel demand for batteries also increased nearly 30% to around 370 kt, despite still making up a smaller portion of total nickel consumption.

Unlike traditional exploration efforts that focused on easily accessible surface deposits, current exploration targets deeper, concealed, or lower-grade resources, where conventional geological methods alone are insufficient. There is growing reliance on advanced high-resolution geochemical techniques, soil and rock geochemistry, and sophisticated multi-element analysis to detect subtle mineralization signals. Companies rely heavily on geochemical data to prioritize drill targets, reduce exploration risks, and make faster, more informed investment decisions.

IMPACT OF COVID-19

The COVID-19 pandemic caused widespread disruption to worldwide production and trade, negatively impacting various sectors, including geochemical services. This disruption led to diminished demand and operational difficulties for businesses offering geochemical services. In response to the pandemic, governments and organizations implemented strategies to help companies adapt to the new normal. These strategies included fiscal benefits to empower companies to continue operations effectively, which could benefit the geochemical services sector by integrating geotechnical services to enhance efficiency and mitigate operational risks. The influence of the pandemic varied across regions as a result of varying lockdown measures and economic reactions. As a result, market leaders, followers, and innovators are expanding differently and recovering across various regions and market segments.

SEGMENTATION ANALYSIS

By Type

Advanced Analytical Capabilities to Propel the Growth of the Laboratory Based Segment

By type, the global geochemical services market covers laboratory based and infield based services.

The laboratory based segment is the dominant segment as it offers advanced analytical capabilities that ensure highly accurate results. Controlled conditions in laboratories allow for precise detection and quantification of minerals, metals, and contaminants, which is critical for industries such as mining, oil and gas exploration, and environmental monitoring. The laboratory-based segment is projected to dominate the market with a share of 72.86% in 2026.

The infield-based segment in the market is growing at the fastest rate. Infield geochemical services allow quick analysis and on-site decision-making. This is particularly beneficial in mining and exploration activities, where timely decisions can significantly impact project timelines and costs. Furthermore, infield services can be more cost-effective compared to laboratory-based services, as they reduce the need for sample transportation and storage. These advantages make infield-based geochemical services increasingly attractive to companies aiming to streamline operations and optimize exploration budgets.

By Service Type

Sample Preparation as the Foundational Stage in Geochemical Services Boosts Sample Preparation Segment Growth

By service type, the global geochemical services market is divided into sample preparation, mixed acid digest, hydrogeochemistry, fire assay, X-ray fluorescence, aqua regia digest, and others.

Sample preparation is the dominating segment in the market. Effective sample preparation is crucial for ensuring accurate and reliable geochemical analyses. It involves processes such as crushing, grinding, and pulverizing samples to ensure uniformity, which is essential for obtaining precise analytical results. Proper sample preparation significantly reduces project timelines and costs. By streamlining the preparation process, companies such as ALS Limited and Intertek Group Plc can handle a variety of samples more efficiently, making it a cost-effective option for mining, energy, and environmental clients. The sample preparation segment is expected to lead the market, contributing 27.71% globally in 2026.

Fire assay is the second dominating segment in the market. Fire assay is a traditional technique used for quantifying precious metals such as gold and silver in mineral samples. It involves fusion and cupellation processes to separate and measure these metals accurately. Fire assay remains indispensable in the mining industry due to its high accuracy and reliability in quantifying precious metals.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Extensive Demand for Minerals Encourage the Minerals and Mining Segment Growth

Based on end-user segment, the global market is divided into minerals and mining, oil and gas, archeological surveys, and others.

The minerals and mining segment dominates the market. The global demand for minerals such as gold, silver, copper, lithium, and rare earth elements has surged due to their extensive use in industries such as electronics, renewable energy (solar panels, wind turbines), automotive (electric vehicle batteries), and construction. Increased mining activities globally has driven the need for geochemical analysis to locate high-potential mineralization zones and assess ore quality. The mining sector relies heavily on geochemical data to optimize exploration strategies and minimize operational risks. The mineral & mining segment is expected to account for 41.85% of the market in 2026.

Oil and gas is the second dominating segment in the market. Geochemical analysis is crucial in the oil & gas sector for reducing risks associated with development and production, detecting molecular and isotopic composition of gases and oil, and assessing reservoir continuity.

GEOCHEMICAL SERVICES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Geochemical Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Mining Operations to Drive Market Development

North America, particularly the U.S. and Canada, is home to extensive mining operations for critical minerals such as gold, silver, copper, and rare earth elements. The need for precise geochemical analyses in mineral exploration is driving demand in the region. Programs such as the Earth Mapping Resources Initiative (Earth MRI) by the U.S. Geological Survey (USGS) aim to identify areas with critical mineral deposits by collecting geochemical data. Such initiatives are boosting the adoption of geochemical services. The U.S. market is estimated to reach USD 224.30 billion by 2026.

U.S.

Improving Mining Practices to Drive the Market Demand

The rising need for minerals such as gold, silver, copper, lithium, cobalt, and rare earth elements is driving the demand for geochemical services in the U.S. In May 2024, the U.S. Geological Survey (USGS) issued a call for proposals for cooperative agreements with state geological surveys to support geologic and geochemical mapping projects nationwide for fiscal year 2024 through the Earth Mapping Resources Initiative (Earth MRI). These services are crucial for identifying high-potential mineral zones, characterizing ore deposits, and improving mining procedures. Advanced technologies such as remote sensing, Artificial Intelligence (AI), and Machine Learning (ML) are improving accuracy in geochemical analysis.

The U.S., as one of the biggest oil and gas producers globally, is experiencing an increase in exploratory activities in this field. These services play a vital role in effective and sustainable extraction methods.

Europe

Europe's Strong Push for Renewable Energy Technologies to Drive Market Growth

Europe is focusing on domestic mineral exploration to reduce reliance on imports of critical minerals such as lithium, cobalt, and rare earth elements. Geochemical services are essential for identifying and assessing these mineral deposits to support industries such as renewable energy and electronics. Europe's strong push for renewable energy technologies, such as wind turbines and electric vehicle batteries, has increased the demand for minerals. The UK market is expected to reach USD 23.11 billion by 2026, while the Germany market is anticipated to reach USD 43.40 billion by 2026.

Stringent European Union environmental regulations mandate close monitoring of soil, water, and air quality, making these services essential for ensuring regulatory compliance, especially in mining and industrial activities. European governments are investing in sustainable mining practices and critical mineral exploration. Initiatives under the European Green Deal aim to secure a supply of raw materials essential for achieving carbon neutrality by 2050. In August 2021, SGS, the foremost global company in inspection, verification, testing, and certification, announced the expansion of its laboratory in Vlissingen (Flushing), Netherlands, to include trace gas analysis capabilities, assisting companies working with chemical gases.

Asia Pacific

Vast Mineral Deposits and Rising Industrialization to Enhance the Market in Asia Pacific

Asia Pacific is the dominant region in the geochemical services market share, driven by abundant mineral resources, particularly in countries such as China, India, and Australia. These nations are major contributors to global mining activities, driving the need for geochemical services to assess and analyze mineral deposits effectively. Rapid industrial growth and urban expansion in Asia Pacific have increased the demand for minerals and metals for infrastructure development, further boosting the market demand. The Japan market is forecast to reach USD 63.05 billion by 2026, the China market is set to reach USD 144.90 billion by 2026, and the India market is likely to reach USD 76.42 billion by 2026.

The shift toward renewable energy technologies, including solar panels and wind turbines, has increased the demand for essential minerals such as lithium and rare earth elements. These services are crucial for discovering and assessing these resources. The adoption of advanced techniques such as machine learning, data analytics, and portable instruments has improved the efficiency of geochemical analysis, making it more accessible to industries across the region. For instance, in March 2025, Fugro secured the contract for offshore soil investigation for the Blue Mackerel offshore wind farm in Australia. Upon its completion, it will become one of Australia’s leading offshore wind energy projects.

China

Surging Research and Development in the Geochemical Sector to Drive Market Growth

China is the dominant country in the market, due to government investments in applied geochemistry research. These investments emphasize geochemical exploration, regional mapping, and environmental assessments. A large portion of these funds is aimed at regional and local-scale geochemical surveys for mineral resources. In January 2025, A superlarge ion-adsorption-style rare-earth mineral deposit was found in Yunnan Province, Southwest China, with estimated resources totaling 1.15 million tons.

Institutions such as the Guangzhou Institute of Geochemistry and the Chinese Academy of Sciences are essential in promoting geochemical research via advanced facilities and global cooperation. Geochemical techniques are essential for the exploration of mineral resources in China. Initiatives such as the China Geochemical Baselines and multi-functional geochemical mapping have played a significant role in discovering new mineral deposits.

Latin America

Considerable Reserves of Vital Minerals to Drive Market Growth

Latin America is a recognized producer of multiple minerals vital for clean energy technologies, and it has the potential to expand its well-established mining industry by tapping into resources. This expansion could assist the global economy in circumventing the shortfalls and bottlenecks that may jeopardize clean energy transitions.

Latin America possesses considerable reserves of vital minerals crucial for the worldwide energy transition, such as copper, lithium, nickel, and cobalt. For example, the region represents roughly 40% of global copper reserves and two-thirds of the world's lithium reserves. Nations, including Chile, Peru, Argentina, and Brazil, significantly contribute to these reserves, increasing the demand for geochemical services to evaluate and manage these resources efficiently.

Middle East & Africa

Expanding Mining & Oil & Gas Exploration Activities Boosts Product Demand in the Region

The mining industry is a significant consumer of geochemical services, and the Middle East and Africa are witnessing an increase in mining activities. Countries such as Saudi Arabia and South Africa are expanding their mining sectors, which is driving demand for geochemical analysis to assess mineral deposits and optimize resource extraction.

The Middle East serves as a significant center for oil and gas production, with these playing an essential role in optimizing exploration and extraction activities. The demand for thorough geochemical analysis to guarantee sustainable oil and gas production is propelling market expansion. For instance, in January 2024, the Saudi Geological Survey (SGS) achieved a remarkable milestone by successfully completing the collection of samples for the high-resolution geochemical survey project of the Arabian Shield.

The market growth is driven by the expanding mining sector, growing oil and gas exploration activities, government initiatives, technological advancements, environmental monitoring requirements, and economic diversification efforts.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Investing in Automation to Optimize Exploration Activities

The global market is largely fragmented, with key players such as Fugro, Chinook Consulting Services Ltd., and SCHLUMBERGER. SGS SA has invested heavily in automation and digital solutions to improve sample processing efficiency and accuracy. Its GeoChem platform integrates AI and advanced analytics to optimize exploration and mineral processing. In January 2024, SGS, the premier inspection, testing, and certification company globally, announced that it had secured a contract to establish and manage a new on-site geochemistry laboratory at North Mara, owned by Barrick Gold, in the Tarime district of the Mara region, Tanzania.

List Of The Key Geochemical Services Companies Profiled In The Report

- Fugro (Netherlands)

- Chinook Consulting Services Ltd. (Canada)

- SCHLUMBERGER (U.S.)

- Bureau Veritas (France)

- SGS SA (Switzerland)

- ALS Australia (Australia)

- Saudi Aramco (Saudi Arabia)

- Intertek Group plc (U.K.)

- Capital Limited (U.K.)

- FLSmidth (Denmark)

KEY INDUSTRY DEVELOPMENTS

- January 2025- Aramco, a prominent global integrated energy and chemicals corporation, and Ma’aden, the foremost multi-commodity mining and metals firm in the Middle East and North Africa region, revealed the signing of a non-binding Heads of Terms agreement. This agreement outlines the establishment of a minerals exploration and mining joint venture (JV) in the Kingdom of Saudi Arabia. The intended JV would concentrate on energy transition minerals, which include the extraction of lithium from high-concentration deposits and the advancement of cost-effective direct lithium extraction (DLE) technologies. Commercial lithium production could possibly begin by 2027.

- December 2024- Global energy technology firm SLB unveiled Neuro autonomous geosteering, which agilely adapts to underground complexities to drill more effective, higher-efficiency wells while minimizing the carbon footprint of the drilling processes. Employing artificial intelligence (AI), Neuro geosteering assimilates and analyzes intricate real-time subsurface data to autonomously navigate the drill bit through the most productive layer or “sweet spot” of the reservoir. In traditional geosteering operations, geologists are required to manually analyze this data to determine a well target, revise the well plan and trajectory, and communicate this information to the directional driller. Neuro geosteering automates the entire task from start to finish without any human involvement.

- January 2023- SGS received contracts to perform tailings waste analysis, assessment of legacy ore stockpiles, and environmental water monitoring for Green Tech Mining and Services (GTMS). The services will be delivered as part of GTMS’s Bishara, Rakkah (previously known as Mining Block 10), and Arjaa Tailings (previously known as Mining Block 4) initiatives. These services would enable GTMS to extract any remaining targeted minerals and remedy the impaired environmental legacy. This opportunity also enhances the company’s position as a prominent provider of laboratory services to the natural resources sector in the Sultanate of Oman and the Middle East. They will also manage and provide access to the comprehensive geochemistry laboratory operated by strategic partner Strategic Precious Metal Processing (SPMP) in Oman.

- November 2022- Dutch geo-data expert Fugro collaborated with Energinet on a significant geotechnical site investigation contract assessment for a Danish offshore wind project in the North Sea. The Danish government aimed to increase offshore wind capacity by 4 GW by 2030, and the geo-data gathered by Fugro would aid in shaping future proposals in the region. Fugro’s geo-data would offer details on the seabed and sub-surface conditions, minimizing uncertainty and assisting installers in making knowledgeable decisions regarding optimal locations for the wind turbines and export cables.

- December 2021- ALS Limited announced the acquisition of MinAnalytical Laboratory Services Australia Pty Ltd (‘MinAnalytical’), a Geochemistry testing firm located in Western Australia. The acquisition of MinAnalytical would substantially enhance the capacity of ALS’ Western Australian operations, initially by approximately 40%. There exists the potential to further expand this by taking advantage of the unused capacity within MinAnalytical and utilizing ALS’s current sample preparation network. This comes on top of the anticipated ~15% increase in capacity throughout the global ‘hub and spoke’ Geochemistry network, which is expected to be finalized in FY22.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The investments in geochemical services are anticipated to grow gradually driven by increasing demand in sectors like mining and exploration, as well as the need for environmental monitoring and sustainability solutions. Key areas for investment include emerging markets, technological innovations in analytical techniques, and the development of specialized geochemical services.

- In February 2023, The U. S. Geological Survey (USGS), along with a group of state geological surveys, is allocating approximately USD 325,000 Million to carry out geochemical sampling across around 2 million square kilometers of the central U.S., spanning from the Midcontinent to the Appalachian Basin.

The geological surveys from Illinois, Indiana, Iowa, Kansas, Kentucky, Missouri, and Ohio are working together on a reconnaissance geochemical and petrophysical investigation of Pennsylvanian black shales located in the Cherokee-Forest City, Illinois, and Appalachian basins to examine their potential for critical minerals. The concentrations of critical minerals in these metalliferous black shales might exceed those found in more conventional types of deposits. The project area may contain critical minerals such as molybdenum, nickel, platinum group elements, rare earth elements, uranium, and vanadium.

REPORT COVERAGE

The global market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations, offering geochemical services. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Service Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market stood at USD 1.32 billion in 2025.

The market is likely to grow at a CAGR of 4.50% during the forecast period (2026-2034).

The mineral and mining segment leads the market.

The market size of Asia Pacific stood at USD 0.39 billion in 2025.

Increasing demand from the mining sector is a key factor driving the growth in the market.

SGS SA, Fugro, Chinook Consulting Services Ltd., SCHLUMBERGER, and others are some of the markets top players.

The global market size is expected to reach USD 1.98 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us